Kiwi Workers DO deserve a tax cut – here’s how we can get one!

More than half of Kiwis want a tax cut, more than a third don’t, new poll reveals

More than half of voters believe the time is ripe for tax cuts, while more than a third disagree, according to a 1News Kantar Public poll.

The poll, conducted from May 20 to May 24, asked; “Is now the right time to introduce tax cuts in New Zealand?”

Fifty-two per cent of the 1002 respondents replied “yes,” 35 per cent said “no,” while the remaining respondents remained silent.

Prime Minister Chris Hipkins has ruled out any possibility of introducing a capital gains tax, wealth tax or any other significant tax changes before the election.

OF COURSE Kiwi workers deserve a tax cut!

Thanks to 30 years of de-unionised neoliberalism, we are welded to a low wage economy that requires migrant worker exploitation to work.

This has depressed wages and as we see right now, it is not wage inflation that is causing the current spike of inflation, it is price gouging by companies that are driving up inflation!

So of course Kiwis deserve a tax cut, but it’s how we fund that tax cut while funding critical services that is the political issue.

We have a under regulated capitalism that rigs the game for the rich, we know this because that’s what IRD told us!

Bernard Hickey makes the point that if we did have a functioning tax system with a wealth tax we would have generated $200Billion in extra resourcing!

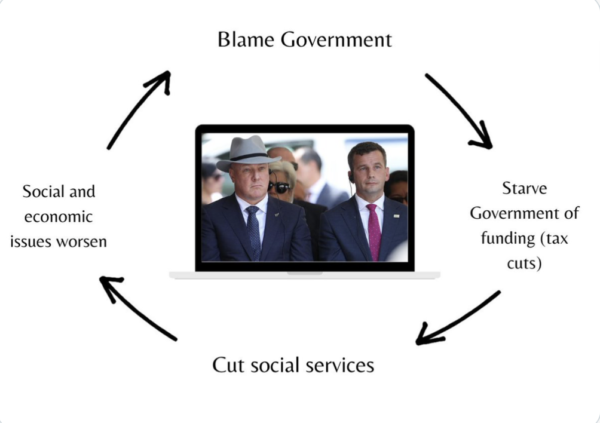

The political agenda of the Right is to constantly amputate the State ability to raise revenue so that the State has no resources to redistribute in the first place!

Nationals 3 biggest donors (Hart, Mowbray and Bolton) have a combined net worth of 15 billion! The Bottom 50% of NZ has 23 billion.

The top 5% of NZers own roughly 50% of NZs wealth, while the bottom 50% of NZers own a miserable 5%!

Are those stats that live up to the egalitarian dream of NZ?

We need to remove the tax yoke from workers and put it on the rich pricks who have rigged NZ Capitalism in their favour.

The Financial Transaction Tax is that solution and would raise so much revenue we could lower GST AND make the first $10 000 tax free!

THAT’S how you get a tax cut!

Tax the rich, fund the social and physical infrastructure AND lower the tax paid by the poor!

There are 14 Billionaires in NZ + 3118 ultra-high net worth individuals with over $50million each, why not start start with them, then move onto the Banks, then the Property Speculators, the Climate Change polluters and big industry to pay their fair share before making workers pay more tax!

The Green Party wealth tax will hit too many home owner occupiers who are just hard working kiwis, a Financial Transaction Tax on the other hand hurts the speculators the hardest.

The Māori Party are talking about a Financial Transaction Tax this election, I look forward to their announcement on this.

If we want to rebuild our social infrastructure and physical infrastructure, we need more revenue and that revenue shouldn’t come from workers, it should come from the speculators.

We need to be kinder to individuals and crueller to corporations.

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

If you can’t contribute but want to help, please always feel free to share our blogs on social media

Putting all MP’s on the Minimum Wage would probably sort out the wood from the trees, many of the bludgers would bail and get a real job, only those who were truly committed to doing some good for the country would stay. Seymour would be one of the first to bail, however his well healed m*te’s would kindly pay his salary to keep him there.

A universal FTT would not just hit the wealthy, it would hit everyone with a a KiwiSaver account.

The reason that OECD countries do not have a universal FTT’s is that they would be fiendishly difficult to apply. A number of European countries do have FTT’s. But they only apply to a very limited range of transactions, such as equities trades. As such they produce limited revenue.

A much more sensible approach would be a Australian style CGT. That generates enough revenue for the first $20,000 of income to be tax free.

It also makes sense that New Zealand and Australia have broadly similar tax systems. introducing a CGT and the first $10,000 or $20,000 would do just that. A completely new tax, such as a FTT would simply promote capital flight.

I would also note that New Zealand and Australia tax a similar percentage of GDP, around the low 30% range.

The promoters of wealth taxes, FTT’s, etc have as their goal, the fundamental increase of the total tax take to much higher levels of around 40% of GDP. A level that is more typically associated with some of the Nordics, with their much more intrusive styles of government. That will also promote an exodus to Australia, both of people and of capital.

Watch this space.

Labour are very good at one thing. Adamantly claiming a policy they are cooking up is right…..and couldn’t possibly be wrong. They are a reactive Government rather than proactive. Masters of the U-Turn.

The Cycle Lane on Auckland’s Harbour Bridge one of many examples.

Aucklanders hated the idea and said so. They were ignored by the lycra wearing Micheal Wood who went further and arrogantly chastised the public and told them it’s happening and just get their head around it. Nurses were incredulous. They repeatedly told the Government their work conditions were unsafe and this needed to be addressed urgently but were told there was nothing in the kitty.

Tens of millions was spent buying properties on the Northern side of the bridge and consultants were paid millions. Nek minute a poll came out that highlighted the overwhelming majority of Aucklanders didn’t want the cycle lane. We know what happened next. Call me old fashioned but shouldn’t Governments do genuine due diligence before spending tens of millions of tax payer funds…. especially on pet projects?

Our tax system is a mess and it’s antiquated. We saw that highlighted again when only Auckland went into lockdown during Covid but the Government was allowing businesses in the deep South barely impacted by the lockdown to apply for wage subsidies etc because the IRD system couldn’t distinguish if a tax payer was in Auckland or Southland.

There are also considerable inequities through the system that are not being addressed despite this Government allegedly being all about putting inequities right.

It’s obscene to have GST on our supermarket food bill but that’s in the too hard basket. (pardon the pun)

Now there is a poll out showing it’s not just the wealthy that think tax cuts are a good idea. The majority of Kiwi’s now want tax cuts. This is at the same time Labour are repeating their big NO to tax cuts.

We know Labour are extremely motivated by re-election and will do / say just about anything to help make that happen. They know now that National are getting traction with tax cuts policy.

My confident prediction here on the 30th of May is you will hear a gentle U-Turn commencing on the subject during June. The time has run out for a working group to be formed and policy put forward pre-election so it will be a fast forwarded cabinet decision. Before the end of August Labour will have done a complete U-Turn and new tax cuts policy will be in place and being promoted by September. Take this to the bank.

TMP will get rid of GST on essential food products.

Geez that’s a big statement you sure this government will go that far?

Unfortunately for Labour the time-bomb of a fuel tax reset is inevitable. The punters will see a jump in fuel prices as the tax goes back on. Nice!

You can: just go back to the old rates. Abolish the G.S.T., abolish all top bracket and corporate tax cuts, and bring back the universal Family Benefit.

That would return the top income rate to 76.5% for the bracket over $8m (Nash Administration level), and the corporate rate to 45% (Muldoon level).

The old Family Benefit level (Nash era) is such that a breadwinner earning the average wage, with two children, would have an effective tax rate of zero.

They can have that tax cut if we disestablish the 14,000 extra bureaucrats Labour has added to the Wellington headcount.

We can have an even bigger one if we close the ‘demographic ministries’ that achieve nothing and never have.

Replace your Bill Nighy video with something from Yes Minister! or Gliding On.

Of course there is funding issues right now but what if for instance applying a financial transactions tax or whatever ends up paying a negative return in the case of loses ends up giving tax credits back to them. What if the government borrowed and took a stake in superannuation funds so it could post it’s precious surplus every year at 5% return on $200 billion?

A qualitative analysis with a strong Asian background who’ve never made a mathematical error in his life would have to proof any financial calculation and make it work anyway.