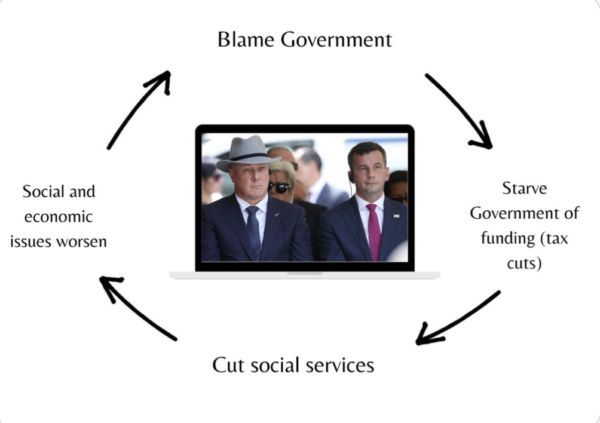

The image below is the reality no one in NZ politics wants to admit – the spectrum of Political Parties economically are all very free market and right wing…

…

The true demarcation of power in a liberal progressive democracy is between the 1% richest + their 9% enablers vs the 90% rest of us.

The richest protect their wealth from any new taxes and our social and physical infrastructure suffers.

The political project of the Right is to starve the State of revenue so there is nothing to redistribute in the first place.

The Māori Party identify this and have put together a Tax Policy that is as close to Socialism as we are going to get!

Te Pāti Māori’s tax policy

Tax rates

-

- $30,000 and under – 0% tax

- $30,001 – $60,000 – 15% tax

- $60,001 – $90,000 – 33% tax

- $90,001 – $180,000 – 39% tax

- $180,001 – $300,000 – 42% tax

- $300,001 and up – 48% tax

Currently the top tax rate – for earnings over $180,000 – is 39%.

The party would also:

-

- Remove GST from all kai and regulate the ability of supermarkets to hike prices

- Increase the company tax rate from 28% to 33%

And introduce:

-

- A net wealth tax

- A foreign companies tax

- A land banking tax

- A vacant house tax

The enormity of what the Māori Party are espousing here can not be ignored.

Labour is here to manage under regulated capitalism (and let the free market do the rest), the Greens are here to try and add the cost of pollution into the price (and let the free market do the rest) while the Māori Party are actually here to disrupt capitalism!

Normally the wealthy can rely on the fecklessness of the Greens or the cowardice of Labour to do nothing meaningful on Tax Policy, currently Labour are trying to smother a CPT and a Wealth Tax so as to be as meaningless as possible and the Greens aren’t really sure how their Wealth Tax will work!

How do NZ Political Parties save us from the Free Trade neoliberal collapse they spent decades building?

As Trump shits on Global Trade, where are you free market Gods now?

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

You are right Martyn. “The enormity of what the Māori Party are espousing here can not be ignored.” and yet TPM are only advocating the policies followed by indisputably right wing parties from the end of the second world war until the nineteen eighties.

But would it be enough to save colonial capitalism?

We may never know the answer to that question, because it is hard to see such measures finding favor with a majority in the colonialist parliament.

Rather, our future as tangata motu depends on the the successful development of political and economic institutions outside of the colonialist system.

Yeah! Oh the irony of it. Gonna vote Te Pati Maori on the strength of their tax policy. This is the really meaningful thing, the only thing that really matters to rectify a broken broken system.Greens, where the hell are ya??? Labour, well it’s LINO now, and probably forever. One thing Trump has proven is that the status quo can certainly be changed, because he has changed it, with shock and horror rather than awe. Why can’t a left government ever effect change in the same dramatic way? Chippy has already signaled he won’t change a thing National have done so get fucked Labour, the great betrayal party.

Lets go!

Status quo. No. Then ‘Quo Vadis’. Look it up and start thinking dudes.

They have by far the best tax policy ,which is very close to AUS whom everyone thinks is the golden country .But at the last election NZ was too busy making sure that Pakeha could steal the water and the remaining Maori land .Luxon just got educated by Tainui on how big the Maori economy is and how big it will be very soon .He even tried to claim their giant deal for Ruakura inland port as the result of his free feed for a few rich pricks a couple of weeks ago .

The wealth tax needs to be done in such a way that the assets within the country remain taxable regardless of where the person trying to escape them moves to.

In NZ due to all the tax incentives and breaks the majority of the wealth tends to be tied up in real estate, and is also where many of our societal problems are. We don’t have systemic problems from the wealthy buying up too much art for example. Struggling local artists might actually welcome it!

In France their wealth tax is predominately on real estate (net of loans), primarily focused on residential homes, investment real estate and rental assets rather than commercial premises or agricultural land.

It kicks in from 1.3 million euro’s, and is per household, which includes the assets of couple’s and their minors under 18. The rate goes up in stages with the top rate being 1.5% (for over 10m euro).

If the person is resident they are taxed on all their real estate including global. If they go offshore, their French real estate.

If a wealth tax is implemented in NZ something along those lines needs to be done to ensure the domestic assets continue to be taxable even if the person goes offshore for it to be feasible, and without too many exclusions and complex dodges, like via trusts and gifting etc.

The point of the wealth tax besides the collection of revenue should be to disincentivise wealth going into areas that are causing problems, which in NZ is largely residential real estate and land banking. Maybe if the wealth tax is limited to real estate in NZ it would also avoid the excuse of it being too hard to administer, as council records could be used.

https://chasebuchanan.com/france-wealth-tax-charges-explained/

Comments are closed.