Evening Report looks into the separation of Kiwibank from New Zealand Post, and considers the impact on the public’s access to banking services in their communities. Kiwibank. What’s going on?

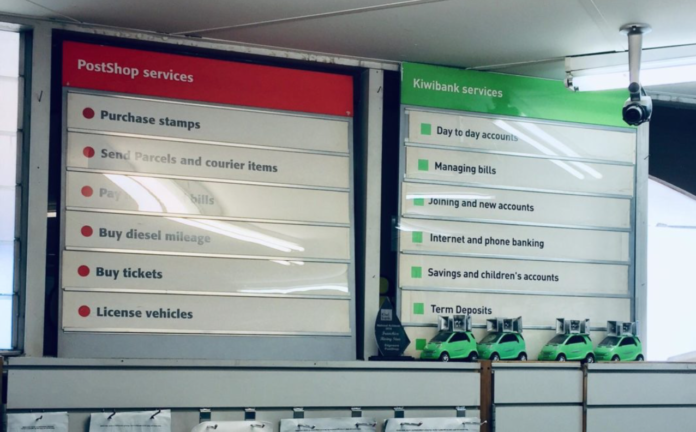

Kiwibank and New Zealand Post are in the process of separating the two businesses. This means that both Kiwibank and New Zealand Post are looking at their network models, going forward.

Kiwibank’s decision means that they are looking at having two different types of branches.

One type will be Kiwibank owned and will concentrate on purely banking services. The other type of Kiwibank outlet will be a Transactional Plus model for franchise branches.

This new model will affect the availability of services at the franchise branches which incorporate New Zealand Post.

There will be a reduction in services regarding opening and closing accounts. Foreign currency services will also be affected. Though it is understood that many franchise branches may still be able to continue providing these particular services.

Kiwibank Closures

Kiwibank launched in 2002 and by the end of that year had 211 branches situated throughout New Zealand. It was the brainchild of the late Jim Anderton, who advanced the idea that New Zealanders needed a bank of their own, a bank that operated on Kiwi values and as an alternative to dominant foreign owned and controlled banks. Kiwibank’s business model was pitched while Jim Anderton was the leader of the Alliance Party and deputy prime minister in the Labour-Alliance coalition government (1999-2002).

Kiwibank was able to open so many locations due to Kiwibank’s banking services being partnered with New Zealand Post. It was a clever move that ensured Kiwibank had a presence and branch all over the country.

But now, New Zealand Post and Kiwibank are in the process of separating out their services. This process will lead to a reduction of the number of actual physical branches.

As at October 18, 2019 there were 208 total physical points of presence for Kiwibank (number excludes ATMs).

This number is broken down into:

- 42 standalone Kiwibank branches (financial service only)

- 33 co-located shared service branches

- 115 co-located franchises

- 18 Kiwibank agents (transaction only).

In the period October 1, 2018 to September 30, 2019: 24 Kiwibank outlets that were shared with NZ Post were transitioned to standalone Kiwibank branches in the same location. Kiwibank also relocated in five areas – Tauranga, Henderson, Queenstown, Ashburton, and Porirua. Kiwibank also withdrew from 18 shared premises.

According to Kiwibank, where they have made the decision to withdraw, there are other branches in close proximity (no more than 15km away).

Kiwibank states: “We are also part of the NZBA coordinated Regional Hubs pilot and will provide shared banking services with five other banks in four regional locations including Martinborough, Opunake, Stoke and Twizel.”

In the next 12 months, Kiwibank has confirmed withdrawal dates for six locations. Also, Kiwibank is relocating in two areas, Westgate/North West and Newmarket, and opening a new Kiwibank standalone branch in Sylvia Park. Kiwibank also intends to transition five other shared Kiwibank and NZ Post shops to standalone Kiwibank branches which will stay in the same location.

Kiwibank has also confirmed it’s working through additional closure plans and communicating its intentions for further closures over the next 24 months.

Kiwibank defends its decision to close branches by pointing out that it is committed to retaining a presence in the regions and investing in standalone branches in places such as Westport, Whitianga and Tokoroa. For customers in urban areas where Kiwibank has withdrawn services other banking options are suggested.

In correspondence with Evening Report, Kiwibank states: “Branch numbers will continue to change as our separation from NZ Post plays out. For every city where we consolidate there is a regional town celebrating our investment in their community.”

It adds: “As you can see these changes are complex and the numbers constantly changing. Driving our strategy is feedback from Kiwibank customers who are telling us they want an environment better suited to more in-depth financial conversations. This means a focus on financial services and consideration to how we best meet customer demands and stay relevant for our customers in to the future.”

The Banking Environment – Physical banking services in New Zealand (as at October 2019)

Although it is the fifth largest bank in New Zealand, Kiwibank still has the largest retail footprint in New Zealand.

According to the 2018 KPMG Report on banking, Kiwibank is the only bank with more than 200 physical points of location. Australia New Zealand bank (ANZ) had 179 branches in 2018 while Westpac had 161 locations throughout New Zealand. All the major banks had a reduction in physical locations for banking according to the KPMG survey.

Kiwibank’s suggested solutions to reduced services

Senior citizens challenged by the modern internet world and the potential closure of their Kiwibank are being offered the support of a “Kiwibank Angel” and a hearty cuppa tea. This is designed to help people who remain unfamiliar with internet banking, to learn, or be assisted to complete their banking tasks.

Kiwibank also intends to tackle growing customer dissatisfaction with the withdrawal of physical banking services by partnering with Digital Inclusion Alliance Aotearoa. This is an Alliance that delivers ‘Stepping UP’ Digital Banking courses in libraries and community centres across the country. This course is open to anyone, not just Kiwibank customers.

Other ways Kiwibank intends to mitigate grumpy customers that feel ‘Jim’s bank’ is being messed with is by supporting Digital Inclusion Alliance Aotearoa’s DORA (Digital on Road Access) – a portable bus unit that travels around Aotearoa offering online banking training in retirement villages, near Marae and in other community locations.

At some Kiwibank branches there are a number of services provided such as providing identification through the Real Me service. But how many branches provide these services, and can new owner operator franchise outlets choose not to provide these and other services?

Kiwibank responds: “As at today we have 87 locations which provide RealMe identity services. Locations of the outlets offering RealMe is determined by geographic spread for the service rather than by operator choice. To date we have only included the service in eight of our standalone Kiwibank branches due to geographic coverage requirements.”

But is this good enough?

At present the banking jury is out on whether Kiwibank’s solutions will work in transitioning, and appeasing, discontented customers who want face-to-face customer service.

Kiwibank states: “Like other industries banking is being disrupted. The preferences of our customers are changing, and we must evolve to stay relevant.

“Although it is the fifth largest bank in New Zealand Kiwibank still has the largest retail footprint and we’re proud of that.

“We have committed to retaining a presence in the regions, investing in standalone branches in places such as Westport, Whitianga and Tokoroa. Where we have withdrawn services, it is in urban areas where there are other options nearby.

“We’re putting a lot of effort into education and support for our customers, especially those challenged by a changing world,” Kiwibank states.

Kiwibank’s board of directors are appointed by shareholders of Kiwi Group Holdings Limited (ACC, NZ Post and NZ Super Fund) in accordance with the Shareholders’ Agreement and requirements of the Reserve Bank. The shareholders are the New Zealand Government, currently represented by various ministers in the Labour-led Government.

EDITOR’S NOTE: Evening Report is continuing its investigation into whether Kiwibank will retain the elements of its original purpose and presence. We are seeking a response from the Government and have Official Information Act requests lodged with appropriate ministers. To be continued…

Kevin List is a respected researcher and writer who specialises in political issues. He is a former reporter and duty editor with Scoop Media, was an accredited member of the New Zealand Parliamentary Press Gallery, and also served as a parliamentary press secretary for the Green Party.

Oh Christ.

I go to ‘Real Me’ services and my brain crashed.

” Kiwibank states: “Like other industries banking is being disrupted. The preferences of our customers are changing, and we must evolve to stay relevant.”

Balls. . When I go into Kiwi Bank these days I feel guilty if I’ve not bleached my anus first.

The reason why Kiwi Bank’s customers preferences are changing is the hideous decor. All that insipid Green and White.

‘Tradition’s what’s needed. An epidemic of sameness. ‘Tradition’ is like ‘Class’. Those who have [it] simply have it. Those who don’t have it would do anything to get it and it’s then that they realise that money can buy anything except Class born of tradition dahlings.

Kiwi Bank’s being picked off and slaughtered by the big four banksters and I’d bet my left ball, the one that seems to need the most scratching, that jonky and his zionist mates are not wriggling around in their respective foreign-zombie-bank, walking-dead carcasses.

“Other ways Kiwibank intends to mitigate grumpy customers that feel ‘Jim’s bank’ is being messed with is …”

” Grumpy customers” ?

Fuck yes!

“Jims bank being messed with”

It fucking is!?

What are you writing!? That’s pure, logical fallacy, psyche 101 gibberish and you know it.

“being messed with” !? “Being MESSED with….? WTF?

“Kiwibank Angel” and a hearty cuppa tea.”

Oh dear God.

Where does this literal scrout come from? From some U$A university would be my bet.

Fuck the angle and fuck the cuppa. I want a line of coke and a big huff of opium when I’m older and more crispy.

If someone said ” See that old coot over there? He just died laughing with a stiffy” That, is what I want people to say about me. NOT ” Aw. Poor old dear. Saw a fluffy angle then chocked on a Crispy. ”

Our Kiwi Bank is OURS thanks to Jim Anderton and fuck knows why Kiwi Bank hasn’t given him a posthumous Person of the Year award. He was an awesome fellow and an actual human being and it’s those qualities that Kiwi Bank is synonymous with. We’re human beings. And that’s why Kiwi Bank’s the fifth largest bank in Nu Zillind despite having to compete with the Big Four predatory monster banksters our all bought and paid for politicians were happy to watch on while they were let loose on us.

The Big Four scum banksters should be asset stripped, and those assets redistributed to us then shut down and kicked out. Then Kiwi bank would flourish and so would the collective ‘we’.

So they consider “close proximity” to be no more than 15km away. Sick joke.

If the Natzskis get back into power, Kiwibank will be sold by lunchtime.

Certainly sounds like the first steps to a sale

Comments are closed.