It is dawning on the Market that even if his Trade War was a negotiating tactic, it’s caused so much damage that the market is forced to now factor it all in.

The idiot clown posse around Trump didn’t calculate how China would refuse to call them first to sort out the Trade War Trump has tripped them into.

The idiocy and gleeful ignorance at what they are causing as Trump reshapes a century of Western economic and foreign policy in 6 months truly risks plunging the planet into war.

It is economic shocks like this that trigger the desperation and the economic necessity to go to war.

Trump is generating that with his insane economic policy.

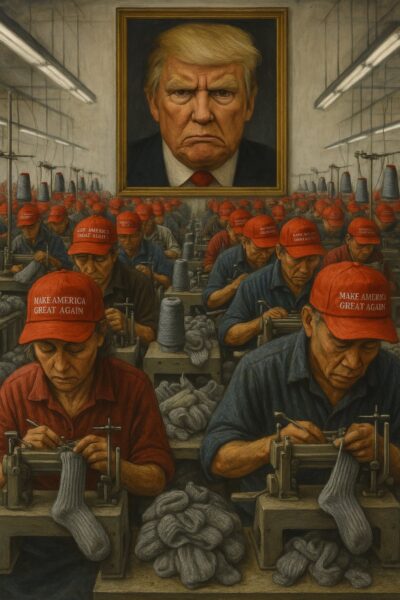

The idea that this is Americas manufacturing future…

…is nonsense.

One of the most interesting features which I didn’t consider was how the rest of the world would punish Trump…

US economy is set to lose billions as foreign tourists stay away

The US economy is set to lose billions of dollars in revenue in 2025 from a pullback in foreign tourism and boycotts of American products, adding to a growing list of headwinds keeping recession risk elevated.

Arrivals of non-citizens to the US by plane dropped almost 10% in March from a year earlier, according to data published Monday by the International Trade Administration. Goldman Sachs Group Inc estimates in a worst-case scenario, the hit this year from reduced travel and boycotts could total 0.3% of gross domestic product, which would amount to almost US$90 billion (NZ$152 billion).

…the attack on the dollar, the bond market, domestic boycotts against American products and the withdrawal of tourism alongside the inflationary explosion of the tariffs is drawing and pushing Trump into desperation.

His ‘Big Beautiful Bill’ could cause a massive economic collapse!

Trump’s tax bill would add $2.4tn to US debt, says non-partisan analysis

The Congressional Budget Office warns Trump’s ‘one big, beautiful bill’ will leave 10.9 million uninsured by 2034

…the reason the Bond Markets are getting nervous again is because if Trump gets this through, it could trigger shocks to the global system that makes things far worse...

The bond market’s mood was darker. Treasury yields rose past significant mileage markers as the 10-year benchmark note topped 4.5% and the 30-year long bond approached 5%. More important, those risk-free returns threatened to breach levels that had historically hurt the stock market. While bond yields backed off slightly from those levels, there remained a distinct air of disquiet in the debt market.

That may be traced to the Trump administration’s other signal initiative, the so-called big, beautiful bill to extend the 2017 tax cuts due to expire at year end along with an array of other goodies promised in last year’s presidential campaign. The rub is that the BBB, to use the measure’s initials, is utterly incompatible with AAA, the top credit rating, which the U.S. Treasury just lost. Late Friday, Moody’s Investors became the last of the major raters to strip Uncle Sam of its best grade. Standard & Poor’s and Fitch Ratings previously demoted him one notch.

“Successive U.S. administrations and Congress have failed to agree on measures to reverse the trend of large annual fiscal deficits and growing interest costs,” Moody’s wrote in a statement. “We do not believe that material multi-year reductions in mandatory spending and deficits will result from current fiscal proposals under consideration.”

The BBB, as marked up by the tax-writing House Ways and Means Committee and rejected by five House Republicans this past week, points to even greater federal budget deficits than what’s currently in place. The bond market, charged with funding those deficits, seems discomfited by the prospect.

The Joint Committee on Taxation estimated that the bill, including the renewal of the Tax Cut and Jobs Act of 2017, would increase deficits by $3.8 trillion through 2034, equal to 1.1% of gross domestic product. If the BBB were extended permanently, the Bipartisan Policy Center estimated that the deficit would be $5.3 trillion higher, or 1.5% of GDP, even including some $2 trillion in spending cuts through 2034. Based on the behavior of recent Congresses, that seems the more likely bet. Even before these expanded future deficits, the U.S. government is running up red ink at an annual rate of $2 trillion, or close to 7% of GDP—a level unprecedented except for recessions or wartime.

Those projections may be optimistic. According to the Penn Wharton Budget Model, the bill would increase the “primary” deficit by $6 trillion over 10 years. The so-called primary deficit excludes interest costs, focusing only on spending on programs. But as noted here ad nauseam, the government’s interest expense is the fastest-growing part of the budget, especially as old notes and bonds sold during the ultralow-interest-rate era following the 2008-09 financial crisis are refinanced with the current 4% coupons. Debt service now is a bigger burden than the military, which has marked a tipping point historically for great global powers.

Even after the administration backed down from 145% levies on China to a mere 10% or 30% in some cases, Goldman Sachs economists estimate that the U.S. economy faces an increase of some 13 percentage points in the levy on imports, the highest burden since the 1930s during the infamous Smoot-Hawley tariffs. Contrary to the administration’s avowed aims, Goldman thinks the tariffs are unlikely to produce much in the way of onshoring of production. That’s especially the case for high-value-added products such as medical equipment and semiconductors, which the firm’s economists say are less responsive to price changes.

Moreover, Goldman estimates that real—that is, after inflation—incomes in the U.S. will be reduced by 1.5%-2% per annum by the tariff regime. But that doesn’t take into account potential retaliatory actions by trade partners to the U.S. levies, the firm’s economists add. That would only exacerbate the economic impact.

The risks are rising. “Our view is that the nation is headed for a fiscal crisis because the economy cannot sustain budget deficits this big,” writes Carl Weinberg, chief economist at High Frequency Economics. “At some point, markets will rebel against unsound fiscal practices, and that includes the wisdom of cutting taxes and increasing the fiscal deficit when the economy is at full employment already, especially if it boosts the public sector debt to more than 100% of GDP,” he concludes.

…Trump will get cornered as the economy collapses and get conned by the crypto-bro billionaire libertarians to move the dollar to a crypto currency, which will then burst in a way that makes the Great Crash of 1929 look mediocre.

The more economic chaos Trump creates, the more likely it is that war will be the end point.

That is how all the great wars start, economic carnage.

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

Can you stop using AI to make graphics, truely awful and deadening. The graphics were so good before.

Agreed

The key point missing is that most Trump voters don’t care. They want:

Lower fuel costs

Lower food costs

Jobs

All of which Trump will deliver. Trump represents a working class revolution against the big end of town.

Elon Musk voted Trump and he completely disagrees that it’s big and beautiful. Your point falls over and the rest of your comment is nonsense.

When the working class turns into the slave class due mostly to inflation they are going to turn against the government/ Trump violently.

Yes, Trump is insane and Andrew, none of what you are suggesting what voters want count when they have no healthcare.

Policy is essentially irrelevant, since the USA have borrowed more money than will ever be repaid. The question is what happens when Dimon’s crack finally opens.

The crack starts here, trickle by trickle. I always liked the story about the brave boy who stopped the hole in the Dutch dyke.

The Little Hero of Holland. The Little Hero of Holland is a 1910 American silent short drama produced by the Thanhouser Company. It is an adaptation of the short fictional story popularized in Hans Brinker, or The Silver Skates, about a boy who plugs a leaking dike with his finger to prevent it from bursting.

The Little Hero of Holland – Wikipedia

The story told simply is one that we should be able to interpret, understand its wider implications, and remember – but don’t count on it.

https://www.youtube.com/watch?v=QzVoiO60dnA

It involves thinking socially, widely, rationally, nationally though still being concerned about individuals and what we owe to each other as a community.

Chomsky is speaking out again. We should listen.

https://www.youtube.com/watch?v=aAdrKfkFiyg

Noam Chomsky: Trump and Musk’s Feud Is a Smokescreen for Corporate Control. (Must Watch!)

34m Is this all a distraction for minds set on quick response?

Comments are closed.