GDP Triple Dip recession vs inflation vs degrowth Capitalism

Reserve Bank cuts OCR by 0.5%, mortgage rate falls follow

The Reserve Bank has cut the Official Cash Rate by 0.5% to 4.75%.

The Reserve Bank said it made its decision based on its belief that inflation is now within the 1-3% target range, and heading towards the 2% midpoint.

The big four banks – ASB, ANZ and BNZ and Westpac – quickly cut their variable rates by 50 basis points, following Kiwibank which went early and lopped 0.50% off its variable loan rates yesterday.

The drop of inflation followed by OCR cuts have been seized upon by the Government as proof positive their borrowing of billions in tax cuts, landlord tax breaks and slashing of public services shows NZ is right on Track.

Bullshit.

Our economy is in a terrible place because the Government has pulled public funding in favour of privatisation that has strangled off the construction industry.

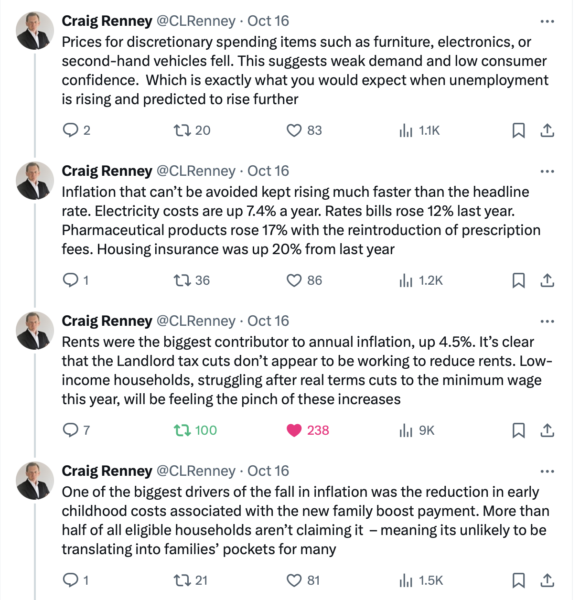

CTU Economist Craig Renney paints the grim picture…

…he’s right, poverty is a choice for this Government, their focus is on their Donors interests, not the common good.

Rents are crippling people, yet the Landlords get more!

Banks prepare for home loans going bad

Good to know the Banks are safe and that we have extended the economic pain longer than we needed…

Three years of recession deeper than GFC

GDP per-capita down 4.6% from Sept 2022 peak, a steeper fall than first 3 years of GFC recession, when per-capita GDP took 5 years to get recover; ASB forecasts recovery to peak may take 4 more years

This inequality happens at a time the reality of climate change changes the entire economic model…

Trees and land absorbed almost no CO2 last year. Is nature’s carbon sink failing?

The sudden collapse of carbon sinks was not factored into climate models – and could rapidly accelerate global heating

…on the one hand we have catastrophic weather events exacerbated by climate change happening in NZ…

…and on the other hand we have a Government pimping for the climate change polluters…

…Shane Jones social media feed a ‘pick me’ culture war hot mess that would make Incels blush.

We need economic resilience, we need community resilience, we need radical reform to strengthen sustainability.

We need more Left Universalism.

We need to lift the tax yoke off working people, beneficiaries and the middle classes and we need to put it on the Banks, the Corporations, the Billionaires and the mega wealthy.

We need more Democratic Infrastructure, not less!

Why do we need these things?

Because the climate is shutting down and we face a bleak future where Billions will suffer and die thanks to catastrophic climate change.

This change will be forced upon us whether we like it or not.

This demands more connections, more bonds that bind us together to emotionally, socially, economically and politically survive what is coming.

Māori communalism is going to teach us a lot.

Here are some thoughts:

Iwi backed new Supermarket: Bring in a 3rd player into the supermarket duopoly that is Iwi backed with a focus on cheap prices for consumers, best prices for producers and high wages and work conditions for workers. Take 30% of the Supermarket Industry by force (allowed under the Commerce Commission powers) and use this as the backbone for a new food security system.

Mārae Civil Defence: Use Marae as the backbone of Civil Defence throughout NZ with resources based there alongside new building grants to strengthen those Marae.

Ministry of Green Works: We need to be able to build our own infrastructure.

New Mental Health First Responders: A whole new branch of first responders to deal specifically with mental health issues to talk people down and seek help rather than calling then Police and arresting people.

Artist Benefit: As part of a degrowth Capitalism model, pay Artists to make public art, use that art as a means to deal with the wondrous grief caused by the destruction of the planet.

Māori Parliament: An indigenous Parliament that amplifies Māori political voices.

Universal Student Union: Allow Student Unions to be the incubators for tomorrows politicians and stop students simply being cash cows for corporate education.

Universal Migrant Union: Stop migrant worker exploitation with universal student membership.

Retirement Village Unions: These scumbag retirement villages abuse their elderly and sick clients, universal Retirement Village Unions would stop them being exploited.

Pensioner Unions: Give our elderly a voice!

We don’t comprehend how bad things are going to get environmentally, the speed of heat that is happening right now shocks scientists and with research suggesting AMOC will shut down BEFORE 2050, we are in a a realm of violent change whether we want to acknowledge that or not.

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

Let’s have both inflation and employment linked again. It is one-sided at present isn’t it? Money controls of all sorts should act for the good of the nation’s economy. I don’t know whose economy we are now thinking about. Or which sector of the citizenry. But hey that can include businesses which can be regarded in law as ‘persons’ can’t they. Soon they will have separate grand toilets built for them male – female – trans – and pretentious!

What about inflation rates that don’t sink down to near stagnation. 2-4.5% I think would still be on the careful side. Get to it you people? supposed to be serving the people??

Inflation figures are bull shit untill they include house price increases and things like rates and insurance and all the other things other than food and petrol .

Yes, my landlord visited yesterday to inform me my rent was increasing by $90 a week. The justification was an increase in rates and a bigger cost that of insurance hikes. She didn’t say how much the landlord rebates from the government she was receiving but taking her at face value anyone thinking that the sun is shining down on every New Zealander has rocks in their head or has political naivety.

Inflation now around the 1 – 3% target range? How can that be when we, those that live in the real world, increasingly face rising costs. Insurance, a good many grocery items, goods and services, rates, fuck me, even a gourmet vegetarian pie cost me 10 bucks the other day, that was something I wasn’t prepared for. Sure, a gourmet pie in the top end of town, and I hadn’t bought one for years but it seems like 20-30% for me on thus one. Within the 1 – 3% range? What creative accounting are the bean counters using to make this assertion? Ordinary folk, rich, poor, and anywhere in between must be stratching their heads.

At the super market the other day .

Milk up 40 cents

The Prebiotic yogurt I normally buy up $1

Gold kiwi fruit $9 per kg .