Harford said Kiwis should expect price increases.

“There are significant inflationary pressures building, as the cost of procurement and freight increase, and the cost of employing staff goes up.

“Around two-thirds of Retail NZ members expect to see prices increase over the next quarter.”

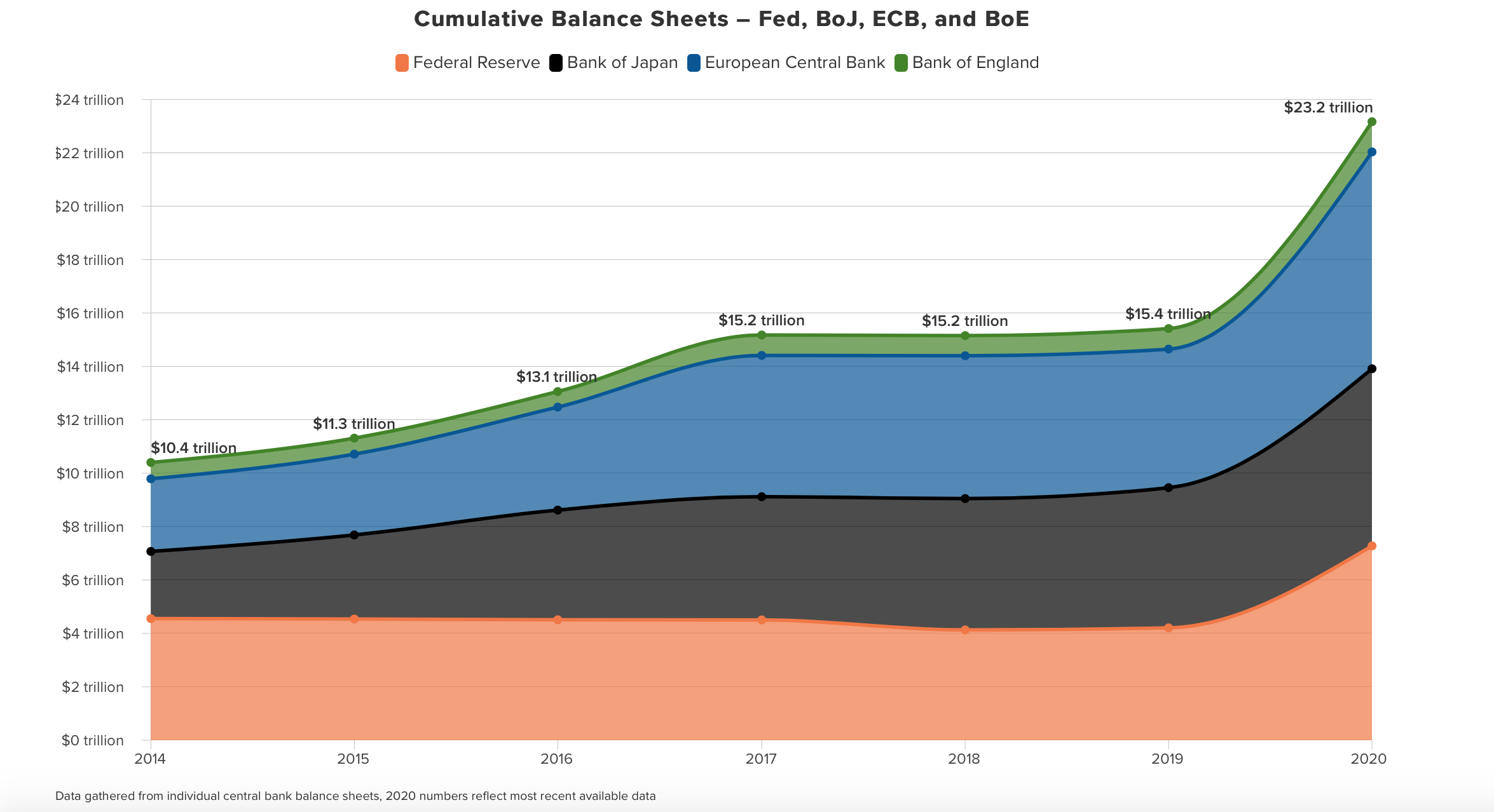

One of the great surprises in modern economics was that the avalanche of quantitative easing used to save the global economy from American Corporate bank greed in the 2008 financial meltdown didn’t create an explosion in hyper inflation in the day to day lives of ordinary people.

Because of the ease of global labour supply, wages didn’t increase, prices of goods stagnated, inflation disappeared but it did create the false conditions for the lowest interest rates in 5000 years, and saw all that quantitative easing balloon into speculative house and stock prices.

Covid has seen the main banks of the West sink trillions more into quantitive easing to deal with the economic whiplash the pandemic has created and in NZ we saw with the pumping of billions into the pockets of property speculators how our own house prices have skyrocketed.

This game of printing money to pump into property and stock market speculation to create a false illusion of wealth can continue playing as long as hyper inflation doesn’t overturn the apple cart.

But what happens if it does?

What happens if hyper inflation does suddenly explode out of nowhere?

To date all the inflationary pressures caused by this mass printing has led to driving up property prices and stock markets without touching the essentials and basics of life, but one of the impacts of Covid has been to shut down the global supply chains which is now creating scarcity of products that can’t get to market because they are bottlenecked at a Port.

This seems insanely dangerous because all those hyper inflation pressures will immediately jump to the very basics everyone uses.

Your Kiwisaver going up and your property value climbing is one thing, paying $15 for a loaf of bread and $20 for milk is completely another.

The ocean of debt the private and public sector have taken on is jaw dropping…

World’s $281 Trillion Debt Pile Is Set to Rise Again in 2021

The world has never been more indebted after a year of battling Covid-19. And there’s even more borrowing ahead.

Governments, companies and households raised $24 trillion last year to offset the pandemic’s economic toll, bringing the global debt total to an all-time high of $281 trillion by the end of 2020, or more than 355% of global GDP, according to the Institute of International Finance. They may have little choice but to keep borrowing in 2021, said Washington-based director of sustainability research Emre Tiftik and economist Khadija Mahmood.

…now imagine a jump in hyper inflation kicked off by supply side dynamics, I’m no economist, but that looks like a bubble of unprecedented dimensions that would plunge the planet into mass economic turmoil.

If inflation starts, banks will have to lift interest rates on all that debt!

This looks less like a black swan and more like a black hole.

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

If you can’t contribute but want to help, please always feel free to share our blogs on social media

After many years of sinking (being pushed down) to unprecedented lows, US 10 Year Treasuries have risen from 1.10% in January to 1.72% last week. That doesn’t sound much but the effect is to wipe billions of dollars off balance sheets.

The financial tsunami has been thundering up the beach since September 2019 (when the US repo market seized up) and nothing is going to stop it because all the fundamentals that underpin the financial markets have been either been ‘fraudified’ or consumed.

I’d better quickly rehypethecate the old bicycle outside and see if I can use it as a deposit on a brand new BMW at ‘nothing to pay for the first year’.

Kunstler’s got is sussed:

‘Alas, the psychology of previous investment tends to dictate that societies pound their capital — if they still have any —down a rat-hole in the vain and desperate attempt to keep old rackets going,’

https://kunstler.com/clusterfuck-nation/paradigm-failure/

Here comes the inflation…

It keeps gettin gloomier, time for a little sunlight…

The Beatles – Here Comes The Sun

https://youtu.be/KQetemT1sWc?t=12

This old worlds in for more shite yet…

The problem for little Aotearoa is we are exposed like no other western country. While most western democracies have a large domestic economy or part of a large trading bloc we have neither. That is why stagflation (coupled with our lack of social cohesion) would be such a killer.

Why do you think Clark, Key (the master) and even Grunter and the Blairite using an Asian immigration ponzi scheme? To mask our structural economic weaknesses that politically are ‘too hard’ to fix.

The costs a business owner needs to allow for in the last year have been ramped up by this government . A minimum wage increase means a similar increase to many other workers to hold the extra margin they have gained through experience.

Added to this are extra sick leave a extra public holiday and family harm leave . That is just one area of cost added to that the flow on of extra transport cost both TO NZ and locally and rents and we have a hefty price increase in the pipe line to stay afloat.

The costs a business owner needs to allow for in the last year have been ramped up by this government . A minimum wage increase means a similar increase to many other workers to hold the extra margin they have gained through experience.

Added to this are extra sick leave a extra public holiday and family harm leave . That is just one area of cost added to that the flow on of extra transport cost both TO NZ and locally and rents and we have a hefty price increase in the pipe line to stay afloat.

There is inflation in almost everything, except gold and silver (those markets are notoriously manipulated).

https://finviz.com/futures.ashx

Especially have a look at lumber (you know, the stuff we need to build houses with) futures:

https://finviz.com/futures_charts.ashx?t=LB&p=w1

Basically up over 300% over the last year!!!

A Few Know the Truth cites the 10 Year, but I’m not really seeing a lot of movement in there:

https://finviz.com/futures_charts.ashx?t=ZN&p=w1

It spiked over the last year during CoVid, but is now back where it was this time last year:

https://finviz.com/futures_charts.ashx?t=ZN&p=d1

“Bondzilla” just isn’t going to happen any time soon imo.

We will probably have to wait till the Biden ‘stimulus’ package falls flat on its face later this year. $1.9 trillion of empty promises is quite a lot. But as CHS pointed out a few weeks ago, they might then try $3 trillion, and then $5 trillion…$10 trillion…$20 trillion…

But it really doesn’t matter how big the sticking plaster is when the patient has terminal cancer and extensive gangrene.

Oh for sure. The ludicrous marriage of giant corporations and government, where the former constantly requires the latter for “stimulus”, is not a sustainable system. Ironically it’s the very opposite of “capitalism”, where the weak are meant to fail if they’re not working in the current climate in order to make way for better ideas to suit current realities. Now nothing is allowed to fail, so the same tired corporate ideologies (i.e. profit at any cost) are effectively mandated by the jackboot of the government.

“I’m no economist, but”, well that means you know more than economists, because what economists “know” is of negative value and truth.

Socialism has failed.

Relax, in this turn of events such as hyper-inflation, it is simple to control.

Wipe debt. Remove the trading banking sector, shut down the insurance sector and stop all gambling on the stock exchange.

Nothing is to difficult to deal with, if your bold, honest and put people before greed.

‘bold, honest and put people before greed.’

Aren’t you highlighting traits that have been entirely missing from the political spectrum since the time of Norman Kirk?

Anyway, the powers that be have already made it abundantly clear what happens to anyone who seriously challenges the rort-come-exploit system, as per Goff Whitlam.

The future will be characterised by more of the same shit, maybe delivered with a frown instead of a smile. But definitely more of the same shit -until the system implodes as a consequence of its own inconsistencies, contradictions and failings.

Comments are closed.