Scum Landlord’s being forced to provide homes rather than capital gains tax free commodities are now threatening to leave Ghost Houses to punish tenants as a fuck you to the Government…

Investor John Kenel of Assured Property Investments said yesterday there was no question about what he would do in response to the law change from February 11.

“This means I’ll be keeping more property vacant, unfortunately. I buy older houses for development and in the past I could rent them out at low costs until I wanted to develop them. Now, it will be just too hard,” Kenel said.

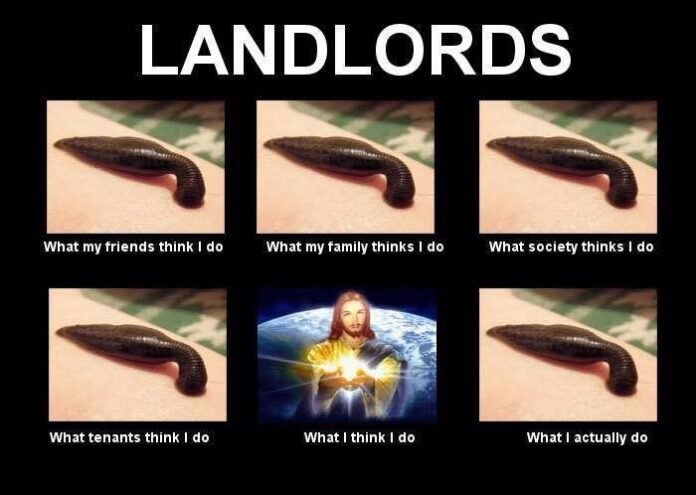

…these scum maggot landlords need a crackdown, and they need it hard!

Tax the 200 000 Ghost Houses NZ currently has with the only exemption being a holiday batch. Every other Ghost House should be taxed a percentage of its value, watch how quickly the scum maggot Landlords will rush to find tenants then!

I am sick of scum maggot Landlords benefitting from a rigged housing market and then making threats against us if we don’t let them have their own way!

If only the Greens weren’t so spineless and Labour so gutless.

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

If you can’t contribute but want to help, please always feel free to share our blogs on social media.

You will own nothing and be happy

How about an Occupy Housing Movement targeting all longterm empty houses?

Yes RosieLee, that’s the only course of action left. Appealing to the conscience of people that don’t have one yet hold all the power is pointless.

Nothing will change until it’s in the interest of those in control to do so.

Friends just had their rental agreement extended for another year. Happy to have one more year of certainty. Came with a rental increase of 10% no explanation take it or leave.

Unfortunately there are scum tenants you never mention these and the regulations do not take them into account. I had a tenant that smeared faeces over the toilet wall just before a open home and another turned my lawn into a hangi pit.

I sold at a lose as I could not take the worry of renting. I do not deny there are scum landlords and unfortunately one of the worst landlords in Chch is the council run homes.

So Trevor have you hammered the Council about their responsibilities as a landlord, if not why not, I know Minto has repeatedly!

Unlike Minto I do not think the council should be involved in housing as all it does is duplicate the services offered by the government and they do not do it well. . Most of those I have come across in social housing need more than cheap rent they need wrap around support and the government has the social services in their system . This is the reason we have a government to look after those that cannot look after themselves. We need more state houses built instead of promises this time.

I dont know if Labour are gutless or just plain stupid. For those in it who know better, gutless sums them up. Had it of been National, rest assured, the housing market woes would be down to pure self interest.

But it looks increasingly like key players within Labour have zero work and or life experience other than academia and politics and are just too reliant on polling, advisors and focus groups to think for them. In other words they cannot see anything for themselves such as the obvious damage NZ’s housing market is doing to society.

As James Shaw said, Labour’s attitude toward housing was infuriating and it is but I wonder if it’s because their lack of life experience means they are too mentally impaired to think about any other subject other than risk to re-election?

On housing the Greens must to be that thoroughly annoying thorn in Labour’s side to overcome Jacinda’s current catatonic state created by her risk adversion that hamstrings her government on multiple levels. Somebody needs to, for New Zealanders sake!

I wasn’t alive at the time..

From what I understand [** puts neo-liberalism in the corner**] David Lange’s Labour Government understood huge reforms needed to be made. Lange’s Labour government didn’t care about reelection, they had a guaranteed thee years in power and they WEREN’T going to waste it!

How bold they were! NZ went form (again, as I understand it) a closed economy to one of the MOST OPEN in the world.. right down to the NZD. They had gumption!

As for the ‘neo-liberalism’.. Boomers have had 30+ years to shave off the hard edges, go please let ‘s not long for Muldoon, not that anyone would.

Contrast the about to Jacinda.. as someone on interest.co.nz said, “she’s a Waffle in a Soft-Serve-Cone”. Probably the best line of 2020.

Expect Rodney Hyde and Rimmer to start screaming about the supremacy of individual property rights very soon

According to the Income Tax Act landlords who leave their properties untenanted would not be able to claim tax deductions for expenses such as rates, insurance, depreciation, maintenance, or interest.

Given the risk of having tenants at this point, trivial taxation losses are more attractive than tenants.

In anycase if you aren’t renting your property out then by defintion you aren’t a landlord.

It’s not just the tax losses: the expenses themselves, rates, insurance, interest, etc, still would have to be met from the the landlord’s own pocket. Interest, in particular, can be quite a large amount if the landlord is highly leveraged

“Which is fine if the main income source is property speculation. One of the intended consequences of low interest rates and appreciating values is it makes it easier for banks to justify lending to individuals without debt servicing capabilities. They all do it despite internal bank rules against it.”

Sounds very much like a repeat of the Yank’s sub prime mortgage scheme that preceded the 08 GFC

The renting situation in NZ is deplorable. I have seen the absolute 3rd-world hovels (no kidding) that my daughter has had to live in in Wellington [the capital city!!] during the last 8 or 9 years. There should be a government-set fair-rate system based on the property state/size/amenities but with a enforceable minimum [and respectable/decent] standard. Landlords should not be able to rent out properties that they themselves would not deign to live in. Provision of homes should be the business, not making profits as the be-all and end-all. Shame on NZ for allowing this.

I know. I live in a house with rising damp and mould. Nobody is coming and nobody cares.

The rates and insurance increases due to quake damage and quake risk will of course be passed on to tenants. Wellington is Absolutely Positive about that

And this won’t help

https://www.nzherald.co.nz/nz/engineers-withdraw-from-building-consent-work-in-wellington/FM7YTMAQBE4H6XKUXVT3F4KLEQ/

I can’t see many landlords wanting to leave their properties untenanted if it means they have to meet the ownership expenses from their own pockets. It is more likely that they will sell, which would make things easier for first home buyers.

Don’t worry, business can provide a motel room for $1000 p/w with the profits often going overseas when the landlords give up.

Not sure if tenants are better off, with the campaign to drive landlords out or the NZ economy having circular money staying within NZ with local landlords, rather than being offshore international housing profits never to be seen again in NZ as seems to be the globalist solution to housing.

Most of NZ problems are replicated in the UK, which went from Thatcherism and selling off government housing and converting it to private and social housing ownership, to globalism and allowing the UK to swell with new foreign residents who were apparently the new developers… (spoiler), has not worked out for the UK very well. NZ is mimicking the UK strategy with the same poor results.

“More than 500 high-rise developments are in progress across the city of London. For a nation in the grip of a housing crisis, this should be good news. But in reality, this will bring hardly any benefit for many of those seeking a decent home. Almost none of the new homes are reserved for people with no or low incomes and, although house prices in London are falling – particularly at the upper end of the market – construction for wealthy people and international buyers continues.

Much of this building is actually intensifying the stress on the affordable housing market, as developers grab cheap land and resources that can be converted into expensive, for-profit housing construction. Many public housing estates have been demolished, while others threatened with demolition may be replaced by expensive rented housing and units for sale at eye-watering prices.

London hosts the highest number of super-rich individuals per capita of any city globally: around 3,100 residents are ultra-high net worth individuals (UHNWIs) – those with assets, not including property, of £20m or more. And a further 6,100 UHNWIs have second homes in the city. The 2018 Sunday Times rich list suggested there were 92 billionaires in London.”

https://theconversation.com/londons-extraordinary-surplus-of-empty-luxury-apartments-revealed-97947

and you get this

“UK housing crisis: Influx of foreign cash boosted average property prices by a quarter, research finds

‘Significant’ proportion of price growth down to overseas investment – much of it through anonymous shell companies registered in secretive tax havens”

https://www.independent.co.uk/news/business/news/house-prices-increase-foreign-buyers-money-property-market-kings-college-london-a8274106.html

Note with immigration new people (or their families) are living in the houses so the capital gains taxes do nothing, it is their ‘family’ home and NZ then needs to convert our taxes away from current social problems to creating the circa 1 million more houses needed for the 1 million new families, and we then need to borrow the money for the infrastructure and social services for the 1 million incomeless or low/middle income people coming into NZ and being able to call on NZ’s social welfare.

Listen, without us landlords there would be more people living in cars. End of story.

Or, conversely, there would be more first home buyers without landlords/speculators/investors ramping up prices in bidding wars?

Comments are closed.