Myths about inequality mask a medieval tax system

It’s disappointing after three decades of free market policies to still have commentators peddling government myths about inequality.

The National government view, espoused by Martin van Beynen, agrees inequality has increased since the 1980s but denies it’s a problem that should worry us unduly.

We are being encouraged to believe it’s all a bit of a beat-up.

The government’s carefully constructed fantasy goes like this: The poor pay very little tax while the heaviest burden is carried by high-income earners. We’ve gone as far as we can in adjusting tax rates and Working for Families deals with any residual problems for people on low-incomes. The poor are being carried by the rest of us. There’s nothing new to see here. Move on.

Selectively chosen figures are used to bolster this argument.

Van Beynen is right to say that the top 10% of income earners pay 35% of total income tax but this ignores the miserly tax paid by the super-rich and the heavy burden of GST on our lowest income earners.

According to the Inland Revenue Department half the wealthiest 150 New Zealanders declare incomes of less than $70,000 for tax purposes. In other words, they don’t even get into the top tax bracket.

So, while it’s true that those on high salaries and the middle class pay the bulk of income tax this masks the failure of the super-rich to pay anything but the most miserly amount despite stripping billions from the economy annually.

Last year for example the net wealth of those on the rich list increased by $4.5 billion – an average increase of $30 million each in unearned, untaxed income.

Successive governments have effectively exempted this group from paying income tax with the inevitable outcome revealed in an Oxfam report released earlier this week.

That report revealed that just two New Zealanders – Graeme Hart and Richard Chandler – were worth the same as the poorest 30 per cent of the adult Kiwi population.

At the international level, the Oxfam report shows that just eight men – the world’s wealthiest – are between them worth more than the 3.6 billion people who form the poorer half of the world’s population. Oxfam describes this as “beyond grotesque”. I agree.

Our government is blaming the problem on multinational companies avoiding paying their fair share of tax. This is important but the more serious problem is on our doorstep.

Tax rates themselves are at the heart of the problem.

Not only do the super-rich pay virtually no income tax but the picture becomes even uglier when we look at GST.

The lowest 10% of income earners in New Zealand spend 14% of their disposable incomes on GST while the wealthiest 10% spend less than 5%.

Over several years US billionaire Warren Buffet has pointed out the unfairness of the US tax system whereby his secretary pays higher tax rates than he does.

New Zealand is just as sickening.

Workers on the minimum wage pay 12.5% of their earnings in income tax then 14% of their disposable income on GST. In other words a quarter of what they earn goes to the government in tax compared to the wealthiest New Zealanders who in general pay less than 5% of their total income in tax to the government.

Those getting national superannuation or a sickness benefit pay much higher tax rates than the typical rich lister.

We run a medieval tax system which in earlier times would have been applauded by the Sheriff of Nottingham.

The super-rich coast along on the backs of the rest of us denying responsibility to help provide roads, hospitals, schools or public services while that burden falls heaviest on those least able to pay.

Not only do low-income New Zealanders face the highest tax rates but they also confront the raft of social problems which increase dramatically in countries such as ours which have high levels of inequality. Poorer mental and physical health, drug addiction, violent crime, burglaries, murder, teenage pregnancy and educational failure are all highest in countries with the greatest inequality.

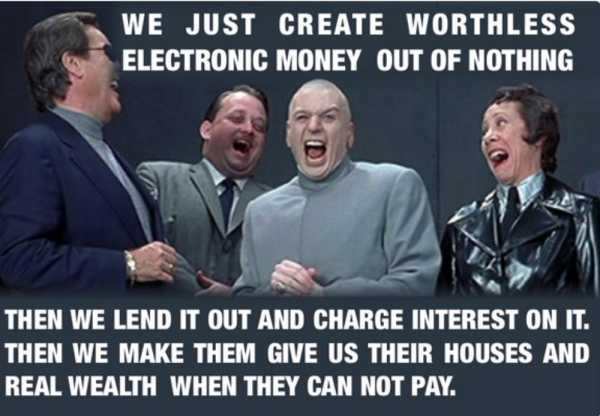

Not content to have the poorest New Zealanders face the biggest tax burdens and corrosive social problems our lowest income communities also face a plague of what can only be described as “parasites on poverty”.

I’m talking about the proliferation of pokie machines, bottle stores, loan sharks and fast-food outlets – all operating disproportionately in poorer areas. These “businesses” profit from the addictions to which those on the lowest incomes are so much more vulnerable.

And to rub it in the government cynically demonises these people and encourages the rest of us to see them as bludgers.

If we set aside the government’s carefully constructed myths, inequality is at the heart of the social and economic crisis facing New Zealand with the term bludger directed at the wrong end of the inequality spectrum.

Published in Christchurch Press 18 January

Lisa Renee’s January Report on Poverty Consciousness:

http://sananda.website/lisa-renee-january-report-2017/

Good post John. I agree with your points.

You must be right because look at the number of fascists your article has smoked out… 🙂

Another measure that should be considered would be to get rid of deductibility of interest. Interest deductibility is an anomaly in the Income Tax Act anyway, and benefits mostly those who are able to borrow for investment purposes.

To Andrew: “what the poor are getting wrong, generation after generation” – believing the BS that a standard education is the way to an honest well-paid job that will pay enough to live decently.

Generation after generation fails to receive effective financial training leading to literacy. Nor are they mentored.

Are not told that it takes money to make money and that accumulation plus using appropriate advantages is the way to break free of the rat race. If they don’t have the training in speculation, plus the advantages offered to people who have reserves above the average – they will remain disadvantaged.

Those who aren’t too worried by morality or honesty can and do make large incomes. Think drug dealers, armament traders, people traffickers above the ‘workers’. They know how to create wealth – and keep it, often for generations.

They also know ‘money has no smell’ – particularly after laundering, so they’ll be welcomed into useful circles for contacts and opportunities for respectable speculation, though not all high stakes circles.

The ones who don’t know are the honest fools who have different ambitions to the Mammon-worshippers, and are despised accordingly.

They simply lack the training and mentoring that those paragons of affluence take for granted. But who would challenge the fable of Virtuous Wealth? Or level the playing field? The current players might find themselves outclassed…

So just who then are the useless eaters?

First that assumes men understands the power they hold. Listen to any of nixons recordings, and it will be apparent real fucking fast, that they do not understand the power the POTUS wields. It’s often expressed simply as Nixon discribes, but his recordings weren’t meant for public distribution.

Yes, thanks to the tax changes by the Nat led government a fair few years back now (much praised by English as having been supposedly “neutral” in effect), the previous GST was increased by a whopping 25 percent. That hit every ordinary consumer, while the income tax cuts did benefit the richer ones, and high earners much more than most ordinary workers.

And as John writes, the wealthy have ways to hide their wealth and much of incomes, by knowing how to work the system, e.g. by setting up trusts, where they as beneficiaries end up getting paid a relatively low salary to themselves, that is below 70k, so taxed comparatively low.

Wealth amasses, as the money is shifted into new acquisitions in assets, in company shares and what else there is, also of course real estate, as they can declare such spending as a investment and cost factor. And we know, many property owners in Auckland did over last year suddenly become millionaires, that is, because the values of their homes suddenly went up above that value, by them doing fuck all, except rely on the property value boom.

It is time to bring in a fairer, progressive tax system, and introduce a higher rate of income tax, also introduce a capital gains, and property tax of sorts, to hit those ones that know how to work the present system we have.

I agree with a lot of what you say. But how would you change things to make the tax system more fair – we need to get past who is to blame and into ways to make it fairer under globalism and into the issues of the 21st century.

Personally I think we need a UBI as we can see with superannuation, it makes sure every person is largely out of poverty. Our current welfare system is broken with more money being wasted on the process than the outcomes, and a proliferation of in real terms fake data and statistics to support the fake welfare system.

I also think that there needs to be more ways to tax at source like micro transaction taxes on electronic transfers as a way to tax rather than the focus on physical assets because big money is largely made on paper and can be easily modified to avoid taxes under the current system.

Physical assets are already being taxed yearly with council rates on property and shares being taxed. It seems to be the point where money is created and then disappears from the tax system using loop holes that should be targeted.

In addition under Globalism the money flowing in and out of countries but due to residency status can be paid in low tax countries instead of the country the money has flowed out of.

The Brenton Woods system, better known as the gold standard, abolished by Nixon. Then destroyed by Clinton in 96, kept financial crises at bay for 50 years. Now financial crises is commen place.

The key feature of the Brenton Woods system is the idea that government, or private institution “must”not be warehouses for cash. Nixon turned “must not” into “should not. And Bill Clinton turned “should not” into must do.” Those are the literal technical changes made to the Breton woods system. They literally took those words out of the original text and replaced them with each amendment.

Who would have thought two or three tiny words would have a propound effect on the way the whole world lives there lives.

How would I chnage things? For a start…

1. progressive inheritance tax starting after $500,000

2. return to progressive income tax

Replace GST with a financial transactions tax

3. a return to progressive income tax structure.

Are you concerned you may open up tax evasion on other fronts?

So you do all that and I financializ my work force and take the tax free credits.

Could I suggest a funding boost to The Financial Markets authority, and a mandate for financial markets investigators to begin high level talks and information sharing with there forign counterparts where thier interests intersect.

I think you may be quietly surprised in the direction these investigators want to go, but can’t for political reasons.

+1

I don’t think anything to do with income tax works anymore. Less people are on PAYE and the rich listers often earn under $70k and can do this all legally.

Those so called rich on 33% are often paying a lot more with 10% student loans added on, Kiwisaver, GST and so forth.

That is why the left is failing in it’s message on this issue. Income tax is not the answer and the middle don’t want to pay any more they are, being already squeezed enough with 33% income tax at the highest level, student loans, GST, council rates, Kiwisaver, doctors visits & prescriptions charges without a community services card, school donations, the cost of child care pre school, parking or transport costs especially in Auckland, the cost of living in this country and then to be told to pay more for a system that seems to be unable to guarantee superannuation for you in your life time or any sort of welfare if anything goes wrong as you previously earned too much…. not that fair.

I agree with the financial transaction tax, but not with focusing on increasing income tax – not fair under the present system of globalism and precarious living.

There are 2 Kiwi individuals earning as much as the bottom 30% – would a rise in income tax effect their tax bill – I doubt it, but it would effect the doctors salary helping the poorest 30%.

I agree with most of that, but an inheritance tax should, I think, be levied individually, and only on those beneficiaries whose share of the inheritance is above the threshold. Also, I think we should reform trust law so as to avoid trusts being used to avoid inheritance tax (or even other taxes).

“Physical assets are already being taxed yearly with council rates on property and shares being taxed.”

Council rates are irrelevant when when we are discussing how central governments might aquire their funding. In fact a land tax in my opinion would be a very appropriate tax for a central government to levy.

Any further land/property taxes would help non residents get cheap property holdings here, and more Kiwis would become tenants in their own country as they would not be able to afford to own the running costs of owning a house. NZ already has dwindling property ownership, making it more expensive to own a property would not help. The banks would take that expense into consideration when assessing mortgages.

Countries like Sweden that have a yearly capital tax on property have much higher wages. To make both a council and government yearly capital tax work in NZ, wages would have to rise and the cost of living reduce.

It would also impact exports, as our main exports are all farm based so further taxes on land and property would increase the cost of those exports (and more likely drive farmers into bankruptcy and the family farms would be sold and be bought and run by corporations, US style).

Not so. Levying a land tax would allow for reductions in income tax, preferably targeted at those at the lower end of the tax scale. Hopefully it would also help to reduce property prices.