BOOM – Māori Party Tax Policy a reason for the Left to vote in 2023

Te Pāti Māori: Time for wealthy to ‘pull their weight’ on tax

A tax-free threshold of $30,000, introducing two new top tax rates of 42% and 48% and introducing four new taxes, including a wealth tax, land banking tax and vacant house tax.

That’s all part of Te Pāti Māori’s tax policy, announced today.

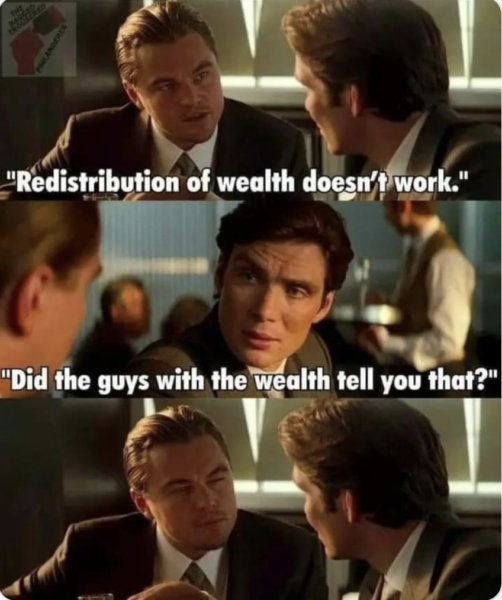

Te Pāti Māori co-leader Rawiri Waititi said the current tax system took money from the poor and gave it to the rich.

“It’s time we rectified this imbalance,” he said.

“Our vision is simple, yet profound: to shift the burden of tax from the poor to the wealthy, and to restore fairness and economic justice. We believe in an Aotearoa Hou [a new New Zealand] where ordinary people don’t have to subsidise the extravagant lifestyles of the rich.

“No one should go hungry while supermarkets are making record profits.

BOOM!

As TDB has been arguing, The Māori Tax Policy was always going to be the true deciding moment of this election.

Labour is here to manage capitalism (and let the free market do the rest), the Greens are here to try and add the cost of pollution into the price (and let the free market do the rest) while the Māori Party are actually here to disrupt the Free Market!

These tax policies are truly inspired and are an actual threat to the establishment, now you know what the Billionaire class and 1% have been pouring money in to National and ACT because they knew the Māori Party under John Tamihere was a completely different political beast and that they have no issues holding the wealthy to account.

The Left finally have a political movement they can vote for that will actually force the rich to pay more.

Not Labour’s incrementalism, not the Greens fecklessness, actual hard balling arm twisting real reform.

David Parker, Grant Robertson and Chloe Swarbrick all finally have a partner inn John Tamihere to force these changes through.

This is the most radical change to taxing the rich and removing the tax yoke from the working Kiwi!

It’s as close to socialism as we are going to get comrades and the broadness of the policy is not purely for Māori! The MANA Party knew what was good for poor Māori babies is also good for poor white babies and the same is true of the Māori Party Tax Policy – this is good for all of us!

Te Pāti Māori’s tax policy

Tax rates

-

- $30,000 and under – 0% tax

- $30,001 – $60,000 – 15% tax

- $60,001 – $90,000 – 33% tax

- $90,001 – $180,000 – 39% tax

- $180,001 – $300,000 – 42% tax

- $300,001 and up – 48% tax

Currently the top tax rate – for earnings over $180,000 – is 39%.

The party would also:

-

- Remove GST from all kai and regulate the ability of supermarkets to hike prices

- Increase the company tax rate from 28% to 33%

And introduce:

-

- A net wealth tax

- A foreign companies tax

- A land banking tax

- A vacant house tax

The Māori Party have stepped up here and provided NZ with a means to finally tax those rich pricks who are in turn doing everything to stop the Māori Party being in any position to ram this through.

If you have been depressed by Labour’s lack of courage or the Greens alienating ideity politics, here is a real socialist tax programme from the Māori Party that would be good for every single kiwi.

I particularly like the Foreign Companies tax which will be used like a financial transaction tax that will kick the Australian Banks.

Fuck you Australian Banks!

The Māori Party promised, now they have delivered, if you are Left wing in this country, you finally have a Party worth voting for.

There is finally light at the end of the tunnel, and we all know it can’t be a train because we know public transport in this country is never on time or barely working.

This is a watershed moment in NZ politics.

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

If you can’t contribute but want to help, please always feel free to share our blogs on social media

TPM Policy will kill development of any new company

Rod Drury set up Xero.

The value of the shares increased and he was a major shareholder. During the development phase the company was burning through cash and not making a profit

The only way Drury could have paid the tax would have been by selling up to 8% of his shares per annum. He would have lost control of his own company very quickly

Or he could have gone offshore and NZ would have got no tax at all and fewer high skilled well paying jobs

I am curious how much you think entrepreneurs will pay per annum to stay in NZ ?

I bought a house 40 years ago for $100,000. It is now worth $1.3 million. When I retire, I intend to go overseas for 7-8 months to travel. Will I have to pay $400,000 tax?

For what it is worth, getting rid of GST on food is a terrible idea.

They only get to implement all those policies is if they win government.

The Maori party is the only party that would become more powerful the less party votes it gets by causing an electorate overhang.

Imagine if Maori voters gave the greens their party votes and the Maori party their electorate votes, they’d cause a 2-4 seat overhang and make it impossible for anyone to govern without the Maori party.

It’d be utterly hilarious to watch the rage if national and Labour get 51% of non wasted votes but labour/green/Maori govern on 49% due to MMP proportional overhangs.

One sentence for absolute failure – bureaucracy costs and business profiteering opportunity.

My (Maori) wahine was unsure who to vote for, till she saw this policy today. Now she is clear: TPM all the way. She wont be the only one among Maori who now have added reason to vote this year. It’s genuine progressive tax policy for a change.

As an aside, if you dont have a TPM or Greens candidate in your local electorate, you can STILL vote TPM or Greens with your party vote (which is th eone tht actually decides the overall parliamentary make-up)

With GST a company can then claim back expenses. So if a company earns %100 from gst it will not be the full amount the consumer gets back. The company can then deduct expenses so if their expenses are $40.00 they can claim the gst off that which will mean that they pay less than $100.

Just saying. But it is a good policy

sadly I dont have a candidate from either party in my white electorite so will have to stick to 2 ticks red

No no no

Te Pati Maori for the party vote!

‘Labour is here to manage capitalism (and let the free market do the rest), the Greens are here to try and add the cost of pollution into the price (and let the free market do the rest) while the Māori Party are actually here to disrupt the Free Market!’

Great statement above.

Absolutely, Te Pati Maori all the way.

A great policy except I think they should have a financial transactions tax in here as well.

Ditch GST and bring in a comprehensive FTT tax on all transactions would be better than just taking gst off food.

That’s JT anchoring his post election negotiating position. Labour just removing GST from food wont cut it with JT.

Love it! Was talking – very grimly – with friends about who to vote for this year and I said I’d check the actual policies on offer but whoever took GST off food and made cannabis legal would have my vote. Reading my mind…

he pai tenei

Damn straight.

Two points.

First: The Maori Party are already having an effect. To address the cost of iiving crisis, the Maori Party are demanding that GST be removed from food.

Second: Labour fucks it up. Reluctantly dragged kicking and screaming part way there.

Taking GST only off fruit and vegetables, as Labour is allegedly proposing, delivers the smallest benefit to the families stressed by the cost of living crisis.

While delivering the smallest benefit to the family budget, overseas experience indicates that taking GST off only fruit and vegetables has proved to be confusing and overly complicated leading to expensive litigation and bureaucratic oversight.

As Stuff.co.nz points out, while taking GST off all food though the simplest thing to do, with the biggest benefits to the household budget, it would need to be balanced by, wait for it, taxing the rich. Something Chris Hipkins is dead against.

https://www.stuff.co.nz/business/money/300937406/how-much-difference-would-removing-gst-from-fruit-and-veg-really-make

The idea of dropping GST off fruit and vege alone is insane.

It’s like they’re trying to split the difference between appealing to people who are angry at the idea that them poors won’t have to pay GST on KFC, and some small couture of Wellington fruitarians.

Heres the test. If you can eat it then no gst. 15% off food helps everyone in a cost of living crisis where food price increased 20%

Cue pundits (Mi-cockskin, Soper & the rest) whimpering… “unfair to rich fat cats with 7 houses”…and blog commenters…but but…Labour won’t go there…

Was weighing up TPM vs Greens for my valuable vote–now I have decided.

The bigger the vote TPM & Greens get, the more likely this policy could be implemented. It is always better to vote for something you support than a grudging lesser evil vote.

sadly I dont have a candidate from either party in my white electorite so will have to stick to 2 ticks red

Come on Gordon, use you party vote smartly. Party Vote TMP