In an era marked by economic fluctuations, making the most of every penny has become a necessity. For New Zealanders, like many global citizens, the increasing inflation rate has brought about a wave of changes in spending habits. With careful planning, leveraging promotions, and employing bonus codes, it’s possible to navigate this challenging economic landscape.

Inflation’s Global Bite: New Zealand Not Spared

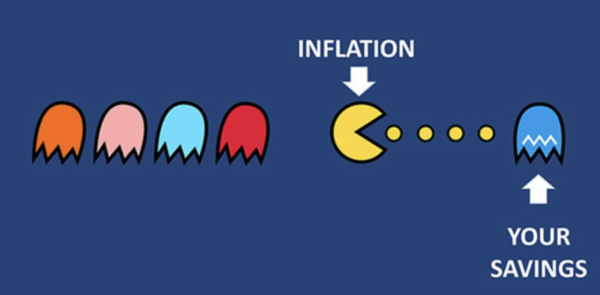

Worldwide, economies are grappling with the sting of inflation, and New Zealand is no exception. According to Stats NZ, the consumer price index increased to 6% in the 12 months preceding June. In the year 2022, the inflation rate stood at 7.17%, which was significantly higher than in the preceding years. This rate significantly impacted the purchasing power of Kiwis.

Here is a chart from www.figure.nz to better show the sharp increase:

Adapting to Economic Changes

The pinch of inflation demands that households adapt, stretching their income in creative ways. For many New Zealanders, this means cutting costs on some non-essential items, seeking out discounts, or taking advantage of promotions and bonus codes. Being savvy about how and where you spend your money has become essential.

The Power of Bonus Codes: An Overview

Bonus codes offer consumers the opportunity to access products or services at discounted rates or with added value. In some cases, businesses offer these codes as part of promotional strategies, aiming to attract new customers or retain the existing ones. Given the current economic situation, harnessing these codes can lead to substantial savings.

1. Bonus Codes in Retail

Many New Zealand retailers offer bonus codes, especially during seasonal sales or promotional periods. Whether it’s for clothing, electronics, or household items, consumers can often find codes online or through subscription-based mailing lists. By applying these at checkout, shoppers can achieve instant discounts or benefits such as free shipping.

2. Dining Out and Food Deliveries

With the boom in food delivery apps and services, many New Zealanders are finding that bonus codes can offer discounts on their favourite meals. From free delivery to a percentage off your total order, keeping an eye out for these codes when ordering can make eating out or in more affordable.

3. Gambling Bonus Codes

While gambling should always be approached with caution, those who enjoy this form of entertainment can benefit from the NZ deals from bonus-codes.com. Online casinos often provide offers for new users or promotions for regular visitors. Whether it’s free spins on a slot machine or match deposits, these codes can extend the playing time without requiring additional funds.

4. Experiences and Entertainment

Beyond physical products and services, bonus codes can also be found for experiences. Whether it’s a discount on a local attraction, a theatre show, or an outdoor activity, such offers make leisure more accessible, even when on a tight budget. The ongoing talks about a wealth tax have made some people feel ostracized because of their fortune, but let that not mislead you into thinking that cultural events were meant only for an select few.

Strategies for Responsible Savings

The numbers speak louder than words – 55% of New Zealanders struggle financially. It’s always a good idea to assess whether a product or service is genuinely needed or if the promotion is simply an incentive to spend. Additionally, with activities like gambling, it’s crucial to set limits and ensure that the activity remains a form of entertainment rather than a financial burden.

- Assessing Needs vs. Wants: Before diving into any promotional offer, it’s essential to distinguish between ‘needs’ and ‘wants’. A need could be something fundamental, like groceries, whereas a want might be an impulse purchase, like a new pair of shoes when you already have several.

- Setting Clear Boundaries: Activities such as gambling come with their own set of risks, making it even more vital to employ a robust strategy. Beyond just looking for bonus codes, it’s crucial to establish boundaries. This might mean setting aside a fixed budget for such activities, deciding beforehand how much time you’ll spend, or even using tools and apps that remind or restrict you.

- Tracking and Reviewing Expenditures: One effective strategy to ensure responsible savings is to regularly track and review expenditures. By maintaining a monthly or weekly record, one can gain insights into where their money is going and identify areas of unnecessary spending.

Remember: Spend and Gamble Responsibly

Economic tides, particularly inflation, often test the resilience and adaptability of households. For New Zealanders, the key to financial stability lies not just in earning but in smart spending. Embracing available tools, such as bonus codes, can offer some relief. However, true financial security is a blend of informed choices, responsible habits, and strategic planning.