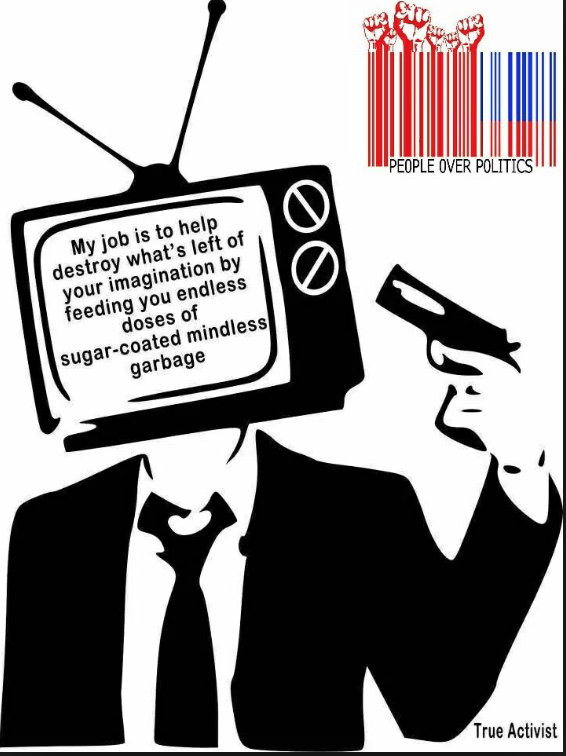

Look, I don’t wish to be overtly critical of the mainstream news media, I appreciate the pressure of banging out a dozen stories while self editing them from your selfie stick camera, but the lack of critical analysis by the Political Media at criticising National’s Tax Policy just isn’t acceptable.

Firstly, the Real Estate Pimps are pouring millions in donations to National!

Secondly, National will give Landlords the right to kick tenants out with no reason!

Thirdly, many National MPs are property owners who will directly benefit from these plans!

Fourthly, they intend to remove the foreign buyer ban on property pricing the next generation out of home ownership!

Fifthly, the $250 tax cut per fortnight is for rich landlords is funded by robbing 2 year olds!

Sixthly, the $250 tax cut per fortnight is for rich landlords is funded by stealing from climate change budgets!

Seventhly, the $250 tax cut per fortnight is for rich landlords is funded by mutilating Public Transport!

Eighthly , the revenue raised won’t cover any of this!

Ninthly, the vast majority won’t get any of that $250 per fortnight!

The math doesn’t add up and the entire thrust of robbing the poor to pay for the rich is an obscenity, the Political Media have a greater obligation and responsibility to spell this out to voters and they aren’t!

It’s a shallow analysis that doesn’t serve our democracy well!

Think I’m being biased because I am a Lefty? Here’s Right Wing Head of Slytherin House Matthew Hooton behind the Herald Paywall…

National concedes savings alone won’t fund its tax cuts, so also announced four new taxes. None applies to tax-exempt “charities” such as Go Bus, Shotover Jet, Sanitarium and Mission Estate Winery.

The first new tax, which National developed with assistance from Auckland’s Sky City Casino, is on offshore gambling websites. Labour says it already taxes them, collecting nearly $40 million a year in GST.

The second new tax is charging foreigners higher visa fees.

These two would raise a few hundred million dollars.

The third is bigger, which is reversing Labour’s Covid-era tax break for commercial property investors, forecast to raise just over $2b over the next four years.

The fourth is the proposed tax on foreign buyers purchasing properties worth over $2m.

The tax won’t apply to Australians, Singaporeans and perhaps citizens of other countries with which New Zealand has tax and trade treaties, but National says it will bring in $3b.

For that to be true, foreigners from countries other than Australia, Singapore and so forth would need to buy around $20b of houses over the next four years.

That’s more than 6000 houses with an average value of $3m. That assumption seems heroic, even if encouraging people to sell houses to foreigners to fund tax cuts is a good idea.

…Hoot’s ain’t no card carrying member of the Communist Party! His analysis highlights the naked venal self interest National are prepared to use to m utility public policy to deny political gravity and generate ‘trickle up’ instead of ‘trickle down’ economics where the poor have to subsidise the rich!!!

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

If you can’t contribute but want to help, please always feel free to share our blogs on social media

But it’s not Chippy’s’ policy Thomas its Lux-ons. This is why they released the policy so late to avoid the truth coming out as they know their tax policy would be heavily critiqued. They also know they just have to sell it to some of the dumb, greedy and selfish middle voters and we have many in our country. And if they get elected, they will make cuts to public services under the auspices of a lame excuse. They (the gnats) have decided they will cross that bridge when they come to it, that is how bad they want to be in power they are prepared to lie outright and prop up the already rich.

Labour is shite but the Nats are shiter…. vote Red…. hold nose…. struggle through with a bit less exploitation.

Hey Thomas. Thanks for your thoughts. Another case of deflection because you cannot defend the policy in a logical manner. I don’t give a monkeys if Hipkins owns a hundred houses. It’s not he who is promoting the policy , if he was then fair to point out that he would gain from it. However you could in fact point out that the policy he promotes and actually legislated for leaves him disadvantaged

Very good analysis Tom.

But according to Nicola Willis the bright line extension is a really a CGT. So Thomas chippy didn’t want remove that or reinstate interest deductibility. Agree he may be “rich” too but he’s not trying to get out of paying tax is he.

But according to Nicola Willis the bright line extension is a really a CGT. So Thomas chippy didn’t want remove that or reinstate interest deductibility. Agree he may be “rich” too but he’s not trying to get out of paying tax is he.

At the moment the way Chris Bishop is crying he is acting like a baby that needs a bottle or a dummy put in his mouth. The union adds are standing up for the people they represent if you are going to get rid of fair pay agreements the low paid will be the ones effected the most and they are getting the least from Nationals’ tax policies. Cutting reduced public transport and reintroducing prescription fees are also a kick in the teeth as is bringing back the 90-day policy. If you want to get rid of useless workers employ them on a casual contract and don’t renew it. The other issue is National will make many other cuts and most of them will hurt the same group, they just haven’t told us yet, but they will be coming.

Comments are closed.