So 1.25% increase within a year – that’s pretty steep…

Reserve Bank leaves OCR unchanged: Kiwi dollar soars on inflation outlook

The Reserve Bank has left the official cash rate unchanged at a record low of 0.25 in its latest Monetary Policy Statement.

But it now has forecasts which imply it will begin hiking rates in the second half of next year.

The decision to keep the cash rate on hold was widely expected by economists.

Reserve Bank Governor Adrian Orr said the RBNZ saw inflation reaching 2.6 per cent in the second quarter of this year.

…this matters because of the enormous debt we have…

Small increase in OCR will hit mortgage-holders hard – economist

“The flipside is that someone pays,” said Bagrie. “So if ANZ is correct and we get 100 basis points’ worth of OCR increases in the next 30-odd months, you’re going to see the likes of a one-year fixed mortgage rate go from 2.25 to 3.25 percent. [That’s] still really, low, still really cheap money, but that’s about a 45 percent increase in your interest bill, and that’s not a small number.”

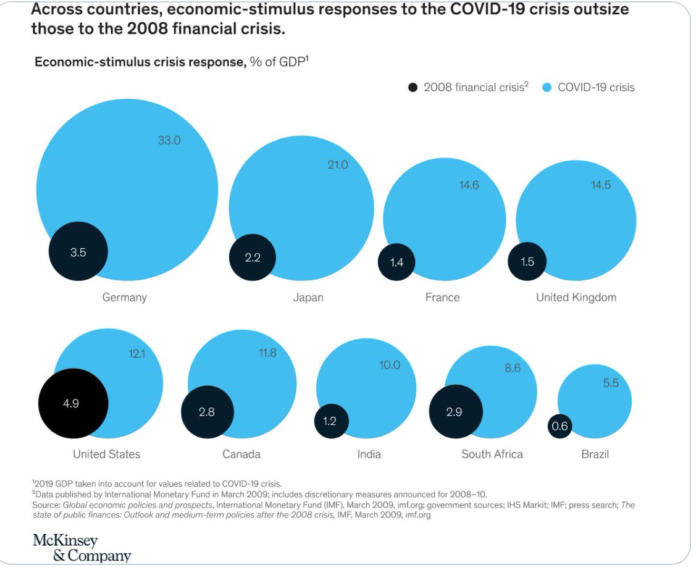

…Covid has seen the main banks of the West sink trillions more into quantitive easing to deal with the economic whiplash the pandemic has created and in NZ we saw with the pumping of billions into the pockets of property speculators how our own house prices have skyrocketed.

This game of printing money to pump into property and stock market speculation to create a false illusion of wealth can continue playing as long as hyper inflation doesn’t overturn the apple cart.

But what happens if it does?

‘Perfect storm’: Cost of living rises 0.8 percent, tipped to increase further

Household living costs rose 0.8 percent in the March 2021 quarter, the latest Statistics New Zealand Consumer Price Index survey shows.

Consumer prices are on their way up, as petrol, transport and rent are becoming more expensive.

What happens if hyper inflation does suddenly explode out of nowhere?

To date all the inflationary pressures caused by this mass printing has led to driving up property prices and stock markets without touching the essentials and basics of life, but one of the impacts of Covid has been to shut down the global supply chains which is now creating scarcity of products that can’t get to market because they are bottlenecked at a Port.

This seems insanely dangerous because all those hyper inflation pressures will immediately jump to the very basics everyone uses.

Your Kiwisaver going up and your property value climbing is one thing, paying $15 for a loaf of bread and $20 for milk is completely another.

To date the cost rises have been in things poor people have to pay, transport, rent and gas. That means food will be cut, hungry people get angry quickly.

There are already arson attacks on Landlords…

Auckland house fire blamed on frustration over skyrocketing rents

A resident of a street where an empty house went up in flames on Saturday morning thinks someone angry about the housing crisis could be to blame.

…after every great pandemic throughout history, the peasant revolt in the 1300s, the London riots of the 1600s and the social unrest right after the Influenza pandemic of 1918, society always goes through intense social change brought on by the economic collapse lockdowns generate.

If the bottlenecks of supply chains are blocked unleashing a tsunami of hyper inflation on the goods everyone requires for life, Central Banks will have no choice but to lift inflation rates to desperately attempt to curtail that hyper inflation, which of course will mean the ocean of low interest debt that has been created to fuel hyper speculation will suddenly start feeling the true gravity of trillions in borrowing.

This is the new ‘normal’. Constant eruptions of external global disruptions that cause widespread damage. The climate crisis will simply exacurbate these economic meltdowns.

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

If you can’t contribute but want to help, please always feel free to share our blogs on social media

The peasants are getting restless…

Well, we all might end up like this wee doggie…

Sausages and Custard

https://youtu.be/45J3tOlrONY?t=5

Rag and bone man times are coming.

Comments are closed.