Newsroom makes the point…

Growing labour market cracks to dominate next year’s election

Kiwibank chief economist Jarrod Kerr highlights the fact that some businesses he has spoken to recently – already burnt from the misfire that occurred at the start of the year when initial growth quickly petered out in the wake of the tariff scare – are not convinced about the integrity of their own order books.

“Many of them would rather run lower inventories and miss out on potential business than run the risk of being overstocked, which highlights the lack of confidence that is evident and also explains why many employers are simply not hiring.”

… The decisions made by this Government to destroy the Infrastructure Pipeline that Labour built has had a cascade effect across the NZ economy that has seen 73 000 flee and 30 000 jobs destroyed in the construction industry.

National’s response to this is mass importation of cheaper labour from exploited migrant workers while allowing multi millionaires to buy $5million mansions.

NZ is 3 huge sparsely populated Islands.

We simply don’t have the population density for free market dynamics to generate the competitive advantages that they can provide, NZ has ALWAYS required the State to step in as the foundation stone.

National and ACT want to kick that foundation stone out from under us and pretend that’s not economic vandalism.

Unemployment reached a 9-year high of 5.3 percent, it’s 10.5% for Māori, 12.1% for Pacifica and 15.2% for 15-24year olds while an increasing number of disillusioned job seekers are opting out of joining the workforce altogether.

The reality is that it is likely to get far worse…

Is another GFC about to upend New Zealand’s recovery? – Liam Dann

- Speculation about a Wall Street tech bubble is rising, with concerns over overvalued stocks.

- Michael Burry is short-selling big tech stocks, drawing parallels to the late 1990s tech bubble.

- A major crash could dent consumer confidence and impact exports, but New Zealand’s banks are well-capitalised.

…if the AI bubble pops, if Trump invades Venezuela, if India and Pakistan destabilise, if climate change extremes become even more extreme, the list if instabilities that can all snuff out any ‘green shoots’ of recovery are becoming a doom scroll.

All this Government now have is flogging off assets, when we need a completely different upgrade and urgent redistribution of capital with a post growth focus on adaptation and self sustainability.

Bernard Hickey makes the point...

- In my view, Luxon and the Treasury are right to view the Government’s balance sheet as lazy, but for debt, not assets. New Zealand’s Government has a positive net worth after including assets and the NZ Super Fund of 43.6% of GDP, largely because the Government hasn’t used debt to invest to keep up with population growth and maintain existing infrastructure.

- The Government and Aotearoa would get a much better ‘return on equity’ by using leverage to build up its assets and the wellbeing of its people.

Shit ’bout to get real.

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

Your opinion is right on the button.Every Street in Chch has a new home going up and mall car parks are full. Newspaper headline Construction bounces back and as I travel through the small towns in the South they feel busy again.

By election time the Coalition will be a in line for another 3 years

Dream on…

The only reason “every street in Christchurch is having a new house built”…which is a gross exaggeration… is because …

A) Rebuilds are still occurring after the earthquake and B) the billiard table flat geography of most of Christchurch allows for the cheapest fastest house construction in the country… absolute minimal excavation required ….no retaining walls …easy access.

This means Christchurch houses are way more affordable….hence people shifting there.

This has nothing to do with anything the Coalition of Chaos has done..

.

The construction industry has not “bounced back” in Auckland or Wellington…in fact they are construction ghost towns… aside from the odd Chinese knockdowns going on in Auckland.

It’s a salutary lesson ..if you make life affordable and doable people will come …if you don’t.. they go elsewhere …like Australia…which is where most of the young, and even not so young, are now heading… sustainably affordable and doable

Bullshit Trevor. Go to Nelson and surrounds and you will get the real picture.

In mid North Island beef farmers are in a Quandary, selling cattle for $3000 to the processors but can’t afford to replace them. Also they know the bubble will burst within a year so they will be selling at a loss.

Go and look at the dairy auctions for the last few months. Dropped by about 20%. Dairy farmers aren’t spending because they know the drop is coming. They will spend their payment for selling the silver to the French on paying down debt and shoring up balance sheets to fight the coming crash.

This time next year no political party will want to win the election.

The country is fucked, evidenced by the amount of kiwis leaving for Australia. No sugar coating the massive failure by this CoC by Trevor, Frank, Bob or any right wing dribblers will underscore the carnage that has occurred under this government.

“Rural NZ is economically booming as is Christchurch.” You sound like Trump, you are factually incorrect.

Tourism has gone backwards and Brown’s Auckland’s bed tax will stop foreigners from coming and the only place wealthy tourists visit is the hell hole expensive Queenstown and the profits don’t filter out of that place, they stay there.

By election time next year the Greens and Labour will have a majority as shown by the latest polling with the Greens and Labour on the rise.

Uncle Tom, Frank and Trevor’s comments are one’s of hope and rhetoric. Even in this column where the evidence is presented in black and white they find “Trump” untruths which give us all a bit of a laugh in gloomy economic times.

You and Frank are full of shit as usual Trevor, here’s just another example…

https://www.stuff.co.nz/nz-news/360884898/ice-cream-factory-moving-away-region-already-punch-drunk-bad-news

https://www.stuff.co.nz/nz-news/360885147/people-voting-their-feet-labour-seizes-exodus-72000-kiwis-nz

My god Willis is ugly on the inside as well as the outside.

Christchurch is but one city in NZ Trevor we need Auckland’s unemployment rate to come down, and they need to home the homeless not sweep them under the carpet. They also need to invest in Wellington. If congestions charges are rushed like everything else this will unfairly impact on part time and low paid workers with public transport not being the bests otherwise only the rich will be able to drive our roads.

The farming boom is driving price inflation for local consumers of read meat and dairy. The humble beef rump steak sits around $30/kg. Great for exporters, not so good for kiwis getting sick of mince, or the school lunch programme that now has to bulk out lunches with offal.

Let’s hope tourism growth isn’t going to rely on imported labour to support it. A surge in rent prices and an associated lack of availability are probably not vote winners.

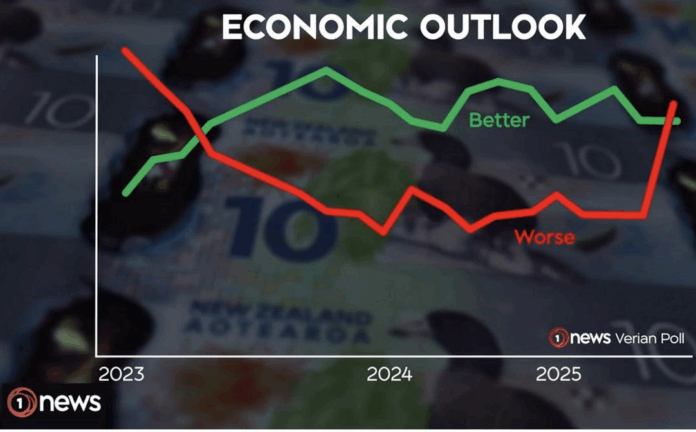

While there is the potential for headline economic indicators to improve, people need to feel that their personal situation is improving too. The government needs to address the real pessimism that New Zealanders are feeling.

“While there is the potential for headline economic indicators to improve”

To be fair that shouldn’t be hard given the shit hole economic situation this CoC has put us in.

Booming on the back of cowshit and over-crowded shit – woohoo – quality of life. The former can turn to shit overnight and the latter turn the backyard into a shithole.

Way to go mwnn – more concise summaries like yours and the lead-lined mind of the fatheful may get dented at least. Though I doubt that. But we others need to keep thinking rationally and with foresight as well as hindsight ie watch our backs! (Ref. BBC news and disturbance.)

I live in a rural area and dont see the boom you are dreaming about .There are much lower numbers of stock in the farms for a start .I dont see any new tractors going past the gate even though the government is allowing tax rebates of 20% .

And because the rebuild is still happening in Christchurch it is a no brainer that new houses will still be being built .My son is in the roofing trade and his company were doing 180 roofs a monthe before the election now they are lucky if they do 3 a month now .

Yes building in Christchurch is well below the peak of a few years ago, my mate in the freight business tells me that freight is well down as well so Frank and Trevor are away with the fairies, they have probably read the national party propaganda that arrived in the mail, something about back on track on the cover. It burns well is my only learning from it as I didn’t have the stomach to actually read it.

The youth unemployment is the one that will sink this government – they went with no future for the Gen Z except low wages and more disrepair. They may win the next election, but by the end of it – they will have wiped away a whole generations future of a decent life here in NZ.

Many people look at their own small corner of the country and think that is representative of everywhere.

Chch is a blip on the economic horizon and if it’s thriving, then other places must be in worse straits than average.

If the unemployed are not in CHch, they must be somewhere else.

Taking things at face-value is seldom a good way to assess the situation.

Critical thinking!

All down hill at the moment .Dairy is starting on its downward slide so no more big bucks there soon .How long do you expect NZ to survive on milk and meat .Now that manufacturing is in its death throws what else do we have to sell ?bugger all .We used to make most of what we needed here but now we have become a net importer including meat .Once the EU and UK realise we are polluting hard out and intending to ramp up pollution sales there will plunge .We need to invest in making real stuff not electronic transactions .We have a whole generation under 25 who are unemployed under employed or have left the country which is a disaster for the whole country .No doubt plans are under way to import more people so we can throw more onto the unemployed heap .There is no future when 600000 are under employed working onlt 75% of the hours they need to make a living .

.

On point GW.

Comments are closed.