Food price increase still running at 13-year high, but is relief coming?

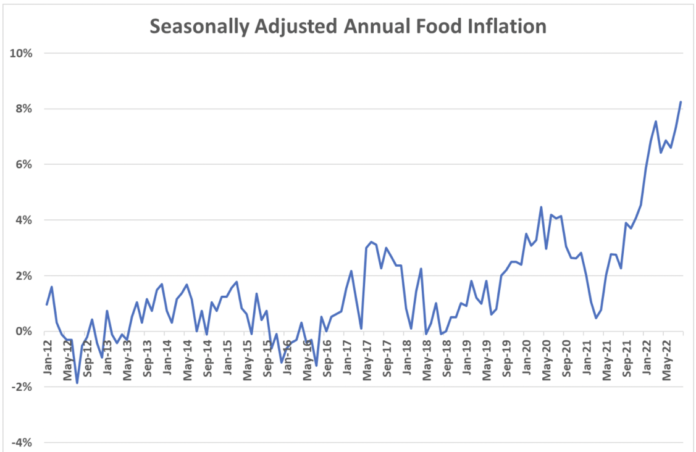

Food prices were 8.3% higher in September than the year before, a 13-year high.

It was the same rate of price growth recorded in August, and the highest since July 2009.

Stats NZ said the increase was due to movement of all food categories measured. Grocery food prices were up 7.7% year-on-year, fruit and vegetables up 16%, restaurant and ready-to-eat up 6.9%, meat, poultry and fish increased by 6.7%, and non-alcoholic drinks up 4.8%.

“Increasing prices for yoghurt, two-minute noodles, and tomato-based pasta sauce were the largest drivers within grocery food,” consumer prices manager Katrina Dewbery said.

In his must read book ‘Crisis’ former Reserve Bank Governor Alan Bollard recounts a meeting at Davos where a very smart financial expert was asking all the Reserve Bank Governors in the room who owned the debt in a credit default swap.

When everyone in the room realised they had no idea who owns the debt, they all gulped.

Shortly after that, credit default swaps crashed the entire global economy.

No one knew what these complex financial instruments were actually doing or how hollow and corrupt they had become until they melted down.

The nervousness in that room at Davos in 2006 when Allan Bollard first heard about credit default swaps hangs over the entire global market as reserve banks desperately attempt to jam the inflation Genie back into its bottle before the worst hits.

We are on the verge of extreme market dislocations as Central Banks are forced to continue ramming up interest rates to the point they cause the debt to event horizon and implode.

The Government’s 25cent tax fuel subsidy comes off in January, but OPEC last week just cut oil production to aid the Russians despite fist bumping Biden just in time for the full impact to be felt in America during the November midterms.

How does NZ avoid that spike in oil prices?

Can the Government politically risk removing that fuel subsidy?

Since the 2007 global financial crash, we have printed $25Trillion in quantitative easing artificially creating the lowest interest rates in 5000 years. The global supply chains pushing deep into the most de-unionised parts of China subdued all the inflation, but Covid, the massive drought impacting agricultural calendar and the war in Ukraine has caused supply side shocks that are causing hyper inflationary pressures Reserve Banks can’t contain.

We will see tomorrow the CPI numbers out of America and next week the NZ numbers are out.

My argument is that we are in a unique perfect storm of massive debt, catastrophic climate change destroying the agricultural calendar and war in the Ukraine which will combine to cause a geopolitical shockwave that will knock us into crisis.

Our experts have claimed since March that we had passed peak inflation, but the numbers aren’t telling us that – I argue the uniqueness of this perfect storm means the rules that previously worked aren’t working and radical change will be necessary.

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

If you can’t contribute but want to help, please always feel free to share our blogs on social media

Let’s tax our farmers for carbon emissions so our 16 year old city living climate activists can fly to Fiji on holiday.

That will fix it…

Correct on all points Martyn. We face a year of discontent that the voters will, not unfairly, blame in part on the current government.

Excellent!

Council elections votes are now held in Countdown – government demanded that productive land for housing for more people who are on low wages in NZ working at places, like countdown. Yet another enquiry about supermarkets duopoly but still nothing done.

Many in the middle class don’t want Orr using his 75 point bazooka because of the adverse effect it could well have on property prices. Housing prices have been far too high for far too long but a dramatic slump in the sector akin to what we had in the late eighties/early nineties would have a detrimental effect on the assets owned by those who are in their twenties to forties now, and these are the citizens who are likely to be the first lot of retirees who take retirement at 67 years of age instead of 65 years of age.

Labours genius assault on farmers will help solve this problem. Looks like there’s nothing they can’t make worse

There is no assault on farmers. The scheme has been prepared by the primary sector as an alternative to the ETS. It’s laughable that people are making out like the farmers are being down trodden and have had a scheme foisted on them. Those feral pricks at groundswell don’t even speak on behalf of the industry. They just act like it. Have you heard loads of pushback from National etc? No.

I guess Yeti wont be voting National, Wheel?

What the fuck has farming have to do with this thread?

I assume Keepcalm and Yeti are saying it will drive food price inflation.

I believe they think farming keeps NZ alive. Fuck knows why when the average kiwi can no longer afford to eat meat.

Correct – it will drive prices higher.

Its everybody else that has been footing the ETS tax bill while farmers were given time to produce technologies to counter their emissions, since then emissions have only gone up, no sympathy for farmers at this point.

Michael Wood demonstrated last week he lives in Lala land, seemingly oblivious to the fact that whacking a tax on fuel during a cost of living crisis, in an election year is pure kamikaze thinking. It was remarkable just how out of touch he was.

Fact is that tax can never go back on. And no Michael, your government has not given a billion dollars in relief, you’ve just stopped fucking over your citizens, mugging us of what’s left of our pay packets!

Somehow I think subsidising the well off to update their Tesla’s is not the way to go!

Adam Smith outlined that inflation can occur where a government increases the supply of money. When that happens it is the government’s duty to reduce that supply of money via taxation. NZ printed 10s of billions for covid. That needs to be taxed out of circulation. Instead, interest rates increase which only benefits the private bank shareholders. A financial transaction tax of 1% on transactions over $5m that goes offshore will address inflation in short order. Problem is, we have a house of representatives who have been captured by false chicago school of economics thinking.

National s answer is tax cuts, end of story. They have costed this out by taking their socks off to count their toes also. Yes masters of the economy.

Fact is they are not only hopeless, they are useless, as seen by everything they say and do.

That’s ridiculous.

Ridiculously correct.

And the rest of NZ is still waiting for trickle down economics from John Key’s tax cuts to benefit the rest of the economy aside from rich people and corporations.

When National announced more tax cuts all my mind heads towards is what tax changes elsewhere will happen to balance the books?

Already making noise when it comes to the public service and unemployment. I dread to think where this is heading if the rich get another tax cut.

Robo should get the rest of his, our ‘Bazooka Cash’ out and throw a big leaving party for Labour next year like it’s party 9teen 9ty 9!

Martyn I don’t see the link between inflated food prices ( with probably a touch of gouging along the way which basis point rises won’t fix) and the story outline for The Big Short. I think it’s pretty clear who owns the original debt, it’s the lender. Isn’t it? Problem is the issuer of the credit default swap may not have money to honour the swap when the original loan defaults.

Simple, a radical direct action campaign to force labour to remove the fuckin GST.

we should stop using the term ‘inflation’ what we have in NZ is rampant goughing on prices…it’s not connected at all to wages.

and slashing any tax just means it has to be made up elsewhere…sorry if you want ‘services’ facts is facts….now if we had a CGT…

A CGT would do nothing. Doesn’t work in AU the UK. It’s just another tax. Stamp duty doesn’t work either. A wealth tax or land tax would work.

Comments are closed.