Labour’s John Key Budget

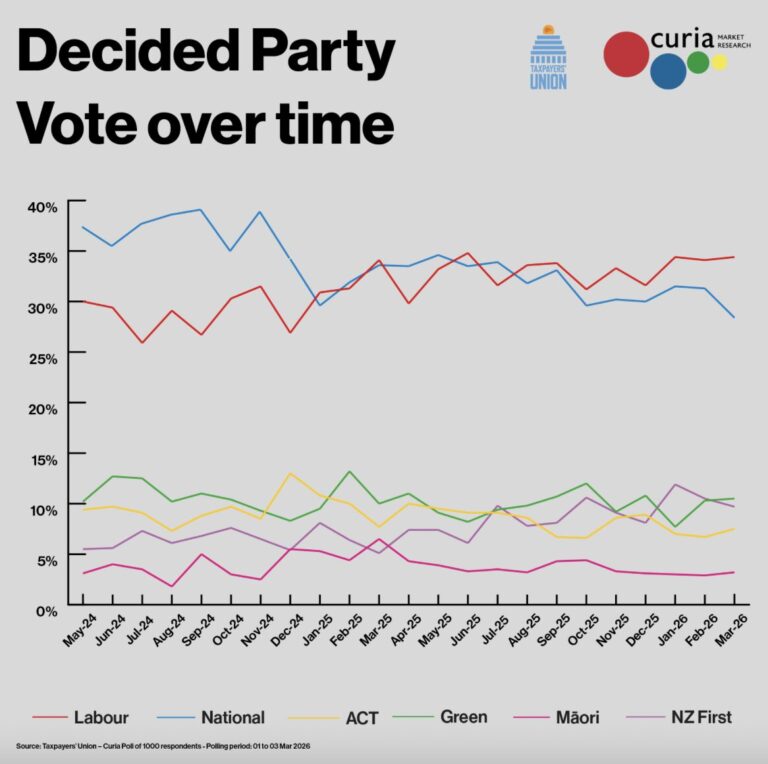

Imagine a 2023 budget prepared by John Key. National are in government but recent poll results are disturbingly close. With an election looming, the Labour-Green bloc almost have the numbers. Combined support for National-ACT is flatlining, and Te Pāti Māori could potentially hold the balance of power. Crucially, a large tranche of swinging Labour-National voters may well determine the election night results.

In the above scenario, Key’s budget would look a lot like the one Grant Robertson has just delivered. No austerity measures, a few tax changes but nothing major. Post-cyclone infrastructure spending would be necessary; don’t want to lose Coromandel, East Coast and Hawkes Bay votes. New funding for health, increased subsidies for childcare centres? Key would do this too, notwithstanding the inevitable ACT party complaints. Do they not understand? If we can’t entice those swinging voters, the opposition benches await. Also from the Key playbook, allocations for Māori-focused initiatives—Kapa Haka, housing and whenua-based investment programmes. Granted, Te Pāti Māori may not be biddable now, as they lean toward Labour-Green. But leaderships change as political circumstances change; therefore, certain coalition options must stay open.

Behind this policy correspondence lies the fundamental truth of New Zealand party politics. Labour and National are both die-hard monetarists, the Reserve Bank Act is their unspoken article of faith. On this doctrine, advanced in the late 1970s, excessive public expenditure and real wage growth will increase aggregate demand and inflation levels. If central banks can adjust the money supply to increase commercial/investment bank interest rates, demand will contract, and inflation will be manageable. Unemployment rise is a necessary if unfortunate side effect.

Research from William Phillips, Paul Samuelson, Milton Friedman and others seemed to indicate a trade-off between inflation and unemployment. Fiscally responsible governments would target the former through monetary policy. Well-meaning spend-up governments would over-inflate and damage the economy. In New Zealand, Labour’s 1989 Reserve Bank Act effectively ended the debate. Both major parties concurred with the legislation. The 2021 RBNZ Act modernised operations and tweaked the legal wording but didn’t change the basic doctrine.

Aside from older macro-economic arguments, the doctrine is wrong. Inflation today does not have monetary causes and monetarist solutions cannot work. Edward Miller, economic researcher for FIRST UNION, cites a US Federal Reserve study which debunks the Phillips Curve. Organised labour’s declining bargaining power weakens the relation between unemployment and inflation. Wage-push inflation growth is just not there, so why contract the economy? In New Zealand, between 1991 and 2023, union density declined from over 50 to 20% of the workforce. Clearly, today’s stunted, uneven wage growth is not going to trigger an inflationary surge. Emeritus economics professor Tim Hazeldine proposes a more plausible diagnosis:

It’s COVID inflation that was driven by a supply push from the pricing side of the market. The initial transportation logjams caused by lockdowns gave shippers—especially container shippers—the excuse to drastically hike their prices. In the confusion, many other sellers of many other products discovered that they suddenly had, as one analyst put it, ‘real pricing power’. And boy did they use it!

International research points in the same direction. For US economists Isabella Weber and Evan Wasner, evidence acknowledged by US and European central bankers indicates that “price setting by firms with market power drive inflation”. Giant corporations have the product portfolios, dominant market positions and revenue management systems to maintain margins and customers. With global reach, they are less dependent on any single national market and can shape prices. By contrast, small businesses cannot easily raise prices as costs go up and interest rate repayments increase. Creditworthiness and access to loans will therefore diminish.

Sound familiar? As Tim Hazledine would attest, supermarkets, power companies and banks are pricemakers who drive up inflation while the rest of us struggle. Most obviously, the four largest Australian banks in New Zealand collectively made over NZ$6 billion in 2022. They exploit, ruthlessly, the margins between the interest rates of wholesale money for them and the mortgage rates for captive homeowners.

This brings me to a major budget coverage gripe. Cited and interviewed bank economists have skin in the game. None of them will challenge the Reserve Bank Act even if its inflation assumptions are wrong. In fact, from the perspective of a borrowing household, rising bank interest rates are themselves an inflationary threat. And, if it is pricemakers who drive inflation, who loans to them? That’s right, the employers of our supposedly objective bank economists.

Meanwhile, the political fallout from budget day presents a clear picture. As Matthew Hooton and Shane Te Pou have also observed, Robertson’s budget has snookered Chris Luxon. That tranche of Labour-National swinging voters are coping, just, or are reasonably well off. Not socialists of course, but they wouldn’t support an austerity budget. National’s vow to bring back $5 prescription fees is an election loser. But Robertson’s free childcare initiative for 2-year-olds will get the swinging vote. ACT is out on a limb here. Their brand of neoliberal monetarism, if implemented, would estrange many National voters, and make the country ungovernable. Coalition of chaos indeed.

Miller, “Why does our inflation response punish low-income workers?”, The Newsroom, August 17, 2022.

I work in a company that imports materials for industry and I can tell you from the inside Wayne is absolutely right.

It is gobsmacking to watch these guys complain about inflation and the government one minute and the next wet themselves over their record profits, and not make the connection that it is their fault for importing massive inflation not the governments.

The core behaviour is the single minded obsession with % markups. So if at 50% on $100 COGS then selling at $150, making $50 and that was fine. Now suddenly price hikes have made COGS $200 but instead of being happy to take the $50, the markup goes to $100 so selling at $300. Then bragging about how they are brilliant businesspeople while people can’t afford groceries and have to be put out of work to curb inflation. Meanwhile knobend-in-chief Seymour drivels on about government spending.

NZ is a captive market of capital corruption, monopoly and hegemony – until it isn’t – someone will undercut them with $250 COGS and take all their business. there’s no loyalty with that crowd.

Yes, market will fix it, sure. But not in reality.

And in the case it does eventually, that profit is gone, funnelled to the wealthy. Are you going to tell me it will trickle down from there now?

With the intellectual giants commenting here, Wayne Hope could be wondering…“is it worth my time”… but hey, as per most online forums there are more readers than commenters at The Daily Blog so lets be optimistic.

Roger Douglas and his mates sneaky, undercover monetarist takeover of the New Zealand State, Parliament and Labour Party is coming up for its 40th anniversary next year. Be nice to greet that fact with a Labour/Green/Māori Govt. and a new left movement building the pressure on them.

The Emperor has no clothes alright when it comes to the likes of the RBA. How dare an unelected clown like Mr Orr tell the country he is going to cause unemployment to rise–on purpose–and be allowed to get away with it?

New Zealanders need to get their mojo back and blockade the Reserve Bank, and Aussie bank offices, with hit and run action, and demonstrate wherever Orr appears–ooh, scary…

The problem in our case is that the government revenue is too large – a billion a week more than when Labour took over. They’ve achieved this through more taxes, higher taxes and inflationary bracket creep.

Just about every dollar spent by government, any government, is almost by definition detracting from our national productivity. (An exception would be the recent deal with NZ Steel). Wellington is a money-go-round with nothing much tangible coming out at the end. In business terms, it’s overhead and it needs trimming.

The problem is the previous Government, the coalition of cuts, underspent so badly, this government has had to spend big time to pay nurses and teachers a better income than the coalition of cuts ever did. Then of course there is the infrastructure that Nact, with it’s underfunding, make us look 3rd world. And of course the great immigration pozi scheme that went unchecked leading to skyrocketing house prices from 2011.

You righties created this fucking mess and have the audacity and hypocrisy to blame Labour.

In social terms this investment is needed as it should have been in the long hard nine years of the Nact coalition of cuts.

Running public health is not the same as running AirNZ because AirNZ doesn’t have to supply seats for public good. Thus your anology that government revenue can be looked at in business terms is delusional.

How is building/rebuilding infrastructure detracting from productivity?

“They’ve achieved this through more taxes, higher taxes and inflationary bracket creep.”

Please provide proof of your statement?