No fucking way!

ANZ made $2billion in profits???

ANZ records first $2b profit: ‘Keeping close eye on recent home-buyers’

ANZ’s chief executive says the bank is keeping a close eye on borrowers who were stress-tested for their home loans at a rate below current market interest rates.

The country’s largest bank posted its first $2 billion annual profit on Thursday.

In the 12 months to September 30, it made a cash net profit after tax of $2.064b, up 8% compared with the year before. Its statutory net profit after tax, which includes gains and losses from economic hedges, was $2.229b, up 20%.

Net interest income was up 10%. Chief executive Antonia Watson said the 8% increase in profit was a result of a combination of pent-up economic activity after the pandemic and a buoyant housing market.

As interest rates rise and a global recession looms, NZ’s corporates continue to make disgusting monopoly rentals from our economy!

Why on earth are we not talking about the obscene wealth the NZ Banks have made over Covid?

ASB made $1.4billion in fucking profit…

ASB bank posts increased annual profit of $1.42 billion

…and the Banks collectively made $6billion in profit…

Record profit: NZ banks made over $6 billion in 2021, KPMG report

…while charging Kiwis $5billion in interest…

Banks post record profits and close in on $5 billion in interest income as mortgage costs spiral

…why aren’t we hitting them with a windfall tax so we can rebuild the infrastructure that will allow us to grow back from Covid?

Britain passed windfall tax on Gas and Oil profits, why can’t we do it on our banks?

One reason is because our debate is shallow and petty and stupid.

Right now people are bitching about Rugby NZ clashing with the Black Ferns, or Fuck Boy Island or whatever dumb shit Seven Sharp and the Project are dumbing us down with!

We are a shallow juvenile settler nation with a very low imagination horizon and all the social maturity of a can of day old coke-cola.

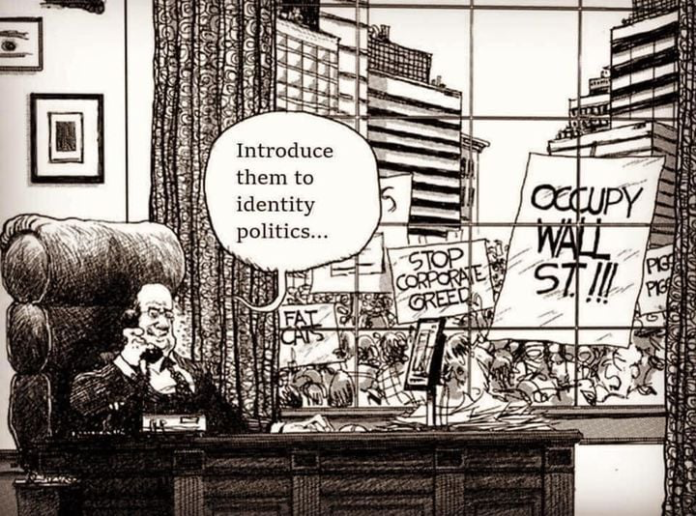

The Right ignore these obscene profits for Banks because they are the political party for Framers, Property Speculators, Bankers and rich Chinese Business interests.

The Left are too busy cancelling people for pronouns, not pronouncing Te Reo properly and not supporting Womens sport.

The Right are great at tricking poor people that their interests are the same as corporations while the Left are focused on cancelling everyone who is a heteronormative white cis male.

Meanwhile the 1% are laughing all the way to the bank.

Our brittle weakness is collectively beneath the challenge of our times.

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

If you can’t contribute but want to help, please always feel free to share our blogs on social media

Aussie banks do not help or support Kiwi’s and Kiwi business, it’s just price gouging profits out of NZ and money laundering to new residents with the NZ government not doing even the basics of regulation that OZ does.

Australian banking inquiry: Misconduct ‘driven by greed’

https://www.bbc.com/news/world-australia-45674716

No commission of enquiry of banking in NZ unlike OZ that found a lot of bank profiteering/moneylaundering and fined them. NZ government said, nothing to see here.

++ the only enquiry our government seemed reluctant to undertake.++

So-called Aussie Banks

ANZ Australia ownership

Citigroup – 41%

JP Morgan – 14%

HSBC – 18%

National Nominees – 11%

Westpac ownership

HSBC 17%

JP Morgan 13%

National Nominees 10%

Citigroup 5%

BNZ owned by National Aust. Bank

ownership

HSBC 16%

JP Morgan 12%

Citigroup 4%

National Nominees 10%

ASB owned by Commonwealth Bank of Aust.

ownership

HSBC 15%

JPMorgan 12%

National Nominees 8.5%

Citigroup 5%

Source: https://finty.com/au/research/big-four-ownership/

+1 Joseph

Can’t live without banks…also hard to live with them.

+1 Marco+Battler

Maybe better regulated banks are the answer like better regulated politicians. Trump, Boris, Liz Truss is that the best that the west can now offer? Meanwhile in Russia and China, ruling till death do us part, and what ever they decide, goes, any dissenter or difference of opinion goes.

Left should be romping home, but can’t because the woke are the pre-communist destroyers of democracy in league with the post-capitalist Trickle down globalists.

“The Left are too busy cancelling people for pronouns, not pronouncing Te Reo properly and not supporting Womens sport….

….the Left are focused on cancelling everyone who is a heteronormative white cis male”. You have described, the wokistas not the real left.

The Real Left are interested in economics, equality and class war, not skin colour and how you have sex. As for equity (total assets minus total liabilities), how can that be calculated socially?

Here is one American opinion Joseph: https://patimes.org/primer-effective-meaningful-social-equity-measurement/

Yes but the woke have overthrown the left in coups. Look at the Green Party where so many former high ranking MP’s have left. Labour have the rogernoms and the woke. The middle lefties are again pushed out of the party.

Remember this was all started by fraudulent (claiming house expenses) Bill English, the money manager ponytail fetish snake oil salesman Key( ANZ Chairman, now there’s a surprise) and Graeme Wheeler. Think of how well off and paid our health workers would be, or our hospital infrastructure would be if National had spent during their ” rockstar economy”. Think of the 1000’s of nurses trying to qualify if they knew their occupation was a well remunerated profession.

Although this the biggest year they hit 1.96 bn in 2018 as well. Let’s face it the banks have been doing well for a long time.

Comments are closed.