“You shall not charge interest on loans to your brother.”

— Deuteronomy 23 : 19-20

“Allah has permitted trade and forbidden usury.”

— Qur’an 2 : 275

“Money is barren; charging interest is unnatural.”

— Aristotle, Politics, Book I

“Let me control the supply of money, and I care not who makes the laws.”

— Anon

“Gold is money; everything else is credit.”

— J. P. Morgan

“People who have been bamboozled seldom break free of the bamboozle.”

— Carl Sagan

“The love of money is the root of many kinds of evil.”

— 1 Timothy 6 : 10

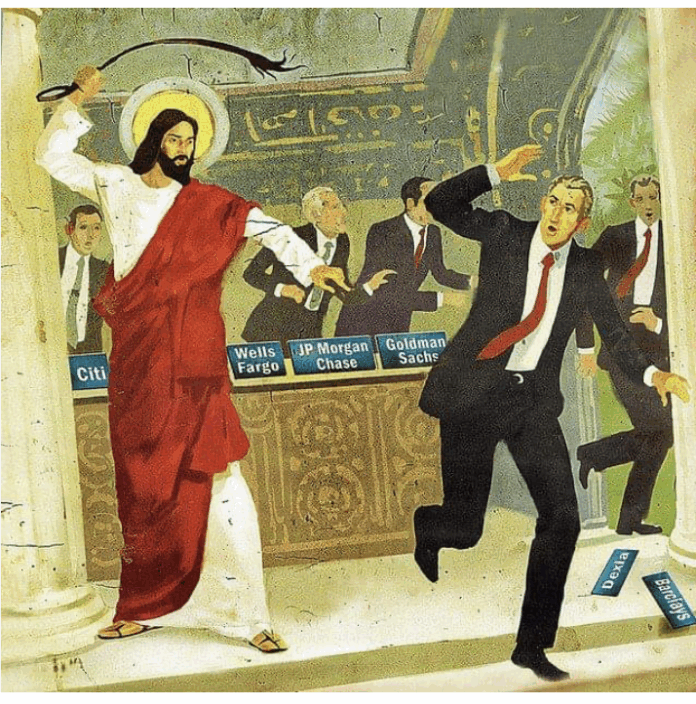

“You have made my Father’s house a den of robbers.”

— Jesus Christ, cleansing the Temple

The Faith That Bound Interest

Across faiths and centuries, the message was the same: debt must serve life, not rule it.

Every ancient civilisation learned the hard way that compound interest grows faster than production, and that unchecked, it devours families, farms, and nations.

At 5 percent, a loan doubles in 14 years.

At 10 percent, in seven.

At 20 percent, in under four.

That is not enterprise – it is alchemy that turns debt into dominion.

When kings and prophets proclaimed Jubilee, they were not preaching utopia. They were performing national maintenance – resetting the social ledger so that freedom, not bondage, defined the people.

The Bamboozle of Our Age

In New Zealand, we have forgotten that wisdom.

Our temples of finance hum again with money-changers.

Foreign-owned banks extract record profits from a small population by creating credit for second-hand houses.

Buying and selling existing houses is not production – it is rentier inflation that enriches banks and excludes youth.

Since 1989, the Public Finance Act and Reserve Bank Act have bound the Crown to borrow its own currency from private markets.

These 1989 ‘reforms’ outlawed the direct issue of public credit that once built our state houses, railways, and hydro dams.

Thus the nation that financed the first State Houses at 1 percent interest now finances itself through offshore bond traders at whatever rate “the market” demands.

The False Prophets of Prudence

Encouraged by a Treasury drunk on Chicago School Kool Aid, Labour’s technocrats wrote the Acts. National sanctified them. All still worship at the altar of “the market.”

Each Budget repeats the same catechism: there is no money.

But the Reserve Bank proves otherwise every time it settles a Crown payment or runs an LSAP.

We have the power of sovereign credit creation.

We simply refuse to use it for public purpose.

Instead, we rent our own money-paying tribute to the very priesthood that told us debt was virtue.

From Temple to Treasury

What Jesus overturned in the Temple is what we must overturn in policy: the marriage of law-making and money-power.

When credit creation serves private profit alone, the economy ceases to be productive; it becomes extractive.

Our GDP rises while our net worth falls, our houses inflate while our industries decay.

We are told this is efficiency.

It is, in truth, usury with spreadsheets.

The Restoration of Order

Ancient palaces understood that freedom required periodic debt forgiveness and public credit for the common good.

Today, restoration requires law.

a. The Public Finance (Golden Rule & Debt-for-Growth) Amendment Bill

- Golden Rule: balance the daily budget; borrow and create only to build the future.

- Debt-for-Growth Rule: projects using debt must show positive returns, certified by an independent Investment Certification Office.

- Fiscal Dashboard: track net worth, interest burden, and public-capital per worker-not just gross debt.

- Public Investment Statement: publish a 15-year pipeline so citizens can see what and where every dollar builds.

b. The New Zealand Investment Bank (NZIB)

A public bank with commercial discipline-KfW in spirit, Temasek in governance, Bank of North Dakota in patriotism.

It finances certified projects in energy, housing, transport, and industry, crowding-in private and iwi capital but anchoring it in public purpose.

c. RBNZ–Treasury Discipline Note

Future LSAPs and bond purchases occur only within transparent limits, with published loss caps and exit ramps.

No more hidden fiscal transfers for private gain.

Together these form a Sovereign Investment Framework-a modern Jubilee by design, not by crisis.

The Moral Economics of Sovereignty

To restore the nation we must re-marry ethics and economics.

The point of money is to measure value, not dictate it.

The point of debt is to enable creation, not servitude.

Sovereign credit is not a sin; it is the tool by which a people build what they need-energy security, housing, education, health, and infrastructure-without kneeling to the market’s priesthood.

As JP Morgan said, “Gold is money; everything else is credit.”

So let our credit serve the people who mint it.

The Path Forward

Month 0–2: Cabinet adopts the Golden Rule; establishes the Investment Certification Office.

Month 3–6: Introduce the Bill; release the first Public Investment Statement.

Month 6–12: Launch the NZ Investment Bank; refinance high-multiplier local projects; publish a national portfolio dashboard.

Each step is lawful, transparent, and self-funding.

It replaces austerity loops with investment cycles; dependency with dignity.

The Jubilee of Our Time

Jesus announced a Year of the Lord’s Favour-a Jubilee of debt release.

We can announce one too: a Jubilee of sovereign renewal, not by miracle but by statute.

Let us cleanse our modern temple: the fiscal code.

Let us restore public credit to public purpose.

Let us make the love of country stronger than the love of compound interest.

The Call

If you are tired of watching a rich country grow poor, if you are ready to replace the bamboozle with balance, then join the work.

Speak of it, print it, share it.

Ask the obvious: “If the government can create money for banks, why not for us?”

New Zealand is not broke.

It is bound—and the knots are legal ones.

The Acts that tied us can be untied.

“The Spirit of the Lord is upon me, because He has anointed me to proclaim good news to the poor… to set the oppressed free, to proclaim the year of the Lord’s favour.”

— Luke 4 : 18-19

Reform the Public Finance Act.

Reclaim the power of public credit.

Build the balance sheet that builds the nation.

Tadhg Stopford is a historian and teacher.

Support change by purchasing your CBD hemp CBG at www.tigerdrops.co.nz

100% Let’s do it!

Yes, very true. Christianity and Islam have always forbidden usurious lending by their adherents to anyone. Judaism has always forbidden usurious lending to other jews and allowed it to gentiles. We prohibit such practices when they inflict harm on people we consider human.

At the Headquarters of Lyin’ Cheet and Swindle( Publicity management for bankers).

I.M.Lyin “This Social Credit idea is quite popular in some quarters and Chief Ponytail Puller, in particular, is worried it might become a trend. What can we do to counter it?’

A.Swindle ‘ Well Rob Muldoon always called Social Credit ‘funny money’ and said it was a new and dangerous experiment and it would result in massive inflation as in Weimar Germany. It always worked then. We can call its supporters communists, socialists and left loonies as well. ‘

I.Cheet. ” Is there not a danger that someone will point out that it has been used successfully in the past and Weimar inflation was a response to allied demands post First World War and………………?’

I.M. Lyin ” Great things about the New Zealand public is they have short memories and do not read much. Now if any Social Credit supporters are Maori we can use that to say it is part of a racist plot against Pakeha – is there any way we can work terrorist supporters in as well?’

Great plotting and planning Stevie; thoughts extending exponentially the limits of NZAO known universe,

The public are always better informed about economics than the overpaid and underperforming homunculi of Treasury assume, because economic facts impact them in ways that excessive unearned salaries cushion institutional pretenders from. There is simmering fury out there worse than anything I have seen before.

SM I have thought multiple times, when I listened to talk radio and heard some economic forecast, usually from a bank economist, that I could give the same summary out of my own experience and limited knowledge so much cheaper.

Comments are closed.