WTF?

The economy is recovering, but brace yourself, there’s bad news coming – Liam Dann

The economic recovery might well be under way.

The ingredients are in place – low interest rates and high export prices.

But brace yourself.

Even if things go well from here, we’re going to get a series of ugly economic statistics between now and Christmas.

There is always a sting in the tail of a downturn.

Recessions usually save the worst for last, and when confidence is already low (as it is now), the risk that grim headlines will undermine progress is heightened.

Let’s look at what’s coming up so we can face it with the kind of brave, steely resolve that Kiwis seem to manage when we’re defending trylines and climbing mountains and so forth.

Ummmmmmmmmm.

Is Liam micro-dosing acid?

I don’t think we have Economic Journalists anymore, I think we have cheerleaders for capitalism.

Capitalists live in a fantasy land where everyone has to be super positive because money is so emotional and when people lose it thanks to ideological experiments from Right Wing Governments, any business journalist who critiques too negatively gets their balls kicked in for spooking the stupid consumers and I think Liam’s very rational analysis of a market crash in the Housing market had Real Estate Pimp after Real Estate Pimp screaming at him for crashing sentiment.

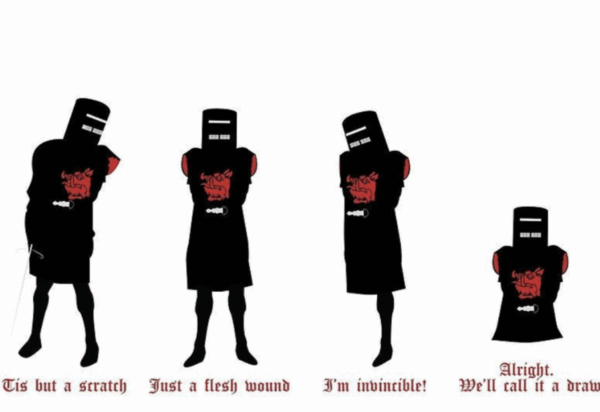

From here on in he’s only allowed to scream, “ALWAYS LOOK ON THE BRIGHTS SIDE OF LIFE”, or, “Tis merely a flesh wound”.

Maybe, just maybe the terrible decision to smash the Infrastructure Pipeline Labour had built for public housing, hospitals, schools and roads in 2024 had a cascade impact on the economy that has scarred the market so badly that we are actually in for far worse damage than Laim’s cheerleading can acknowledge.

Put aside the inflation and Unemployment rates that will dominate news headlines, look at the raw economic data.

Maybe those ‘green shoots’ are really the dried snot of vacant hope?

The Reserve Bank made a dramatic 50 point drop last week in the OCR as more and more economic data suggests the economy is in far worse shape than feared, this isn’t prudent management it’s naked desperation and panic.

The latest leading indicators for the economy suggest a darkening outlook for September quarter GDP. The BusinessNZ-BNZ PSI survey out yesterday showed the services sector that makes up over 60% of the economy contracted in September, its 19th-consecutive month of contraction.

The matching BusinessNZ-BNZ PMI survey for the manufacturing sector on Friday also showed a contraction.

Liam doesn’t have much to say about that.

Information out last week shows the Housing market continues to slide as QV report shows prices down 1.1 percent in the three months ended September with the Market marginally weaker than year ago, down 14 percent from its peak in 2022.

The NZ Economy is built on selling each other over inflated houses and pretending that’s wealth, but again, RNZ and Stuff are pretty quiet on that front.

Overall migrant arrivals dropped 16% to 138,600, while departures increased 13% to 127,900 – the economy is so bad that now even the migrant workers are fleeing!

Treasury papers show we have an $11.1billion deficit, but the Government has given away $19.5b to landlords, the rich and tobacco companies – if they hadn’t done that we would have an $8.4b surplus – this Government has manufactured a debt problem and called that an economic plan.

The reality is that the economy is about to get far, far, far worse and none of this Government’s austerity agenda will make any of that pain easier to take.

I believe it is time for the Political Left to look at Sovereign Credit to fund our infrastructure.

The greatest mistake Labour did over Covid, was that they borrowed the money from private banking rather than do what Mickey Savage did, create Sovereign Credit!

In the 1930s–40s, the first Labour Government (Savage & Fraser) used the Reserve Bank to directly finance social housing, infrastructure, and employment schemes. This was sovereign credit creation — money issued into the economy for public purposes.

New Zealand used sovereign credit creation in the 1930s for housing and recovery. Since the late 20th century, reforms locked us into a bond-based system to satisfy global financial orthodoxy and inflation fears. The difference is simple: bonds create debt to outsiders, sovereign credit creates money internally.

So what would happen if NZ created sovereign credit now?

-

If the Reserve Bank or Treasury created credit for targeted, productive investment(say, green infrastructure, affordable housing, climate resilience):

-

The economy could benefit from extra capacity and jobs.

-

Inflationary pressure would be limited if the spending matched real productive needs.

-

International markets might notice but wouldn’t necessarily “punish” NZ — especially if debt-to-GDP stayed stable.

-

If NZ created sovereign credit now for targeted, productive investment, markets might grumble but wouldn’t punish us severely — especially if inflation stayed under control.

We could back this Sovereign Credit using ACC and KiwiSaver:

-

ACC Fund: ~$50 billion+ investment portfolio to meet future injury compensation liabilities.

-

KiwiSaver funds: ~$100 billion+ in private retirement savings, invested across shares, bonds, property, etc.

How backing sovereign credit with them could work:

-

Collateralisation model

-

The government issues new sovereign credit (say $10 billion for housing or climate infrastructure).

-

To reassure markets, it pledges that this credit is “backed” by the assets of ACC or KiwiSaver (effectively saying: if inflation gets out of hand, or repayment is needed, we can draw on these assets).

-

-

Investment direction model

-

Instead of using them as collateral, the government could require ACC or KiwiSaver funds to buy sovereign credit instruments (like 0% or low-interest bonds).

-

This would channel domestic savings into public projects instead of relying on offshore investors.

-

-

Hybrid public wealth fund model

-

NZ could merge sovereign credit issuance with a sovereign wealth approach — creating credit but investing it in productive, revenue-generating infrastructure, and having ACC/KiwiSaver co-invest.

-

That way, the projects themselves generate returns to repay the credit, limiting inflation risks.

-

None of what I am suggesting is new, Mickey Savage used it to build NZ and Postive Money has been making these points for a long time:

Positive Money NZ is the New Zealand branch of the international Positive Moneymovement (originally UK-based). Their core aim is to change who creates moneyin the economy.

At present:

-

About 97% of money in NZ is created by commercial banks when they issue loans (especially mortgages).

-

Only ~3% is physical cash issued by the Reserve Bank.

Positive Money argues this system:

-

Drives house price inflation (since most new money goes into property lending).

-

Makes the economy unstable (credit booms and busts).

-

Privatises the benefits of money creation (banks profit, not the public).

Labour, Greens and te Parti Maori need radical solutions to the many problems we have, investigating Sovereign Credit to build our infrastructure and climate adaptation is one of those radical solutions.

As for Liam…

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

Where are all the Trevors and the 1Z Bleaters, when the 19.5 billion is mentioned? Complete fing hypocrisy.

NZ didn’t save for a rainy day hell you Muppets didn’t even borrow for weather proofing. Lucky for you though Nicola Willis fuck the place up way worse than Jacinda.

Hang on about Jacinda. I appreciated what she did but she was really bad at estimates always watering down prices she should have published a more believable IRex price but thank goodness Nicola is just shit. Just shit.

Good question Martyn. The BS speel from Liam Dann clearly shows how Right Wing our media is and confirms that Economic Journalism has already died. This is purely and simply “brain-washing” and wishful thinking. It appears it’s easy to see it works on the brain-dead enablers who vote for the Right, most of whom are not interested in the actual facts nor do they wish to acknowledge the devastating results. It’s unbelievable that so many privileged people have so little grey matter. I guess for some of them it’s all about the next overseas holiday, new car, yacht, or latest fashion. Now can some of you start to see what the Left is up against? By the time the next election comes around this country will be so damaged it could take years to recover and a huge amount of money! Continuing with this bunch of thickos is a risk none of us can take. Think about it and do something positive for NZ!

Liam is dreaming and his sponsors are telling him what to say .The economy will continue to shrink and endless growth has come to a halt .Farmers are going hard to get the sugar hit by selling half of fonterra and are leaping with joy because the government is going to allow them to pollute as much as they like .Maybe the last government could have saved money and just let the mico plasma virus kill of all the cows .They spent millions eradicating it only now for the farmers they saved to go mad and deciding to kill the cows by making them drink polluted water and die of heat stress .

‘cause everybody’s talking about world war three but we’re as safe as safe can be

There’s no unrest in this country…

The amount of woman on tik tok airing out their financial laundry is amazingly ridiculous everyone who knows me they watch me while I’m looking at these ultra orthodox feminist one and only truest of all believers as they bitch and moan and whine saying that they didn’t know that the maintenance on the 2025 Mercedes Range Rover or whatever the fuck was so expensive while carrying the load of society slaving in the kitchen taking care of their at least four children after doing the positive thing and healing the trauma of divorcing thier husband who’s crime is as far as anyone can tell is making wives feel bad. It’s all so laughable.

My friends say that guys gana make some big purchases. Look at what happened to the suckers that got run over by the 08 crises. They all protested on the lawns of parliament and now have their benifits cut.

The recovery is coming. Oh it is coming. Don’t say you weren’t warned.

Oh happy days.

is that you Bruce? Social credit for infrastructure borrowing. Magic up the beans and get some engineering happening. FIAT $NZ an illusion, curtail the banks. spend it in, tax it out. buy back the country.

Comments are closed.