Fonterra dumps all that ‘value added’ crap we’ve been told to swallow for basic bitch milk powder

Dairy co-operative Fonterra selling Anchor, Mainland, Kāpiti: What does it mean for consumers?

Dairy co-op Fonterra has agreed to sell its global consumer and associated businesses, raising questions over what impact the sale will have on Kiwis at the checkout.

Staple New Zealand dairy brands Anchor, Mainland and Kāpiti are among those impacted by the $3.845 billion sale to French food group Lactalis.

Given that butter and cheese prices have soared recently, concerns have been raised. Butter prices have almost doubled in the past 14 months.

The average 500g block jumped from $4.49 in April last year to $8.60 last month. In January 2015, the same block cost $2.97.

Asked about the impact Fonterra’s divestment will have on prices for consumers, the dairy co-operative’s chief executive, Miles Hurrell, said there would be none.

Bullshit!

Fonterra dumps all that ‘value added’ crap we’ve been told to swallow for basic bitch milk powder!

Fonteera gets to pollute the country, steal and filthy our water, create climate change gases and sell to us a product at global prices because it has the social contract to do that.

The social contract is built upon the lie that we sell our cheese and milk to the world when the truth is we create basic bitch milk powder for the heavily manufactured food industry as an ingredient.

We lie to ourselves using our brands to pretend we are making dairy products when the reality is no value added basic bitch milk powder.

I have been arguing for some time that the NZ Dairy industry is a sunset industry the millisecond a synthetic calcium casing is found.

We have been led to believe that we are some fancy Dairy producer when the reality is we are a basic bitch exporter of basic bitch milk powder that is used as ingredient filler for the heavily manufactured food industry, 75% of our export is milk powder and the millisecond those big manufacturing industries can remove the cost of growing the cow to make the milk, our economy will risk an enormous implosion.

The NZ Dairy Industry Flashpoint is approaching…

Scientists have found a new way to make a substitute for cow’s milk that could have a radical effect on the dairy industry.

It’s called precision fermentation – creating cow protein in the lab – and could replace dairy ingredients, which make up a significant proportion of New Zealand’s export market.

“Precision fermentation of dairy proteins which creates a very easy pathway for creating proteins without using dairy cows,” University of Otago Professor Hugh Campbell explained.“If this area takes off, it improves New Zealand’s economic prospects because a whole lot of things happen that are high value, but it does shrink our livestock footprint on the land.”

Food technologist Anna Benny has worked in food science for decades and has found herself living on a dairy farm in South Otago, so she has a unique perspective on the future of the dairy industry.

“My concerns are we are right in the firing line if this technology can take off,” she said.

Benny said New Zealand was vulnerable because three-quarters of our dairy exports could be replaced.

“The types of products that precision fermentation will produce are ingredients and powders. The types of products that we specialise in.”

…the Dairy Powder Industry has managed to get environmental rules sidelined and water pollution limits eroded as they take on huge debt from the Banks to afford dairy intensification when that industry is a sunset industry.

Why on earth would the heavy manufactured food industry who peddle salt, sugar and fat laden food give a shit that the filler ingredient is organic when they want only profit maximisation?

We have built all economic support into a product that had a technological limit.

Cows will soon be Taxis in an uber world.

There is zero recognition of this risk because kiwis have been conned into believing that NZ Milk and Butter is the clever product we are exporting when the milk powder reality is far more demeaning.

So what does Fonterra do?

Why they destroy the brand future and settle to go all in on the sunset part of their industry – business-to-business milk powder exportation…

Fonterra considers selling global consumer business including Anchor, Mainland, Kāpiti brands

Dairy cooperative Fonterra is looking to sell all or part of its global consumer business as it shifts its focus to becoming a global business-to-business provider of dairy nutrition products.

Fonterra’s consumer business brands included Anchor, Mainland, Kāpiti,Anlene, Anmum, Fernleaf, Western Star, Perfect Italiano and others.

Those brands used about 15% of the co-op’s total milk solids and represented about 19% of its underlying profit in the first half of this financial year.

Fonterra chief executive Miles Hurrell said the co-op could increase its value to farmers as a business-to-business dairy nutrition provider.

…this basic bitch level export plan is even reaching to the cows themselves with the push for live exports to undermine our own meat processing industry FFS…

‘Essentially cruel’: Greens urge Govt to reconsider live animal exports

The Green Party and animal welfare activists are urging the Government to reconsider its move to repeal a ban on live exports in the wake of images showing animals living in their own filth on “purpose-built” ships.

…so we will produce raw timber, raw milk powder and just the cows themselves!

There is no development of product or value adding, just basic production of raw goods.

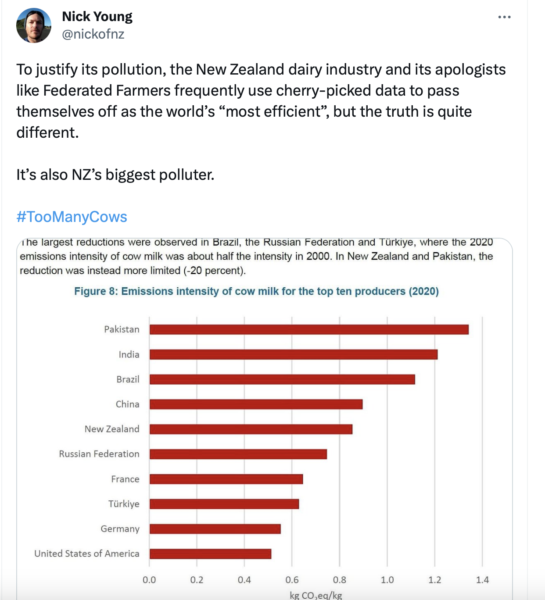

The Biggest Lie in NZ Politics is that NZ Dairy is the cleanest and greenest in the world when the reality is that it’s a cherry picked nonsense that leaves out pollution so NZ Dairy can get to the numbers to pretend to be clean and green.

Russel Norman’s take down of this Dairy propaganda was just ruthless…

“NZ is the biggest seller of a simple commodity called dried milk powder, the cheapest of the cheap, and if you look at what is happening in food production around the world they are looking for more environmentally sound food products.

They are looking for higher value products.

We’ve gone down the pathway of the lowest quality commodity you can produce in the world.

NZ is mid range in terms of its environmental cost per kilogram of milk solids, there is nothing special about it, and we do feed a small number of people compared to the billions on the planet and the economics is very clear that you can be just as profitable if you pull back on the stock rate, pull back on the amount of fertiliser and actually produce a higher product.

Organics is in fact doing incredibly well globally, so why don’t we become a producer of dairy rather than the producer of the cheapest commodity on the planet which results in us trashing our water ways and being big climate producers, that’s a better pathway isn’t it?

…he’s so right!

We always ignore that the 40million number is based on us selling milk powder as a base line ingredient filler for the manufactured food industry. The PR spin pretends it’s wholesome NZ cheese and milk and meat those 40million are eating when the truth is the vast majority of what we export is basic bitch milk powder used as a filler ingredient!

The Climate Crisis was some event we feared at the end of the century, what we are seeing is an unleashing of heat events well beyond what we feared.

There is just no plan to adapt to this new reality when it should be the driving force to begin immediate and radical adaptation for what is coming.

We have no comprehension of what is coming and we are simply not prepared for the age of consequences.

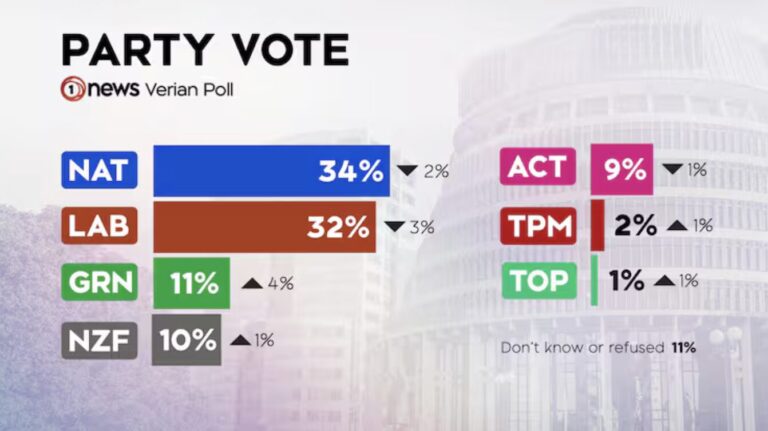

Watching National, ACT and Corporate Farmers use their economic and political muscle to avoid responsibility for what comes next can only be resolved by civil unrest and a campaign of civil disobedience against those interests.

Just consider how the Corporate Farming Lobby have managed to avoid any tax on their pollution since mid 2004!

They have pushed and pushed and pushed it off for 20 years!

National have already promised ANOTHER 5 year extension which will mean the agricultural industry have managed to stop any tax on their pollution for quarter of a century!!!!!!!!!!!!!!!!!!!!!!

Claiming that NZs emissions mean nothing in comparison to China and India isn’t a justification to do nothing, it’s an acknowledgement that radical adaptation is the only move left because those Goliath economies have already doomed us to a dangerous climate change future!

Why should any of this matter to us?

BECAUSE WE CREATED THE MONOPOLY!

We created a monopoly in the form of Fonterra to maximise price negotiations on the global market, but the flipside of that is that me as a consumer in NZ, for a product made in NZ, I’m competing with 500 million middle class Chinese who want this product.

NZ only has a population of 5million, we can never compete for price against 500million middle class Chinese.

Why should we be forced to pay the same price as the Chinese Middle Class can afford?

The Chinese Middle Class is forecast to grow to 787 million!

On top of that, this butter is created by a cow which takes water, pollutes water and generates climate warming emissions.

So this product, that I’ve already paid an environmental price in the manufacturing of, also costs me an arm and a leg price wise, because I’m competing with 500million middle class Chinese?

Why are we paying a price that is imposed upon us by a middle class market that is many times larger than our total population?

Why can’t we eat the harvest of our own nation?

NZ’s food system in ‘disarray’, scientist says

New Zealand’s food system is in “disarray”, with major cross-sector challenges to resilience, a leading scientist says.

There was a growing need for a national food strategy to improve the country’s food resilience, Te Whare Wānaka o Aoraki Lincoln University Professor Alan Renwick said.

Food systems needed to withstand shocks from international conflicts or disasters, as well as deal with accessibility and health concerns, he said.

One example cited by Renwick was of price shocks during the Covid-19 pandemic.

He said food price inflation during that time was more severe and persisted longer in New Zealand than elsewhere.

That was partly to do with a food system that was very reliant on imports and a concentrated agriculture system, he said.

“The idea to me about food system resilience is we’re able to maintain good access to food for our people, at a reasonable price, even when these shocks come along.”

He said the rise in food inflation in New Zealand since 2021 had resulted in further challenges for families.

“We need to understand how our food system and supply chains differ from other countries. Is it that supermarkets have too little competition? Is it a consequence of our export-focused primary production that is detrimental to our food supply?”

A recent report on food security found NZ had incredibly low food security because it was so open market driven and refused to subsidise farmers.

Which is where we on the Left must drive the debate.

We should absolutely consider subsidising food grown by NZ farmers and horticulturalists and our seafood and meat and dairy that generates a 25% price reduction for all NZ produce consumed here.

For growers we need to protect our most productive growing land for food by giving those producers tax breaks to ensure they can continue to feed NZers first.

Rebuilding a direct link between the harvest grown here, the people who grow it and a grateful local market who enjoy the product WITH a 25% price reduction.

Climate change will kill global free market supply chains, we are locked into hyper-regionalism. We need to build new economic structures, subsidising NZ kai for the domestic market would lock in certainty for producers while strengthening food security for the population.

We have to find new ways of working together to ensure we can survive what’s coming.

Fitch Ratings analysts warned NZ last month that the next 10 years of economic growth was dangerously stunted.

This matters because it is ratings analysts like Fitch who warn the market if we are good for all the money we borrowed.

They base that on future projections of our economic cycle and their analysis is terrible.

Fitch have made clear to us that Dairy, Tourism and exports to China have waned and can not grow beyond the manner in which we have already grown them.

We have allowed free market dynamics to be created where we as Kiwis are competing against far larger markets for the kai that was grown in our own country!

Why shouldn’t our children eat from the harvest of our own nation?

Why have we allowed the corporates to take the kai from our nation and make us compete against far larger markets who will pay more than the domestic population in NZ can afford?

I’m sick of Fonterra’s excuses.

We created a Monopoly for them and these greedy fucks have trashed their social contract with Kiwis!

We are what we’ve always been, an exporter of basic bitch raw materials with zero added value.

None of this is ever discussed or talked about in the mainstream media because they are terrified of annoying Dairy Farmers.

Where’s your productivity Gods now NZ?

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

Bill Gates Butter Factory forces closure of Dairy Factories worldwide!

https://youtu.be/_hKapUhVgQM

What value the salt content.

Problem with not just these brands but every New Zealand brand in the FMCG market place. It is distribution. Silver farms manages that somewhat but it costs a lot of capital to stay there. Fonterra will never compete with Nestle for that requires 10’s of billion dollar investment into warehousing, stock and distribution channels. We (as in New Zealand FMCG manufacturers) cannot even compete in Australia. The distribution channels are simply not there to stockpile goods ready for distribution on an FOT (full and on time) basis. Supermarkets want a pallet of butter today, not tomorrow, not on back order, not in shipping. They want it now to keep their stock levels at best to 7 days turnover.

Gerrit you make the practical reasoned experienced points that we should know when we are considering our national trading measures. I didn’t learn the parameters on trade for NZAO till I was in my 40’s and doing a simple economics course at polytech. Our economics tutor said that no country relying on basic agriculture could develop into a first world economy. Shock for me.

We were always on edge of problems so 1975 when UK went to the EU showed us up. But we have never dealt with the business game sensibly, always with a gold rush propensity, venison etc, kiwifruit etc. and we sell off advantage as soon as succeeded. We needed to buy our own stuff nationally and keep it, but we went out like children and spent the benefits once we achieved. I think Fonterra originally was along that idea, but economic ideas changed like fashions, but our basic truths should have remained stable; should have stood strong and unchanging in people’s minds against our own Trumps, children of the market and stock exchange,

We laughed at Pacific Islands cargo-cult mentality after WW2, and then didn’t think about our own approach. So grandiose we became that we rose from working man support and better conditions for ordinary people reflecting enlightenment thought, to walking with the titans of the world. Who have now picked up all our plums and are treading those fallen to pulp. Damn we are squashed from going for insane money goals, and good times, just Harvey Weinsteins in another milieu.

So how come the French can turn a buck from New Zealand consumer dairy products when New Zealanders can’t?

What is it? Some sort of national personality defect? What?

Distribution. See my comment below. AFFCO tried that with their meat ready for supermarket shelves. Turnover of a billion dollars but a net profit of 100K. It just costs a lot of money to install distribution channels, not helped by high shipping costs from the rump of the world to overseas markets..They closed all their overseas sales offices, fired the staff, closed (gave up the lease) the refrigerated warehouses and moved HQ to Ngaruawahia. Share price was 28 cents. Company was going broke. Share price recovered.

Thanks. Interesting. So would volume be at the root of it – as in the capacity and capability to have all the steps of the chain stocked at all times?

Yes volume (as in finished goods) is the problem for it eats cash in the fact that the volume generates no income till sold. The volume is not in one product line of finished goods, it is in every variation (think meat cuts) and every size. Huge financial outlay in finished goods inventory

It is the reason New Zealand exports logs. For if we were to value add with sawn timber products (furniture, plywood, etc) one has to second guess the market in design and volume.

In an ideal scenario New Zealand export companies would export raw products (milk powder, meat carcasses. timber logs, etc.,etc.) to their own processing plants close to the customers. But again, requires buckets of cash and more importantly time.

Nestle did not become a world wide brand overnight. The built factories and distribution channels over a long period of time as finances permitted. Nestle started in 1866 and began to became a world wide industrial entity in 1905. They have been at it for 120 years. Slow but steady managed growth .

If New Zealand companies started now, 2150 should be a good year. Fisher and Paykel did by setting up a factory in Queensland. But again they started in 1934 so have some history building up to expansion. .

So where are the new owners going to make these products .Have they bought the manufacturing plants as well as the brands ?If that is the case then it is a major sell down of fonterra assets as well as the brands .Not only will we be sending profit off to france we will have lost the ability to manufacture anything other than milk powder for bulk sale .Remember when Frucor was the owner of the V energy drink brand which was also sold to a French company who now make billions a year from it while we got a few million so we could get a batch at the beach and a sports car for doing all the development work .

We can all see it and smell it. Fucked up waterways from Diary. How about Fonterra selling butter at cost to make up for something that won’t be fixed by anyone connected to them.

Fonterra are about profits they don’t care if we can’t afford their products maybe they got sick of NZers moaning about the price of butter so they thought let’s sell then we don’t have to listen to all the whinging. The French company are also about profits so soon we won’t have to worry about the price cause there won’t be any products for us to buy.

Perhaps the French took notice of the intelligence their agents picked up when they were here helping Greenpeace? and setting up the Rainbow Warrior attack. And they saw opportunities to profit from our eager beaver desire to sell out our assets was noticed hence Fonterra.

I don’t know why we went to so much trouble for 150-170 years since colonising as Brits. Only to sell it off with the money received doing what? We will run out of pieces of land to sell and houses to buy. And all so that many of us would need poverty foodbanks and could end up living in hovels, those who missed out on being the right stuff.

French people are owners of one of our major jams, preserve companies’; they bought into Barkers in Geraldine. Later a Tasman/Nelson firm making preserves under the Anathoth label sold out to the Geraldine Barkers firm but the business outcome was different from expected, and the local people, Popes thought they had retained some working relationship I think, but no.

Background to business in Nelson of jam makers Anathoth

Shop Ethical! https://ethical.org.au › companies › 192

Anathoth – Shop Ethical!

Established in NZ in 1969. Bought Anathoth jams and pickles in 2007. Family-owned French company Andros acquired a majority stake in 2015.

Something went badly wrong with the Pope partnership sale of their jam making business. This information from an article on their business closure. They had a good product and I don’t know what happened.

https://www.stuff.co.nz/nelson-mail/news/6631679/Anathoth-founders-property-in-forced-sale

Mar.24/12 …It will complete the selldown of the Popes’ various properties in Nelson and Central Otago, which failed to save them from bankruptcy after they were left millions of dollars in debt following the acrimonious sale of their Anathoth brand to South Canterbury fruit processor Barkers in 2005…

Meanwhile, the Kelling Rd property comes with its own packhouse, blast freezer, worker accommodation and kitchen facilities as well as 8ha of raspberries, which this year yielded more than 49,000kg of fruit. It also has a three-bedroom house and two-bedroom cottage….

Barkers later closed the Upper Moutere factory with the loss of 20 jobs and moved processing to its Geraldine headquarters.

Mr Pope said he and his wife now lived on the pension in North Queensland and as undischarged bankrupts had little to do with Pope Jams apart from offering advice and training to staff….

Perhaps trying to limit legal costs and not getting thorough explanation of the provisions, thinking that something discussed and apparently agreed was set down, but was worded differently in the legal documents or there was some equivocal clause that resulted in loss. But the foreign firms buying up NZ resources and enterprise have often badly affected regional businesses that once flourished. An example is the pine plantations put in to gain carbon credits where we would have grazed beef cattle or sheep and the rural communities have been denied the business round that provided their living.

Barkers expanded in Geraldine and disappeared from Tasman, Nelson also 20 jobs. Popes kept on in a small way, their preserves still good but couldn’t recover. Is this progress? Barkers start and sell out business to French, the French buy out another small business and relocate it. The business would have done just as well under NZ ownership. The business expands, and now there is a problem with water quality of the larger entity.

http://www.rnz.co.nz › national › programmes › countrylife › audio › 2018909048 › barker-s-of-geraldine-thriving-after-linking-up-with-french-jam-maker

Sep 29, 2023 Founded by Anthony Barker and his wife Gillian, Barker’s began as a humble venture, aimed at supplementing their farm income. Little did they know that their foray into the world of culinary delights would evolve into a thriving, internationally recognised brand…

****

PressReader.com https://www.pressreader.com › new-zealand › the-press › 20241102 › 282046217602565

The rise and rise of Barker’s of Geraldine – PressReader

Nov 2, 2024 Making 14,000 tonnes of product each year across chutneys, jams, toppings, drink syrups, sauces and marinades, Barker’s sends about 50% of its goods to the supermarkets and the same to

*****

Newsroom https://newsroom.co.nz › 2025 › 07 › 08 › council-investigates-alleged-barkers-wastewater-breach

Council investigates alleged Barker’s wastewater breach

Jul 8, 2025 The South Canterbury fruit and vegetable processor, famous for its jams, chutneys, spreads and preserves, was started on the Barker family’s sheep farm just outside Geraldine, and is owned by French …

“Why can’t we eat the harvest of our own nation?”

Because it hasn’t been ours for many, many decades.

So true

Huh! Farms, forest, fish are the primary basis of the maori economy.

This is either a smart move like Telecom ripping Canadian Pensioners when they sold the The Yellow Pages for $3.4billion (in todays money). Apparently Canadian pension funds didnt know Google existed.

Or incredibly dumb with French Milk Inc having beguiled the kiwi farmers. When a sophisticated consumer is choosing track and trace food. Are they going to pay heaps for a natural dairy product with the quality surety of a 100year old brand, advertised by old codgers philosophising about time and the product traced to a cow in a nearby meadow. Or are they going to be happy to trace the food origin to a lab in Ohio? People pay up for french trademarked Champagne and Lui Vuiton and Coco Channel and soon Ancre Butter.

Or is Fonterra going to double down on ingredients – scrap the cows and farmers and water pollution and just make proteins at a lab in Morrinsville?

Latest smart brainfart.

https://www.rnz.co.nz/news/country/570831/country-life-barley-a-source-of-new-dairy-alternatives

We certainly have more than our share of dickheads most of whom comment ignorantly here.

Don’t despair some of us are here to save you from yourselves.

There is no way they can shrink them selves to greatness .Sure farmers will get a sugar hit next year of $2 a share then what .Fletcher building is heading in the same direction down sizing to save their backside .So now we are just a wholesale seller of milk powder,logs,and just about everything else including fruit .Watch the balance of payments get worse in the next 5 years as we no longer sell butter for 7k a ton but import more cheap shit to feed the retail therapists .

“I have been arguing for some time that the NZ Dairy industry is a sunset industry the millisecond a synthetic calcium casing is found.”

Pipe dream. No one is going to voluntarily eat GMO chemical-laced Big-Pharma manufactured Franken-foods. Not here or not anywhere else. Unless of course they create a man-made food-shortage (wouldn’t surprise me tbh).

Your description is completely wrong. Precision fermentation makes the same stuff that comes out of a cow (are you aware what the microbiome inside mammals is), although it will probably be purer as there shouldn’t be any somatic cell presence. While some will be reluctant to try it, if it has a cost advantage it will sell. We are talking about replacing milk powder which is a bulk filler ingredient so most people will remain happily ignorant.

Brilliant Steve. I find it ironic Nirtrium’s own “Pipe Dream” is so full of holes I suggest he go back and take another look at the science behind ” pipes” because you certainly put his Theory to bed.

Once a proud New Zealand company with principled national interests, Fonterra is now reduced to pawning off the remnants of the company to the colonials abroad, while the farmers, ragged and haggard, are onsold to a new plantation owner. Was the inflated butter price a pump and dump, kind sir?

Agreed Ethan. Fonterra is a cooperative in name only, reliant on the language of profit rather than surplus.

Yep, simply neoliberalism in action.

If Fonterra is forgetting value-added and going back to basic milk powder production for B2B sale, what is its growth model going to be?

There seems to be only one possibility – more dairy conversions, more cows, more water pollution, more GHG emissions and more technology fetishism as we are continually reassured that tech solutions to GHG emissions by cows are on the way soon (i.e. just round the corner, great progress is being made, encouraging signs, innovative Kiwis are on the cusp of a breakthrough, bright future, etc.)

“So what does Fonterra do?”

The next thing they do is what all managerialists and CEOs do: They spend a fortune on ‘rebranding and reimaging’ – Preferably passing the cost on to the least able to pay.

Yes where does that $3 bullion sic go to?

Like a lot of others Martyn, you miss that margin is more important than value

Unless you make the mistake of doing the thing that produces the best margin now, but is so simple that it is easy for others to replicate and start cutting your margin to the bone as they outcompete you. No doubt Fonterra has an agreement to supply the new French owners of their retail brands. But those agreements will expire. It might be a case of cash now, tears later.

My thoughts also, we will probably get cheaper butter, cheese etc subsidized by other countries tax payers and our local production of those products will be reduced. Not a worry to me as I don’t eat dairy products although it will be pain for the workers involved in that production.

yes cash sugar hit this year and nothing next 100 years .

If that is your only brainfart it sounds as if your understanding of everything is only marginal.

My comments are absolutely true, but given your obvious commercial naivety it’s folly to debate with a fool.

Bob, there are two sub-types of commercial naivety – those who know nothing but don’t realise it, and those who know a little but generalise the little they do know beyond the point of usefulness. In my experience, the former are keen to learn while the latter are smug, over-confident fools. The readers won’t need as many as two guesses to decide which of these you are.

Bob troll needs relevance in his life, he gets it here because Whale Oil was shut down.

Your naivety is on full display Bob troll and no one will argue the idiocy of your comment. One day you will realize that spreading your lies is not a debate. You are clearly wrong again that this is not open for debate.

Golly Squeak I’m immaculate.

Gosh Bob troll, only in your undies.

Value added by definition is supposed to increase the profit or margin, that it isn’t is a sign that Fonterra has inept management. Tatua Dairy does extremely well by specializing in value added dairy so the problem is Fonterra, probably run by National party and ACT members so they will need to destroy it before they acknowledge that something is wrong, they will probably still blame Jacinda though.

The great problem for Fonterra seems to be that the ‘smartest people in the room’ aren’t even in the room. They’re too busy explaining the simple answers on Bradbury’s blog.