The West is in a debt supercycle. That’s bad.

But New Zealand got here without even investing in ourselves.

That’s worse.

Along the way, we also threw away our sovereign power to invest in ourselves.

A mistake? You’d think so. Unless you have a conflict of interest.

Privatising the supply of your own currency is dumber than playing a World Cup final in bare feet. You’re going to get crushed.

But that’s exactly what the Public Finance Act (1989) did.

It forbade us from issuing credit (the green line in the graph) to ourselves through our own national bank, the RBNZ.

Instead, we now borrow it from commercial banks – at compounding interest.

That isn’t fiscal responsibility.

That’s a racket. We got chumped. Dont you think forty years is enough?

What are we going to do about it?

Lets Get Our Boots Back On: the state of play

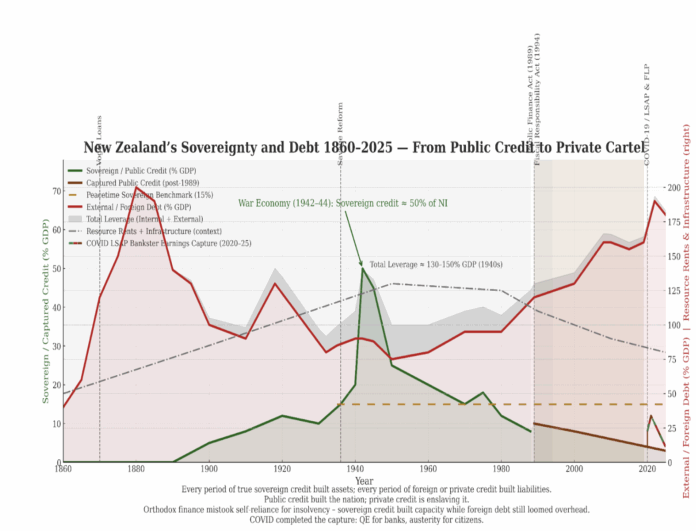

This chart tells the story of our sovereignty and wealth in the Green and dashed Grey lines. Its also tells the story of our capture by bankster politics in the 1980s. You can see it turn brown with the Public Finance Act. The Red Grteen Brown dash spike at the end is a handout to private banks. Red is our external debt.

New Zealand’s Sovereignty and Debt 1860–2025 — From Public Credit to Private Cartel

- The Green Line – Sovereign Credit

That’s us funding ourselves.

During the War Economy (1942–44), sovereign credit supplied about 50 % of national income, building infrastructure, jobs, and victory — without foreign debt.

Every time the green line rises, New Zealand is investing in its people.

Every time it falls, we’re borrowing from someone else and paying rent for our own money. See how our infrastructure and resource rents fall too. - The Red Line – Foreign Debt

That’s dependence. you can see a massive spike in the 1800s? Thats us investing in ourselves. You can see infrastructure and resource rents climb.

Each red spike shows when we traded sovereignty for credit, when banks and bondholders dictated policy.

Today that leverage nears 200 % of GDP, yet housing, energy, and wages stagnate. Because we have stopped using sovereign credit, and stopped directing i towards strategic goals for national development. Because we have let the children run the sweetshop; or the lunatics run the asylum.

That’s a debt supercycle: record debt, shrinking return. Its irresponsible and foolish. - The Brown Line – Captured Credit (Post-1989)

This is the sleight-of-hand.

After the Public Finance Act (1989) and Fiscal Responsibility Act (1994), government could no longer issue credit directly.

It must now borrow its own currency from private banks.

They create it, lend it, and collect the interest.

The brown line marks this capture – the point where public credit became private profit. Doh! - The Grey Band – Total Leverage

Internal + external debt together.

In the 1940s it built factories, homes, and railways.

Today it fuels speculation, buy-backs, and bubbles.

Same leverage, opposite purpose. - The Shaded Zones

• 1860–1945 – The Building Age: Public credit builds the nation.

• 1989 onward – The Capture: Fiscal “reform” hands control to banks.

• 2020s – The Absurdity/racket: We “stimulate” the economy by paying banks to hold our own debt. Its an unproductive shortsighted recipe for disaster, and the opposite of Western Christian values. It’s resulted in unproductive investments, asset price bubbles, poverty, and poor infrastructure. It’s bad management.

From Rogernomics to Ruthanasia

That’s how we got here – under-invested, over-indebted, and owned by others.

‘Labour’, ‘National’, and now Nact First all made it worse. None of them recant.

Why destroy industries without investing in new ones? How long must the market not provide before we do something sensible like invest in energy production and housing or food security?

Why privatise monopolies on the cheap?

Why let the privatised monopolies hike prices while under-investing?

Why give away gold and gas for free?

Why grant yourselves 10 % pay rises from sovereign credit while the public service starves?

We were promised choice and competition.

We got looting.

What the Graph Really Shows

Every period of sovereign credit built assets.

Every period of private or foreign credit built liabilities.

Orthodox economists mistook self-reliance for insolvency and debt for discipline.

But the truth is simple:

Public credit built New Zealand. Private credit is enslaving it.

COVID made it plain: quantitative easing for banks, austerity for citizens.

We bailed out lenders while public housing, energy, and health withered.

It’s time to reverse that capture.

The Golden Kiwi Solution – A Trinity of Reform

To be sovereign again, we must rewrite the three Acts that chained us to private debt. We must renounce the banksterism of fay, richwhite, gibbs, roche, NZI, TPU, etc.

Public Finance Act (1989) — Restore the Right to Issue Public Credit

- Create a Public Credit Authority so Treasury can draw directly from the RBNZ for strategic investment.

• Define Sovereign Credit as debt-free public capital, not borrowing.

• Classify productive spending as asset creation, not deficit.

• Remove the rule forcing borrowing from private markets.

• Report annually on returns from public-credit projects.

Reserve Bank of New Zealand Act (2021) — Re-Empower the Nation’s Bank

- Add national development and full employment to the Bank’s objectives.

• Establish a Public Credit Facility inside RBNZ for zero-interest lending to public projects.

• Stop paying banks interest on reserves created for public-purpose programs.

• Publish full data on private-bank credit creation by sector.

• Authorise public-purpose digital instruments convertible 1:1 with NZD.

Fiscal Responsibility Act (1994) — Replace Austerity with Prosperity

- Redefine “fiscal responsibility” as intergenerational balance-sheet health.

• Introduce a Sovereign Investment Rule allowing public credit to maintain employment and infrastructure.

• Require Treasury to report the cost of under-investment each year.

• Lift debt ceilings on non-interest-bearing domestic credit only.

• Enforce a Public Purpose Test for all fiscal decisions.

Let’s Be Golden Kiwis Again

Once, the Golden Kiwi was our national lottery — an investment in ourselves.

Now it should mean something deeper: a return to national self-belief.

Because sovereign credit is the real jackpot.

It funds the homes, railways, hospitals, and industries that build a future worth living in — without selling our soul to the bond market.

Amend these Acts, and the green line rises again.

Public credit builds assets, private debt shrinks, and prosperity becomes something we make — not something we rent.

Let’s be Golden Kiwis.

Let’s back ourselves.

Let’s beat the banksters. The only way to do that, is to use your own bank too. If government finances are like a household, then NZ has the luckiest households in the world; because we own the Reserve Bank of New Zealand.

But we’ve been robbed, and its still going on.

What are you going to do about it? Tell a mate. Share this on.

Lets improve things. Because we have been on the wrong track since 1989, and not one single party is talking about how we actually rebuild the wealth of our nation. Its starts with reclaiming our treasury. Then, by using it wisely. Giving control of the keys to banksters is madness. Are our politicians mad? Or crazy as a fox in the chickenhouse?

Support my work by purchasing from www.tigerdrops.co.nz, and join us at www.thehempfoundation.org.nz

Sources for Panel 3.4 “Sovereignty & Debt”

Primary Quantitative Sources

The Treasury – Long-Term Fiscal Data Series (LTFP-06-Charts.xls)

• Covers 1860–1991.

• Metric: Public Debt Outstanding % of GDP.

• Defines the sovereign / public credit baseline (green line).

• Official Treasury publication at https://www.treasury.govt.nz/publications/longterm-fiscal-data

Stats NZ – Balance of Payments & International Investment Position (IIP)

• Covers 1992–2025 (Q2 latest).

• Metric: Gross External Debt and NIIP % of GDP.

• Defines the external / foreign debt series (red line).

• Primary national account source (C22 tables).

Reserve Bank of New Zealand – Historical Statistics and LSAP Review (2023)

• Covers 1980–2025.

• Metrics: External liabilities, monetary base, Large-Scale Asset Purchases (≈ 35 % GDP).

• Provides transition from Treasury series to Stats NZ and anchors the captured-credit (brown) component.

Baker (1965) The Official War Economy in New Zealand

• Official War History Series.

• Shows ≈ 50 % of wartime outlays financed by sovereign credit (1942–44 peak).

• Anchor for WWII green-line high point.

Muldoon (1981) The New Zealand Economy

• Documents 1974–1984 public investment and foreign-borrowing structure.

• Bridges Treasury historical data to modern era.

Secondary / Cross-Validation Sources (not plotted directly):

• BIS Locational Banking Statistics (Table A6.2) – used only to verify magnitude and timing of foreign claims peaks (≈ 1988 120 % GDP, 2008 150 %, 2023 130 %).

• IMF IFS & World Bank IDS – used for GDP denominators and post-1990s ratio checks; methodological validation only.

Integration method:

• 1860–1991 → Treasury LTFP (sovereign credit).

• 1970–1991 → Muldoon and RBNZ data to bridge to external series.

• 1992–2025 → Stats NZ IIP (external debt).

• Empirical anchors added for Vogel Loans (1870), Savage Credit (1936), War Mobilisation (1942–44 ≈ 50 %), Public Finance Act (1989), LSAP (2020–25).

Hierarchy of authority:

Treasury LTFP – sovereign/internal debt.

Stats NZ IIP – external debt.

RBNZ – captured credit / monetary operations.

Baker & Muldoon – historical validation and bridging.

BIS / IMF – cross-check only

Tadhg Stopford is a historian and teacher.

Support change by purchasing your CBD hemp CBG at www.tigerdrops.co.nz

100% Tadhg Stopford represents the real New Zealand First!

Comments are closed.