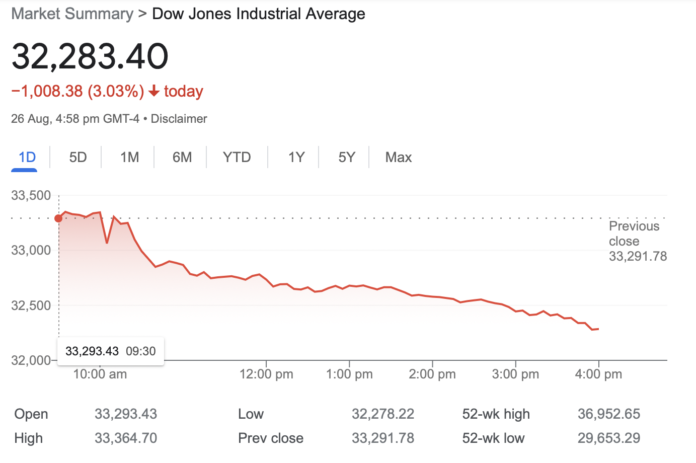

Dow Jones drop 3 percent after Fed Chair Powell warns interest rates to stay high

The Dow Jones Industrial Average sank more than 1,000 points Friday after the head of the Federal Reserve dashed Wall Street’s hopes that it may soon ease up on high interest rates in its effort to tame inflation.

The S&P 500 lost 3.4 percent, its biggest drop since mid-June, after Jerome Powell said the Fed will likely need to keep interest rates high enough to slow the economy “for some time” in order to beat back the high inflation sweeping the country.

No amount off ticker tape tantrums can sway Powell any longer, the reality of unwinding $25Tillion in quantitive easing is upon us and Powell has to keep pushing the stake into the heart of these Global Zombie Corporations because there is nothing else left in this Late stage Capitalism meltdown.

All that debt, all that speculative bubble in property and stocks, all of it is about to get hit be demand side and supply side destruction.

If the Fed comes out with 100 point raises rise, the pressure will be on Orr to follow with 75 points.

What Treasury are wanting to claim is inflation is dropping because demand is dropping, but this is a supply chain and scarcity problem as well, as Consumers retreat, the natural scarcity of products also compounds issues by driving prices up even as people can’t afford them.

The super rich and super wealthy will benefit, middle classes and below however will suffer.

With supply chains broken, with geopolitical tensions bringing supply chains back to friendly territories and the inflationary pressures of bringing those supply chains home, the day of reckoning here suggests a spectacular 1929 stock market crash.

There is a crunch point coming and the worst has not hit.

I do not believe we are ready for this Jelly.

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

If you can’t contribute but want to help, please always feel free to share our blogs on social media

Jelly indeed. Buckle up. Shit be spinning round the fan now. Hopefully those that could have paid down debt. Interesting times. We have no control over this so will have to wait it out. I’ve started buying lotto. What else can ya do?

Arent we suppose to protest somewhere – outside Costco? With big signs warning everyone that we are well inside the dying zone of Climate Chaos now. Only thing we can do now is offer our children some kind of chance of survival in the decades ahead.

How about we start turning up outside fossil fuel HQs or at major road intersections, not to disrupt but to bring attention to what the real deal is.

Pray

Think jelly wobbles, from this track: https://www.azlyrics.com/lyrics/destinyschild/bootylicious.html

Oops, posted wrong place

Have to keep in mind though that an immense amount of wealth was created during the plague years with all that credit creation. To get back to only 2019 levels Auckland house prices need to fall spectacularly.

US Fed trying to do a controlled demolition. Very risky but not impossible odds.

We have obviously entered the chaos and death zone of Climate “Change” decades earlier than IPCC conservative modelling predicted ( ha ha jokes on you selfish Boomers! ). This is what will destroy the current economic system with climatic external shock after external shock smashing civilization from now on.

Really? The head of the fed states close to the blatantly obvious and this isn’t factored into the market already? It just shows people with vested interests start rumours for their own benefit to get people thinking the fed won’t take a text book approach to quelling inflation.

Did you say higher interest on my term deposits!

Excellent!

Isn’t “jelly” a new Zoomer word that means “jealous” (I’ve seen and heard it used by them regularly e.g. “I’m so jelly of you right now!”)? I see you’ve been using it often lately in your blogs, but I don’t understand the origins for the context that you use it for.

Think jelly wobbles from this track: https://www.azlyrics.com/lyrics/destinyschild/bootylicious.html

Employers are getting concerned that the workers of the USA are getting too much of a share of the economic gains, so like a good little boy, Powell is determined to break them financially, just Volcker did 40 years ago.

We are about to see the biggest reduction of living standards in history. The incomes of workers in NZ, Australia, the UK and Canada are going to be dragged down to where they are in China and India. The uppity workers will never challenge the investors, landlords and shareholders again

It would have taken a Government led by the likes of Norman Kirk, and stacked with a caucus not unlike the one behind Kirk, to have had any real chance of heading off the looming lemming waltz.. What we have now, is what you get after over four decades of almost constant attacks on the foundations of the labour movement… And we let it happen..

NZ has the fourth lowest inflation in the OECD below Australia.

Our inflation rates are heading down as predicted at least twelve months ago.

Exports are up.

Just saying.

NZ has the fourth lowest inflation in the OECD below Australia.

Our inflation rates are heading down as predicted at least twelve months ago.

Exports are up.

Just saying.

Nah. I went to buy a leg of lamb at pak n save recently but it was $50 so I didn’t. Got home and checked the freezer and pulled out a leg of lamb I’d bought some months ago with price tag showing $25 (on special) from same shop. Huge difference even considering one price on special and the other not. Bloody mental we pay so much for our own home grown food to start with. Inflation has NOT peaked

I think you leg of lamb story could have been told two years ago. Lamb is ridiculous.

I am not sure what inflation is going to do. As Damien Grant pointed out with the last CPI release, the quarter versus previous quarter trend was going down not up but everyone went on about the annual number.

Comments are closed.