The Bank of England expects the UK economy to tank after inflation peaks at 13% in the fourth quarter this year and remain elevated throughout 2023 despite the economy entering a recession in the fourth quarter this year as well.

The combination of elevated inflation and recession is the classic definition of Stagflation which plagued capitalist economies in the late 1970s and early 1980s.

The end result of the period of repeated capitalist economic crises since 2008 is that the UK economy will emerge 25% smaller than it would have if it had followed the trends prior to 2008. Of course, the Tory government is trying to make working people pay the price of

Inflationary pressures in the United Kingdom and the rest of Europe have intensified significantly since the May Monetary Policy Report and the MPC’s previous meeting. That largely reflects a near doubling in wholesale gas prices since May, owing to Russia’s restriction of gas supplies to Europe and the risk of further curbs. As this feeds through to retail energy prices, it will exacerbate the fall in real incomes for UK households and further increase UK CPI inflation in the near term. CPI inflation is expected to rise more than forecast in the May Report, from 9.4% in June to just over 13% in 2022 Q4, and to remain at very elevated levels throughout much of 2023, before falling to the 2% target two years ahead.

GDP growth in the United Kingdom is slowing. The latest rise in gas prices has led to another significant deterioration in the outlook for activity in the United Kingdom and the rest of Europe. The United Kingdom is now projected to enter recession from the fourth quarter of this year. Real household post-tax income is projected to fall sharply in 2022 and 2023, while consumption growth turns negative.

A Bloomberg opinion piece by John Authers noted August 5 that:

Despite being so negative about the economy, the BoE still felt obliged to hike rates because the inflationary pressure is so great. And bear in mind that the UK is less exposed to natural gas prices than several of the bigger EU economies, such as Germany, Italy and the Netherlands.

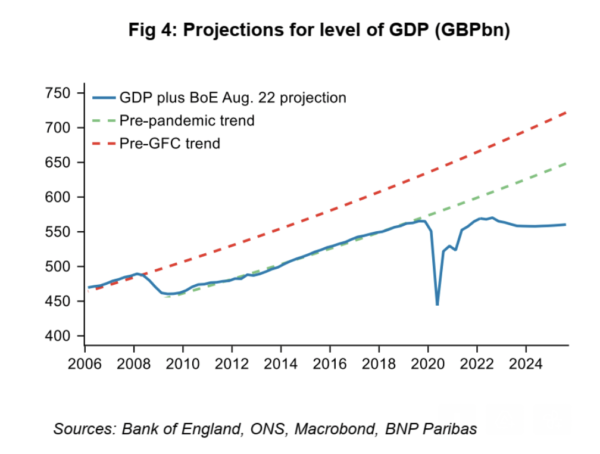

To show the scale of the long-term damage that has already accumulated, and which the central bank believes is about to be further compounded, this chart from BNP Paribas shows the current forecast compared to the trends before the Global Financial Crisis, and the comparison to the trend of growth between the GFC and the pandemic.

If the BoE proves right, then British gross domestic product in 2025 will be a third less than it was reasonable to expect given the growth rate before the financial crisis:

How much is really inflation and how much is price gouging?

UK also has rampant inflation like NZ, and also a lot of overcharging while police and government do very little/nothing – thus sending the message that it is not a crime.

In France sounds like they stop overcharging in it’s tracks by giving a prison sentence! Unlike NZ, who it’s normal to overcharge or defraud people.

Tourist charged $1000 for a 10-minute pedicab ride in London

https://www.stuff.co.nz/travel/travel-troubles/129512055/tourist-charged-1000-for-a-10minute-pedicab-ride-in-london

“In 2018 in Paris, France, two unsuspecting tourists from Thailand were picked up by an unscrupulous taxi driver and charged an exorbitant fare.

They uploaded a video to YouTube showing their stand-off with a driver who charged them €247 (NZ$416) for the 45km journey from Charles de Gaulle airport into the city. The journey would normally cost €55. That driver was sentenced to eight months in prison.”

NZ cost of living crisis, might also be related to overcharging, fraud and crime, that does not seem to be investigate or punished in NZ.

Cybercrime rampant in New Zealand and cases not investigated until there’s multiple victims

https://www.nzherald.co.nz/nz/cybercrime-rampant-in-new-zealand-and-cases-not-investigated-until-theres-multiple-victims/HUU6TURB6SJYU6O27RTXM736MI/

Leading to people just going around randomly stealing.

Good Samaritan car thief: Police looking for man who offered help, then drove off with car

https://www.nzherald.co.nz/nz/good-samaritan-car-thief-police-looking-for-man-who-offered-help-then-drove-off-with-car/5DH3ARWJH2F67TUDECRVO3NER4/

I haven’t read this yet but the heading reminds me of Don Brash arguing about the purpose of banks or something with the Governor in England. Don might have some different ideas. I am wondering what they are. I suppose he has been asked. I may find the answers in the post but if not someone ought to ask him. Old financial advisors never die, they just autocratically drive their fiats over a cliff!

As pointed out elsewhere, the fallacy of infinite growth is capitalism’s greatest deceit.

Two factors contribute to this:

1. The obvious one: Printing money and throwing it at the punters while they couch surfed during lockdowns was always bound to cause inflation.

2. We are are witnessing the crash and burn of green policies based on ‘magical thinking’ rather than science. Energy prices will likely treble this winter in Europe, all thanks to misguided and weak politicians. Policies that not only drove prices up but left them vulnerable to the tyrant running Russia.

Expect protests and the dumping of the established political class.

Globalist have been printing money and throwing it at their Imperial Wars, Fossil Fuel/Wall Street rich scum etc for decades with no inflationary effect thanks to the powerful deflationary effects of Globalisation.

Globalism is now falling apart therefore its magically deflationary effect is vanishing. 20 plus years of cheap credit and no inflation is now over unless they can get Globalism up and going again (I very much doubt it.)

While the elite are watching their project go up in flames, what is missing is leadership who understand the whys and can lead the oppressed filthy peasants of Globalism to replace it with something justice.