.

.

Introduction

.

The following is the amount spent by Labour, on Vote Education in the 2008 Budget;

Total 2008 Vote Education: $10,775,482,000 (in 2008 dollars)

Total students in 2009: 751,330*

spend per student: $14,341.88

The following is the amount spent by National, on Vote Education in the 2016 Budget;

Total 2016 Vote Education: $11,044,598,000 (in 2016 dollars)

Total students in 2016: 776,948**

spend per student in 2016 dollars: $14,215.36

Total 2016 Vote Education: $9,608,800,000 (re-calculated in 2008 dollars)

spend per student in 2008 dollars: $12,367.37

Calculated in real terms (2008 dollars), National’s spending on Vote Education was $1,166,682,000 less last year than Labour budgetted in 2008.

In dollar terms, in 2016, National spent less per student ($14,215.36) than Labour did in 2008 ($14,341.88). Converting National’s $14,215.36 from 2016 dollars to 2008 dollars, and the sum spent per student is even less: 12,367.37.

In real terms, National has cut the total*** education budget by $1,974.51 per student.

* Not including 9,529 international fee-paying students

** Not including 11,012 international fee-paying students

*** Total spent on Vote Education, not just schools and tertiary education.

.

Tax-cuts and Service-cuts

.

Writing in the Daily Blog recently, political commentator Chris Trotter had this to say on the matter of taxation and social services;

“Speaking on behalf of the NewLabour Party, I felt obliged to spell out the realities of tertiary education funding. I told them that they could have free education or low taxes – but they could not have both. If the wealthy refused to pay higher taxes, then students would have to pay higher fees. If the middle class (i.e. their family) was serious about keeping young people (i.e. themselves) out of debt, then they would have to vote for a party that was willing to restore a genuinely progressive taxation system.”

Since 1986, there have been no less than seven tax-cuts;

1 October 1986 – Labour

1 October 1988 – Labour

1 July 1996 – National

1 July 1998 – National

1 October 2008 – Labour

1 April 2009 – National

1 October 2010 – National

The 2010 tax-cuts alone were estimated to cost the State $2 billion in lost revenue.

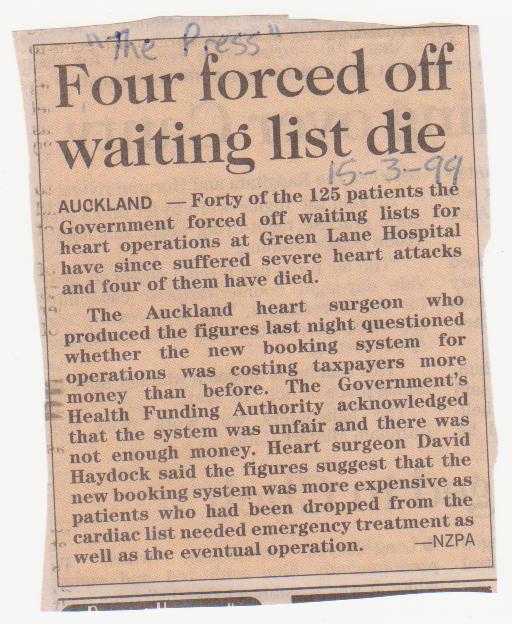

Taxes were raised in 2000 by the incoming Labour government, to inject much needed funding for a cash-strapped health sector. The previous National government, led by Bolger and later Shipley, had gutted the public health service. Hospital waiting lists grew. People waited for months, if not years, for life-saving operations. Some died – still waiting.

.

.

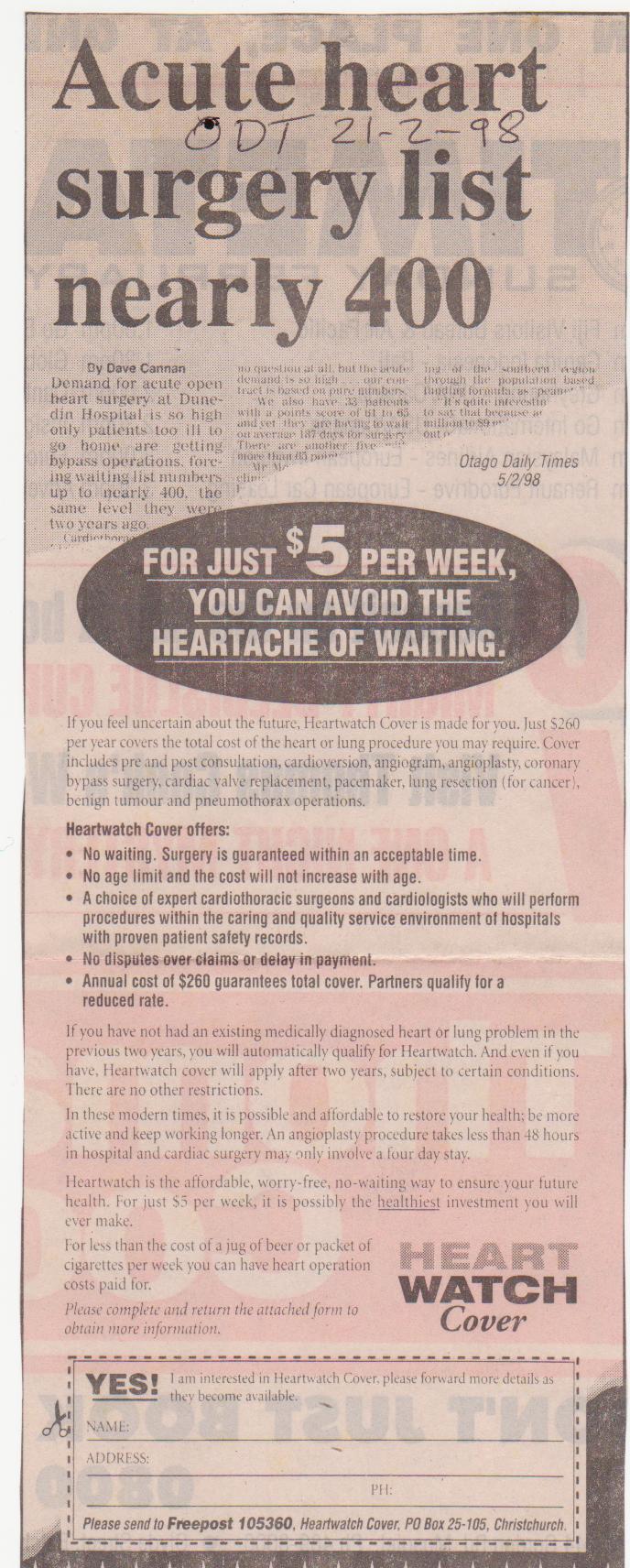

During that time, National cut taxes twice (see above). Funding for public healthcare suffered and predictably, private health insurance capitalised on peoples’ fears;

.

.

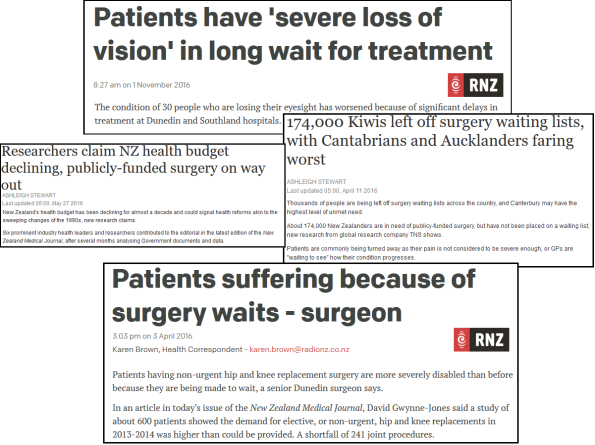

A decade late, National’s ongoing cuts, or under-funding, of state services such as the Health budget have resulted in wholly predictable – and preventable – negative outcomes;

.

.

A critic of National’s under-funding of the health system, Phil Bagshaw, pointed out the covert agenda behind the cuts;

New Zealand’s health budget has been declining for almost a decade and could signal health reforms akin to the sweeping changes of the 1990s, new research claims.

[…]

The accumulated “very conservative” shortfall over the five years to 2014-15 was estimated at $800 million, but could be double that, Canterbury Charity Hospital founder and editorial co-author Phil Bagshaw said.

Bagshaw believed the Government was moving away from publicly-funded healthcare, and beginning to favour a model that meant everyone had to pay for their own.

“It’s very dangerous. If this continues we will slide into an American-style healthcare system.”

Funding cuts to the Health sector have been matched with increases to charges;

.

.

… cuts to NGOs offering support services;

.

.

… and leaving district health boards in dire financial straits;

.

.

The critical correlation between tax cuts and consequential reduction of state services was nowhere better highlighted then by US satirist and commentator, Seth Meyer. He was unyielding with his scathing, mocking, examination of the travesty of the Kansas Example of “minimalist government”;

.

.

Here in New Zealand, National’s funding cuts have not been restricted to the Health sector and NGOs. Government agencies from the Police , Radio NZ, to the Department of Conservation have had their funding slashed (or frozen – a cut after inflation is factored in).

The exception has been the Prime Minister’s department which, since 2008, has enjoyed a massive increase of $24,476,000 since 2008 and a near-doubling of John Key’s department and Cabinet expenditure since Michael Cullen’s last budget, seven years previously.

.

Tax cuts, slashed services, and increasing user-pays

.

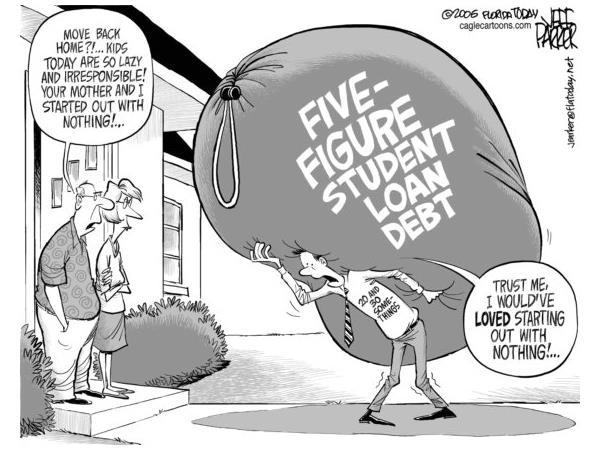

By contrast, parents are finding more and more that the notion of a free state education is quietly and gradually slipping away. User-pays has crept into the schools and universities – with harsh penalties for those who fail to pay.

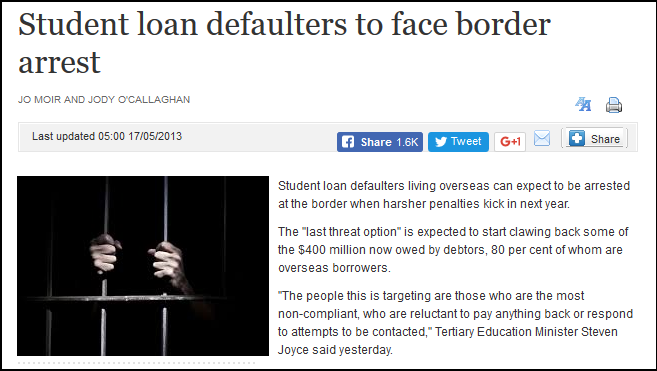

In May 2013, National’s Tertiary Education Minister, Steven Joyce, announced;

.

.

True to his word, in January 2016, the first person was arrested for allegedly “defaulting on his student loan”. By November the same year, a third person had been arrested. Joyce was unrepentant;

“There probably will be more, we don’t know of course how many are in Australia but that’s a very good start, and I think it’s probably a reasonable proportion of those who are in Australia.”

Joyce, of course, has nothing to fear from being arrested for defaulting on a student loan. His tertiary education was near-free, paid for by the tax-payer.

.

.

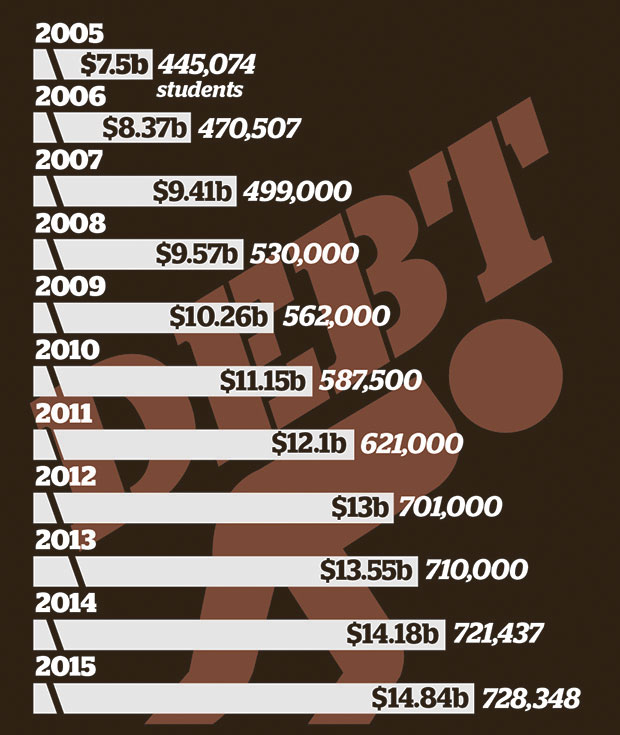

National had no choice, of course. The entire premise of user-pays was predicated on citizens paying services that until the late ’80s/early ’90s, had been either free or near-free. With student debt now at an astronomical $14.84 billion, National cannot afford to let ‘debtors’ get off scott-free. That would send the entire unjust system crashing to the ground. According to Inland Revenue;

… nearly 80,000 of the 111,000 New Zealanders living overseas were behind on their student loan repayments.

IRD collections manager Stuart Duff said about 22 percent of borrowers living overseas were in Australia.

He said the $840m owed to New Zealand was a substantial amount of debt.

Figures show that student debt has been increasing every year since it’s inception in 1992. At this rate, student debt will achieve Greece-like proportions;

.

.

Unsurprisingly, loan ‘defaulters’ have surpassed $1 billion, including $16 million written off through bankruptcy. Some never pay off their “debt” with $19 million lost after death of the borrower.

But it is not only tertiary education that has attracted a user-pay factor. School funding has also been frozen, with operational grants the most recent to suffer National’s budgetary cuts;

.

.

Education, Inc.

.

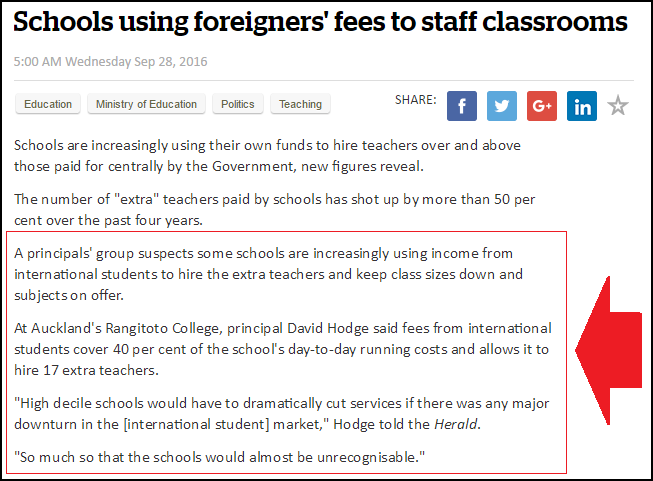

Schools are so starved of funds that they are having to rely on outside sources of income to make up shortfalls;

.

.

Reliance on foreign students to make up shortfalls in government spending is essentially turning our schools into commercial ventures; touting for “business” and ensuring “clients” achieve good results so as to ensure repeat custom.

When did we vote for a policy which effectively commercialised our education system?

Schools are also funded more and more by parents – to the tune of hundreds of millions of dollars. Fund-raising and ever-increasing school fees are required, lest our schools become financially too cash-strapped to function.

In 2014, school “donations” (actually fees by another name) and necessary fundraising reached $357 million and is estimated to reach a staggering $1 billion by this year;

.

.

It is estimated that a child born this year will cost his/her parents $38,362 for thirteen years of a “free” state education. In 2007, that cost was 33,274. Our supposedly “free” state education is being gradually whittled away, and replaced with surreptitious user-pays. According to Radio NZ;

Some school principals say many schools are considering a hike in parent donations next year and cutting teacher aide hours, as they respond to a freeze on core school funding.

More than 300 school principals responded to a survey by teacher unions.

About 40 percent of school principals said they were considering cutting back on the hours of teacher aides and other support staff next year.

Thirteen percent said they were looking to increase parent donations.

The president of the teacher union NZEI, Louise Green, said the survey showed it was students who miss out when school funding was frozen.

The neo-liberal princiciple of user-pays is being covertly implemented throughout the public sector and nowhere is this more apparent than in education. Parents and guardians are expected to pay more for education and this is “off-set” by cuts to taxes. This is core to the concept of user-pays.

.

User-pays is hard to pay

.

The problem is that this is not an overt policy by National. The public have not been given a clear choice in the matter and instead increasing user-pays has crept in, barely noticed by the voting public. Even when challenged, a National Minister will use mis-information to attempt to use Trump-like “alternative facts” to hide what is happening;

But Education Minister Hekia Parata said parents contributed just $1.80 for every $100 spent by the taxpayer on education.

The Government was set to invest $10.8 billion in early childhood, primary and secondary education, more than the combined budget for police, defence, roads and foreign affairs.

New Zealanders have been lulled into a false sense of security that, even after seven tax cuts, we still have “free” education. But as Chris Trotter pointed out with cool logic;

I told them that they could have free education or low taxes – but they could not have both.

The question is, what kind of society do New Zealanders want: a free education system or tax cuts and more user-pays?

Because we can’t have both.

At the moment, politicians are making this choice for us.

.

Postscript

.

From a Dominion Post article on 24 January;

Student loans are getting bigger and graduates are taking longer to pay back the money they owe.

Figures from last year’s Student Loan Scheme Annual Report show the median loan balance in this country grew from $10,833 in 2008 to $14,904 in 2016.

The median repayment time for someone with a bachelor’s degree also lifted from just over six years, to eight and a half.

Since a peak in 2005, the numbers of people taking up tertiary education have declined.

[…]

Labour education spokesman Chris Hipkins said there was a variety of factors that lead to higher student loans and longer repayment times. Tuition fees continued to rise, as did living costs.

“The long term impact for people is quite significant, basically they have a large debt for longer,” Hipkins said.

“If they’re weighed down with student loan debt it will be difficult to get on the property ladder, it’s already a burden, and this is making it even harder for the next generation.”

Universities New Zealand executive director Chris Whelan said that when it came to universities fees increasing, one need only look at published annual accounts of the country’s eight universities to see they were not “raking in” a lot of money.

Currently two-thirds of the cost of tuition was covered by subsidies, and one-third was covered by the student.

LOANS ON THE RISE

Median loan balances

2010 – $11,399

2012 – $12,849

2014 – $13,882

2016 – $14,904

Median repayment times for a bachelors/graduate certificates or diplomas

2010 – 6.9 years

2012 – 7.8 years

2014 – 8.5 years

.

.

.

.

References

Reserve Bank NZ: Inflation calculator

Treasury: Vote Education 2008

Treasury: Vote Education 2016

Educationcounts: School Rolls – Student Rolls by School 2005-2009

Educationcounts: School Rolls – Student Rolls by School 2010-2016

The Daily Blog: Don’t Riot For A Better Society: Vote For One!

Infonews: Government’s 2010 tax cuts costing $2 billion and counting

The Press: Four forced off waiting list die

Otago Daily Times: Heartwatch Insurance Cover

Radio NZ: Patients have ‘severe loss of vision’ in long wait for treatment

Fairfax media: Researchers claim NZ health budget declining, publicly-funded surgery on way out

Radio NZ: Patients suffering because of surgery waits – surgeon

Fairfax media: Prescription price rise hits vulnerable

TVNZ News: Kiwi charities and NGOs face closure with impending funding cuts

NBR: Leaked document shows 10 District Health Boards face budget cuts – King

Fairfax media: Police shut 30 stations in effort to combat budget cuts

Youtube: Kansas Tax Cuts – A Closer Look

Scoop media: Budget cuts continue National’s miserly underfunding of DOC

Fairfax media: Student loan defaulters to face border arrest

NBR: Arrested student loan defaulter claims to be Cook Island PM’s relative

Fairfax media: Third arrest of student loan defaulter made following government crackdown

Radio NZ: Govt tightens education purse strings

NZ Herald: ‘At risk’ school funding revealed – with 1300 to lose out under new model

Fairfax media: Student loan borrowers seeking bankruptcy as millions in debts wiped due to insolvency

NZ Herald: Schools using foreigners’ fees to staff classrooms

NZ Herald: Parents fundraise $357m for ‘free’ schooling

NZ Herald: Parents paid $161m for children’s ‘free education

NZ Herald: School costs: $40,000 for ‘free’ state education

Radio NZ: Schools consider parent donation hike

Dominion Post: Student loans are getting bigger and harder to pay off, new figures show

Additional

Motherjones: Trickle-Down Economics Has Ruined the Kansas Economy

The New Yorker: Covert Operations

CBS News: Kansas loses patience with Gov. Brownback’s tax cuts

Kansas City Star: Gov. Sam Brownback cuts higher education as Kansas tax receipts fall $53 million short

Bloomberg: Kansas Tried Tax Cuts. Its Neighbor Didn’t. Guess Which Worked

Fairfax media: Tourism industry claims DOC will be severely handicapped by funding cuts

Previous related blogposts

The slow starvation of Radio NZ – the final nail in the coffin of the Fourth Estate?

12 June – Issues of Interest – User pays healthcare?

The Mendacities of Mr Key # 16: No one deserves a free tertiary education (except my mates and me)

The Mendacities of Mr Key # 19: Tax Cuts Galore! Money Scramble!

Steven Joyce – Hypocrite of the Week

.

.

.

.

.

= fs =

‘You can fool all the people some of the time, and some of the people all the time, but you cannot fool all the people all the time.’ -Abraham Lincoln

However, in present-day NZ you can fool most of the people most of the time.

(Several decades of dumbing-down has been extremely successful.)

American health care (should read as insurance care) has the worst outcomes in the world and we all know it. How can we want anything like that?

This is how the Americans see their own healthcare, Sam;

“Lacking a national health care system of their own, thousands of Americans are tapping into Canada’s — illegally.

” http://www.nytimes.com/1993/12/20/world/americans-filching-free-health-care-in-canada.html?pagewanted=all

And bound to get worse as Trump dismantles Obama’s Affordable Care Act, stripping millions of Americans of health insurance!

Louis Theroux did a doco comparing US/Canadian/Cuban health system and concluded it was cheaper to fly to Cuba and receive health care, for free right down to Persciption and diognoisis. That’s embarrassing. He shouted a whole bunch of cancer patients to Cuba and filmed there experiences. Shocking! Best expose on this subject ever

http://www.bbc.com/news/health-35073966

Because it is extraordinarily profitable. The profits posted by pharmaceutical, medical and health insurance companies in the US are enormous. In the case of the pharmaceutical industry they are protected from basic market forces by laws that forbid government and state authorities setting or even bargaining for lower drug prices.

Just as recently as two weeks ago Bernie Sanders put forward a bill in the Senate to allow US citizens to buy Canadian medicines (currently this is against the law in the US) which are significantly cheaper than their US counterparts. The bill was supported by 13 Republicans but failed to pass because it was opposed by 12 Democrats. Oh yes. Even after having their corporate backsides spanked by Trump the corporate Democrats are still feasting at the trough.

So, no wonder it has felt as if education has been underfunded. IT HAS!!

Well researched, Frank.

If this isn’t enough to spook the Middle Classes, I don’t know what is!

“* Not including 9,529 international fee-paying students”

Many of whom are getting ripped off blind, then told to fuck off so the next lot can be cycled through.

https://www.workerexploitation.co.nz A useful read – a component of it deals with international students.

And the clever thing by the Natzis is that they can ride on the old “bloody foreigners coming here taking all our jobs” routine.

And of course because the author has hitched her wagon to a worthwhile cause and institution, it’ll allow the Natz to play the person, and blame the under-resourced public service rather than deal with the facts. You’ll notice too (if you’re not averse to TL:DR), that the sources now go back several years – I.E SFA has changed

Bankruptcy no longer applies to student loan debts, a pity as mine is nearing six figures… How on earth am I expected to pay that while supporting a family and trying to buy a house? Contrary to National’s statements I actually don’t enjoyer a higher- than- average salary as a result of my education. If I go overseas and try and pay it back earning a better than average income then interest kicks in!

Well, this explains why our school “donations” and other costs have gone up the last ten years. Even with low inflation, costs kept rising and we couldn’t figure out why.

Now we know why and that WHY is the Nats screwing down the education budget to pay for tax cuts.

talk about robbing Peter to pay Paul!!

So you have to ask where the Natz are putting the money that used to be put into the education budget? They must be putting all this under funded money somewhere?

That’s how National operates – it offers tax cuts to the rich whilst simultaneously running down government services, particularly health.

The worst thing about it is that hardly anyone notices, and when they do it is all blamed on the health sector unions for “wanting a weekend off” as the Wairarapa DHB described the latest industrial action.

Our hospitals are so short of money to run basic services they have to resort to leasing their car parks out to brownshirts like Wilson Parking.

You won’t see any mention of that in our MSM outlets, will you?

No wonder the elite is in party mode. They pay pretty much no tax. Having the time of there lives at our expense. Watch if there is a threat of a new govt increasing taxes they will scream. They have had it good for too long…

Few of my comments make the cut … ah well. That’s too bad ’cause we’re not the top of the food chain. Things are about to change for the better and it wont be a prison planet for much longer.

I hope your right Helena cause this government is so low and rotten they might start exporting our prisoners next

Don’t give them ideas…

Spot on – this is – as the author pointed out – what Chris Trotter pointed out in a recent article. We need the NZ Labour Party to be shouting this from the rooftops and reminding people why we need more progressive taxation desperately. Something tells me the current parliamentary Labour Party members won’t want to upset their dinner party mates and wealthy neighbors.

“Something tells me the current parliamentary Labour Party members won’t want to upset their dinner party mates and wealthy neighbors.”

Something tells me you might be right, Peter.

I hope the middle classes enjoy their tax cut bribes. They’ll be spending it on increasingly privatised education and healthcare.

That’s the thing with user-pays, if you can’t pay, you can’t use it.

Excellent report, Frank.

“In Judaism and Christianity, the concept of the Jubilee is a special year of remission of sins and universal pardon. In the Book of Leviticus, a Jubilee year (Hebrew: יובל yūḇāl) is mentioned to occur every fiftieth year, during which slaves and prisoners would be freed, debts would be forgiven and the mercies of God would be particularly manifest.

In Western Christianity, the tradition dates to 1300, when Pope Boniface VIII convoked a holy year, following which ordinary jubilees have generally been celebrated every 25 or 50 years, with extraordinary jubilees in addition depending on need.”

Let’s declare a need and have an extraordinary jubilee and expunge student debt from the lexicon and the education process.

The money borrowed is already in circulation. No pixels were harmed by its creation.

Let’s toss the whole lot. Those who borrowed are mostly doomed to be held by the mortgage until nearly dead anyway.

[…] blogpost was first published on The Daily Blog on 26 January […]

Comments are closed.