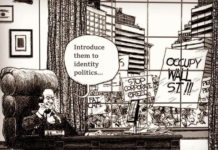

The conclave of free market capitalism have slaughtered a virgin goat and looked through the entrails and have declared inflation has peaked and we will avoid recession…

New Zealand central bank’s Orr does not expect recession

WELLINGTON, Aug 17 (Reuters) – Reserve Bank of New Zealand Governor Adrian Orr said on Wednesday that while growth would slow he did not expect a recession, adding that the central bank believed it was on top of inflation, which has hit three-decade highs.

“Through our projection period ahead, whilst we do not forecast at all a recession … we do forecast low GDP growth, below (the) potential growth rate,” Orr told a media briefing after the RBNZ hiked interest rates by 50 basis points.

…hmmmm.

This from the same people who predicted inflationary pressures were temporary in January.

Look, it would seem to me that inflation is still cripplingly high and the latest Covid modelling shows we are still in for economic pain from having so many people sick, plus the impact of China’s economic slowdown and zero covid policy impact on supply chains, alongside severe climate crisis impacts on the economy alongside Putin strangling gas off to Europe in December.

None of this looks solvable by Orr and he must use the 75 point jump next month to spook the attention of the markets before the real impact of the war in Ukraine kicks in at the end of the year.

Orr’s bedside manner is calming the markets, it’s not convincing them.

We have an enormous way to go…

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

If you can’t contribute but want to help, please always feel free to share our blogs on social media

Orr’s ‘bedside manner’, is akin to having offered his guests a free lunch and a smorgasbord at the same time, he wonders why the guest has so grossly overeaten and has had to retire to bed with a distended and painfilled stomach. Now he offers a glass of water.

Here’s the oil. Construction is set to slump by 75% by the close of the year due to a combination of labour shortage, price inflation and lack of demand. When that occurs what else powers domestic consumption in new Zimbabwe as retail and tourism are already poked. What they are hoping is Biden’s Hail Mary pump and dump stimulus will keep the wolves at bay – it won’t.

So you’re admitting that this largely white dominated economic construct is going to turn NZ into the new ‘Zimbabwe’? Please verify!…

So there is a labour shortage but no demand for projects?

Here’s the oil from Frankie the “snake oil salesman “.

The end of the world is nigh, you heard it here first. Meanwhile in the real world house prices have dropped, those unwise enough to buy in an overinflated market will suffer, sadly this can happen with any investment.

Reserve bank policy is to treat inflation sourced from overseas by supressing domestic demand. Its a bit like burning down the hospital and then claiming that health is better since less people are receiving treatment. This was true during the GFC when they managed to put the economy into recession 6 months before the rest of the world. That was to reduce the risk of bad loans caused by increasing interest rates, the solution to which ,oddly is to incease interest rates. In the past, much of the erosion of wages in NZ has been the bank ‘dabbing the brakes’ as soon as wages started to rise even where ‘productivity’ had improved. The result over time has been slowly rising prices and slowly decreasing real pay. It will be no different this time unless we find a different solution. we need higher value jobs. Our current economy doesnt deliver them. we need to change.

Orr won’t do that. He would sooner do two sets of 50 basis points, one in Sept and one in Oct. He wants a more gradual slowdown, not an abrupt jolt.

In any event I would have thought you would prefer a more gradual approach. The Left have been complaining for nearly 40 years that part of the problem of the 1980’s reforms is that they were too abrupt, displacing too many low skilled workers.

New Zealand will shortly be getting a big increase in inwards migration, including temporary work visas. This will affect the labour market, in that it will be less tight. That will also mean less pressure on wages.

An abrupt increase in the OCR will dampen demand. Coupled with an increase in the number of workers, that would make things quite difficult.

I have to say it’s ironic that we have people ramming down our throats how the rest of the world has “moved on” from COVID. Unfortunately it doesn’t include the parts of the world where everything is made.

Are you really convinced Putin will shut off the gas? He has to pay for his war. In fact so many comments on TDB rave about how Putins mighty military will be victorious and the Ukrainians have no show. Why would Putin need to bother cutting his income sources? Or is the Russian economy not doing quite so swimmingly as people have been saying.