Tax debate opportunity for Labour members to be ‘very explicit’ to leadership – former president

Former Labour Party president Nigel Haworth said members have the opportunity to draft a “prescriptive” and “explicit” tax policy for the party in the next 15 months, which would be “binding” on its MPs, leaving no room for their caucus or governing council to wriggle out of.

Haworth’s intervention, published in a post to the Standard, a popular leftwing blog site, comes as Labour members debate not just the issue of tax, but also the extent to which the party’s leadership has the ability to make “captain’s calls”, overruling the wishes of members.

Many members look at leader Chris Hipkins’ decision to rule-out a capital gains tax and a wealth tax and campaign on an unpopular GST exemption for fruit and vegetables last election as the embodiment of this problem, although the party maintains that the correct process was followed in campaigning on those policies.

Labour, as a large party, but with a strong tradition of democratic decision-making, is in the throes of debating how much policy power should rest with members, and how much should rest with the Labour’s caucus of MPs and governing council.

It can’t be just a tax debate, or else it will fail.

It has to de a debate about the kind of State we want in New Zealand.

I think Cyclone Gabrielle and Covid have fundamentally changed the political debate in New Zealand.

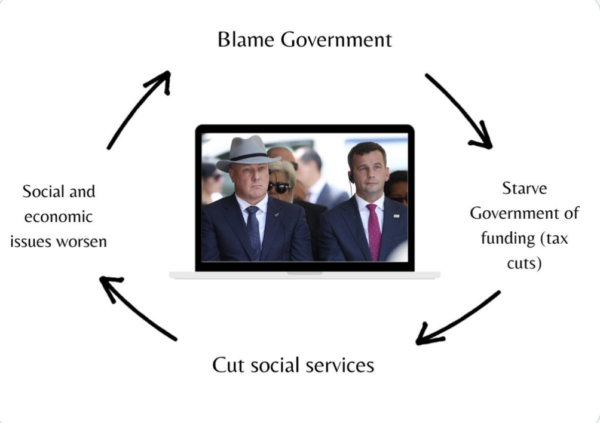

Since Rogernomics, the neoliberal experiment has cut the NZ State back to the bone and the Right’s political agenda ever since has been to starve the State of revenue so there is no political expectation of redistribution.

The enormity of the storm damage, ongoing geopolitical instability and the ongoing threat that rapid climate change causes forces an entirely different perspective politically, economically and culturally.

This is now the age of consequences.

Business as usual simply can’t work.

Bernard Hickey argues that even if we agree to the neoliberal Wellington Consensus of 30% GDP debt, we could still borrow $60Billion and remain within that absurd ideological economic straight jacket so where should that $60billion be spent on resilience and adaptation?

We need future proofing ideas, we need a Ministry of Works to do it, we need big ideas and we need big new taxes to fund those big ideas, we need to build in self sufficiency, we need mitigation and adaptation.

Unlike Covid, whose worst was avoided, this Cyclone damage is real world and physical. The magnitude of what is required from the State politically resets National and ACT’s small Government agenda.

No one wants to hear about amputating the State when they are running to the State for protection.

The Rights usual slash and burn of the State simply isn’t sustainable in face of how invested the State is going to have to be in the rebuild.

Big ideas are needed, and Labour should use the MMP majority they still enjoy to force through some desperately needed regulation over the Forestry Industry, Trucking Industry, Telecommunications Industry, and the Industries who are emitting the gasses that are ultimately driving this catastrophic climate change.

We need to build resilience into a new infrastructure landscape that is urgently implemented with radical policies.

This is the age of consequences now, we will either chose our direction or be forced by the weather events themselves to blindly scramble.

The Left’s response must be universal services funded by a tax system that removes the yoke from workers onto corporations, Banks and the wealthy alongside a State with far greater capacity.

We don’t just need more Drs and Nurses, we need more hospitals and ambulances too. We need more teachers, more schools, more, prisons, more corrections staff, more military, more police, more universal free services.

Argue for a State that has the capacity to build our resilience while preparing us for a different world, economy and culture.

As we struggle to comprehend the impact of climate change in front of us, it is clear we are in desperate need of legislative regulation built upon an election mandate which means Greens/Labour and Maori Party have to agree to a shared platform of reforms that are ready to pass on day 1.

Universal Left

Let’s ensure taxation is targeted at the corporates and the wealthy while subsidising the costs of the poorest.

I present the 10 point Left wing Economic Justice Plan for Aotearoa New Zealand.

1: Feed every kid in NZ a free nutritious and healthy breakfast and lunch at every school using local product and school gardens with parents paid to come in and help.

2: 50 000 State Homes for life built using the best environmental and social architecture standards using the public works act to seize land and immediately start building satellite towns using upgraded public transport hubs.

3: Free public transport plus vast infrastructure upgrade for climate crisis.

4: Taking GST down to 10% and first $10 000 tax free

5: GST off fresh fruit and vegetables and essentials like tampons, toilet paper, condoms, oral health.

6: Free Dental services for everyone through public health.

7: Debt cancellation – student loans, welfare overpayments, beneficiary debt, easier debt cancellation.

8: Renter Rights – (rent freezes, end accomodation payments, long term tenancy arrangements)

9: Buy out houses that can’t be saved, look at universal insurance for climate change events to cover those with no insurance, survival packs in every home, solar panels on every roof, vast increase in Civil Defence equipment, social licence of essential service resilience.

10: Properly funded public broadcasting with TVNZ advert free and merged with RNZ alongside properly funded journalism through NZ on Air with more money for the Arts and Science. If you can’t have good public journalism, the right wing media will destroy these other 9 advances.

Don’t tell me we can’t afford any of this because we can if the wealthy are taxed!

There are 14 Billionaires in NZ, let’s start with them, then move to the Banks, then the Property Speculators, the Climate Change polluters and big industry.

There’s no point making workers pay more to rebuild our resilience, tax the rich!

-Sugar Tax

-Inheritance Tax

-Wealth Tax

-Financial Transactions Tax

-New top tax rate on people earning over $250 000 per year.

-Capital Gains Tax

-Windfall profit taxes

-First $10 000 tax free

I’m not looking for socialism from Chippy, just basic regulated capitalism.

For too long the middle class activists of the Left have indulged in alienating Pure Temple Social Justice purges, when the common ground of Economic Justice is the way to win a democratic majority.

Our aim should be Economic Justice because Social Justice is just an ideological cul-de-sac that only generates culture war ammunition for the Right.

It is time for Labour to be bold in articulating the kind of state we need and how we will fund that social and physical infrastructure by taxing the very wealthy.

Climate Change Insurance…. Sounds good but we’re going to want the insurance industry to drive people out of areas that are dangerous and universal insurance won’t achieve that.

Comments are closed.