Now Stuff are singing ‘always look on the bright side of life’ over ‘green shoots’ in the Economy

First it was RNZ, now Stuff are singing ‘always look on the bright side of life’ over ‘green shoots’ in the Economy…

Economy shows early signs of lifting, Westpac survey of households, businesses shows

There are early signs the economy is picking up, a new survey has found, with households and businesses reporting still challenging but improving conditions.

Westpac’s regional roundup report has found businesses are continuing to experience “soft” trading conditions, especially in retail and construction, but there has been a modest lift in demand.

…maybe those ‘green shoots’ are really the dried snot of vacant hope?

The Reserve Bank made a dramatic 50 point drop last week in the OCR as more and more economic data suggests the economy is in far worse shape than feared, this isn’t prudent management it’s naked desperation and panic.

The latest leading indicators for the economy suggest a darkening outlook for September quarter GDP. The BusinessNZ-BNZ PSI survey out yesterday showed the services sector that makes up over 60% of the economy contracted in September, its 19th-consecutive month of contraction.

The matching BusinessNZ-BNZ PMI survey for the manufacturing sector on Friday also showed a contraction.

RNZ and Stuff don’t have much to say about that.

Information out this week shows the Housing market continues to slide as QV report shows prices down 1.1 percent in the three months ended September with the Market marginally weaker than year ago, down 14 percent from its peak in 2022.

The NZ Economy is built on selling each other over inflated houses and pretending that’s wealth, but again, RNZ and Stuff are pretty quiet on that front.

Overall migrant arrivals dropped 16% to 138,600, while departures increased 13% to 127,900 – the economy is so bad that now even the migrant workers are fleeing!

Treasury papers show we have an $11.1billion deficit, but the Government has given away $19.5b to landlords, the rich and tobacco companies – if they hadn’t done that we would have an $8.4b surplus – this Government has manufactured a debt problem and called that an economic plan.

The reality is that the economy is about to get far, far, far worse and none of this Government’s austerity agenda will make any of that pain easier to take.

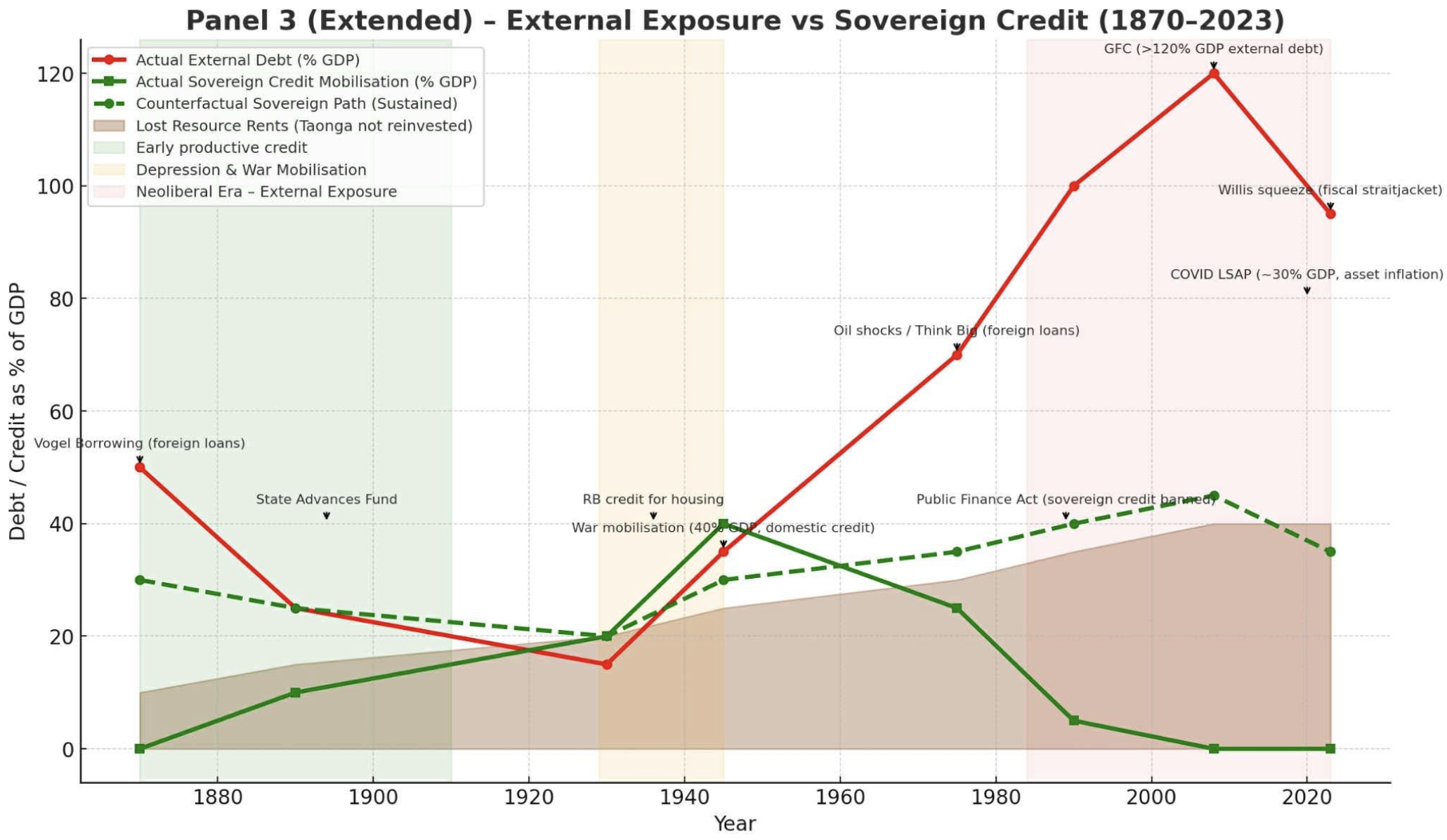

I believe it is time for the Political Left to look at Sovereign Credit to fund our infrastructure.

The greatest mistake Labour did over Covid, was that they borrowed the money from private banking rather than do what Mickey Savage did, create Sovereign Credit!

In the 1930s–40s, the first Labour Government (Savage & Fraser) used the Reserve Bank to directly finance social housing, infrastructure, and employment schemes. This was sovereign credit creation — money issued into the economy for public purposes.

New Zealand used sovereign credit creation in the 1930s for housing and recovery. Since the late 20th century, reforms locked us into a bond-based system to satisfy global financial orthodoxy and inflation fears. The difference is simple: bonds create debt to outsiders, sovereign credit creates money internally.

Why borrow from private banks when we should be directly creating sovereign credit to build the vast infrastructure deficit and climate adaptation investment net we face.

Consider the actual borrowed debt vs sovereign credit…

…so what would happen if NZ created sovereign credit now?

-

If the Reserve Bank or Treasury created credit for targeted, productive investment(say, green infrastructure, affordable housing, climate resilience):

-

The economy could benefit from extra capacity and jobs.

-

Inflationary pressure would be limited if the spending matched real productive needs.

-

International markets might notice but wouldn’t necessarily “punish” NZ — especially if debt-to-GDP stayed stable.

-

If NZ created sovereign credit now for targeted, productive investment, markets might grumble but wouldn’t punish us severely — especially if inflation stayed under control.

We could back this Sovereign Credit using ACC and KiwiSaver:

-

ACC Fund: ~$50 billion+ investment portfolio to meet future injury compensation liabilities.

-

KiwiSaver funds: ~$100 billion+ in private retirement savings, invested across shares, bonds, property, etc.

How backing sovereign credit with them could work:

-

Collateralisation model

-

The government issues new sovereign credit (say $10 billion for housing or climate infrastructure).

-

To reassure markets, it pledges that this credit is “backed” by the assets of ACC or KiwiSaver (effectively saying: if inflation gets out of hand, or repayment is needed, we can draw on these assets).

-

-

Investment direction model

-

Instead of using them as collateral, the government could require ACC or KiwiSaver funds to buy sovereign credit instruments (like 0% or low-interest bonds).

-

This would channel domestic savings into public projects instead of relying on offshore investors.

-

-

Hybrid public wealth fund model

-

NZ could merge sovereign credit issuance with a sovereign wealth approach — creating credit but investing it in productive, revenue-generating infrastructure, and having ACC/KiwiSaver co-invest.

-

That way, the projects themselves generate returns to repay the credit, limiting inflation risks.

-

None of what I am suggesting is new, Mickey Savage used it to build NZ and Postive Money has been making these points for a long time:

Positive Money NZ is the New Zealand branch of the international Positive Moneymovement (originally UK-based). Their core aim is to change who creates money in the economy.

At present:

-

About 97% of money in NZ is created by commercial banks when they issue loans (especially mortgages).

-

Only ~3% is physical cash issued by the Reserve Bank.

Positive Money argues this system:

-

Drives house price inflation (since most new money goes into property lending).

-

Makes the economy unstable (credit booms and busts).

-

Privatises the benefits of money creation (banks profit, not the public).

Labour, Greens and te Parti Maori need radical solutions to the many problems we have, investigating Sovereign Credit to build our infrastructure and climate adaptation is one of those radical solutions.

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

Excellent article and gets to the dark heart of modern fiat currency based economies. The bond market does not dictate what a government can ‘borrow’ or spend – it is a construct or convention for setting the OCR and controlling the money supply – the amount of money in circulation. Bonds are viewed as a safe harbor benchmark asset by investors – bonds are a savings service provided to savers by the government.

All government spending happens through the creation of reserves at commercial banks by the RBNZ when instructed by Treasury to do so. These reserves are used to create deposits in the bank accounts of the private sector – teachers, doctors, nurses, police salaries, pensions, welfare payments, contractor payments etc.

All of these payments happen regardless of the amount of tax revenue or bond purchases – these come after the government has put new money into circulation through spending.

The idea that the government taxes and ‘borrows’ money to pay for spending is not what happens in the real world. If you think about – how did the government get money for the GFC and COVID when the private sector had collapsed? The money the government spends cannot come from the collapsing private sector – obviously. The government meets its commitments regardless of it’s income – it spends through the business cycle using it’s own overdraft – infinite reserves – at the RBNZ.

Yes! But don’t underestimate the blowback from the bond market. It’s possible to execute what you’re suggesting but I don’t think we have sufficient intellectual horsepower in treasury and strength in our politicians to navigate this. Chances are more likely this blows up in our faces rather badly.

The time to do this was in covid when the markets were very distracted – the “eye of Sauron” will be very much focused on NZ this time and I don’t doubt we’ll be made an example of.

While it was a sensible idea in the 1930s, now we have the professional management class, who will take 40% of any spending for doing very little, so unless a new efficient system is introduced, any sovereign credit will just be used to increase the inequality in society.

Fungus always grows on dead things, sometimes it is green.

The only growth in NZ IS UNEMPLOYMENT ,UNDER EMPLOYMENT ,BUSINSESSES CLOSING AND POVERTY ALONG WITH HOMELESSNESS .What a record to be proud of as a country .

Any blog that says the opposition comes from a grouping including TPM must be taken with a grain of salt as they may have vanished by the next election.

ACT and NZ First will be gone next election because of their racist nature. Any blogger attacking TPM is complicit in the act.

Any blogger constantly spouting the economy is on the right track needs educating and telling it to this guy…

https://www.nzherald.co.nz/lifestyle/top-chef-lesley-chandra-closes-ponsonby-fine-diner-sidart-after-award-win/4GK7ZBYEH5GYTI2NROMWEYNARA/

Having been in hospitality for many years I found many great chefs 2ho are not good at business and restaurants are constantly opening and closing as trends change . No one I’d disputing times are hard but economy is always in flux and will improve in time.

Yeah no worries eh trev sheel be right

I’d say Trevor wasn’t in hospitality very long judging by his grammar?

“2ho”?

The tired old dogma of “not good at business and restaurants are constantly opening and closing as trends change” gets trotted out every single time despite overwhelming evidence that the this government is responsible for the economy tanking. And by the way record numbers of businesses are closing, that’s not a trend pal. Oh and next time you have a fire at your house Trev, don’t call the fire brigade as they are in a “flux” state right now unless of course Trev you’ve been in the fires service for many years?

https://www.nzherald.co.nz/rotorua-daily-post/news/bay-of-plenty-firefighters-strike-goes-ahead-fenz-warns-of-delays-in-111-responses/T4QJKKY6UVE77EALMAOVF7WZMM/

Add in teachers striking and health workers striking and you will find there is a fucking trend all right!

That’s the trouble with fucking trends they multiply

I have never heard of “sovereign credit”. That’s OK, but can we be sure that the Greens and Te Pati Maori have heard of it, let alone adopt it?