One year on from lockdown and we have slumping GDP…

Grant Robertson: GDP result shows economic turbulence will be here for a while

…warnings that it will take years before the border will reopen…

…Westpac rats jumping ship…

…all the while the spectre of inflation over the ocean of debt represents a global threat to economic stability.

This all at the same time the Covid Pandemic still threatens with mutations and uneven vaccination roll outs to over throw all the sacrifices and gains.

Will the global economy have a Suez canal moment?

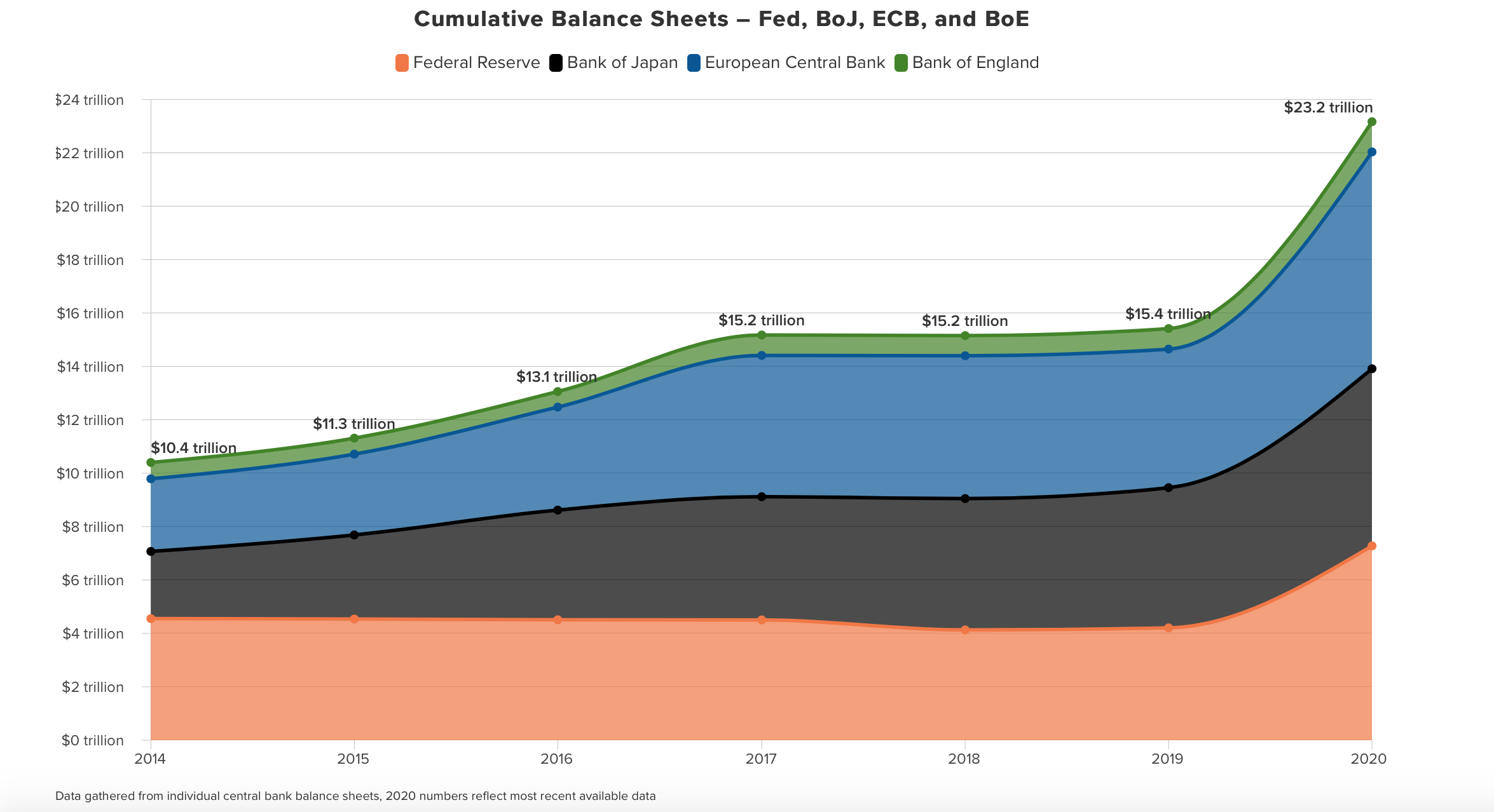

One of the great surprises in modern economics was that the avalanche of quantitative easing used to save the global economy from American Corporate bank greed in the 2008 financial meltdown didn’t create an explosion in hyper inflation in the day to day lives of ordinary people.

Because of the ease of global labour supply, wages didn’t increase, prices of goods stagnated, inflation disappeared but it did create the false conditions for the lowest interest rates in 5000 years, and saw all that quantitative easing balloon into speculative house and stock prices.

Covid has seen the main banks of the West sink trillions more into quantitive easing to deal with the economic whiplash the pandemic has created and in NZ we saw with the pumping of billions into the pockets of property speculators how our own house prices have skyrocketed.

This game of printing money to pump into property and stock market speculation to create a false illusion of wealth can continue playing as long as hyper inflation doesn’t overturn the apple cart.

But what happens if it does?

What happens if hyper inflation does suddenly explode out of nowhere?

To date all the inflationary pressures caused by this mass printing has led to driving up property prices and stock markets without touching the essentials and basics of life, but one of the impacts of Covid has been to shut down the global supply chains which is now creating scarcity of products that can’t get to market because they are bottlenecked at a Port.

This seems insanely dangerous because all those hyper inflation pressures will immediately jump to the very basics everyone uses.

Your Kiwisaver going up and your property value climbing is one thing, paying $15 for a loaf of bread and $20 for milk is completely another.

After every great pandemic throughout history, the peasant revolt in the 1300s, the London riots of the 1600s and the social unrest right after the Influenza pandemic of 1918, society always goes through intense social change brought on by the economic collapse lockdowns generate.

If the bottlenecks of supply chains are blocked unleashing a tsunami of hyper inflation on the goods everyone requires for life, Central Banks will have no choice but to lift inflation rates to desperately attempt to curtail that hyper inflation, which of course will mean the ocean of low interest debt that has been created to fuel hyper speculation will suddenly start feeling the true gravity of trillions in borrowing.

I’m no economist or financial guru, but it seems the basic laws of capitalism’s supply and demand will unleash a terrible tsunami of hyper inflation that the Global Reserve Banks will struggle to contain in any other way than to allow stock markets and house prices to shatter and crash by forcing interest rates back up.

Now if a vaccine can reach the 75% herd immunity threshold, those supply chains will reopen, but if we don’t gain that herd immunity, quarantine will continue to force those supply chains closed and the prices of scarce ordinary goods will start to dangerously inflate.

I fear all our Black Swans are coming home to roost in 2021.

The economic depression this pandemic causes is the second wave of this tsunami after the lost lives. The Government has protected us from the first, it now must focus on the latter and that will demand a Labour Party brave enough to challenge the sleeping dogs of the neoliberal debate that almost destroyed the Party in the 1980s.

The foundations of the 35 year neoliberal experiment in NZ have been exposed an found to be cracked to their core, with the climate crisis demanding a radical change, this pandemic is the perfect time to challenge the religious orthodoxy of free market dogma.

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

If you can’t contribute but want to help, please always feel free to share our blogs on social media

I think we can all relax with Labour in charge. Nobody knows more about economy than Jacinda and Grant. Their real worl experience will come in handy now.

uuumm…. let me see….who did we have before ??… hmmm….that’s right…. a spoilt 3rd generation farmer and a crooked money trader…very worlDly indeed !!

Gee Grant ! Wow? You’re quite awesome. Your instinctual political prowess is as impressive as your spelling.

Clearly you think deeply and approach all subjects with a level of calculated objectivity.

Wee bill english is a traitor and a liar. Surely, farmers are entitled to have one or two of those as well?

Or do you think ‘that type’ should only be found within lawyers, accountants, bankers, real estate agents, media people and the general greedy rabble who scramble for farmer money and the foods they produce then, as you have done, stab good farmers in the heart with a weak little snipe about wee billy the traitor?

jonky is a manipulative opportunist. He saw a pool of free and easy export derived money which is farmer-earned, you can’t deny that, and simply decided to dip into it as his education and his city banker connections readily enabled him to be able to do. A well educated pathological sociopath like jonky is a very dangerous little fellow and we should never forget him and we should never take our eyes of him and we should be forever vigilant for the likes of him sniffing around our pantry door.

Adern and Robertson. They’re fucked. No matter what they do, think, attempt or try, they’re fucked under this particular regime or historic greed.

Any idea they come up with in regard to our ‘economy’ is dead before it’s hatched. A still born turkey.

If they’re genuine, and I must assume they are because the alternatives are just too boring and tiresome to countenance, they’ll find themselves trapped within a ghastly, labyrinthine maze of lies and deceit spanning generations. In there, they’ll see a freak show of lazy crooks who’ve built about them a thin membrane of respectability to hide behind to keep us unquestioning and under their thumb as they siphon off export earned farmer money while we suffer ever more indignities and humiliations that only poverty can provide.

That’s why a paradigm shift in our politics, or at the very least to entertain the idea of a different view of all things political is essential. To keep doing the same thing while expecting a different result is, according to Einstein, the very definition of madness.

Adern? Robertson? I hate to say this but there’s no easy way for you to do what you must do.

The foreign owned banks must go forever. ( Example: Westpac? Good riddance. Fuck off! But before you go? Give us AO/NZ’ers our fucking money back? And how, exactly, did you become our governments bank? Who brokered that deal? Who were the politicians who enabled that cash-cow opportunity at our expense to you? )

Write off all mortgage debt. All of it. Then introduce a massive capital gains tax on all house sales barring the family home.

Sure! That’d cause wailing and moaning and the gnashing of teeth but it’d get people into affordable housing and reduce the madness-causing over -work distress that leads to societal dysfunction and drug abuse too. Working three or four days a week while living in a mortgage free house while enjoying nationalised electricity, public transport and eating world first foods instead of watching watties can it then flog it off to the Aussies? Wouldn’t that be better than what we have? This shit? This fucking nightmare in Paradise?

Martyn Bradbury thinks Auckland’s AO/NZ’s economic powerhouse.

It isn’t.

Our economic engine room is in the sparsely populated countryside where about 52 thousand people earn our money.

Let that sink in…. ?

True….there are silver-spooners and ticket-clippers everywhere ….. they have no idea about the real world and should not be allowed anywhere near Parliament, but for whatever reason, a reasonable portion of them end up there…Bill English just happened to be a farmer and the previous Governments’ Finance Minister… not my fault.

She did work in a fish and chip shop and studied under Blair .I donot know where she would have learnt the most

You say that you are not an economist. Therefore you are ahead of economists because what they “know” is of negative value. Economic “science” only deals with failed theories.

Yeah, while everything you say it true, it just doesn’t turn out that way. The US still has the “Petro-dollar”, which, when combined with most other commodities, sees its “value” guaranteed since it is the only currency you can use to exchange these essential goods. Further, Japan has been running this seemingly unsustainable monetary policy (i.e. MMT) for three decades now and have not seen a hyperinflationary event, despite their now eye-watering 235% debt:GDP ratio (the US is less than half that, NZ about a quarter!). As long as people continue to work to support current economic policy, a fiscal collapse can’t really happen imo.

Maybe the penny is dropping. Capitalism is in its Terminal Crisis. It is already well underway.

The alarms bells have been ringing for a long time because while capitalism was able to recover briefly (relatively) from the massive destruction of the 1930s great depression plus WW2 by destroying enough capital assets and the lives and livelihoods of workers to ramp up the post-war boom.

Since the end of that boom in stagflation (which proved that Keynesianism was a flop) the global economy overall has stagnated relative to the rate of profit in the boom. Even at the height of the neoliberal period in the 90s there was no return to the post-war rate of profit.

So after 60 years of stagnation punctuated by the Asian crisis, the tech bubble, the subprime crisis we are now in another massive crisis that fuses into one earth-mother of all crises, global warming, pandemic, and economic crash.

Terminal crisis means that capitalism cannot recover even briefly by the usual means of depression and war that destroys enough capital (natural and human (which are really the same) to drive down its costs to enable a return to capital accumulation.

This is what Marx meant when he talked of capitalism being its own worst enemy. In the last analysis capital would destroy nature and in doing so it would destroy itself.

I challenge you to find any theory on the left that can grasp the historic enormity of this terminal crisis other than Marxism.

We face extinction without a revolution that puts control of the global economy into the hands of the working majority capable of reversing global warming and rapidly returning to a symbiotic relationship with nature.

There is no time left to hope that the existing state institutions devoted to the dying system will take over banks, key corporates, land use, energy etc.

What we need is mass occupations, an indefinite general strike to create a provisional government of workers and other oppressed sections of society to bring about the immediate socialisation of land, labour and capital.

This is what we need to be debating while are yet not in jail.

You have overlooked the energy crisis i your list of ‘headwinds’, Martyn.

Conventional oil extraction peaked around 2007, and the operators of the Ponzi scheme got over that hurdle by pouring mega-billions into fracking; although most fracking companies have made no significant money, the oil and condensates that came out of the ground did mask the effect of the peaking of conventional oil extraction.

According to both Gail Tverberg and Tim Watkins, that particular game is over and we can look forward to declining oil energy availability. Forever.

https://ourfiniteworld.com/2021/03/20/headed-for-a-collapsing-debt-bubble/

https://consciousnessofsheep.co.uk/2020/11/06/the-narrative-problem-after-peak-oil/

nail. head. but you can always buy another rental with leveraged debt on expectations of inifinite growth on a finite planet – I’m not holding my breath until SpaceX start towing in asteroids made of gold, copper and nickel – lol – we’ll all be rich

Yes, lets ”challenge the sleeping dogs of the neoliberal debate”.

A give em a good swift kick up the rumps.

Please let us get some understanding of fiscal reality. So called ‘printing’ of government funds is a fact of modern life every day. Inflation can only be caused by how you spend that money. Inflation need not be general, but can affect specific areas of the economy. This is what has happened in the housing sector – stupid action by the Government allowing banks access to funds for lending to speculators and others. The Government debt (to its own bank! The Reserve Bank. That is debt to itself!) never needs to be repaid. The worst thing Government can do is NOT to generate and spend money to solve massive social problems. Please get up to date with MMT. Read Bill Mitchell and other modern economists.

Hilarious!

‘Inflation can only be caused by how you spend that money.’

Perhaps you can explain that to people whose incomes have stagnated whilst prices have risen to the point they now cut down on food and heating.

The fact is, entire money ediface is kept alive in the short term by the looting and polluting of the environment and repression of interest rates. The repression of interest rates is failing, as risk increases and more and more enterprises go belly-up.

None of the theories of ‘modern economists’ stand up to scrutiny; of particular note is their total ignoring of the primary role fossil fuels play in the economy -it doesn’t even enter into their ‘equations’- and their ignoring of the increasingly dire effects of the accumulation of pollution all around the world, even in Artic snow -everything from packaging that is overloading land fills, to monstrous amounts of plastic floating round the oceans and being deposited on beaches to microplastics that are in the bloodstreams of humans and which are carriers and resevoirs of toxins within human bodies, leading to yet to be determined consequences but already linked to developmental abnormalities; we might also note that whilst air pollution is primarily an Auckland and Christchurch phenomenon in NZ, in other parts of the world air pollution is already directly causing severe health problems are premature death.

The biggest one of all is atmospheric CO2, which is in the process of rendering the Earth uninhabitable to life-as-we-know it.

What is ‘modern economists’ answer to any of that: print more money via computer system to stimulate economic growth!

This will supposedly provide the funds necessary to tackle the pollution ‘problems’ we haven’t had the money to tackle up till now.

Never forget that ‘modern economists’ still use and advocate GDP, an entirely dysfunctional measure of economic activity that rewards inefficiency and production of waste!

Modern economists are, in my opinion, amongst the most nutty people on this planet, and far more dangerous and life-threatening than the nuclear industry.

Perhaps the biggest driver of inflation will be due to the shortage of semiconductors, that are a fundamental part of so much technology that we utilise today.

https://www.theguardian.com/business/2021/mar/21/global-shortage-in-computer-chips-reaches-crisis-point

It’s worth noting that the basket of goods that makes up the CPI is now weighted towards tech more than ever, as we enjoyed a period of food overproduction at the expense of the environment, as well as global pandemics, and spent more and more on phones, smart TVs and iPads.

Not to mention oil.

And on top of all this, the cost of existing homes, land and the cost of servicing a mortgage was removed from the CPI in the 90s.

So now we are going to see increasing inflation, which will lead to increasing interest rates (you need to correct your article there Martyn) and a corresponding collapse in asset prices.

Personally I think it is all stage managed by the elite. Every economic collapse we have they do very nicely thanks.

And another excuse to tighten government control over our lives to quell upcoming revolution.

Bomber on a unrelated subject our cruelty knows no bounds when it comes to all living creatures not just human !!!

The Guardian has reported that 20 live export ships are delayed, due to the stricken container ship Ever Given, which is currently blocking the Suez Canal. If the situation isn’t resolved, thousands of animals could be killed.

SAFE CEO Debra Ashton said it’s the latest in a series of live export crises.

“It’s unforeseen circumstances like this that make live export so risky,” said Ashton. “And it adds to our concerns for the welfare of animals in the live export trade.”

“Disease, bad weather, and shipping delays can all leave animals stranded at sea.”

Thousands of animals were recently stranded in the Mediterranean on board the livestock ships Elbeik and Karim Allah. Both were bound for Libya, but following an onboard outbreak of the viral disease bluetongue, they were refused entry at multiple ports. Many of those animals have now been slaughtered.

“New Zealand had its own live export crisis last year, when the Gulf Livestock 1 sunk off the coast of China,” said Ashton. “It won’t be the last crisis.”

“The Government is currently considering the future of live export in New Zealand. It is imperative that they ban it.”

Bomber on a unrelated subject our cruelty knows no bounds when it comes to all living creatures not just human !!!

The Guardian has reported that 20 live export ships are delayed, due to the stricken container ship Ever Given, which is currently blocking the Suez Canal. If the situation isn’t resolved, thousands of animals could be killed.

SAFE CEO Debra Ashton said it’s the latest in a series of live export crises.

“It’s unforeseen circumstances like this that make live export so risky,” said Ashton. “And it adds to our concerns for the welfare of animals in the live export trade.”

“Disease, bad weather, and shipping delays can all leave animals stranded at sea.”

Thousands of animals were recently stranded in the Mediterranean on board the livestock ships Elbeik and Karim Allah. Both were bound for Libya, but following an onboard outbreak of the viral disease bluetongue, they were refused entry at multiple ports. Many of those animals have now been slaughtered.

“New Zealand had its own live export crisis last year, when the Gulf Livestock 1 sunk off the coast of China,” said Ashton. “It won’t be the last crisis.”

“The Government is currently considering the future of live export in New Zealand. It is imperative that they ban it.”

Comments are closed.