This Government robbed $12billion from workers and gave $6Billion to bosses.

Not figuratively.

Not metaphorically.

LITERALLY!

They LITERALLY took from the poor to give to the rich.

Out of the pockets of workers, into the pockets of bosses!

This Government are anti-Robin Hood and anti-Midas!

They steal from the poor to give to the rich and everything they touch turns to shit!

This isn’t trickle down, they want to defy economic gravity and trickle up!

There is a social carnage that comes from that!

The Government crow about lower inflation rates and lower mortgage rates.

The Inflation was driven not by why what Labour was forced to borrow to keep the country safe over Covid, it was driven by global supply chains collapsing, so inflation coming back to earth has very little to do with National slashing budgets.

As for the OCR drop, let’s be very clear that there is a social cost to ensuring property owners untaxed capital gains are safe.

Bernard Hickey is scathing…

Calling bullshit on a pro-cyclical tightening of fiscal policy

Willis chooses more cuts as recessionary headwinds gather

Finance Minister Nicola Willis announced a further tightening of Government spending in a pre-Budget speech on Tuesday detailing her response to new Treasuryforecasts that Donald Trump’s tariff shock would slow global growth, which in turn would slow taxation revenues and make it harder to achieve surplus by 2028/29.

Titled Budget 2025: The Growth Budget, her speech noted returning to surplus within three years repaying more debt faster was more important than spending more on Government services or infrastructure.

“I am confirming today that the Government has reduced the size of our Budget 2025 operating allowance to $1.3 billion.

“This means we will be spending billions less over the forecast period than would have otherwise been the case. This will reduce the amount of extra borrowing our country needs to do over the next few years and it will keep us on track towards balanced books and debt reduction.

“The fiscal forecasts will not be finalised until later this week, but according to the latest numbers I have seen, this smaller operating allowance means we will continue to forecast a surplus in 2029.

“The reality of global economic events is that if we’d pushed on with a larger operating allowance then we would be staring down the barrel of even bigger deficits and debt.” Nicola Willis speech

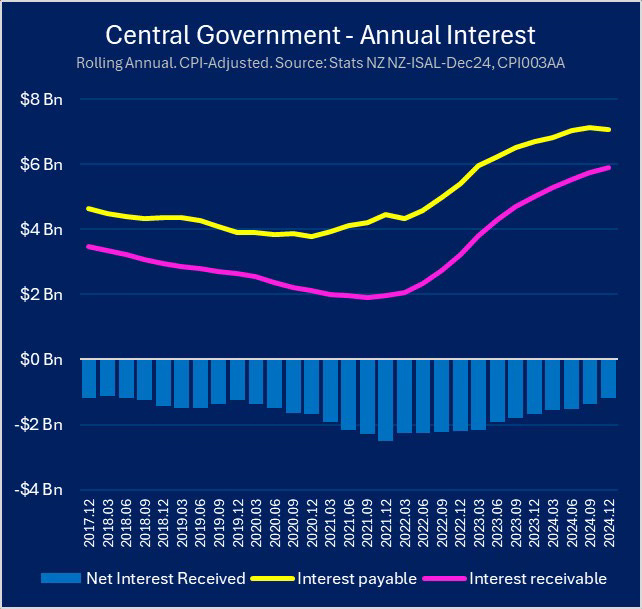

She described Government interest costs as spiralling out of control.

“The interest bill on government debt has soared from $3.6 billion in 2014 to $8.9 billion last year. That sum is more than annual core Crown expenses for the Police, Corrections, the Ministry of Justice, Customs and the Defence Force combined.

“Our Government’s goal is to put net core Crown debt on a downward trajectory towards 40 per cent of GDP and in the longer term keep it below that percentage.

“Why? Because allowing debt to keep spiralling would threaten the livelihood of every New Zealander.” Nicola Willis speech

Actually, there is no spiralling of interest costs

It’s worth challenging Willis’ characterisation of the Government’s debt levels as threatening because that is the spectre behind all of the Government’s drive to cut costs and reduce debt. It’s the ultimate reason given for choosing not to spend more on doctors, hospitals, schools, housing, buses, roads and welfare. The ‘spiralling debt’ line is the burning platform being described as the problem to be dealt with, so voters would think it seems natural that things have to be thrown overboard in a crisis.

Willis regularly suggests the Government is just like a household and therefore it’s natural it ‘tighten its belt’ when it has a debt problem. Here’s the bit in the speech using that framing (bolding mine):

“Every Thursday afternoon, New Zealand Debt Management issues around $500 million of Government bonds. Some of this is to that roll over existing bonds that have expired, but large chunks of it are for new borrowing.

“That level of borrowing obviously can’t go on forever, or else our kids and grandkids will be left with unsustainable debt and considerable economic uncertainty.

“Most of you can probably relate to this if you think about your own household budget: sure, sensible borrowing has its place, but no overdraft can be extended forever, and while you can keep giving the credit card a hammering, left unpaid, it does, eventually, get declined.

“It’s worth bearing this in mind next time somebody tries to suggest to you that the New Zealand Government needs to spend more on something.” Nicola Willis speech

But this is not a crisis. Nowhere near it

The cuts in the face of recessionary headwinds and against the grain of the Reserve Bank’s attempt to stimulate the economy out of recession are unnecessary and counter-productive, in my view.

The Government’s net interest costs, after the NZ Super Fund receives interest on its overseas assets, is actually forecast to be around $2.1 billion or 1.6% of total Government revenues or 0.5% of GDP in the current 2024/25 year.3 To put that into context, households overall are spending an average of 22% of their disposable income on rent or their mortgage interest costs. Home owners with mortgages spent an average of 21% of their disposable income on interest costs in the year to June 30, 2024. Renters spent 23% on average.4

If a neighbour said to you that your household’s interest bill was 1.6% of your income, which meant it was ‘spiralling out of control,’ what would you say to them?

‘Bullshit.’

This is all about reducing mortgage rates

Willis’ argument and actions do make sense if you listen to the bits about trying to further reduce interest rates. A Government can tighten its policy to force the Reserve Bank to ease even more to stop an economy going into a recession bad enough to lower inflation below its 1-3% target band. Here’s those bits on why cutting spending is good for interest rates (bolding mine):

“I always take pause to celebrate that since our Government came to office inflation has returned to normal levels, resulting in a 200 basis point reduction in interest rates.

“In this year’s Budget we’ve also had to carefully consider whether, in light of major global economic events, our fiscal strategy still remains achievable.

“The strategy is focused on two key goals: putting net debt on a downward trajectory and returning the books to an OBEGALx surplus by 2028.

“This strategy matters, it matters for getting the books back in order and that’s about more than a set of numbers. It’s about keeping interest rates lower and providing a solid platform for future growth.” Nicola Willis speech

In theory, the Government could slash and burn even more aggressively to make the Reserve Bank cut the Official Cash Rate even deeper towards 0%, but that would make clear that the Government’s real strategy is to create a recession that lowers mortgage rates to further benefit home owners, both by lowering their costs and increasing house values, which has happened as interest rates have fallen in the past.

So how much might the cuts of $1.1 billion per year for the next four years actually ‘buy’ the Government in the form of lower mortgage rates? Is it worth the political and real grief involved in denying doctors and nurses and teachers and beneficiaries and disabled people the wages and facilities they need to keep working and living sustainable?

It buys the Government 5-10 bps of rate cuts and lowers GDP by $550m

Luckily for us, a few people have some calculators on both the initial impact on GDP of Government spending cuts and the end result after the Reserve Bank is forced into even deeper cuts in the OCR.

Here’s ANZ NZ Chief Economist Sharon Zollner in her weekly note on Friday (bolding mine):

“While the reduction in the operating allowance only reflects around 0.25% of nominal GDP, that’s still less pressure on short-term interest rates (all else equal).

“A rough rule of thumb implies the reduction could be worth around 5-10bp off the OCR – not enough to move the dial if the RBNZ is cutting in 25bp increments, but certainly enough to tip the balance to cut if other economic factors are also moving in that direction.” ANZ NZ Chief Economist Sharon Zollner in her weekly note on Friday

The next Reserve Bank rates decision is on May 28, six days after the Budget. Currently, financial markets and economists expect another cut of 25 basis points in the OCR to 3.25%. Willis will be hoping her nudge this week might bump it up to 50 basis points, but the $1.1 billion per year cut in spending will only be enough for less than half of the 25 basis points she’s trying to ‘buy’.

And what might be the net result for the economy of the offsetting spending cuts and rate cuts? The Reserve Bank estimated in August last year5 that the net ‘multiplier effect’ of a change in Government consumption was around 0.5, even after the Reserve Bank response. IE. That means the Government’s spending cut will result in a cut in GDP by about half the amount of the cuts, or around $550 million or 0.13% of GDP.

So, the end, the Government is not ‘Going for Growth.’ It’s going for lower mortgage rates and higher land prices. GDP actually falls.

Just like the rest of the nation’s home-owning households in our housing-market-with-bits-tacked-on political economy, the Government is prioritising leveraged capital gains on land values over actual investment in growing real productivity, output and wellbeing.

…Willis is manufacturing a cost crisis because that is National’s legacy position against Jacinda, that Labour spent too much money to protect us from a once in a century pandemic. National have over extended that criticism to ensure they burn and slash everything to ensure landowners and landlords are spared at the expense of everyone else.

These cuts to protect landlords come at the expense off the poor.

Right now there are 1000 children at risk who are not being protected by Oranga Tamariki…

…right now half a million kiwis every month need food banks…

Over half a million Kiwis accessing food banks per month – survey

…right now as the poor attempt top get help there is a 2 hour wait at WINZ…

Frustration grows amid two-hour waits to talk to Work and Income

…this is policy cruelty so National can protect their landed gentry voters over the poor and it is as gruesomely callous as that.

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

ACT controls the government. ACT wants less government. This budget cannot be a surprise. Less government, less tax and fewer hand outs for the poor who ought really ought to try cake. The rich have insurance and nice schools that stop the poor people rushing in.

“Just like the rest of the nation’s home-owning households in our housing-market-with-bits-tacked-on political economy, the Government is prioritising leveraged capital gains on land values over actual investment in growing real productivity, output and wellbeing.”

What Hickey leaves out is the effect of lower interest rates on small and medium business the biggest employers in NZ. Small businesses to grow and employ, borrow using housing as collateral and need lower interest rates. Currently, 40% of NZ businesses are using the bank of IRD to prop up cashflow.

With a ‘housing-market-with-bits-tacked-on economy’ the country needs to get house prices moving to regenerate a wealth effect, construction activity and money moving in the economy to create demand for small businesses. Instead, this govt has done the opposite, killed off government-built projects, laid off high-paid workers, reduced the training budget, let electricity companies close mills full of good-paying jobs and reduced the real wages of doctors and by relativity, everyone else – none of that is growth.

The govt move to make 20% of business capital spend deductible is a good move to counter over-investment in housing. Is 20% enough to rejig a ‘housing-market-with-bits-tacked-on economy’?

Comments are closed.