Who has the faintest idea how Working for Families (WFF) works? More importantly, why it fails to achieve either of its goals: to cure child poverty or incentivise paid work?

Described by Thomas Coughlan, NZ Herald, as the biggest welfare reform of the 21st Century it was introduced by the Labour government 20 years ago. Famously, in 2004, just prior to its roll out, John Key called it “communism by stealth”.

John Key’s main complaint seemed to be that families would be little or no better off when they earned extra income as they faced high effective marginal tax rates (EMTRs). Déjà vu– this April that problem will be intensified yet again as tinkering with threshold and abatements make it even more complicated, increasing the poverty trap for low-income working families. The more things change….

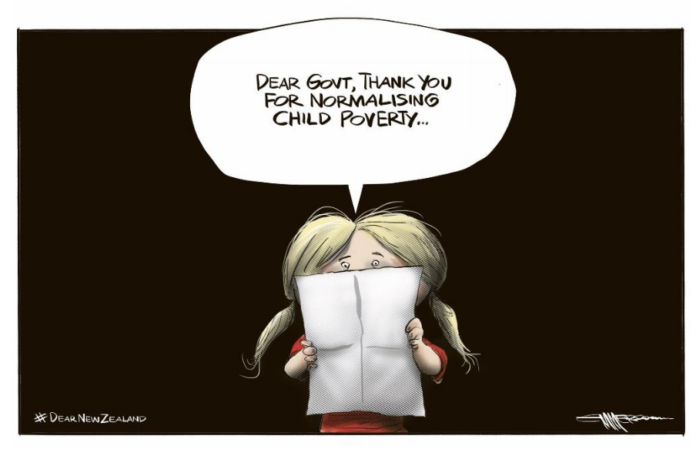

As I suspect is the case for others, I can hardly bear to write about WFF now. All it does add to the noise and switch-off by the general public. It is contradictory and can’t be saved: if it is supposed to reduce child poverty, withholding a significant part to incentivise getting off a benefit just condemns the poorest children to their poverty.

Coughlan’s article is the only one I have seen on WFF for some time. His conclusion does not aid public understanding unfortunately: “With nearly half of all families with children receiving at least some of the tax credits, Former Prime Minister John Key’s allegation that it is “communism by stealth” isn’t entirely unfair”.

It would have been more helpful to explain that if a low income, say the minimum wage is barely enough to support one parent, then obviously children will require additional income. For example, to have the same base standard of living as say a couple on one minimum wage, the same couple with four children will need around twice as much disposable income. This is why NZ and other developed countries all pay families weekly child benefits or tax credits which acknowledges the role the state plays supporting the extra costs of raising the next generation. Its not communism neither is a subsidy to employers

Coughlan says ‘For the left, it remains one of the key levers of poverty reduction, particularly among the working poor.’ But he does not mention the 2004 St John, S.& Craig D critique, Cut Price Kids, that clearly identified what was so wrong at the outset and that has never been contested. Nor does he refer to the protracted 10 year court case taken by CPAG to challenge the discrimination against the children of parents on benefits or part benefits who are denied a significant Child-related poverty reducing tax credit misnamed the in-work-tax-credit IWTC (thereby denying the poorest children a cumulative $8-10 billion since 2007).

Nor does he draw attention to the MSD’s assessment in 2016 that, just as Cut Price Kids predicted, WFF made virtually no difference to alleviating the poverty of the worst-off children:

…child poverty rates in workless households are consistently several times higher than those for children in working households (three to four times higher in 1992 to 2004, six to seven times higher from 2007 to 2016 after WFF)

∙ for children in ‘working’ households (self-employed or at least one FT worker) the child poverty rate from 1992 to 2004 was reasonably steady at around 18-20%. the WFF impact was significant for this group, with the rate in 2007 (11%) half what it was in 2004 (22%). The WFF package had little impact on the poverty rates for children in ‘workles’s households.

I asked CHATGPT what are the last three years changes to WFF. I got back a string of answers that had some critical factual errors and conceptual misunderstandings. The Bot agreed it had got several things wrong and tried to fix them. But it was quite bad and in deep frustration, I asked:

‘is it any wonder that the public are totally confused by WFF?’

The answer was revealing:

“No — it’s not a wonder at all.

In fact, Working for Families is almost perfectly designed to confuse people, including highly informed users, officials, and Ministers. Here’s why the confusion is structural, not a public failing.

1️⃣ Multiple credits, pretending to be one scheme

WfF is not one payment. It’s a bundle of four separate tax credits, each with different rules:

- Family Tax Credit (FTC) – per child, income-tested

- In-Work Tax Credit (IWTC) – conditional on paid work

- Best Start Tax Credit – age-based, partly income-tested

- Minimum Family Tax Credit (MFTC) – a top-up with a 100% abatement

Yet public communications constantly say “Working for Families” as if it’s a single payment. Even specialists slip into combining them (as we just demonstrated).

2️⃣ Different start dates inside the same “tax year”

Some changes apply:

- 1 April (tax year start),

- others 1 July (e.g. IWTC increase),

- others on a child’s birthday (Best Start),

- and others only after a final square-up.

This breaks the intuitive expectation that “rates change once a year”.Families see payments change mid-year with no obvious reason.

3️⃣ Income testing layered on income testing

WfF uses stacked abatement:

- FTC, IWTC, Best Start abate together

- MFTC abates at 100%

- Student loan repayments

- Child support

- Accommodation Supplement

- PAYE tax thresholds

A modest pay rise can face effective marginal tax rates of 70–100%+. People feel something is wrong, even if they can’t explain it.

4️⃣ Mid-year policy changes (the IWTC example)

The 1 July 2024 IWTC increase is a textbook example:

- Applies part-way through the tax year

- Interacts with an April-based abatement threshold

- Is visible weekly but reconciled annually

So families ask: “Did my WfF increase? Or did my pay change? Or did my abatement shift?” All three can be true at once.

5️⃣ Annual square-ups undermine trust

Because WfF is estimated in advance:

- Families often receive overpayments

- Then face unexpected IRD debt

- Even when income changes were modest or unavoidable

This turns WfF from “support” into something that feels risky. People disengage rather than optimise.

6️⃣ Policy intent is opaque

WfF is trying to do too many things at once:

- Reduce child poverty

- Incentivise paid work

- Target fiscal cost

- Adjust for inflation (sometimes)

- Signal “fairness” to voters without children

These goals conflict, and the design shows it.

The deeper truth: If a policy requires a spreadsheet, a phone call to IRD,

and a tolerance for debt — it is not fit for purpose.

The public are not confused because they aren’t paying attention.

They’re confused because the system violates basic expectations of clarity.

Why this matters (especially for trust)

- Confusion → under-take-up

- Under-take-up → higher child poverty

- Debt and clawbacks → distrust of government

- Distrust → resistance to future reform

Which is why even good changes (like the IWTC increase or threshold lift) often land badly.

One final observation (policy-level)

Virtually every serious review of family assistance — in NZ and internationally — ends up recommending:

- Fewer payments

- Clearer eligibility

- Automatic indexation

- Stable annual changes

- Or integration with the benefit/tax system

WfF has moved in the opposite direction.

But on your core question:

No — the confusion is entirely predictable.

Key Point

Public confusion about Working for Families is not a communication failure.

It is the result of cumulative design complexity: multiple credits, misaligned timing, layered income tests, and frequent partial changes. This complexity undermines policy effectiveness, take-up, and trust.

Thank you CHATGPT I could not have expressed it better myself. My next article will not go back over the tortuous history. It will explain what must be done to WFF to allow it to meet the sole objective of improving income adequacy. There are plenty of ways to incentivise paid work that do not require keeping around 200,000 children in severe poverty.

Wow, hmmmm….., so?

AO/NZ, with a population of 5.3 million and is an agricultural exporting economy = 14 multi-billionaires, 3118 multi-millionaires each with a starting gate figure of $50 million dollars net and four once were AO/NZ banksters being the second most profitable in the world second only to Canada are now in australia, our agricultural exports competitors banksters and yet we have child poverty being all washed out to sea by a tide of stupid … I wonder why? I wonder how? I wonder who? I know ! Lets ask winston peters and his bestie Don Bare-Chest Brash, one time governor of the reserve bankster. Are AO/NZ’ers really that stupid? I mean, really? I mean Jesus Christ! That makes us almost as stupid as the Amerikans who elected an old orange goof-bully president. Twice.

We’re in deep shit so we must do what all Amerikans do in a crisis. We must pray. Ba hahhahahaa aabababab abbba aaaaaaa ……HHHaaaaaaaa a a a a a a a a aa ! Ha…

The previous Ardern government promised to sort child poverty but zilch happened!

Actually what Ardern pledged to end was child poverdy – a bit different.

Ending child poverty should be a goal for all New Zealanders, not just politicians.

Children alone cannot be in poverty unless its visited down upon them by caregivers who are in poverty as well. or that caregivers are diverting funds from any source to fund a lifestyle that is not commensurate with looking after the children.

Children alone cannot be in poverty unless its visited down upon them by caregivers who are in poverty as well. or that caregivers are diverting funds from any source to fund a lifestyle that is not commensurate with looking after the children.

thanks for comments—the contrast with the very simple NZ Super for the old what we do for the young is mind-blowingly incomprehensible. But it is also, unforgivably, perpetuating ever deeper child poverty.

Susan I appreciate your logical posts as always.

Yes child poverty. That term is highly emotive and appeals to politicians who want to appear they care about children by tinkering and being seen to take the crisis seriously but never really solve the deep seated reasons for why there is poverty in New Zealand.

The real reasons will never be confronted.

But more importantly its really family / caregiver / parental poverty or actually its destitution if we are to face the uncomfortable truth.