GUEST BLOG: Tadhg Stopford – Kiwi $elf defense $tart$ at home

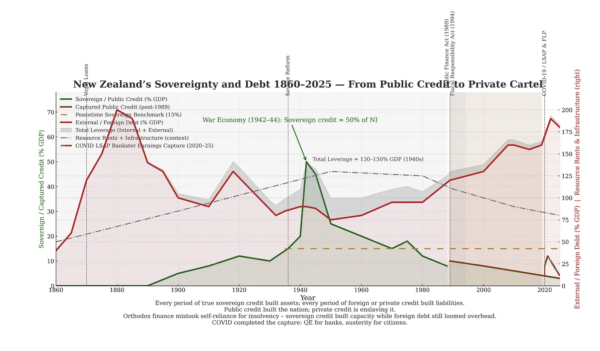

Why New Zealand Must Stop Selling Its Future to Pay Rent on Its Own Money

There is a shift happening in the global economy right now that New Zealand media and policymakers seem to have missed.

The world’s major powers (the United States, China, Japan, South Korea, India, and the Gulf States) are no longer relying on private investors to secure access to the raw materials and industrial systems that underpin national strength.

They are using state-backed credit.

Public credit. Social credit. Sovereign credit creation. Debt free dollars. National Reserve currency issue. Call it what you will, it’s all the same thing. A nations currency. Our money, issued in our name, at low to no interest, to serve strategic national objectives.

Such issue is not a debt, it’s an asset. Because we own it.

Because we have extended the credit to ourselves to invest in wealth creation, it should also provide a return on our investment. As it used to.

That our leaders choose not to try and improve things is a disgrace.

There is a sovereign path, and it’s

Not charity.

Not “free markets.”

Not “foreign direct investment.”

It’s Strategic credit directed through:

- National development banks,

- Export-credit agencies,

- Sovereign wealth funds, and

- State-owned resource and energy corporations.

These institutions are being used to acquire control of critical minerals, energy supply chains, industrial processing, and food systems—not for short-term profit, but for national security and geopolitical leverage.

And this is not speculation.

This is public policy.

Evidence: How Major Powers Are Securing Resource Sovereignty

United States

Since 2021, the U.S. has used the Defence Production Act Title III to fund domestic and allied critical mineral production.

(Source: U.S. Department of Defence, 2022):

https://www.defense.gov/News/Releases/Release/Article/3032193/

The U.S. International Development Finance Corporation (DFC) now provides direct equity financing for mining and mineral processing projects abroad.

(Source: U.S. DFC Product Overview):

https://www.dfc.gov/our-products/direct-equity

The U.S. also uses the Department of Energy Loan Programs Office, which holds up to $250 billion in strategic credit authority to rebuild industrial capacity.

(Source: U.S. DOE LPO):

https://www.energy.gov/lpo/loan-programs-office

This is not “the free market.”

It is state-backed industrial strategy.

China

China has used state development banks to secure energy and minerals worldwide since the 1990s.

- China Development Bank and ExIm Bank of China issue strategic overseas resource loans. (Source: Center for Global Development Database): https://www.cgdev.org/publication/chinese-development-finance-database

- The Belt & Road Initiative formalises resource-for-infrastructure agreements. (Source: World Bank BRI Report, 2019): https://documents.worldbank.org/en/publication/documents-reports/documentdetail/

This is resource access backed by sovereign credit.

Japan

Japan’s JOGMEC provides state-backed equity and risk guarantees for overseas mineral and energy acquisition.

(Source: JOGMEC Mandate, Government of Japan):

https://www.jogmec.go.jp/english/

After China restricted rare earth exports in 2010, Japan strategically financed non-Chinese supply chains.

(Source: METI, 2010 Policy Brief):

https://www.meti.go.jp/english/press/data/pdf/20100929_03.pdf

South Korea

South Korea uses KEXIM and K-SURE to finance overseas mineral resource projects through KORES.

(Source: KORES Corporate Strategy):

https://www.kores.or.kr/eng/

India

India acquires external oil, gas, and minerals through ONGC Videsh, backed by state credit.

(Source: ONGC Videsh Overview):

https://www.ongcvidesh.com/about-us/

Gulf States

Saudi Arabia, UAE, and Qatar use sovereign wealth funds / public investment funds to secure global mining, agriculture, and food supply chains.

(Source: PIF Global Investment Strategy):

https://www.pif.gov.sa/en/Pages/default.aspx

Meanwhile, New Zealand…

New Zealand remains locked inside a 1980s ideological framework that betrays us all. It

- Prohibits sovereign credit issuance for development (Public Finance Act 1989; Fiscal Responsibility Act 1994)

- Forces NZ to borrow its own currency from commercial banks at interest

- Requires selling land, infrastructure, energy, and resource rights to obtain foreign capital

This is not “investment.”

It is structural dependency. We have been pimped out to the finance sector.

And now, with the U.S. and China competing for control of global resource supply, New Zealand is positioned not as a partner—but as a supplier to be captured. Fuck that.

The Real Issue

Capital is no longer scarce.

Private finance is no longer the primary mode of nation-building.

What is scarce now is sovereignty.

If we continue selling:

- geothermal baseload heat

- critical minerals

- water systems

- agricultural land

- ports and fibre networks

- housing and food infrastructure

…we will be tenants in our own country.

The Sovereign Alternative

We can rebuild national economic independence by:

- Amending the Public Finance Act

- Establishing a National Development Bank

- Issuing sovereign credit to fund:

- Electrified national rail

- Geothermal industrial heat networks

- Critical mineral refining in NZ

- Regenerative agriculture and sea-farming

- Affordable, non-speculative housing

This is not new.

This is how New Zealand built everything worth having between 1936 and 1989.

Wealth builds life.

Life builds wealth.

Sovereignty is priceless.

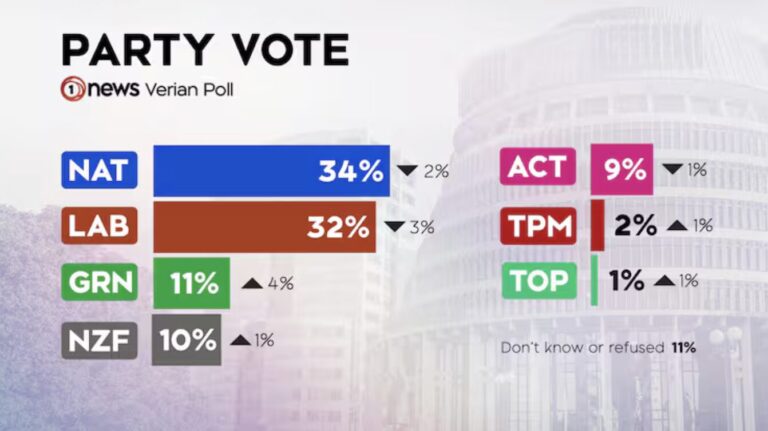

Labour and nact first anre all betraying us.

Each one teach one. Share this post, and talk about it at work tomorrow! Xxx

Tadhg Stopford is a historian and teacher.

Support change by purchasing your CBD hemp CBG at www.tigerdrops.co.nz

If Every country is in debt which is the creditor?

The Financial Historian 9.23

https://www.youtube.com/watch?v=Q3UI39q-M0Q

Mock you! This video puts the facts of the post into colour with illustrations. And after we will all be wiser, though what then I don’t know. It works well the finance system, if you are able to go with the flow.

Good one, Tadhg.

Thanks Tadgh, another good post.

I am all down with what you say but I do have a question.

If we were to go back to the pre Rogernomic situation, what stops us from turning into the economic cot case Muldoon had lead us into?

Keep up the good work.

It’s also how the parents of the baby boomers purchased their houses. Thirty-year 3% government-supplied mortgages. Families did not have to continually monitor an OCR to know their household income for the next couple of years. The interest paid on those mortgages was not exported it went back to the government for social spending.

Free Aotearoa