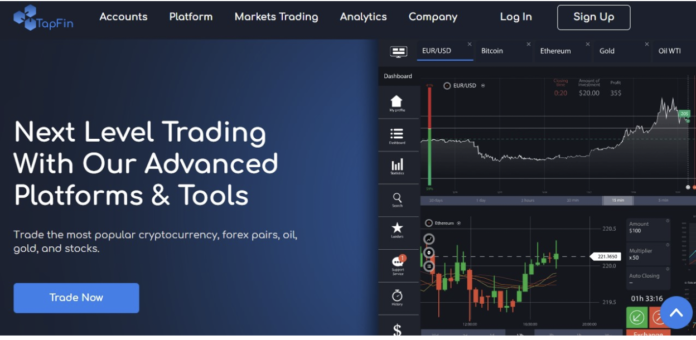

Foreign exchange, or Forex, has provided investors with a lucrative chance to trade currency pairings and bet on the movement of one currency’s value relative to another for decades. You can trade it online via platforms like Tapfin. Recent years have seen a growth in the accessibility and popularity of foreign exchange trading due to the proliferation of internet trading platforms and the availability of information and educational resources.

If you’re an investor in 2023 trying to diversify your portfolio and make some money, FX trading is still a possibility. This is because of the following reasons:

Large amounts of money and a lot of uncertainty

Since there are always buyers and sellers in the Forex market, traders on Tapfin.io may enter and exit positions with relative ease. The extreme volatility of the forex market provides possibilities for traders to capitalize on price changes. Forex traders have the ability to earn big profits if they use a suitable trading strategy and practice sound risk management.

In terms of both availability and cost

The proliferation of internet trading platforms and the proliferation of educational materials have made foreign exchange trading more approachable and inexpensive than ever before. Forex trading is accessible to individuals of varying means because of the widespread availability of online brokers offering minimal minimum deposits and attractive spreads. Trading forums and social media groups, in addition to online courses and webinars, provide a variety of free and paid educational tools.

There are several upsides to having a diversified portfolio

Investors who want to diversify their risk across a variety of asset classes may find Forex trading useful. The foreign exchange market is not as highly associated with other asset classes like equities and bonds as other markets are since it is influenced by things like global economic trends, geopolitical events, and central bank policies. As a result, increasing a portfolio’s exposure to forex may lower the portfolio’s overall risk while simultaneously increasing the portfolio’s potential gains.

Superior Market Resources and Trading Instruments

Platforms for trading foreign exchange (Forex) like Tapfin provide access to a variety of materials and tools designed to assist traders in making educated trades and keeping their risks under control. Traders may benefit from these resources, which range from economic calendars and news feeds to charting and technical analysis tools, in order to keep up with market trends and make better judgments on when to join and leave positions.

Management by the regulators

Last but not least, regulatory regulation in most nations helps to shield traders against fraud and abuse on the currency market. Strict regulations and standards for forex brokers and traders are enforced by regulators like the Securities and Exchange Commission (SEC) in the United States and the Financial Conduct Authority (FCA) in the United Kingdom.

Foreign exchange (Forex) trading on Tapfin is still an alternative for those who want to diversify their portfolios and make a profit. Forex trading has several advantages for investors of all sizes and experience levels, including high liquidity and volatility, accessibility and affordability, diversification benefits, cutting-edge trading tools and resources, and regulatory monitoring. Yet, similar to other forms of trading, binary options trading requires thorough preparation, a sound trading strategy, and cautious risk management.