It isn’t ‘envy’ – it’s taxing rich pricks who have used their wealth to politically insulate their interests

Inheritance taxes

Japan 55%

South Korea 50%

France 45%

United Kingdom 40%

United States 40%

Spain 34%

Ireland 33%

Belgium 30%

Germany 30%

Chile 25%

Greece 20%

Finland 19%

Denmark 15%

Iceland 10%

Turkey 10%

Poland 7%

Switzerland 7%

NZ 0%

ENVY the Rights scream at any challenge of their rigged capitalism.

Bernard Hickey has argued, “We could have gotten $200 billion in extra tax revenues if only there had been a fair tax system which meant that capital gains were taxed at the same rate as every other type of income.”

Envy? Oh no my dear wealth pimps, incandescent mother fucking rage is more where we are all at rather than basic bitch envy!

In a liberal progressive democracy, it doesn’t matter what role you play in the complex super structure of our society and economy.

It doesn’t matter of you are a garbage collector, a dr, a nurse, a drain layer, teacher or tradie – if you all stopped doing your jobs the system can’t work.

Everyone deserves to share the collective harvest of civil society with public services and policies focused on the public good enshrined in the intrinsic civil liberties each individual has.

Wealthy individuals who become mega rich thanks to the landscape generated by those values are required to pay more back into the system they have benefited from beyond the bare necessity of ruthless accountancy practices.

These rich pricks have designed the system for themselves, ‘you can’t tax unrealised capital gains’ the Right scream, like bullshit we can’t!

If it means the mega rich have to sell a mansion or two to pay the tax bill, so fucking be it!

The obligation of the Government is to regulate Capitalism so that we the people benefit from the competitive dynamics of competition!

We are not an over taxed, over regulated economy!

Our top tax rate is the 39th highest in the world behind all the Scandinavian countries plus Germany, the United Kingdom, Ireland, France and South Africa!

Australia’s top tax rate is 47cents!

Our GST rate doesn’t even get us into the top 50 and our corporate tax rate is 40th while Government spending against GDP ranks 56th!

And we are voted easiest to do business by the World Bank!

Total hours spent at work per year (OECD):

Germany- 1330

Denmark- 1346

Japan- 1598

Australia- 1683

Canada- 1644

UK- 1367

New Zealand- 1739

I’m not looking for socialism here folks, just basic garden variety regulated capitalism!

There are 14 Billionaires in NZ + 3118 ultra-high net worth individuals, let’s start with them, then move onto the Banks, then the Property Speculators, the Climate Change polluters and big industry.

You should be angry, NZ Capitalism is a rigged trick for the rich and powerful. The real demarcation line of power in a western democracy is the 1% + their 9% enablers vs the 90% rest of us!

Do not allow their smears of ‘Envy’ dilute the righteous rage you should all be feeling!

There’s no point making workers pay more to rebuild our resilience, tax the rich!

-Sugar Tax

-Inheritance Tax

-Wealth Tax

-Financial Transactions Tax

-New top tax rate on people earning over $300 000 per year.

-Capital Gains Tax

-Windfall profit taxes

-First $10 000 tax free

Lift the tax yoke from the workers and the people and place it on the mega wealthy and have them pay their fair share for once!

The true demarcation off power in a liberal progressive democracy is the 1% wealthy + their 9% enablers vs the 90% rest of us.

Stand. Stand now and demand more from this rigged capitalism!

The political project of National and ACT is to starve the State of revenue so that it can’t redistribute wealth in the first place.

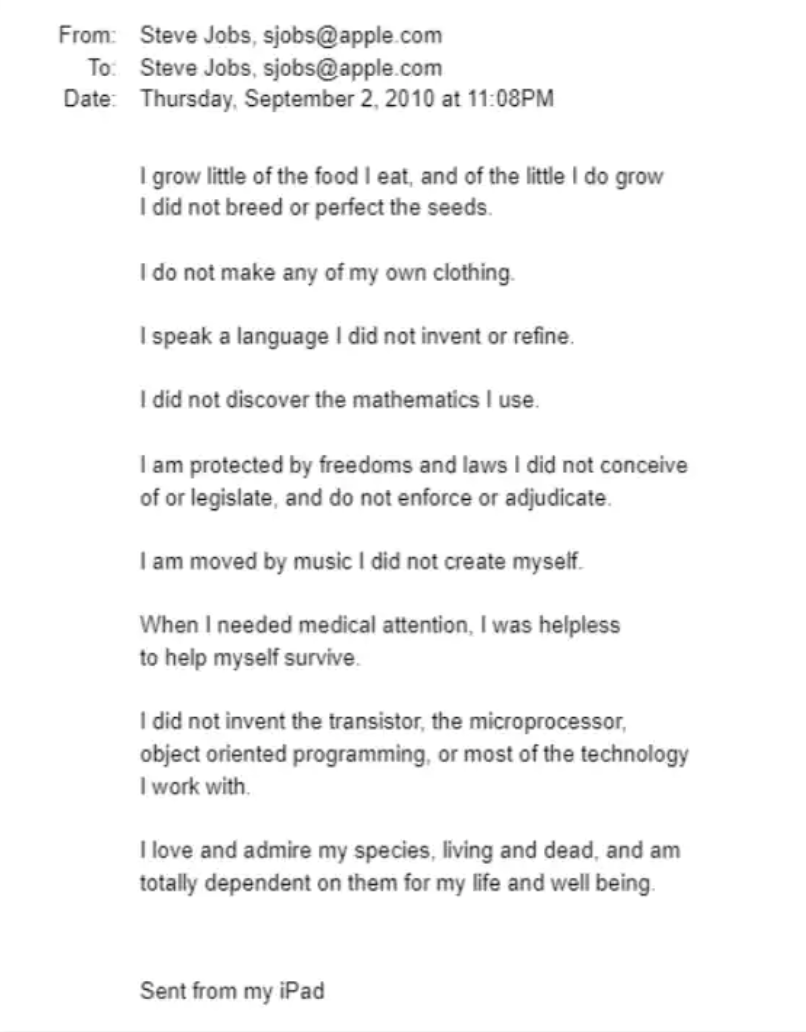

For those rich pricks screaming they are self made and fuck us for wanting a slice of their bread to properly fund society, let’s remember the email Steve Jobs sent to himself before he died…

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

If you can’t contribute but want to help, please always feel free to share our blogs on social media

Does anyone not think that by changing the taxation system, it will affect the markets? Particularly the property market and the share market?

Don’t get how you can tax something which isn’t realised. There’s a difference between taxing money made. Rates already are a type of land tax.

Don’t mind some type CGT on non family home though.

Completely agree Bomber. The system has been skewed for decades and the imbalance we have now is because of poll driven governments whose pursuit of power (and therefore personal wealth) has resulted in the vast inequalities we have now. Not just poor financial policies but also poor social welfare related policies (like state house sales and benefits and regional development).

I think that given our divided population and the recent belief in ‘I want xxx for myself and I want it now!’ that some of it is the politics of envy. We do see this increasingly from the young in particular however for the most part, it is simply the realisation that the system is groaning under the weight of it all and that something needs to change.

Many of us have been aware of the rorts and inequities in the system for a very long time, what’s different now is that we can see something has to be done immediately to close the loopholes and be more responsible. And the more right leaning posters are not incorrect in saying that something also needs to be done about the quality of govt spending.

But I do think something can be done to make it all work in a way that doesnt politicise the issue as much as political parties are trying to do now.

IE: GST off food and education and/ or differentiated amounts of GST on luxury goods ie: 10 % on basics, 30 -35% on luxury items. There has to be a way to lower the tax on basics but direct it at luxury spending.

Financial transaction tax (Hits everyone equally but for most is only a minor contribution)

Windfall taxes (on banks and mega corporates etc) as and when so we dont frighten off business by raising the business rate too much

Maybe increase the business rate by 1%

Agree with a Trust Tax of moderate proportions

And support a targeted capital gains tax or some kind of sensible way of taxing assets over and above a reasonable amount.

Greater taxes on tourism directly or indirectly

Greater taxes on people coming to NZ to live – an infrastructure levy perhaps. For wealth immigration classes, maybe a fee system – $50K or more to the government for the privilege. (They do this in parts of the Caribbean)

Inheritance tax – only over a particular level and capped somewhere in single digit % points.

Land banking tax? Flight tax?

There are many opportunities, but we must have a good look at all the options and accurately determine their downstream effects in a non partisan way.

On top of this we need a David Seymour type sharp knife through the public service but with the aims of ‘Back to Basics’ and ‘Value for Money’ — Again a non partisan no agenda approach. This is equally as important as tax policy.

The government recently held a 5 year contract for multi million dollar services where ‘price’ or ‘value’ was not one of the factors considered by the procurement panel. Sadly this situation is not unique in Wellington.

After that we need to prioritise spending and start looking at Welfare Reform in an honest non partisan way. Setting aside all the decolonisation bullshit and look at how welfare can be managed along with other things like education and housing to bring about the best long term outcomes whilst discouraging generational welfare dependency.

I think if we’re looking at implementing inheritance taxation in particular then we ought to begin with a low to medium rate of between ten and fifteen percent

Yep, we need to tax the tax dodgers, those that use their money to dodge paying tax. But invoking such terminology as ‘envy’ and ‘rich pricks’…that’s playing their game, nothing useful comes from this. Try harder, find terminology that targets the exclusive few, because it is them that are really stuffing us all over.

Greed, pure and simple.

It’s the work of the devil conving poor people that there interests are the same as the 1%.

Man it’s cheap to be rich in New Zealand. How did that happen?

Okay, but the promise from the government is, no wasting taxpayer money.

And since Michael Wood is topical, politicians like him who demonstrates he thinks the taxpayer is a bottomless pit of funds need to be banned the moment they waste our money!

Visited our Saudi sheep farm lately?