SHOTS FIRED!

SHOTS FUCKING FIRED!

CGT debate turns personal as Hipkins says Luxon earned more from property than being PM

Hipkins was also asked about National Party adverts highlighting beach houses would be included in the capital gains tax, and turned the focus onto what he called Luxon’s “tax-free” property flips.

“If Christopher Luxon wants to debate personal finances, bring it on,” Hipkins said. “He sold four houses last year and made more money tax freefrom doing that than he earned as prime minister.

“Why should he be able to make more than $600,000 in one year from flipping properties whilst the people who go out and work hard every day for a living pay tax on every single dollar that they earn.”

BOOM! SHIT JUST GOT REAL!

And there you go, the PM made $600k flipping houses and got away with paying any tax.

Get off your knees to the speculators Kiwi!

Why should a rich prick like Luxon make that kind of money when a targeted Capital Gains Tax aimed at the mega wealthy which will give us all 3 free drs visits plus pump more money into public health is a solution to the naked greed of Chris Luxon!

Labour’s targeted Capital Gains Tax is actually brilliant politics.

There is a lot of grumbling from the Left over Labour’s Targeted Capital Gains Tax with many saying it doesn’t go far enough.

Sure, but you are missing the true genius of what Labour just announced.

I’m not look to Chippy for the Marxist Utopia.

That ain’t him.

He is a decent bloke with true values who sure as Christ wouldn’t have given hundreds of millions to the Big Tobacco, Social Media Giants or Oil and Gas pimps.

The job of Labour is to win back the voters who voted Labour in 2020 and then voted National in 2023.

The soft middle is who the Future Fund appeals to and who this targeted Capital Gains won’t spook and will ultimately appeal to.

The 3 free GP visits per year is also an enormous win for working people who can’t afford to see Drs.

There is no point in Labour announcing a vast wealth tax to cannibalise vote from the Greens, that don’t get us to 51%!

Labour’s targeted Capital Gains allows the Greens and te Pati Māori to push the Overton Window left and it will be up to them to negotiate a better deal post election.

The screams by the right over Labour’s targeted Capital Gains Tax shows they are really frightened – good!

They know they are in trouble and that Kiwis who aren’t toxically polarised into voting ACT or NZF see the genuine worth in Labour policy and it is scaring the shit out of the Right!

Scream louder Right Wing Trolls, your tears are delicious!

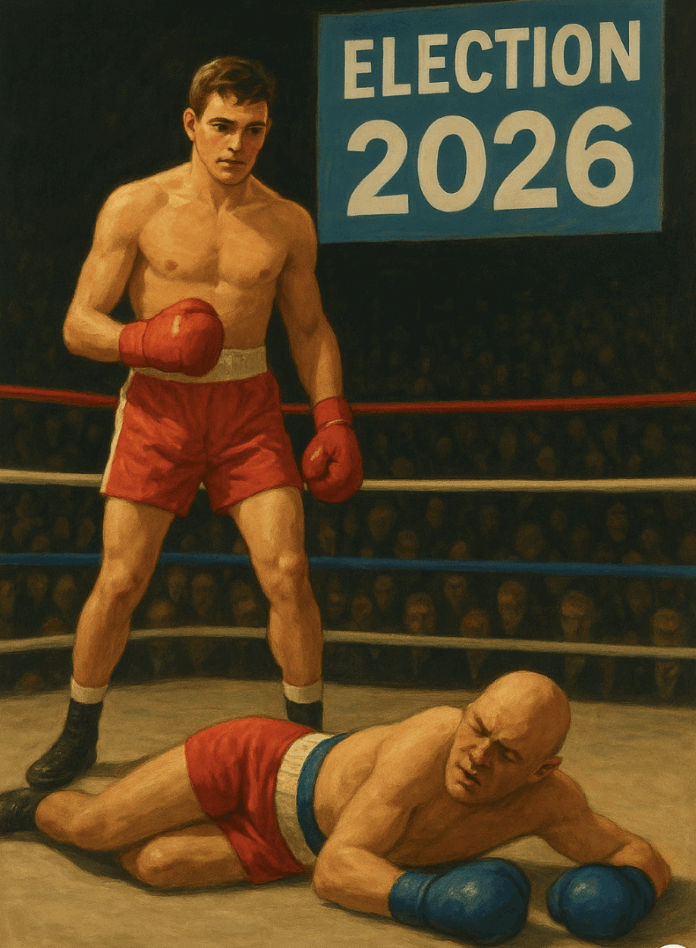

Chippy is going to take the fight all the way to Luxon’s glass jaw.

Luxon might be rich, but he sure as Christ ain’t sorted after that punch.

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

If Luxon was paid what he is worth as a PM he wouldn’t earn anything for that role.

He in fact OWES us for the generational damage caused by their imposition of Trussonomics.

Now comfortably the worst government in New Zealand’s political history (and they had some stiff competition!)

Oh and a message for the storm ravaged communities of Southland.

Don’t go spending that $100,000 all at once now, ya’ hear?

But …he doesn’t even consider himself to be a New Zealander…

Yesterday, when asked by Benedict Collins why he thinks it’s ok for him to be flipping houses and making hundreds of thousands of tax free dollars due to the rapidly rising housing market, when many can’t even get on the property ladder, he replied that this wasn’t about him but about New Zealanders….

W T F is he talking about…

Oh..i see…

So he’s an alien whose been helicoptered in to ‘sort N.Z. out’…

Yes..right..a real man of the people.. …not!!!

What an every trainwreck he is…clueless.

It certainly feels as if most of the population wants a fairer tax system.

Judging by the hysterical reaction from the incumbents, this CGT is a very good first step toward less tax on labor and more tax on extreme wealth.

Agree, it kind of tells us it’s a good idea when Willis gets hysterical doesn’t it. I don’t know anything about finance or tax but that’s good enough for me!

Also, it will affect them more than it will affect us. That’s another good point.

We have a holiday home and it will attract the tax when we sell but we count ourselves lucky to have had the place and enjoyed it for 25 years. We’ve never claimed any rebates or tax relief on it, it doesn’t earn us a cent. Don’t care. It’s a quality of living that has mattered to us.

Another entitled GEN X greedy selfish prick .Has the cheek to tell the under 25s to get off their arse and get a job while he manipulates the bright line test so he can sell a couple of properties and make $600k tax free .Then the self centered prick has the cheek to get Auckland council to lower the value on his beach house so he pays less rates .Next he will make beach houses rates and tax free .

He would have had to own each property for over ten years, with zero intention of making a profit, in order for the “capital” gains to be tax free. Very hard to prove otherwise to IRD when one is clearly in the business of flipping houses. Brightline rules are irrelevant here. Is an IRD audit pending? One should be.

Thats the point. National changed it to 2 years, conveniently that freed up, i think, 4 house of Luxon’s to sell with no tax. But nothing to see here… apparently. The fuckwit should be thrown in jail. It’s corruption, full stop.

So you are saying that Luxon gave up a job paying millions to take a job paying about $400,000 so he could save a few hundred dollars in tax. The fact he sold before the house market collapsed showed he is smart.

For Labour’s plan to be a success they need inflation in the house market which is not good for 1st home buyers. What happens if the plan does not raise enough money to cover 3 doctors visits will they change the rules to make the rich pay for themselves.

Luxon gave up his job for adulation. Tell me if Luxon is so well off and sorted why did he plead for his property to be devalued so his rates will drop? Luxon didn’t give up his job Trevor, he’d gone passed his used by date and has essentially fucked Air New Zealand. Ask the staff.

He was pushed from Air NZ because of stupid attempts to takover Virgin and buying planes that cant be flown .Can you see the similarity as to the way he is running NZ into oblivion.

Brightline is irrelevant. The tax legislation is clear. He’s in the business of flipping houses = a taxable activity. It over-rides brightline parameters.

Hope you are right because it’s a scam to my way of thinking. It might be legit but it’s dodgy.

He has no dignity or class.

AHA! Kim You’re not one of the sorted!!!. Luxon’s I’m sorted song: This Is The Life (Remastered 2021) https://www.youtube.com/watch?v=SzN5Ng4_QI4&list=RDSzN5Ng4_QI4&start_radio=1

This is the life, here’s where the living is.

This is the life, baby, you’re there.

This is the life, you’ve waited long enough.

Girl, you’ve arrived. Breathe in that air.

Wine and perfume,

Silver and candle-light,

Children make way, I’m here to stay.

Nothing but class, that’s how its gonna be.

This is the life for me.

House at the beach,

Dinners at 21: 00

Head waiters smile when you walk in.

Hand tailored suits, shirts with your monogram.

Feel of real silk next to your skin.

Top of the heap(?)

First cabin all the way

How sweet the song when you belong

Nothing but class, that’s how its gonna be.

This is the life for me.

This is the life,

This is the life,

This is the life.

KIM! You’re jealous and envious!

Luxons a smart guy he doesn’t want to be two time loser. 1. Lose the election. 2. Lose money to a capital gains tax. He’s not backing himself to win the election which is why he sold up.

Hawaii is welcome to him, or is it Te Puke?

Good to see Chris Hipkins give melon head a much needed serve, the PM has no wriggle room here, he is guilty as charged by Chippy. Creaming it while most do it hard.

The righties like to say taxation is theft, I say to the parasite class- not paying tax is actually the ultimate rip, it craps on your fellow citizens who create the wealth in the first place.

Exactly. Users and abusers.

Keep stepping up Hipkins – you’ve got Luxon by the throat and you have the moral high ground over him. Luxon has proven over and over again that he is just a greedy, deceitful, insincere, uncaring, insignificant ‘nobody’. All he is interested in are photo-shoots with who HE considers important to HIS career and ego – but Trump? Really? There was a photo earlier this week of Luxon stalking Trump into a room – you would almost have thought he had sellotaped himself to the back of Trump’s jacket – it was so cringeworthy and so very immature. However his one-on-one meeting with Trump should, but won’t, feed his ego for some time! Inviting him to pay golf in NZ – yuk – we don’t want his type anywhere near our lovely country. Grow up Luxon he’s not a pop star he is the epitomy of an Insane Leader so keep imitating him, you’re almost there!

Birds of a Feather.

This is the stuff Labour needs to do if it wants to break out of the rut of being ‘ vote for us because we are not as shit as national but still pretty crappy.’ and ‘We are the lesser of evils but still not very good.’

Go for it Chippy. Luxon’s reaction shows you rattled the bastard.

Luxon walks under the blessing of the Lord, guided by His wisdom and favor. The Lord has not only blessed him with leadership and vision, but also with fruitful stewardship in his property investments. We should be inspired to seek God’s hand upon our own lives, just as He has clearly blessed our amazing Prime Minister!

THANK YOU ZELDA! Now go to sleep again.

Hahahahhahahaha, you should be on Americas got talent, your comedy routine is simply brilliant!

The lord works in mysterious ways, and he certainly took the piss when he designed Luxon to look like humpty dumpty and Shrek.

Yes, I laughed at the meme that had King Charles being introduced to Luxon, Charles said…”oh, I have seen all your films Mr Shrek…”

Harsh but true:)

Zelda takes a shine from / to the Great Head!

and happy to be groped .She would prefer Trump to do it but will settle for the skin head gang leader .

God’s hand seems to mostly go into the underpants of children.

But Zelda is comfortable with that

God, you’re always good for a laugh, Zelda.

The lord must have blessed his beautiful hairdo to aye Zelda, oh! hang on a minute it wasn’t the lord it was one of his shepherds Donald T.

Its a great idea – but it won’t win Labour the election. TPM and the madness of the Greens will put more voters off Labour come voting day than any CGT wil attract

I think you need to get a grip Zelda for someone who appears to be religious some of the toxic and very judgmental stuff that flows out of your mouth is very ungodly like. And does the Lord like greedy people nah! don’t think so.

thats why she worships Trump and Luxon and money and child abuse along with a lot of poverty thrown in for good measure

You’re certainly a delightfully nice person aren’t you CG.

Aha BTF finally rebooted it appears

What is it with this guy? A sense of entitlement for sure but wouldn’t be the only one … and you don’t have to Right leaning to flip houses. It’s become so entrenched in the NZ economy that it’s hardly associated with any political leanings any longer. Do some working class people engage with house flipping – if in the case they have the means. Working class used to mean Left but the allegiance is far more tenuous now. A good many Lefties wouldnt blink at using the housing market to climb the property ladder; speculation on value but its not quite the same as house flipping and pocketing the capital gain. Luxon though is more than simply entitled. He can’t read the room.

thats why she worships Trump and Luxon and money and child abuse along with a lot of poverty thrown in for good measure

Comments are closed.