GUEST BLOG: Ian Powell – A poser for Labour Party: Tax wealth or tax capital gains

Veteran political journalist Vernon Small’s latest regular paywalled column in Stuff’s Sunday Star Times (3 August) has brought to life a subject that by its very nature can put many people to sleep – tax wealth or tax capital gains: A choice Labour may come to regret. Small was previously an advisor to the former Labour government.

Both taxes seek to address tax avoidance. Avoidance involves exploiting or dodging (if there is a difference) the taxation system in order to reduce the amount of tax one might otherwise have to pay.

Tax avoidance can be ethically grey This is in contrast to tax evasion which involves concealing income or other relevant information. The latter is illegal and punishable.

Thomas Piketty a strong advocate of wealth taxes

Wealth taxes involve annually taxing valuable assets such as land, shares, art works, or other valuable collectables.

Some prominent economists, such as France’s Thomas Piketty, argue that wealth taxes are both necessary and practicable.

Drawing upon empirical research Piketty has a particular focus on inherited wealth (think Donald Trump for example). Interestingly Labour leader Chris Hipkins cites Piketty among his reading material.

Capital gains taxes (CGT) also tax wealth. However, they tax the gain in value of an asset. Consequently they apply when the asset is sold. CGT is therefore usually paid only once per asset gain unlike an annual wealth tax.

Shifting the dial on tax avoidance

David Parker shifted dial on tax avoidance

Former Labour MP and cabinet minister David Parker has for many years been a strong advocate of achieving taxation fairness by addressing tax avoidance.

In his recent valedictory speech to Parliament he described his advocacy as “shifting the dial” over this issue as his most significant achievement.

On 26 April 2023, as Minister of Revenue, Parker gave a major speech advocating a wealth tax: David Parker’s wealth tax.

His proposed wealth tax, supported by Finance Minister Grant Robertson, was not as broad as discussed above. It was based on research undertaken by Inland Revenue that provided “hard data confirming fundamental unfairness in our tax system.”

The study revealed that 311 people had collective wealth of $85 billion. Further, the effective tax rate of middle-income New Zealanders was at least double that of the wealthiest.

Subsequently then Labour Prime Minister Chris Hipkins pulled the plug on the Parker-Robertson initiative; a decision which shocked many and helped contribute to Labour’s heavy defeat in the general election later that year.

Insightful column

Chris Hipkins reportedly supports capital gains rather than wealth tax

Vernon Small’s above-mentioned insightful column needs to be read in the above context. He reports that the Labour Party’s Policy Council has narrowly endorsed a CGT as the centre piece of its tax reform for next year’s election.

This reportedly is also Hipkins’ preferred position. However, this is not the end of Labour’s internal decision-making process.

Taxing wealth preferred to taxing capital works (Vernon Small)

Small described this choice as one that “it may come to regret.” Small’s argument for this conclusion is as follows:

- CGT would deliver much less revenue initially and takes a long time to build revenue, if applied only to realised gains.

- CGT requires a “difficult sales job” as National and its rightwing allies “…whip up a smorgasbord of concerns over the devilish details with a side salad of misinformation.”

- By comparison, a wealth tax targeted at the very wealthiest “…should be an easier sell.”

- The claim, which apparently influenced Hipkins’ position, that a wealth tax would lead to fear of capital flight is “over-wrought” and debunked by Treasury

- There is political advantage of a wealth tax also being the preferred option of Labour’s potential coalition allies, the Greens and Te Pāti Māori.

- It would be easier for a future rightwing government to reverse a CGT because it is slow to accumulate.

Widening the thinking beyond either/or

It is hard to argue with Vernon Small’s logic; it certainly resonates with me. However, while not critical of his column, the debate should be widened including not constraining it to either/or options.

The starting point should be recognising the need to address both the unfairness of tax rate inequity favouring the wealthy at the expense of the rest and untaxed income derived in various ways from speculation.

It should also differentiate between getting early ‘runs on the board’ (I’m a cricket addict, just saying) and longer term measures and longer term benefits.

Former Finance Minister Grant Robertson supported wealth tax proposal

Logically this favours a wealth tax for the reasons discussed. Beginning with something like the Parker-Robertson proposal would produce quicker tangible and identifiable fiscal returns.

This would be more likely to be sufficiently bedded in to make it more difficult for a subsequent rightwing government to overturn.

While this implementation is underway, work should be undertaken on broadening the range of wealth taxation taking the lead from economists such at Thomas Piketty.

This does not mean waving goodbye to a capital gains tax. But it is politically savvy to recognise the longer time required to ‘reap the benefits’ .

Taking advantage of the report from the Michael Cullen led working group, further work should be undertaken in order to develop a practical CGT without unintended consequences.

The importance of messaging a good narrative

Vernon Small correctly observes that the rightwing government parties will quickly get into attack mode once Labour announces its taxation policy.

Nicola Willis likely to lead the rightwing opposition charge

They know full well Labour’s past inability to counter such an attack and to look like a possum in a car’s headlights. Expect Finance Minister Nicola Willis to lead the charge.

The political right are experts in messaging. My way of describing this politically is as follows:

- the far right communicates in gestures and soundbites (and sometimes violent threats);

- the political right communicates in sentences reinforced by soundbites;

- the political left communicates in paragraphs (social liberals in longer paragraphs); and

- the far left communicates in footnotes.

Labour in my view is more technocratic social liberal than leftwing. I have discussed this previously in Political Bytes (30 April 2023): What leftwing really means.

Regardless, however, Labour needs to deliver a good narrative on the unfairness of tax avoidance by taking a lead from the political right.

Show more spine and do it in crisp succinct sentences further enabled by smart soundbites.

Ian Powell was Executive Director of the Association of Salaried Medical Specialists, the professional union representing senior doctors and dentists in New Zealand, for over 30 years, until December 2019. He is now a health systems, labour market, and political commentator living in the small river estuary community of Otaihanga (the place by the tide). First published at Political Bytes

The message will be the key. A vague “We will introduce Wealth or Capital Gains tax” will cause the Coalition to campaign that “the left are after YOUR money”.

However, “We will tax people with over $50 million in assets and the resulting income of $0.5 billion will be spent on employing the 1,000 graduated nurses and doctors left unemployed” (or Similar).

“They are after YOUR money” can be countered with, “Do you have $50 million in assets? Then we aren’t”

“They will just waste the tax income” can be countered with, “So you are saying funding the health service is a waste?”

Wealth or capital gains? Both works for me.

https://www.youtube.com/watch?v=zIV4poUZAQo

The K-nights who say ‘Nil’ from Monty Python

(Only to be watched at the end of the life of this post after the last despairing comments requesting improvement from these moribund and backward jerks in power (PTB) politicians and administrators and wealthy, monopolistic businesses and corpse CEOs, whose parents should suffer what the Germans did to the Jews – take all their wealth and furniture and art works and anything of value. That will be our judgment – that these parents should pay for foisting on us their worthless children and enabling them to places of importance for which they are hopelessly unsuitable.)

I blame the parents!!!!

We need lots more taxes frankly. Why is no one looking at a financial transactions tax given we have the ninth most traded currency in the world, sure it will drop, but it will bring a lot of dosh in. We are talking about 0.05% or something like this.

A CGT – of course way way past the time we got that. There might be more housiing to go around – for purchasing

A Wealth tax.

These three would mean we could do away with GST which is a regressive tax on the poor

Out of idle curiosity, what would be a taxable financial transaction?

Possibly housing sales.

In a way I feel that GST could be beneficial if it was at 5% and most went to where it was spent and to things for the people who live in that area and who could vote on where it would go, without any fancy expensive high jumps. The area would get that 5%, some income/revenue from the sale even if it was of foreign-made goods. And of course that is one of our problems, the way we have rejected our own goods like spoilt children.

Perhaps there would be five different sections agreed by all (80% even) and generally the spending would be allocated down the list in turn, unless an outstanding need from another sector popped up and went up for consideration. This method would be seen to be fairer anyway, in choice , location and outcomes.

A wealth tax wouldn’t be removed .

When a large chunk of the 311 families with that $85 billion wealth WANT A WEALTH TAX any move to remove it would be opposed from within. Hell they are even calling for a wealth tax over a CGT tax.

There is no point in introducing a CGT only. The days of asset values, especially land, doubling every 10 years are over. The reason is fairly simple. The doubling in value relied on the doubling of the money supply every 10 years, which was feasible as the resulting inflation was constrained by the transfer and subsequent price reduction of manufactured goods to China. Those price reductions are finished.

In addition, the asset value currently in place cannot generate a yield to make them economic unless interest rates are 2% or less.

So we either have interest rates at 2% or less and rampant inflation, which will be met by social unrest and civil war, or we have controlled inflation and declining asset values for the next 50 years.

Declining asset values is the only option.

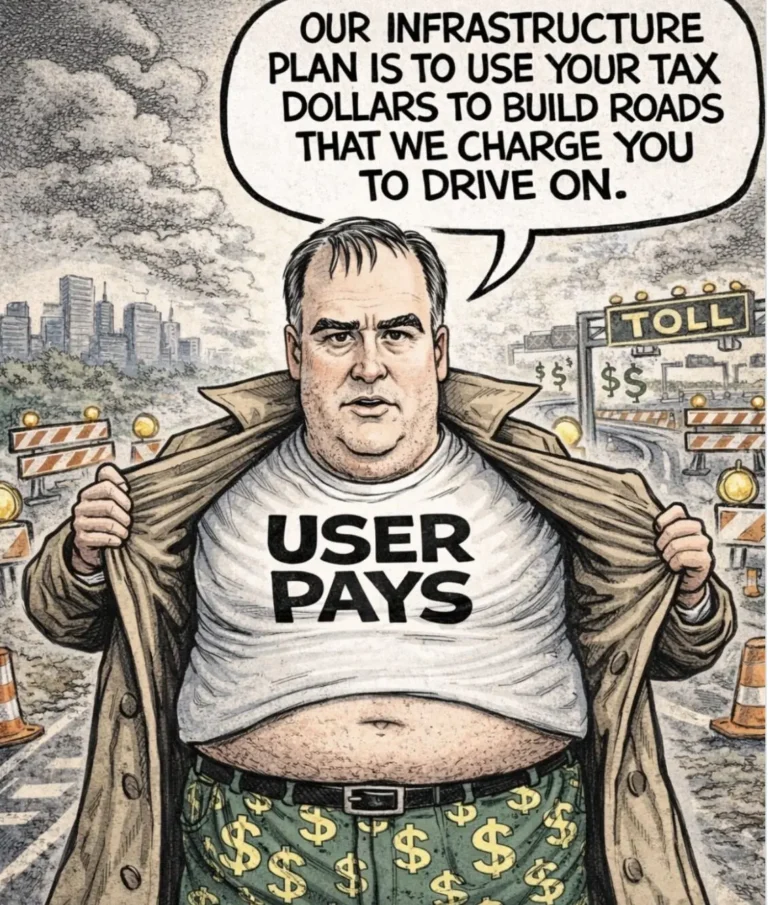

Therefore, you need a tax on wealth and don’t be seduced by the cry of those on the far right for a CGT. All they want is the ability to write off their declining asset value for a tax handout. Everything they ask for is in their self interest and not the interest of society.

I think Hipkins will have to do something either a wealth tax or CG tax or both if he doesn’t Labour won’t get back in. He will need to sell the unfairness of the tax system and do a much better job of this than their three waters policy.

If a Labour led govt introduces a Wealth Tax, it will only last as long as that government. A future conservative govt would instantly repeal it. In contrast, a CGT would likely survive a change of govt. That was the case in Australia. Keating introduced CGT in 1987. It has stayed in place for nearly 40 years. The Howard Liberal govt, which immediately followed the Keating government and governed from 1997 to 2008, did not repeal Keating’s CGT. And of course the CGT has stayed in place ever since.

Which is better? An enduring CGT or a short lived Wealth Tax.

I vote for Wayne’s idea – sounds feesible.

Don’t be so easily fooled, the Far Right will push for a CGT over a wealth tax any day as they know it will benefit them.

Banks support CGT because it has no effect on mortgage repayments. Mortgages are usually fully paid, or payment can be effected from the proceeds from the sale, before a CGT is levied.

A Left government that actually does its long-neglected job, and improves life for low-income New Zealanders, will retain power long enough for the never-even-remotely successful economic nostrums of the failed Right to be consigned to the dustbin of darkage tragedies where they belong.

Everybody feels the taxes they pay are unfair. Since it is unfair to some, have lots of smallish unfair taxes so the unfairness is spread out. Have both a CGT and a Wealth tax. Have all those other suggestions made by TDB. Plus a land tax (Georgist tax) but zero rated for completely NZ owned land. A sales tax on sales of second-hand shares. A tax on use and extraction by business of the Commons. Small taxes to spread the load. The GST should be smaller.

….On 26 April 2023, as Minister of Revenue, Parker gave a major speech advocating a wealth tax: David Parker’s wealth tax.

His proposed wealth tax, supported by Finance Minister Grant Robertson, was not as broad as discussed above. It was based on research undertaken by Inland Revenue that provided “hard data confirming fundamental unfairness in our tax system.”…..

…..Subsequently then Labour Prime Minister Chris Hipkins pulled the plug on the Parker-Robertson initiative; a decision which shocked many and helped contribute to Labour’s heavy defeat in the general election later that year….. Ian Powell, ‘A Poser for Labour’

Chris Hipkins is New Zealand’s Keir Starmer. Don’t believe me? Not only did Chris Hipkins torpedo the wealth tax, (and is likely to do so again, if given the chance). But also like Starmer, Hipkins is a genocide denier. Like Starmer claiming that it is up to the courts to make that determinaion.

In oppostion Keir Starmer promised to tax the rich. On becoming PM Starmer did a U-turn on taxing the rich and instead, citing a weak economy imposed austerity on the poor

Chris Hipkins refuses to answer questions on Labour’s tax policy, claiming he has to wait until he sees what the economy is in when he takes office. Same bullshit.

I echo the above from Pat. Hipkins is a hypnotist apparently.; what does he dangle in front of the eyes of his compatriots? Or does he exude some fragrant drug that mimics sleeping sickness. He and David Seymour are putting me off small men with fine features. Let’s have some bulldozers with ordinary suits and big noses like John A. Lee*. They aren’t thinking about sartorial splendour – they have bigger thoughts about their tasks as representatives of the nation rather than the oilygarks,

They would take notice of this from a thinking economist.

https://www.rnz.co.nz/news/business/569240/the-people-working-for-10-and-less-an-hour

…”MSD does benefits and IRD does Working for Families and student loans… they have this separation there that needs opt brought together.

“Abatement rates in the welfare system are not seen by the tax system. That’s one element.

“We also need to think seriously about our perspective on penalising people. It’s a punitive-first approach welfare system. There is a belief out there that everyone should work, should be able to go to work and should take up work whenever they can. To a degree that’s ok but then it goes to those who don’t work are somehow at fault and should be penalised. That is the perspective to get past.”…

He it seems, has gone to alternative classes to those preaching Ricardo based on exports, reducing jobs, and neoliberalism, teaching how people can be manipulated by propaganda about finance – as bad for people as rhetoric from men with messages about glory of nation, or the comfort of being sorted and disdain of others discomfort.

*A real Labour politician;

Wikipedia https://en.wikipedia.org › wiki › John_A._Lee

John A. Lee – Wikipedia

John Alfred Alexander Lee DCM (31 October 1891 – 13 June 1982) was a New Zealand politician and writer. He is one of the more prominent avowed socialists in New Zealand’s political history.

***

Read NZ https://www.read-nz.org › writers-files › writer › lee-john-a-

John A. Lee – Writer’s Files • Read NZ Te Pou Muramura

He continued to disseminate left-wing socialist views, however, through John A. Lee’s Weekly (1940-48) and other journals well into the 1950s. From 1950 he was a successful Auckland bookseller and writer, adding to

***

https://www.aucklandmuseum.com/visit/exhibitions/2013/a-decade-of-days-robin-morrison/john-a-lee (Young – petty thieving – police!!)

***

https://teara.govt.nz/en/speech/31/john-lee-recorded-during-a-visit-to-parliament

Images and recording of Lee and Holyoake.

***

https://www.pcset.org.nz/blog/blog-post-title-one-b7p4h (Some people remembering Lee)

He died at 91 – I can’t find any media obituary on the net. There should be one but where?