The rich get richer while child poverty just increases

The Tax Package 2024 includes tax bracket increases, Family boost, $25 per week In Work Tax Credit (IWTC) , and $10 for the Independent Tax Credit per week.

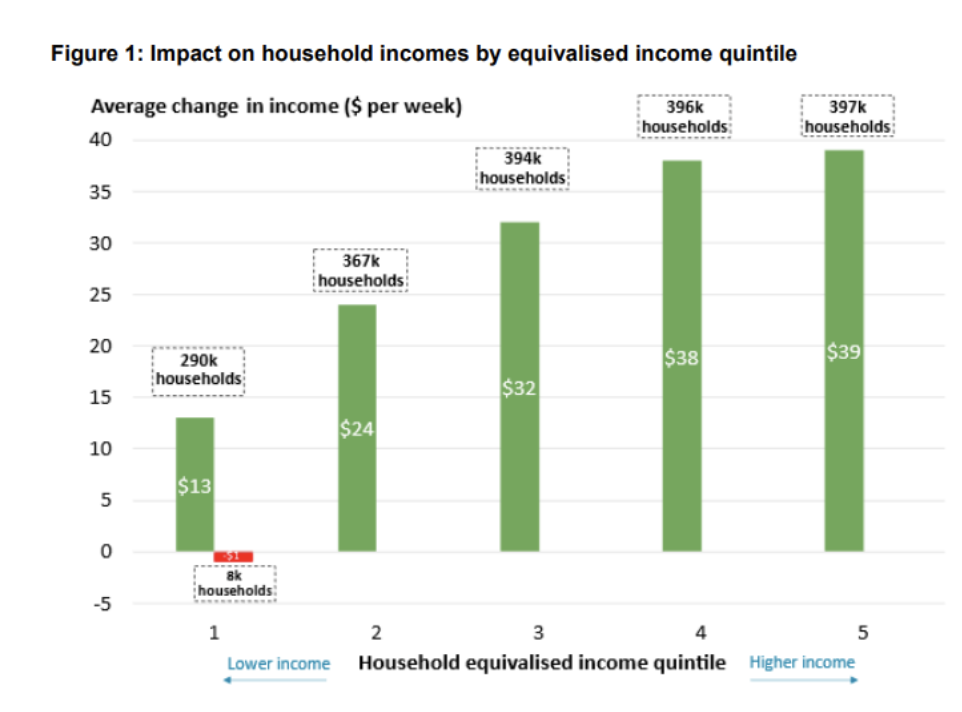

The figures in Treasury’s graph can be used to show the total tax package is $2.9 billion per annum or around $30 per household on average.

The top 2 quintiles (40% of households) gain $1.6 billion or 55% of the total. But they also benefit by $750m a year from the landlords’ tax reduction. When that is Included, they get 64%, by far the lion’s share of the total. What is so shocking is that the lowest quintile gets just 5.4% of the total. About 130,000 households get nothing at all and 8000 are slightly worse-off.

No one seems to have worked out how the many spending cuts will be distributed, but increased transport costs, prescription charges, lower quality school lunches will hurt the poor most. We know that rents are rising along with rates and insurance. Cut-backs to budget advisory services and foodbank funding increase the misery along with changes to price indexation for benefits and an inadequately adjusted minimum wage.

Remember, the worst-off families get no tax relief in this budget and miss out on the IWTC because they are on benefits The IWTC payment (which assist with the costs of raising children) is now nearly $100 per week for 1-3 children with an extra $15 a week per additional child. In this recession, as low-income families lose work, as they will, they also lose $100 per week (more for larger families) FOR THEIR CHILDREN.

We can infer from the Child Poverty Report that the coalition government is abandoning any pretence to reduce child poverty. They think forcing mothers into paid work is the way to address their poverty, ignoring and devaluing the demanding work of parenting.

The ideology of the government clearly is to view all benefits, and even a part benefit as bad and paid work always better and more valued than unpaid work.

Some few sole mothers will get the Minimum Family Tax Credit (MFTC) to top up their earnings but only if they get completely off a benefit. That is, the state rewards getting off a benefit, with another costly tax credit that somehow is deemed morally superior to a part benefit

But the MTFC is just a state funded replacement of their part benefit and is the worst designed benefit imaginable (reduces dollar for dollar for any extra dollar earned!) But hey– being off benefit even if in ill-paid, dangerous unsuitable and low skilled work must be the key to a better life. Looking after your own children is clearly viewed as inferior and unworthy work.

Working for Families (WFF) is supposed to reduce child poverty, but the poorest children are denied a poverty reducing payment in order to provide a ‘work incentive’. National have a history of promoting the work conditional aspects of WFF as they have done in the latest budget. The price is that families denied the IWTC fall into deeper poverty.

Despite their names, neither the IWTC, nor the weird MFTC are effective work incentives. The IWTC rewards being entirely off a benefit, not the extra hour of work, while the MFTC has huge work disincentives with its 100% abatement for extra earnings.

Until we get a proper review of WFF that puts poor children at the centre not paid work, child poverty will continue to get worse.

I wonder if the Min(imum) of Social Development studied and learned from this book –

New rights New Zealand : myths, moralities and markets 2006.

NEW RIGHTS NEW ZEALAND: MYTHS, MORALITIES AND …

Ministry of Social Development

https://www.msd.govt.nz › 27-pages202-206 PDF

by D JANIEWSKI · 2006 · Cited by 28 — Janiewski and Morris are professors of, respectively, history and religious studies. This book presents the findings of a…

New rights New Zealand : myths, moralities and markets

Victoria University of Wellington

https://tewaharoa.victoria.ac.nz › discovery › fulldisplay

Online version: Janiewski, Dolores E., 1948- New rights New Zealand. Auckland, N.Z. : Auckland University Press, 2005. Also published in another …

The Min’s listing has irregular appearance of PDF on my computer, but it is still readable. We should remember too as pointed out, that there have been efforts and funds set up to provide thought and wise comment on matters political and economic that concern us. such as the Marsden Fund. Which apparently have mostly been ignored. by the PTB – if there wasn’t money in them.

Ho hum, buzz; the bees may collect honey but is it affected by current viruses? (Bit of play with words – we know the Covid virus, but what about the one resulting in Converts of the Covert who are drawn to the Convent on the hill – or CCC?)

new riGhts new ZeaLanD: myths, mOraLities anD marKetsBy DOLOres JaniewsKi and PauL mOrris aucKLanD uniVersity Press, 2005

Christine CheyneSenior LecturerSchool of Sociology, Social Policy and Social WorkMassey University

New Rights New Zealand is an intriguing addition to the literature on the economic and social reforms of the late 1980s and 1990s. Janiewski and Morris are professors of, respectively, history and religious studies. This book presents the findings of a research project entitled “Marketing morality: The campaign to remoralise NZ, 1984–1999” for which they received a Royal Society of New Zealand Marsden Fund grant.

Not all readers of this journal will be aware that the aim of the Marsden Fund is to support research that incorporates originality, insight and research excellence. A further goal of the Marsden Fund is to foster the development of research skills and, to this end, projects are encouraged to support postgraduate research. Janiewski and Morris’ research incorporated work done by a Master’s student that is the basis of Chapter 10…

I cry for my own children, but also for all of our tamariki. This is an all out military industrial attack upon all of us, and we must not be silenced.

Yes I feel it as a subtle military attack. Winston once connected himself with Asia – Taiwan I think. What if the Chinese turned out to be better than westerners; certain countries seem to be readying themselves for a match?

Perhaps learning some Mandarin as well as Maori and seeing what Sun Tzu the general, wrote, and Confucius the philosopher, advised and we might get some ideas of how to combat this onslaught and save ourselves. But then the trouble is the onslaught is new technology formed by man, but directed to taking mankind over in the main. And China has embraced this.

Where do humans go to live together in a satisfactory communal way, unmolested?

Playing Toto Make Believe which asks questions that stuck in my mind. Do you like? https://www.youtube.com/watch?v=Mn0MKyesiVI

This has been said by you before – We can infer from the Child Poverty Report that the coalition government is abandoning any pretence to reduce child poverty. They think forcing mothers into paid work is the way to address their poverty, ignoring and devaluing the demanding work of parenting.

And it shows a determination not to notice the words, the meaning, the conditions – because people don’t want to know the facts and face them. How to make them care without mass, concerted violence forcing it? The psychology behind this wilful ignorance has been studied; we need to bring psychology to play and find the chinks that will allow feeling to creep in behind the Wealthy and Orthodox Iron Curtain (WOIC said as ‘woke’).

Bob the first troll doesn’t want to know the facts because they alway poverty him to be the troll he is.

A true Christian PM would not create emoyment slavery and make poverty numbers explode as Luxon has. Alongside seperatism, poverty will be his legacy. But typically, Luxon is weak as unlike Ardern he won’t take on a ministry.

more poverty will lead to more crime suicide family violence truancy ,the list goes on

it would be more useful to recognise all these three and four letter acronyms are just tinkering around the edges, and, along with other redistributions such as the accommodation supplement, are a distraction designed to deflect from the real issue which is the elite are trying to grab all the world’s wealth in hard assets before the whole stinking system that is neoliberalism implodes upon itself.

Don’t swim in the weed with a hard on.

Focus on the actual issues that are causing ever increasing inequality, or else the divide and conquer brigade win.

These neoliberal tinkerings are not the real issue.

Ben. They may seem small issues to you but a proper reform of WFF so that all low income children are treated the same and an adjustment of the absurdly low threshold and high rate of abatement would be a great thing for many many struggling families. Their children can’t wait fir capitalism’s overthrow

I highly recommend reading The Big Kahuna: Turning Tax and Welfare on It’s Head in New Zealand-

Only TOP had a solution for the high marginal tax rates faced by low income families and beneficiaries.

The Greens policy of Income Guarantee only entrenches this further.

Labour- well history shows they had no idea or didn’t care about child poverty.

When they define work as productive & set the tax rates accordingly I might have some time for them. In my view, landlords with their parasitic income stream from exploiting people unable to purchase an overpriced property would be highly taxed & the many lower-income jobs that keep the system going (carers, supermarket workers, etc) would have a tax-free income threshold.

This will be Nationals legacy, actually all National governments legacies.