Labour needs to implement a CGT AND a Wealth Tax (Greens + Māori Party are the solution)

Capital gains over a wealth tax: A choice Labour may come to regret

Vernon Small is a journalist and former Labour Government advisor.

OPINION: Labour has taken a step closer to endorsing a capital gains tax (CGT) as the centrepiece of its tax reform for next year’s election.

It’s a choice it may come to regret.

This timid debate inside Labour over whether we should adopt a Capital Gains Tax vs a Wealth Tax is the reason Labour might lose the 2026 election.

It’s as limp as their GST off Fruit and Vegetables incrementalism that plagued them last election.

The real slap in the face to the voters Labour was relying on with their flaccid GST off Fruit and Vegetables fiasco is that it was such a meaningless gesture, it articulated that Labour just didn’t understand the pain felt at the bottom.

This time around the exact same dynamics will come into play with their limp Capital Gains Tax ‘victory’.

The naked reality is that we need BOTH Taxes, not just one or t’other, BOTH!

AND MORE!

The task at hand comrades is to reset the tax yoke from the poorest and reset it on the richest.

- We need properly funded public health.

- Properly funded public education.

- Properly funded public housing.

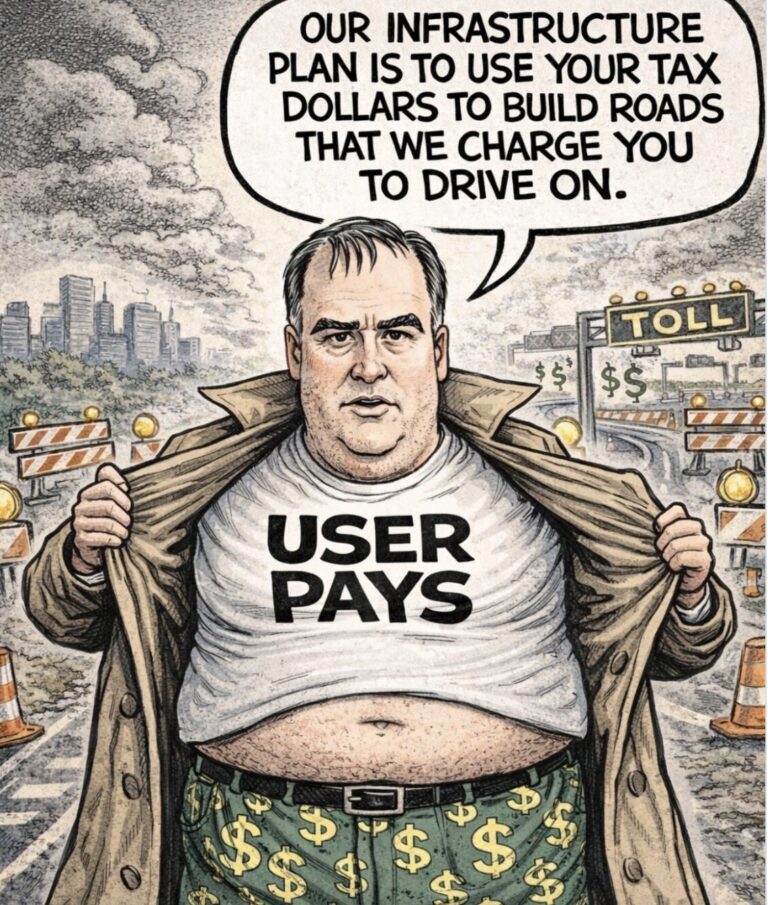

- Properly funded infrastructure.

- Properly funded mental health services.

- We need free public transport.

- We need free dental.

- We need to nationalise Early Childhood Education and make it all free.

- We need to nationalise retirement villages and build more public housing for the elderly.

- We need to fund a 3rd state backed Supermarket to break the duopoly.

- We need properly and fully funded addiction programmes.

- We need Marae Civil Defence funding.

- We need a whole new First Responder Mental Health Teams fully funded service.

There is an enormous amount of money required to actually solve the problems we face and that requires a bold new vision for tax.

We need:

- A Capital Gains tax that doesn’t include the family home.

- A Wealth Tax at the top 1%

- A sugar tax to help fund free dental

- A super tax on Vice profits from smoking, alcohol and gambling.

- $100million ring fenced for addiction services from a legal cannabis market.

- 5% Estate Duties

- First $10000 tax free

- Lower GST from 15% to 10%

- Remove GST altogether from basket of essentials (tampons, toilet paper, fresh fruit and vegetables, tooth paste)

- Financial Transaction Tax

- Pollution Tax

- Land Tax

If the Left actually want to rebuild the current public services and fund genuine solutions by growing the society positively, it is going to need more money.

We must lift the tax yoke off the poorest and put it on the richest!

Bring GST down, subsidise cost and make the wealthiest pay.

Arguing over which tepid tax to gingerly embrace is not a solution and will lead to more Labour Party incrementalism.

The other thing the Labour Party strategists are not seeing is that a strong egalitarian tax policy will bring those middle class Labour Party Auckland voters that Labour haemorrhaged to the Greens back.

For a Party that keeps saying it wants to win Labour they don’t seem to understand why they lost

Labour sacrificed Auckland for the rest of the country over the lockdown, and then added insult to injury by not recognising any of that pain with a build back that justified that sacrifice.

Labour lost working class voters because GST off fruit and vegetables and the petrol prices going back up were a slap in the face and they lost the middle classes who looked at their joke economic platform and intellectually gave their vote to the Greens for their wealth tax.

Ultimately it’s going to require the Greens and Māori Party agreeing now to a united front on negotiating with Chippy so Labour can’t bully the Greens into supporting a NZF/Labour alternative.

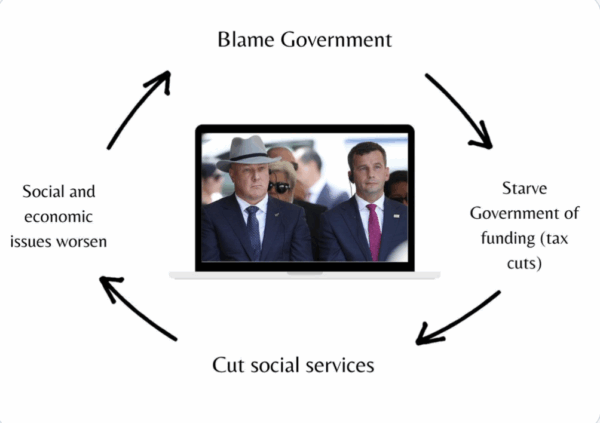

Labour needs more revenue to pay for the social infrastructure they champion, simply rearranging the bureaucratic structures as Jacinda did isn’t enough.

It’s going to require a Greens/Māori Party coalition to get that real change through.

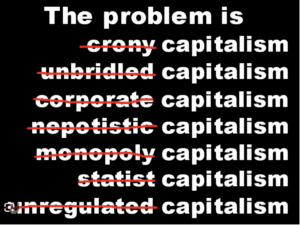

The alternative is this anti-Māori, anti-Treaty, anti-Worker, anti-Renter, anti-environment hard right Government cementing into place their distortions.

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

The word wealth needs to be replaced with bank

I would also like to see some work done on retirement savings (superannuation) I don’t think we should make it compulsory, but we can promote and market it more so those of us that make past 65 years have something to look forward to. Also, if we tax the high earners a bit more many have already said they support this. I support capital gains tax and a wealth tax but let wait and see the reaction as people think it’s unfair, but New Zealand has become a very unfair country, and everything appears to be skewed to the very rich and we know there is no such thing as trickle down.

I would also like to see some work done on retirement savings (superannuation) I don’t think we should make it compulsory, but we can promote and market it more so those of us that make past 65 years have something to look forward to. Also, if we tax the high earners a bit more many have already said they support this.

Unless Labour sacksup and reform our tax system, they will cement their reputation as “National-lite”.

Tax the wealth of the very rich – they won’t even notice it.

For everyone – have your first $25,000 tax free per financial year.

You know, just like many other progressive countries.

So what will they do with the money from these new taxes?

Calling for 8 new ways to tax people, as you do, will keep the left out of government for a very long time, regardless of the justification.

If Labour took notice of the request for new taxes watch their lead vanish.Those that like tax already support Greens

So why is it Trev that Hipkins and Labour are more popular even from a known righty tighty leaning pollster?