But New Zealand doesn’t lack the means to pay for these things, nor do we need to explode the deficit to afford them, since that still seems to be the overriding priority for our political establishment. The fact is that New Zealand is a country that provides a home to 14 billionaires, most of whom have been getting richer, who collectively sit on wealth worth nearly $37 billion, while at last count, there are 347,000 people in the country worth US$1 million or more. A significant number of those will be ordinary homeowners who have seen the values of their houses lately balloon, but many are not.

According to the 2022 Knight Frank Wealth Report, the number of ultra-high net worth individuals in New Zealand — meaning those worth a staggering US$30 million or more — rocketed up 150 per cent from 2016 to 2021, at which point they numbered 3118. This cohort is predicted to increase another 48 per cent by 2026, with New Zealand leading the field in all of Asia as the continent looks set to overtake Europe as the world’s second-largest regional wealth hub, according to the report. Meanwhile, calls for a windfall tax have been fuelled by news of corporate profits surging and looking on track to rise even further, much of it concentrated in sectors like fossil fuels, banking, electricity and supermarkets, even as other sectors like hospitality have struggled.

In other words, it’s a fairly small segment of the country that would be affected by revenue-raising taxes targeting extreme wealth and pandemic-era profiteering, which would in turn help the government meet the cacophony of crises now facing the country as a whole — a course of action that the ultra-rich, too, would benefit from, given that they depend on the same resilient infrastructure and climate disaster mitigation the rest of us do. It’s simply absurd that at a time like this and given the scale of what’s needed, we would continue on a path where the wealthy and big business keeps contributing less in tax than they have through most of New Zealand’s modern history, or worse, pay less than the lowest earners.

There are 14 Billionaires in NZ, and 3118 ultra-high net worth individuals, let’s start with them, then move onto the Banks, then the Property Speculators, the Climate Change polluters and big industry.

There’s no point making workers pay more to rebuild our resilience, tax the rich!

-Sugar Tax

-Inheritance Tax

-Wealth Tax

-Financial Transactions Tax

-New top tax rate on people earning over $250 000 per year.

-Capital Gains Tax

-Windfall profit taxes

-First $10 000 tax free

The Reserve Bank Governor is clearly telling us to raise taxes to pay for the rebuild, if Chippy’s Bread and Butter politics is to mean anything, he has to tax the rich to pay for the rebuild.

The 30 year neoliberal experiment in NZ cut the State back to the bone and the political project of the Right ever since is to tax-cut starve off revenue for the State so it can’t redistribute it in the first place.

What we saw with Covid is that you desperately need a State with capacity. So many of the problems we encountered was the shear slowness of an underfunded, under capacity public service.

With the economic recession, the geopolitical shockwaves and catastrophic climate change upon us, we must have a debate about the capacity of the State!

That is how the Left have to re frame 2023 – vote for the Right and get an amputation of the State, vote for the Left and build new capacity for the challenges ahead.

We need more Drs, more nurses, more teachers, more Police, more State houses, more infrastructure NOT LESS!

We need to debate for a bigger capacity State using the example Covid just gave us.

We need more Scientists, Drs, nurses, teachers, Police, more State houses and more infrastructure alongside policy that directly subsidises the cost of living like removing gst off food, free dental, free public transport, free food in schools and we will fund that extra increase through targeted new taxes to rebuild the capacity of the State.

The obviousness of our need for a Ministry of Works that actually builds shit is painfully clear to everyone by now.

Take Police in NZ, we have a pathetic 203 police per 100 000 NZers!

Compare that with 212 in England, 264 in Australia, 318 in Scotland, 349 in Germany, 422 in France, hell even Fiji at 227 has more Police per 100 000 than we do!

We don’t have the capacity to create a functioning State that lives up to our expectations in a liberal progressive democracy because we won’t tax the rich to find that infrastructure!

We need to actually sell the 2023 election in those explicit terms – vote Right and amputate the State, vote Left and rebuild the capacity to actually face the challenges ahead.

Taxes aimed at speculators and the wealthy to fund services for the egalitarian country we want NZ to be.

Let’s have the courage to actually argue and win over our fellow citizens for solution based policy that actually builds the capacity to have the extra drs, nurses, firemen, police, and teachers.

Let’s champion policies that subsidise people’s cost of living by redistributing from the few to the many.

The voters of NZ are still waiting for the Transformative change we promised them in 2017.

If the Political Left have all finished squabbling over who the biggest victim is and cancelling people for crimes against middle class dogma, could we get back to winning the election and being actually transformative?

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

If you can’t contribute but want to help, please always feel free to share our blogs on social media

let’s tax the billionaires and 5hen watch them leave…

Well they may leave but they wont be closing the business that supplies the wealth. They will just have a new tax structure which can be unstructured.

Think of the kids. https://youtu.be/3oDr1HU53qg

Exactly Yeti!

They may also find that while these billionaires have a property here, they may not be ‘resident for tax purposes’. The basic rules for NZ tax residence are:

> You’ve been in New Zealand for more than 183 days in any 12-month period.

> You have a permanent place of abode in New Zealand.

So, arrange your visits to this country to miss the 183-day threshold and have one of your companies buy your mansion for you. When I was working as an expat several of my colleagues did this: Put their houses into family trusts and limited the time spent back home.

The left really need to get their collective heads around ‘The Laffer Curve’ and its consequences.

Think about the Aus banks $5billion in profit. If that money was taxed at say 50% call it a mining royalty, mining the kiwi house owners for interest payments, Would those banks up and leave because they were only making 2.5 billion of easy money?

Think about the billionaires that do packaging and toys and fishing. Some of them can relocate their business head office or the location of their shareholding companies but the fish arent going anywhere, the local pulp for the packaging etc isnt moving. Those parts of the business can still be appropriately taxed. Their income is likely already sheltered in a tax haven. What is being talked about is unevadeable revenue tax on banked sales streams and gains on local land holdings.

Billionaires typically can move the ownership of their assets. And if you tax them enough they will do so.

Your suite of taxes look more like an intention to destroy capitalism in New Zealand rather than an attempt to raise funds to rebuild infrastructure. The scale of your taxes is akin to what occurred in Leninist Russia and post WW2 East Europe when confiscatory taxes were used to destroy private capital. You only have to see the blight of Eastern Europe, 1945 to 1990, to realise what a disaster that was.

The 3118 individuals (in fact virtually all representing families) probably covers a large percentage of the medium to larger size businesses in Mew Zealand as well as most larger farms. I would imagine it would be 30 to 50% of all business wealth in New Zealand. There are limits to the ability to pay. The wealth is not income, it is capital in the form of buildings, machinery, processes and the IP that make up the business. Start taxing that with a wealth tax, and pretty soon you won’t actually have viable businesses. Again an incentive for people to relocate, particularly to Australia.

The only credible tax in your list is CGT. Many years ago (1989) when I was an associate professor in tax, I wrote papers and articles about New Zealand having a CGT. In fact the Lange/Douglas government had introduced legislation to have a CGT, modelled on that of Australia. The only reason why we don’t have a CGT today is because Labour lost the 1990 election. Perhaps the plan to introduce a CGT was a one of the reasons for the defeat. That lesson was not lost on either Helen Clark or Jacinda Ardern.

However, a reasonably based CGT is credible. It does raise a decent amount of revenue, provided it is not a mechanism to utterly destroy wealth. The Australian CGT does not have that as in intent, and in my view is a reasonable model. Thus it has been able to survive successive changes of government. That is surely is one of the critical tests that any decent legislation must be able to do.

We need more doctors but you want to tax them more? Sure that will encourage them to come/stay here.

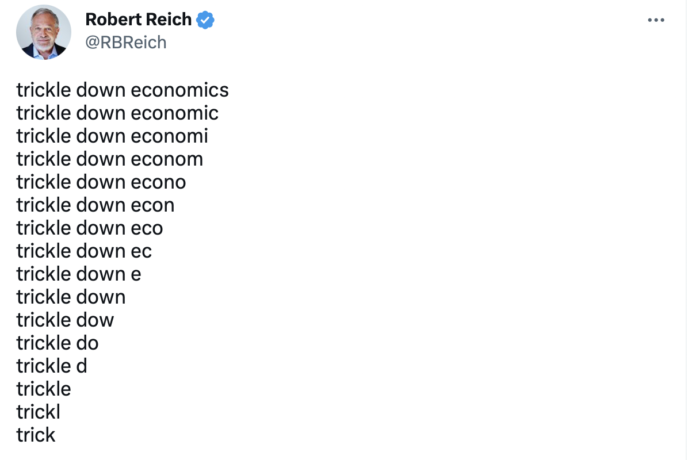

Something must trickle down to Jane and Jo average … Just can’t think what. ….oh yes lawyers, accountants that’s who..better off taxing accountant firms more.

It isn’t just the lack of police which is pathetic. The whole country is now pathetic!

It doesn’t even need to be as complicated as Martyn is suggesting. You could simply abolish all the tax cuts, returning tax rates to where they were at the end of the Nash Administration.

A one-time wealth tax (on high worth citizens) could wipe out the national debt, and pay for any urgent infrastructure repairs (i.e. Trump’s idea).

You could sign a big trade deal to get the infrastructure rebuilt/expanded (to its 1950s peak and beyond), as well as the industrial base. The lucky company or SOE which gets the deal could operate everything until the Sovereign Wealth Fund has enough money to buy most of it back — which would mean you wouldn’t have to borrow money to build it all.

If you’re worried about high user charges, the government could simply guarantee all usage fees will be paid out from tax revenue.

At one stage China was building over 20 new cities PER YEAR. An entire hospital was once erected in five days. They could transform the country very quickly under such a deal.

You’re a beat poet Robert!? We sure need beating around the head with the unsatisfactory facts that no-one wants to face; facts that arise in any common sense discussion; like taxes in this country are largely spent on advancing or repairing or possibly maintaining the nation.

In the old days taxes would largely have been spent on wars, external or civil. I am dipping into, to me, the previously unknown worlds of differing philosophers. Descarte managed, after being a bit frail as a boy, to think and put forward his line on philosophy despite living through the European Thirty Years War*. He kept his ears open and shifted when action started to move in his direction.

It’s hard to take in that everything we see and do is affected in our understanding of it, by our own and our cohorts’ perceptions. Let’s change our perceptions; death seems to be the one certainty that we can’t imagine away, though ghosts might arise, and remembering that ‘Death is the cure for all diseases’.

The Thirty Years’ War[l] was one of the longest and most destructive conflicts in European history, lasting from 1618 to 1648. Fought primarily in Central Europe, an estimated 4.5 to 8 million soldiers and civilians died as a result of battle, famine, and disease, while some areas of what is now modern Germany experienced population declines of over 50%.[19] Related conflicts include the Eighty Years’ War, the War of the Mantuan Succession, the Franco-Spanish War, and the Portuguese Restoration War.

https://en.wikipedia.org/wiki/Thirty_Years%27_War

There is a world of difference between wealth – money gained from investing pre-existing money – and income paid for labour. Tax wealth – yes absolutely. Taxing income for those paid over 250K$ will simply disincentivise some of of most highly educated, highly skilled and extremely productive workers. It will simply be yet one more reason for them to fuck off to higher paid and greener pastures overseas, depriving NZ of their much-needed skills.

But do we really need their skills? Is it that this is a commonly repeated cliche that never gets dissected into fractions? What skills, where, doing what and how does this assist us going forward? Do we need the world wide educated and experienced, who are travelling salesman for themselves? Are we a lot of naive wooden Pinnochios journeying through woods being onset by sharp foxes and hungry wolves, male and female? Ir happens quite often in li’l ole NZ/Ao you know.

Skills. Now there’s a term that needs unpacking. But agreed JS, some skills we simply can’t do without and fair enough they’re earning at the top end. And already being taxed accordingly. It’s those who don’t do much yet collect big bucks every time they pass Go, and avoid paying their fair share, we should be focusing on.

Mortgage Pain

Bankers Gain

Rolling in it

Mortgage pain: Homeowners facing repayment hikes of up to $900 a fortnight

Susan Edmunds

05:00, Feb 28 2023

https://www.stuff.co.nz/business/money/300817697/mortgage-pain-homeowners-facing-repayment-hikes-of-up-to-900-a-fortnight?cx_testId=12&cx_testVariant=cx_1&cx_artPos=0#cxrecs_s

Comments are closed.