It’s now or never Labour

National came up with what looked like quite a reasonable tax plan that does give some money to ordinary people. An extra $20 a fortnight for someone earning $44,000. But less for all earning under this. It came across as more than Labour is giving. But with inflation at 6% it will last less than 2 years before the $20 is gone in costs and everything is back to what can be bought now.

But National is starting to look…stupid, or at best lazy researchers.

- The 15% tax on sales of houses to foreign buyers won’t apply to Chinese buyers who before the ban accounted for 36% of sales. Our free trade agreement with China prevents any tax on Chinese people that does not also apply to NZers.

- The online gambling tax is based on numbers that are not used by the TAB or Lotto in their submissions about the closing off online gambling. So where did they invent them?

So Nationals massive tax cuts to the rich aren’t fully funded which means hacking into our public services to balance the books. And the Chris and Nicola defence is their numbers are rock solid. Perhaps the rocks in their drinks influenced their judgement and their judgement melted away instead. None of it makes sense.

But Labour can’t just argue the points and rebut. They still don’t have a clear platform to differentiate themselves from National. Even though I don’t think a wealth tax is the best idea and it would be hard and costly to administer; surely a referendum could be offered so the people could have a say, rather than one senior person just say no.

But I agree with him that capital flight is a real problem. This does generate some huge issues but they absolutely aren’t impossible to deal with. Too long to explain here but Keynes certainly wanted capital controls. Malaysia did capital controls in the asian crisis.

Labour can’t claim they are New Keysianism or are following Mainstream Keynesian policy because these approaches don’t actually understand or follow Keynes. He defined himself as a liberal socialist, which for him meant keeping the freedoms of democracy so that massive economic and social change could evolve without violent revolution.

It is often falsely said Keynes saved capitalism. He inadvertently did but our current economy is nothing like what he recommended and wanted.

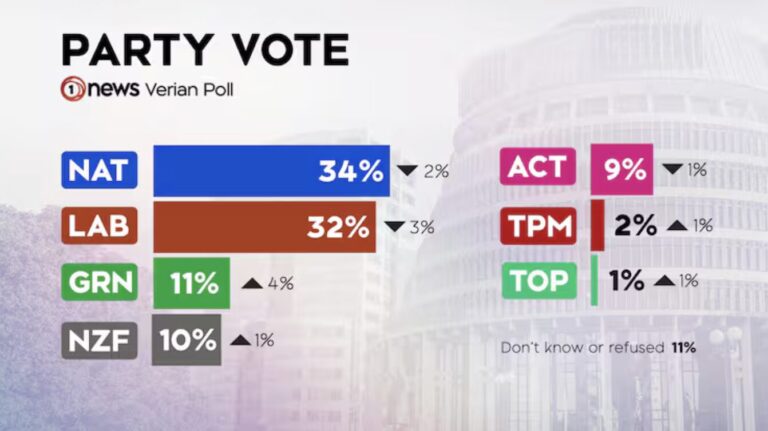

But Labour is well behind on the numbers and I think they need to reflect on why. Labour are behind because they went along with Neo-liberal economics.

So once there was inflation in 2021 and on. The neo-liberal solution is The Reserve Bank must raise interest rates to take money out of the economy so people can’t demand and with less demand prices will stabilise. But taking money out of an economy also leads to a recession.

This meant in an election year, Labour could not spend on people to alleviate the impacts of inflation and recession because that would feed more inflation. i.e. if you give people money you increase demand and demand will push up prices. And inflation is bad for the economy and it is bad for ordinary people as it reduces the spending power of their income.

So Labour following neo-liberal economics had to act milk toast with their budget and all their actions to help ordinary people had to be about giving businesses money, like transport subsidies. And they wanted to appear fiscally credible so they didn’t spend.

But now we find our current inflation is not driven by costs going up but by Greedflation. i.e. Large businesses saying let’s not waste a crisis and they raised their prices to gain more profit. This has now been reported on and is a world wide practice. The Council of Trade Unions were part of doing a report on this for New Zealand and it was 55% of inflation to a period ending 2022 was profit taking. The report is available on the CTU website. But surprise the rubbish one done for the Business Initiative is readily available in lots of places from news articles. And the first 12 or more search items on google is full of the articles saying Greedflation is not real when it is. Perhaps the CTU position that not using the term Greedflation because is not helpful or too critical of business, is not actually helpful in getting their messsage out.

So the Boards of our large business who make key decisions and set the directions on pricing were quite aware of it coming up to an election year and probably quite okay that inflation would cause problems for Labour in an election year.

Labour to survive politically and make themselves relevant and helpful to solving the dozens of crises we have, especially the climate crisis. Labour must rediscover the real liberal socialist Keynes.

There are many obvious solutions to inflation that don’t beat up ordinary people; Labour don’t have to buy into the neo-liberal one.

Show us the numbers,, gold numbers,, show us then, eh!, the mother of budgets on steroids, show us the numbers, or hide the social care slash.

Its always been, corporate exploit, or the lesser same, so its now or ever for what.

“ It’s now or never Labour”

It’s never.

They Labour Party has done it’s dash. It’s over. Time to move on.

So once there was inflation in 2021 and on. The neo-liberal solution is The Reserve Bank must raise interest rates to take money out of the economy so people can’t demand and with less demand prices will stabilise. But taking money out of an economy also leads to a recession.

We expect more from trained wealth merchants ior chefs with fancy financial recipes, in or out of governmen,t than adopting measures that Daddy would apply to an errant child.

Labour: Nothing… in it for you!

It was simple in NZ’s progressive tax system. No tax up to 5-10K and increase current tax thresholds and have a CGT.

Labour even had a mandate to do it – so what the *#@% happened?

It is even better under Te Pati Maori policy

The first $30,000 is tax free……..

Te Pāti Māori will remove: GST from all kai. Income tax for whānau on low

incomes.

Te Pāti Māori will increase: Take home pay for 98% of whānau. Income tax on those earning more than $200,000. The Company Tax Rate from 28% to 33%.

Te Pāti Māori will introduce: Wealth Tax. Foreign Companies Tax.

Land Banking Tax. Vacant House Tax.