GUEST BLOG: Bryan Bruce – Corporate Welfare

The central idea of free market capitalism is that governments should not interfere in the marketplace – that businesses should succeed or fail on their own merits .

But what actually happens with big companies and financial institutions is that in good times shareholders gleefully pocket the profits, while in bad times governments bail them out using tax payer money.

Put another way -company profits are privatised while their debts are socialised in what amounts to Corporate Welfare and to which they feel entitled without any sense of loyalty to the nation that helps them out.

The case of General Motors is the most recent example

In 2007 General Motors lost a record $38.7 Billion.

In 2008 The US Federal Government gave the car manufacturer a $13.4 Billion bailout and in 2009 gave them another $6 Billion

As a result things picked up. In 2010 GM recorded a profit of $4.7 Billion and last October the company reported a third-quarter earnings an operating profit of $2.5 billion and 10.2% profit margins in North America,

However just the other day the company announced it will lay of 14,000 employees and close 5 plants and after the announcement GM’s stocks rose 5%

A New Zealand example of such Corporate Welfare happened in 2010 when the Key- led National Government bailed out the investors in South Canterbury Finance to the tune of $1.6 Billion.

However Corporate Welfare happens not only at moments of crisis – it happens everyday in our country.

The tax rate for companies is 28% but many individual Kiwis pay 33% on their earnings.

Why the difference?

The argument is that companies create jobs and need to be encouraged to stay in our country otherwise big companies will move off shore to jurisdictions where their taxes will be lower.

But this is actually a version of trickle down theory.

We all know that workers do not share in the increased profits of a company. The more money a company makes the richer its share-holders become.

And we all know that if large companies can find ways of increasing their profits by cutting the workforce they will have no hesitation in doing so.

So if the intention of a company is to exploit the resources and people of a country rather than fairly contribute to the well -being of our nation then I’d say “Go if you wish. On these terms we’d be better off without you”.

The interim current Tax Working Group reports that it has modelled what would happen if we lowered the Company Tax rate even further.

Their answer? Very little. It wouldn’t bring in a lot of direct foreign investment.

I find it interesting however that the group doesn’t seem to have investigated what would happen if we put Company Tax up to say 30% as it is in Australia or if we made it equivalent to our highest personal tax rate of 33%.

There just seems to be an unspoken assumption that raising the Corporate Tax rate would be a bad thing-or in other words .. that the trickle down theory is still alive and well in minds of those charged with looking into our tax system.

Low tax rates for Companies is a form of Corporate Welfare. It’s a subsidy.

It’s one of the reasons why, for example, there is less money to pay teachers.

It’s a device by which the rich are able to get even richer…and frankly I don’t see any evidence that our current neoliberal minded government is thinking of changing that situation anytime soon.

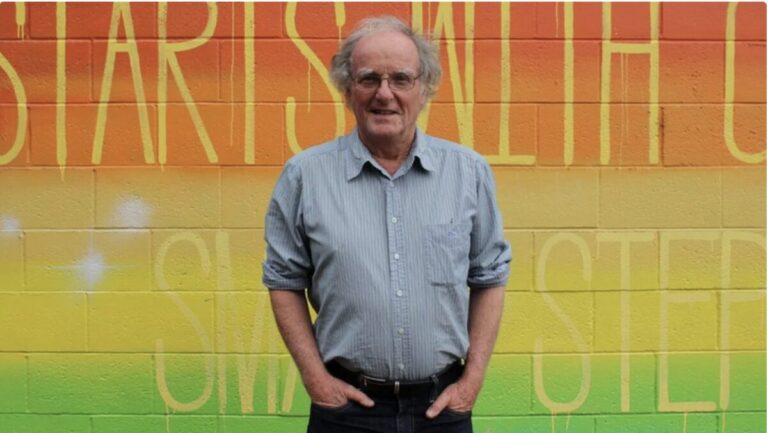

Bryan Bruce is one of NZs most respected documentary makers and public intellectuals who has tirelessly exposed NZs neoliberal economic settings as the main cause for social issues.

Funny how everybody wants to complain but then votes for the most useless and/or corrupt candidates and parties at both the local-body and national levels.

south Canterbury finance billion dollar payout , famers= m bovis more millions so much of us being a fair country be buggered

The rich get richer and they dont care about health and education because their little darlings will be going private and perpetuating the whole cycle of privilege