GUEST BLOG: Nick Rockel – Nicola’s Bag of Money

Have you seen my bag of money?

I left it in the parlour,

It was your party and they were your friends,

I see you got a nice new car and a brand new pair of pants.

So what’s it going to be New Zealand? The Money or the Bag? Do you want those sumptuous social services or would you rather just take the cash?

Expectations are running hot. Tomorrow’s the day when all the pain and cuts will be worth it. All the pandering to Seymour and Winston pays off. The day when Nicola Willis will finally announce her long promised tax relief, saving the squeezed middle from becoming bottom feeders. Hurrah!

What they said.

Before we begin this short news clip from the start of the week will help set the scene:

As we know National won the election by promising tax cuts. It wasn’t the only reason people voted for a change in government, but it’s fair to say it was the cornerstone of their election success.

Helping kiwi families with a tax cut as the increased cost of living had diminished the purchasing power of their wages. National said we’d get up to $250 a fortnight. Pretty hard to resist when you’re struggling to make ends meet and the price of everything keeps going up and up.

Tax cuts were not only their key policy but also a firm promise. A personal commitment from Nicola Willis that she’d deliver them – or resign. Although it’s fair to say that the Finance Minister, and the PM, have demonstrated rather less bravado since being elected.

They’ve still been making positive noises about tax cuts, but they’ve been mumbling while doing so, looking the other way when people ask if they’ll be getting as much as they were promised.

Nicola’s one page tax plan fell apart even before the government was formed. The anticipated revenue from selling off property to people overseas was kiboshed by Winston, although it wouldn’t be an enormous surprise to see it brought back in the budget with a higher price threshold. Except perhaps to NZ First voters.

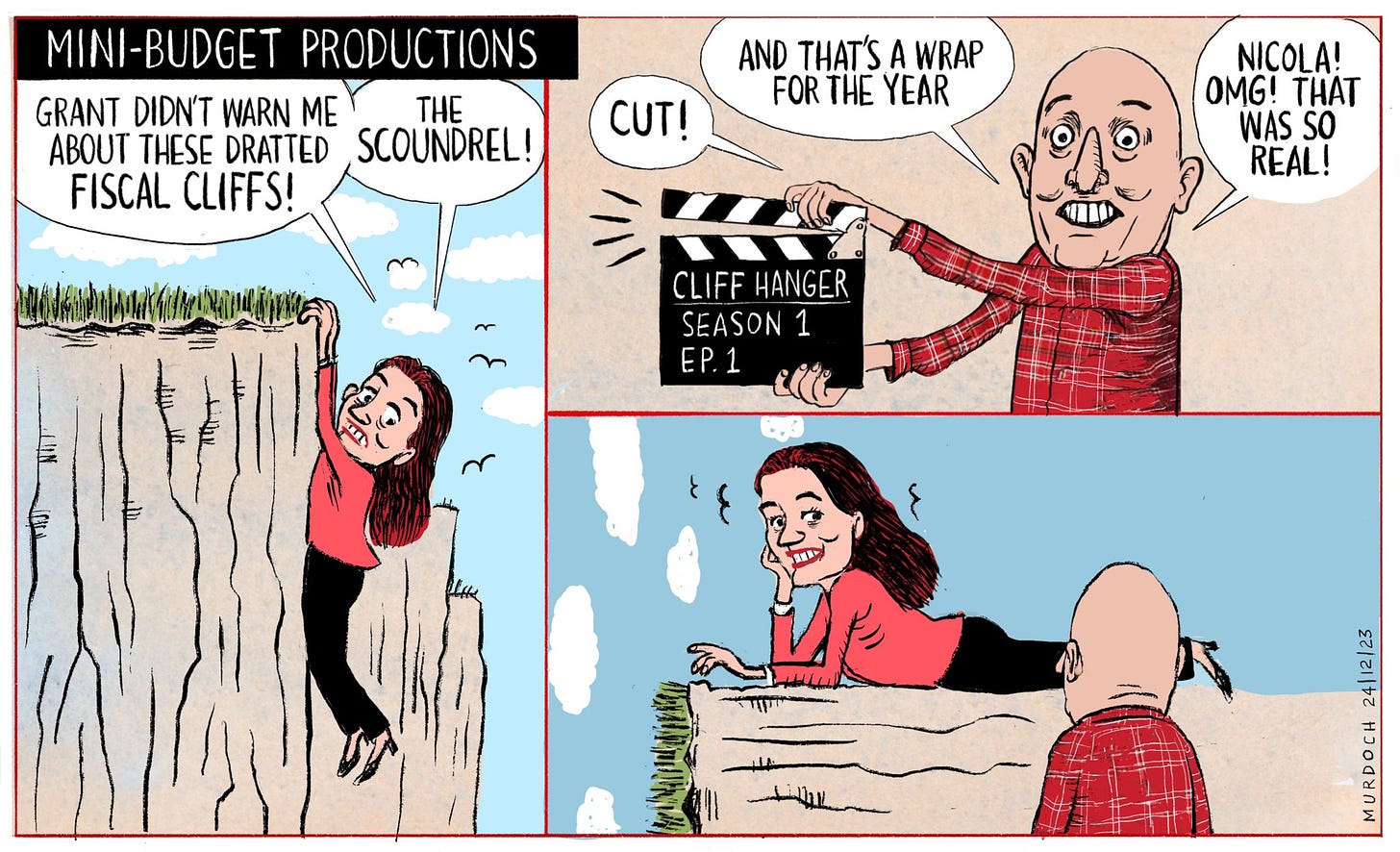

In better news Nicola discovered so called “Fiscal Cliffs”, which she hoped to use as a get-out-of-tax-cuts-free card.

“Don’t stop blaming Labour, you won’t have to give any tax cuts, you’ll get to keep your job”

Unfortunately all the information about what was funded long term, and short term, was right there in black and white. Claiming a lack of awareness as an excuse just made Nicola sound like she hadn’t done her homework.

Lately people have been warning Nicola that despite all her spending cuts she’d still have to borrow from future generations to pay for her tax cuts. As you might well imagine the perceived wisdom amongst economists is that borrowing for tax cuts is a really stupid idea.

Every day there seem to be more reasons and voices calling for her to think again, to listen to reason. The good folks at Big Hairy News had the following to say about Nicola’s Treasury updates, and why she might dread receiving them:

The problem is the more that reality is taken into consideration the more that tax cuts look not only implausible but down right irresponsible. We can’t afford them.

Now they’ve begun talking about even more job cuts in the public sector. Christopher Luxon didn’t seem to have much of a clue how many yesterday, so either he’s not particularly well informed, not overly interested, or maybe there’ll be some surprises in the budget after all. Like a weta in your gumboot.

It’s simple mathematics – if your numbers don’t add up just a wack a few more civil servants. Although at some point people will probably start noticing a reduction in services. Perhaps around the time they’re applying for a passport, or queueing longer to get back into the country.

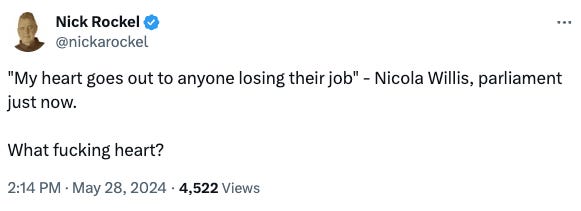

I tuned into parliament yesterday and heard something that was surprising, and quite frankly more than a little difficult to take seriously.

Soon after that Chippy asked the Prime Minister, “Does he agree with the then Leader of the Opposition, Christopher Luxon, who stated on 19 September 2023, regarding the National Party’s proposed tax cuts, that ‘for an average household income family with young kids, that would mean $250 a fortnight’?”

Luxon smugly answered his questions saying, “as your former Finance Minister used to say, ‘Two more sleeps to go.’” Which is fair enough. Grant Robertson did used to say that, and quite gleefully as I recall.

But this is not the same. Christopher wasn’t being asked to divulge some secret plan to get things back on track. By which I mean the polls. He was being asked to confirm whether he’s going to deliver the specific promises he made at the election. I’m guessing it wouldn’t be a secret if the answer had been “yes”.

Luxon didn’t say much beyond that, a bit more evasion, treating the things that many of us are concerned about as if they were all a big joke. He sneered about the small number of people watching, as if to say – nobody cares.

What you said.

Recently I asked readers what you were hoping for or fearing in this budget. Click the link if you’d like to read those thoughts, and I’ve included a selection of the comments below. Suffice to say you weren’t overly optimistic.

What do you hope for/fear from the budget?

Keith said he’d like to see a “reversal of the landlord handout, instead fitting every state house with solar panels and batteries for free! I do miss the old Tui Billboards.”

Forget about the tax cuts that will be announced tomorrow, the government should have simply said, “we can’t afford a three billion dollar tax cut for landlords right now. Sorry about that, you guys will be fine, it’s just that other things have to be a higher priority.”

Someone would have had to retrieve Chris Bishop’s, not insubstantial, jaw from the floor. But more importantly it would’ve meant fewer spending cuts, less borrowing, and more money to spend on the things people really need.

Arlene wanted “no tax cuts. Put the money into police, health, education and raising benefits to a living wage. I’m dreading more items being transferred to councils at ratepayers expense.”

You can see that happening already. National want things off the books. Be it shelving Three Waters, leaving the infrastructure costs to ratepayers, or wanting to move Kāinga Ora’s debt into some other entity.

Helen said she wanted to see “an increase to benefits and no tax on the first $20K, which would be helpful to low income earners.” I agree, if there are to be tax cuts then target them at the first $20k of income, which everyone benefits from. Rather than moving the upper tax brackets or lowering the top tax rates.

John said, “I don’t want to see any ‘reckons’ dressed up as facts. The reason for doing stuff, should be backed up by peer reviewed evidence. I do want to see the pie divided up for the benefit of all NZers not just the privileged and large campaign donors.”

Sounds good to me – how about you?

Having your say tomorrow.

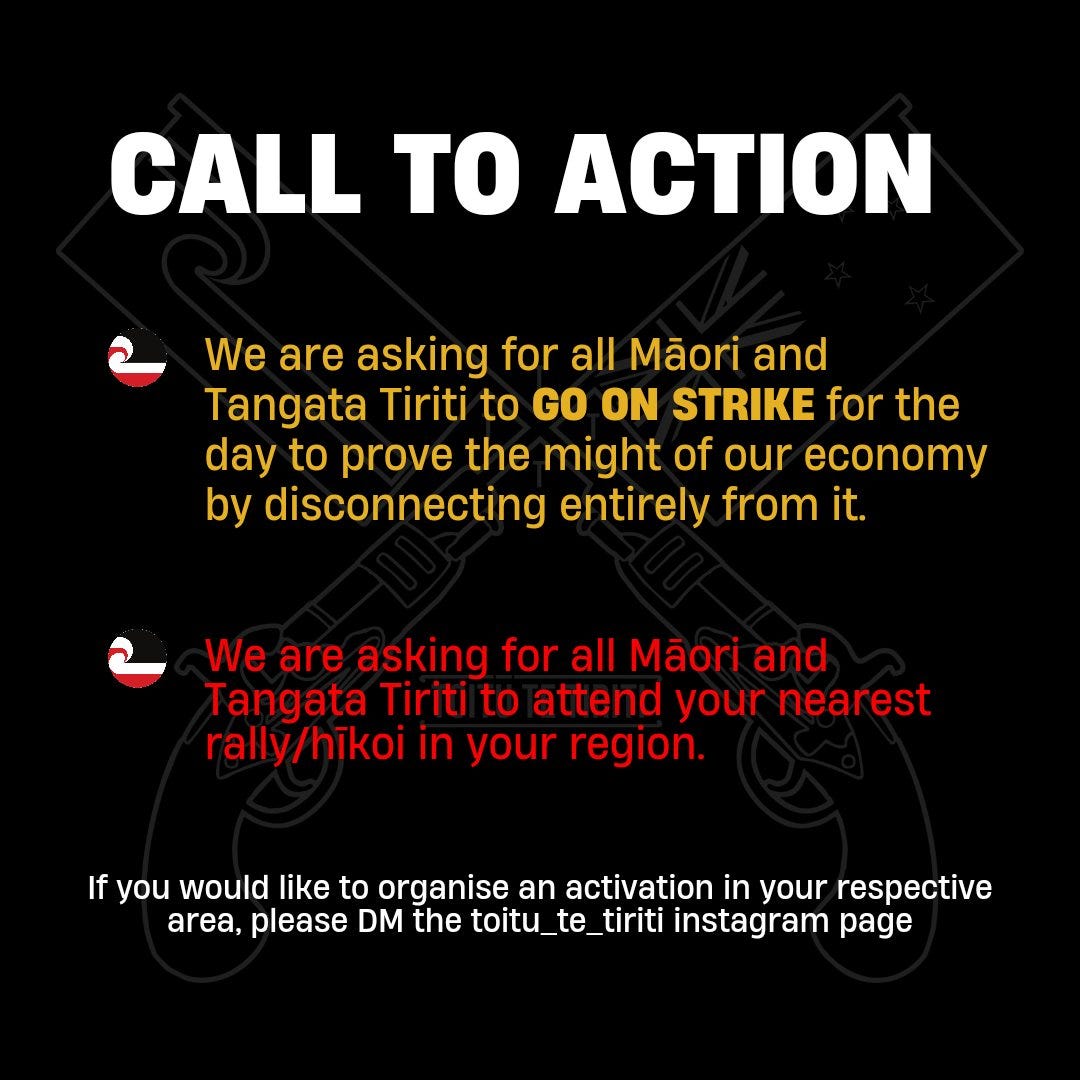

As shown in the 1 News clip there’s a call to action this Thursday, Budget day, which I’m sure is no coincidence.

There are many reasons to protest. The damage being done to worker’s rights and our public services. The freeing up of our environment for commercial exploitation. Or the attacks by the coalition on tangata whenua and te tiriti.

Details of events around the country can be found here.

You may not be able to stop Nicola Willis’ budget, which will leave many worse off, some who thought they’d be better off only marginally so, and a few, with multiple properties, much better off.

But you can sure as heck stand up and say you don’t agree. This is not a time for tax cuts we can’t afford, and would have to borrow for. Our environment’s worth more than the minerals beneath it. That the despicable attacks on Māori have to end.

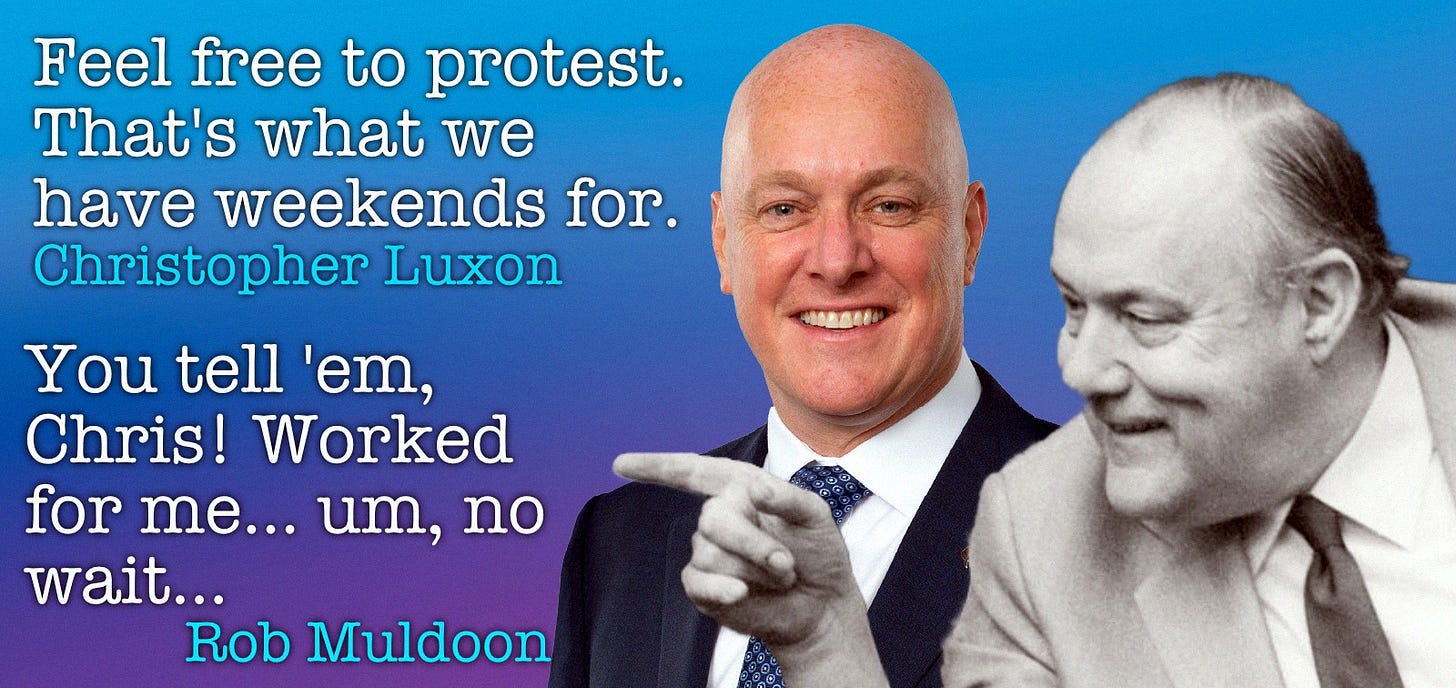

Turns out that not everyone is excited about a protest on the day of the big announcement. “Prime Minister Christopher Luxon has slammed plans for a day of disruption launched by Te Pāti Māori as ‘illegal’.”

Luxon said, “I think that is wrong – I think that is entirely wrong. Feel free to protest, that’s what we have weekends for. Te Pāti Māori, they’re completely free to protest as long as it’s legal.”

Christopher would prefer you not to make a fuss on Nicola’s big day. He suggests doing something in the weekend, you know when business districts and politicians won’t be disrupted. You wouldn’t want to disappoint him, would you?

Oh, and please resist the urge to tell me National have a mandate to do all this. That this is just democracy at work. They don’t, and this isn’t.

They didn’t communicate anything like what they’ve been doing. This budget is presented based upon false pretenses where too many people thought about the extra cash being promised without being told what the cost would be.

Stand up and protest if you want to, because it’s you and yours that will have to endure future austerity to pay back the borrowing for these tax cuts. Long after Nicola has sailed off into the distance with a gold star for meeting her KPIs.

So Nicola, what I would say to you is…

Do you really want to be seen as the next Liz Truss? Ignoring the views of economists with predictably disastrous results? Or remembered like Ruth Richardson? Just as cruel, but without her economic nous?

What could you do to extricate yourself from this mess? Well you could come clean Nicola. You could stand in front of the nation tomorrow and admit that you got it wrong.

Confess that there haven’t been any surprises in terms of what the last government spent or budgeted, the information was there all along.

Admit that the new revenue touted before the election was wildly optimistic at best and simply non-existent in reality.

In short, tell the public “my need to get elected was greater than my need to tell the truth.”

But you won’t, will you Nicola? Self preservation is too important, as is your intention to reward your backers. You won’t even call it borrowing for tax cuts. There’ll be some other euphemism, some meaningless corporate phrase, which makes it sound like you’re doing good things, rather than being economically reckless and compounding inequality.

If you’re thinking about protesting tomorrow remember, as the right always tell us, it isn’t Nicola’s bag of money – that money belongs to us.

“Nick Rockel is a left wing writer who spent far too long working in IT and now writes “Nick’s Kōrero”. An almost daily substack of political satire, news, and views, from Aotearoa New Zealand. He lives in West Auckland, and has 5 kids, 2 dogs, and 1 wife. He Substacks here.

New tax thresholds

The first $15,600 a person earns will be taxed at 10.5% – an increase from $14,000.

The next $15,600 to $53,500 a person earns will be taxed at 17.5%, which was previously $14,001-$48,000.

The 30% bracket will apply to money earned between $53,501-$78,100, rather than $48,001-$70,000.

Then, the next $78,101-$180,000 would be taxed at 33% – rather than from $70,001.

There was no change to the top tax rate of 39% for the income earned over $180,000.

So the only tax group not being taxed more are those earning 180,000+

These people are likely to be landlords receiving rebates whilst all those below will be paying more tax out of their wages. So whilst many will receive less than $40 a fortnight this will be offset by paying more income tax.

This is a corrupt government for the rich.

Willis and national are only competent at telling lies .Just look at the real situation at Kianga ora as pointed out by Bernard Hickey .Just a massive lie by English and repeated by all government ministers since .I look foward to my extra half a pie every fortnite but fully expect the price of said pie to rise by said 50% as rents do each time there are increases in rent allowances and other allowances .Rents will rise next month for sure to soak up any tax cuts .

The utmost fear of this budget is National will once again freeze contributions to the superfund. Muldoon stopped it and Key froze it. The billions they save will fund tax cuts. Sadly this is not a savings but a cost to future generations.