Our lives have been hijacked by billionaires.

They cream off the wealth we create and leave us and our families struggling.

Most of us work longer hours for poor pay in insecure jobs. We have less money, less choices and face lives of increasing struggle. Most of our children will never own a home and face bleaker life chances than us today.

Meanwhile the billionaires are using their wealth and dominant political influence to make obscene piles of cash at our expense. They have overwhelming influence over our main political parties which plead for their corporate donations to run election campaigns. The billionaires have decided the policies before we even cast our votes.

At their behest successive governments have asset-stripped our economy, run down our public services, changed laws to suit the corporates and told us there is no other way.

The billionaires own most of our media – filling our lives with empty celebrity culture, narrowing our vision of ourselves and dumbing down our capacity to fight for meaningful change.

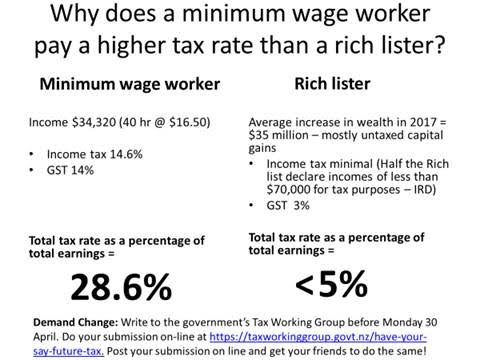

And they don’t pay their share. Billionaires pay lower tax rates than the rest of us.

We must break the billionaires grip on our economy and on our lives.

Here are two things you can do now:

- Write to the government’s Tax Working Group to say you’ve had a gutsful of these high-earning tax dodgers and demand the billionaires pay their share.

- Post your submission to your friends on-line and ask them to do the same. We need a tsunami of messages demanding change.

You have one week to act. Submissions close next Monday 30 April.

Do your submission on-line now here.

Make your own arguments for change but here are a few tax changes I’m suggesting would be a strong start to pushing back the billionaires and loosening their grip on our economy and our lives.

- Firstly a Financial Transactions Tax (set at around .01%) which taxes all money going through our banks. This won’t be noticed by any of us day to day but will bring in large sums of money from corporate billionaires and speculators who move billions in and out of New Zealand every day. This tax would replace GST – a vicious tax on low incomes.

- Secondly, a comprehensive Capital Gains Tax which would tax the unearned income of the wealthy and the super-wealthy. Wage and salary earners can’t avoid tax. We are taxed on every dollar we earn and every dollar we spend. Why not the billionaires?

- Thirdly, we need a much higher top tax rate – currently we have one of the lowest in the world. Why should corporate CEOs pay just 33% on their vastly inflated salaries in tax when much more is demanded in other countries? (Eg Denmark 55.8%; Australia 49%; USA 46.3%; France 54%; UK 45%)

Don’t leave it to someone else. Make your submission today and post it on-line.

Will do

D J S

Inequality is growing inexorably throughout the Western world in particular, and has been since 1970..But John Minto is being too neo- liberal here. Given the finite resources of the planet,the wealth of the billionaires/Oligarchs/1% needs to be stripped from their grasping greedy hands and redistributed for the benefit of the people. What would our housing, hospitals, and schools look like if this was done? However ,I must admit what he proposes is a good interim step!!

‘Our lives have been hijacked by billionaires.’

Our lives have been hijacked by sociopaths

Our lives have been hijacked by economists.

Our lives have been hijacked by banks.

Sadly, the ‘submission’ process has also been hijacked or is totally ineffective, and ‘The billionaires have decided the policies before we even cast our votes’.

Much as we would like to see equity and justice and sustainability, the system will not allow such things because it operates for the benefit of banks, corporations and billionaires.

Good luck trying to change that. And good luck trying to wake people to their predicament.

Sadly I think we are going to have to wait for the pitchforks to appear. The media is owned and the majority are watching MAFS or whatever shit is on the other channel. I’ll write a submission but it is another half hour of my life I won’t get back, probably be better off sharpening the pitchfork.

The Bankster gangs, and their bi-product billionaires, are the enemy of us,us NZ/AO’ers. They’re the enemy of all life on our planet. They’re the enemy of all art and culture. They’re the barrel of the gun that takes aim at the naive and innocent. They’re liars, cheats and crooks and will MSM head-fuck you into unnecessary debt until you work yourself into your grave.

NZ/AO’s foreign banks absolutely must go. Immediately, and be asset stripped on their way out as we close the door on their reign of terror here. And those few Kiwi traitors who sold us out to them MUST be made to atone so as we can have societal closure and move on.

If I had one or two words of advice for young people, they’d be only bank with wholly NZ/AO owned banks in the short term while a responsible government would take steps to heavily regulate even them.

Concise and insightful Post IMV @ John Minto.

Words of advice for young people. W Burroughs

https://youtu.be/8wj21sYKkk0

Would it make sense if Financial Transactions Tax started on transactions of 5K and above?

the middle class (income earners) have lot to answer to they are the ones doing the dirty work for the very rich

‘The greatest crimes of human history are made possible by the most colorless human beings. They are the careerists. The bureaucrats. The cynics. They do the little chores that make vast, complicated systems of exploitation and death a reality. They collect and read the personal data gathered on tens of millions of us by the security and surveillance state. They keep the accounts of ExxonMobil, BP and Goldman Sachs. They build or pilot aerial drones. They work in corporate advertising and public relations. They issue the forms. They process the papers. They deny food stamps to some and unemployment benefits or medical coverage to others. They enforce the laws and the regulations. And they do not ask questions……..’

https://www.truthdig.com/articles/the-careerists/

This video suggests the rich have stolen, with fake news reefer madness a very much brighter future for our planet. And the present politician can’t admit to the mistake so it seems to be were we are headed in the other direction.

https://www.youtube.com/watch?v=0ebz9OuYLL0&t=877s

This reminds me of the game of monopoly. Once the other person has all the best real estate and train stations you are cast into debt forever and there is no way out. I hate monopoly.

The UK has a system whereby all rich-listers are assigned a personal tax inspector in an attempt to get the billionaires to pay their fair share. Each tax inspector is transferred to a different rich-lister every two years to ensure that no unfair or biased relationships develop between the rich

lister and their tax inspector.

According to the UK IRD, the scheme has been a great success and has added billions of pounds to the UK Treasury for a relatively modest outlay. Why not try same scheme here in NZ? The idea that rich-listers are able to manipulate their declared incomes down to below $70,000 is an insult to all honest NZ taxpayers and shouldn’t be tolerated.

A very thourough and useful set of constructive thinking on this subject:

https://taxworkinggroup.govt.nz/…/twg-subm-bgrd-paper-mar18…

and a good example of why we need a democracy such as we have in New Zealand to allow for this sort of process.

Not many, I included, have either the time or the requisite knowledge to grapple with these issues substantively and so I will continue to vote for the politicians who allow this caliber of advisors to help filter the complexities honestly.

Although John’s three tax suggestions sound very useful, they may miss the most important long-term issue the Government should seriously contemplate: a set of environmental taxes that discourage intensive farming. Not just Dairy but all exploitation of natural resources as monocultures, for example mussel farming and scallop dredging).

In theory, the policy looks fine. But the question is, will it ever get past muster in NZ with the political partys & politicians? Probability? less than 0.01%.

I think a straight adoption of the Nordic model taxes & system would be good.

The article isn’t cited. Anyone who owns a company pays themselves $70k. Why?

It makes tax returns easier. Yes you can declare income subject to PAYE to be $70k. That doesn’t mean that is the only tax you pay.

If a business makes money, 28% is paid in tax. If a business makes $5m in profit and distributed it to a single shareholder who also received a salary of $70k the owner would 1. Have already paid tax of 28% and 2. would compete a tax return and pay an extra 5% in tax because the effective tax rate as you approach $5m becomes ~33%.

Acting like the rich capital owners do not pay tax is a blatant lie.

The author of this article should be ashamed for spreading misinformation.

IRD busted dentists for only declaring a $70k income & splitting other income into family trusts. Its prolific.

What if the only way to keep 7.6(?) billion people alive is that we have to have all these utter bastards running the show?

Like if the bastards weren’t screwing over most of the countries that have resources to extract IE – OUR fertilizer (think bird poo) to all the oil NZ uses to maintain our present living conditions (of which admittedly aren’t that shit hot for most of us).

I mean what thanks have we given say the Iraqi’s ? No fing thanks, just aided the US to murder them instead.

And if everyone had dollars to spend the environment would be even more screwed, picture 7.6 billion 20 degree C temp bedrooms, all with TVs and hot and cold water, and 3 cars in garage.

3,858,000 vehicles in New Zealand in 2015, so for NZ that is nearly a vehicle per person times that by 7.6 billion?

Environmentally it is better to have a few rich pricks driving around in $200,000.00 cars, than a bunch of broken arses in say 40 $5,000 cars, My van is worth $500.00 so that would be 400 vans = $200,000.00

What if as Jack said “This is as good as it gets” … but no ifs really

Any country that does not have a state bank as the main agency for issue of loans, is run by the international private banking cabal. The scourge of the Earth.

NZ needs to bring back the State Advances agency as well as change the banking system.

Such actions may bring the US frigates to our harbours, but solidarity of Kiwis can bring a change.

We have to take media control out of private hands and dump RNZ right wing management which facilitates the steady stream of propaganda from US studios polluting out understanding of what is happening locally and internationally.

Throwing off the shackles of myths and lies is the first step to understanding.

Criminal activity disposing of our sovereign banks for a pittance, in the end the sale of the BNZ actually cost the country ? ie ……a loss on the sale ?

Thanks John motivated me to make a submission adding my own hobby horse GREEN TAXES.

Especially on Tourists and Dairying.

Have a look at the Rich List in NZ and figure out how they got there, it definitely wasn’t through blood, sweat and tears ?

[…] The Tax Working Group have emphasised they want peoples’ input without necessarily including detailed arguments. I made some suggestions here. […]

Comments are closed.