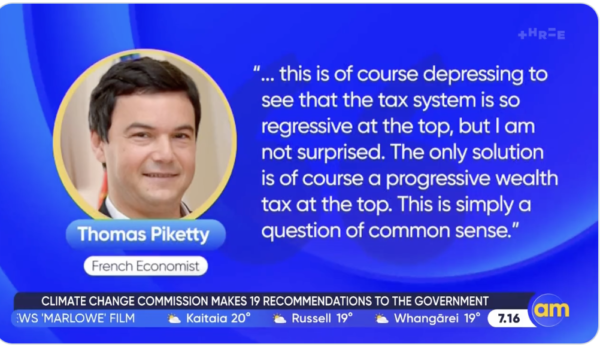

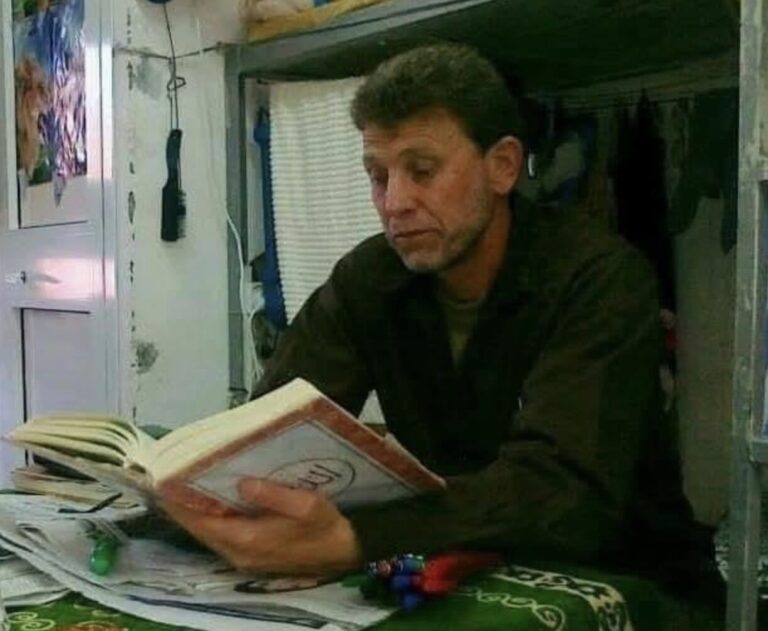

BREAKING: Thomas Piketty reads Tax report and urges David Parker to do something meaningful

The greatest Left wing critique of Capitalism since Marx, Thomas Piketty read David Parker’s tax report and said the following…

…if Thomas Piketty can see it, why can’t the Labour Party of NZ?

The report clearly shows the economy has been rigged for the rich – if you are not incandescent with rage over that betrayal – you are the problem!

We need to be kinder to workers and crueller to corporations and the 1%.

There are 14 Billionaires in NZ + 3118 ultra-high net worth individuals, let’s start with them, then move onto the Banks, then the Property Speculators, the Climate Change polluters and big industry.

There’s no point making workers pay more to rebuild our resilience, tax the rich!

-Sugar Tax

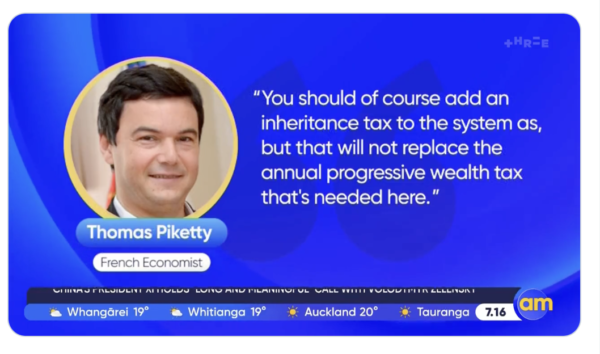

-Inheritance Tax

-Wealth Tax

-Financial Transactions Tax

-New top tax rate on people earning over $300 000 per year.

-Capital Gains Tax

-Windfall profit taxes

-First $10 000 tax free

The Reserve Bank Governor is clearly telling us to raise taxes to pay for the rebuild, if Chippy’s Bread and Butter politics is to mean anything, he has to tax the rich to pay for the rebuild.

What’s the point of Bread and Butter politics of no one can afford to buy Bread or Butter?

Capitalism is rigged, Democracy is supposed to have the moral authority to challenge that.

We need to be kinder to individuals and crueller to corporations.

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

If you can’t contribute but want to help, please always feel free to share our blogs on social media

I’m not keen on a wealth tax or an inheritance tax but I think the rest all have legs. FTT to me makes the most sense electorally but a CGT on all properties bar the family home or all properties over and above the 2nd home (if you want to be electorally PC) would also fly. Defo on the $300K 50% tax but this should be done transitionally so those affected have time to get their houses in order.

The tax change that really needs to happen is the one that would probably be most voraciously fought against and that is the company owners who pay themselves and spouses minimal amounts in order to lower taxes. Similarly those who go on international holidays and pass them off as ‘business trips’ and drive around in a fleet of family Mercs whilst claiming them as business expenses.

Myriads of small business owners employ these tactics and dodge a reasonable amount of tax by doing so. The sums may not be huge compared to rich listers but the number of people doing it and the timescale they do it over is the issue. IE: we should go after the 200,000 business owners who are dodging tax to the tune of say $25K a year.

NZ has a growing attitudinal problem of tax avoidance (Its celebrated as being smart for example) and we need to stop encouraging that by closing the loopholes. Deducting interest on housing was one but there are many more.

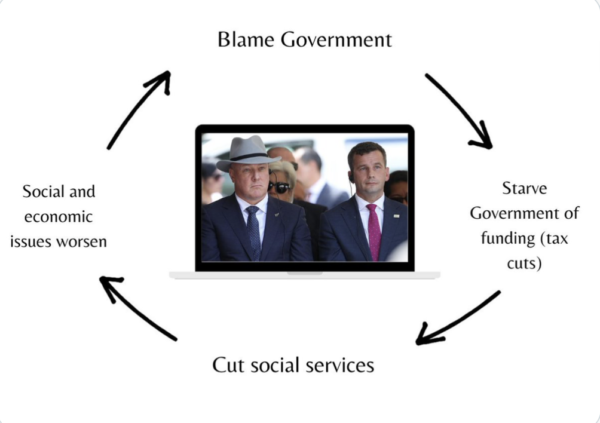

Of course Labour know and knew all along.

Labour are not on the left, they haven’t been for years and years and years.

They are frightened of their own shadow.

They are gutless. They are not at all interested in leveling the playing field.

They want to keep in with business…

But they garner the votes from South Auckland every single time.

The rich might flee the country, good they can piss off. The fact is they want to live here because apart from being a tax haven it is a wonderful place to live in the south pacific and most of them have family here.

The was one hell of a waste of money, good recommendations ignored surprise surprise.

People need to stop the rhetoric ‘kiwis pay high taxes’ bull shit if you look at Australia they pay more as they do in many western countries.

The top tax rate should be put back to what it was 66c for high income earners, Labour did this bastards.

Until the centre bloc of the electorate decides radical change is required, neither major party will rock the boat, especially with the poles showing a looming neck and neck race. That’s the reality of a democracy.

Although we all knew this and nothing was done, other than National and ACT as a coalition dropping the tax take top bracket( supporting the wealthy) we now have a formal report for Labour to act upon. Whether they do anything is debatable but one thing is certain, right wing supporters, National and ACT will scream blue murder against any tax on the wealthy albeit this report is clear evidence the wealthiest paying the most tax is the biggest scam going around.

Thomas Piketty probably doesn’t realise that the numbers are often made up to paint the picture they want or is it just plain incompetence? Hard to tell!

Te Whatu Ora pulls inaccurate emergency department data

https://www.rnz.co.nz/news/national/485623/te-whatu-ora-pulls-inaccurate-emergency-department-data

Swim coach with a calculator spots $5m accounting error in NZ council planning

https://www.9news.com.au/world/new-zealand-christchurch-council-pool-closure-accounting-error/bdb1b39a-d7ac-4c46-82a8-d74cd3e96a0f

Did they mention that NZ woke government love to give away our taxes to wealthy new residents who don’t live here too https://www.nzherald.co.nz/nz/cost-of-living-payments-potentially-go-to-120000-ineligible-people-worth-14m/WG6H23HDT7Q5474BJ2GRMJZXE4/

Too many people are in NZ and never paid a single dollar of tax, https://www.nzherald.co.nz/nz/news/article.cfm?c_id=1&objectid=11842563 while living opulent lifestyles with multiple properties and overseas travel, while receiving NZ benefits and it’s only getting worse with all the free money that NZ government loves to give out.

It’s got so bad that the overseas are sailing into NZ on luxury yachts are actually expecting millions in refunds. https://www.odt.co.nz/news/national/former-new-york-developer-jailed-nz-tax-fraud

Cases even lead to murdering each other over NZ assets that are bankrupted.https://www.nzherald.co.nz/nz/elizabeth-zhong-murder-vineyard-owned-by-victim-bought-by-southland-farmers/UYJSXJ5OXHTIIX67PEE2KT5SMU/

Don’t worry about paying income taxes – using illegal and underpaid labour! If caught it is only a $2500 fine or NZ will pay the relatives ACC money never collected, while the perps go free. https://www.stuff.co.nz/business/118004926/family-of-migrant-worker-who-died-on-the-job-seeks-compensation

This is in addition to overseas property owners and overseas backpackers are getting cost of living payments freely handed out, something is wrong with NZ government thinking.

No social taxes here.

Italy’s plastic tax will enter into force on 1 January 2023

https://www.ey.com/en_gl/tax-alerts/italy-s-plastic-tax-will-enter-into-force-on-1-january-2023

No Covid windfall taxes here.

Santander profits up despite windfall tax on banks

https://news.yahoo.com/santander-profits-despite-windfall-tax-100657211.html

“The robust start offset the impact of a temporary windfall tax on big banks imposed by Spain’s government in January to fund measures to help households cope with higher prices.”

From the report: Tax rates for each decile of income when including GST and welfare benefits.

Decile 1: -52%

Decile 2: -55%

Decile 3: -36%

Decile 4: -2%

Decile 5: 6%

Decile 6: 18%

Decile 7: 21%

Decile 8: 23%

Decile 9: 26%

Decile 10: 29%

So who’ll be first with the election cry “Tax the Rich”?

ACT?

National?

So who’ll be first with the election cry “Tax the Rich”?

ACT?

National?

Tax the rich. Eat the rich. That sounds really dumb. It’s the Fairness Election for the Chipster’s “Fair Society.”

Fair price. Fair deal. Fair go. Fair shake. Fair suck of the sav. Antipodeans love this. Fair tax. Can’t get fairer than that.

We need to tax the shit out of these rich pricks to pay for schools, hospitals and other public services.

30 years ago, we had a hospital in every town, with surgical services, then they all got closed down because the rich didn’t want to be taxed anymore. Also, there are way less public services on offer than there were 30-40 years ago.

Things are actually as obvious as you portray millsy. Pity we did not have a class left, fighting central labour organisation calling for strategic working class disruption until the Richies cough up.

Totally agree. Instead we’ve got this endless fascination with dancing the wokey tokey and it’s a complete distraction from real meaningful issues. The left need to get real focus on what’s important to the vast majority of people and become relevant again.

I still remember during the first media rush of “Jacinda–mania” when in a puff piece style magazine interview Ms Ardern talked about her media habits and personal interests. A recent Thomas Piketty book was on her shelf, and she candidly admitted to having not finished it.

And that is 99% of the Labour Caucus problem–lack of a class left analysis and ideology. They are captured by monetarist orthodoxy & an embedded neo liberal Parliamentary consensus, hugging the centre line and the middle class and the employing class.

A circuit breaker is needed, and at the moment that looks like Te Pāti Māori in a tight election. For 2026 it will be a new gen mass community movement that will finally boot Rogernomics and Ruthanasia.

Yet Ardern is off to Havard to be right-wing programmed, in a scheme designed to capture influential movers and shakers and indoctrinate them before they can do any further damage to the plutocracy. Ex politicians, economists and media figures (remember Sharon Crosby) are especially targeted for this treat.