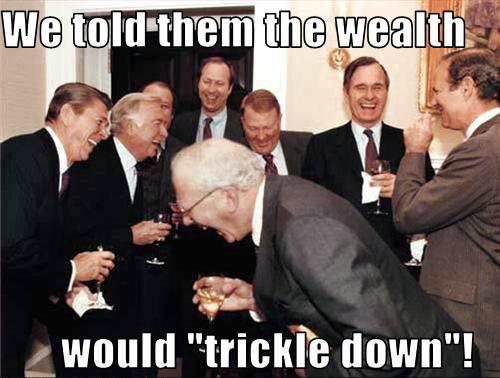

We are about to be assailed once more with the National Business Review’s Rich List – the annual fawning over the super wealthy and how more “successful” they have become this year.

Here’s how NBR Editor Duncan Bridgeman shares his personal excitement over the 2017 celebration of theft from the commons:

Overall he (Duncan Bridgeman) said the list showed that New Zealand had become the land of opportunity for entrepreneurs and risk-takers.

“I think it’s continued boom times for the rich, the rich get richer and the rich are having a really successful period at the moment.”

According to Bridgeman New Zealand’s super wealthy have increased their wealth by $7 billion over the past year to a total of $80 billion.

Think about that for a moment. Wealth is not created from thin air. It is made from manipulating the wealth created by working people. In other words, you and I and every person living in New Zealand has been fleeced $1,489 more this past year so these bloodsuckers can build a bigger pile of unearned income. And they don’t pay tax on it.

It’s the inevitable result of corporate capitalism – a vile system of shame and blame for people of low incomes alongside the adoration of the small group of our biggest parasites.

Last week we had the flip side of the Rich List. The admission by Metiria Turei that as a beneficiary earlier in her life she had to lie to survive on a benefit under the same economic regime that has spawned the naked, selfish greed of those on the Rich List.

Here are a few simple facts:

The super wealthy:

- Pay virtually no tax (IRD tell us half the Rich List don’t even declare an income of $70,000 where the top tax rate cuts in)

- Pay less than 5% of their income on GST (less than 1% for most on the rich list)

- Use our roads, health and education systems when it suits them (but they don’t pay for any of it)

- Don’t pay capital gains tax

Those on benefits:

- Pay 12.5% of their income in taxation

- Pay 14% of their incomes (after-housing costs) on GST

The question at the head of this article is not a trick question. It reflects an obscene tragedy.

Most of us pay tax on every dollar we earn and every dollar we spend. The rich pay virtually nothing.

If you are on a low income or a benefit, the only thing you know for sure is that you pay more tax than the bludging bastards on the rich list.

That’s right.

Reminds me of the old saying my father used to tell me: “You can’t make an honest million”, except that with inflation I suppose we should change it to a billion.

The 99% will always pay for the indulges of the rich John.

Theb 2008 global financial crash was caused by then and we wound up pating for it with our grandchildren’s future.

we will never get a fair deal while they control the treasury benches.

One day it will backfire “as the poor shall internet the earth.” as was told us as far back as Sunday school.

We must plan for the day.

Those without a conscience but more likely controlled by greed are the ones who treat those they deem lesser beings with absolute contempt.

The world is so full of the corrupt and corruptible that to bring them all to court would require the biggest court on the planet. But the greedy will have the opportunity and access to lawyers who could argue tax evasion/tax avoidance out of a paper bag with justifiable reasons and reasonings.

We will always see those with enough money often resort to avoid taking responsibility for their OWN actions. But to demean the ordinary worker further those in power often say they are the ones providing the jobs and therefore the workers MUST accept paying taxes.

But that doesn’t apply to say multi-corporates who use tax havens like the Switzerland of the South Pacific(John Key wanted NZ to be the Switzerland of the South Pacific and obviously got HIS way on it)that is called NZ to avoid paying the taxes of NZ.

The ridiculous thing is more than a year after we NZ citizens have been informed of this blatant daylight robbery of tax avoidance/tax evasion I am sure we will continue hearing the usual churned out rubbish by say the government of the day and the IRD etc of “We are working on it…..”. Methinks the matter has gone into the “Too Hard Basket’ and the excuse of ‘we are working on it’ is something that NZers have become totally fed-up with hearing on a daily basis whether it be Tax Evasion/Avoidance, Homelessness, etc,etc,etc.

The obvious rule of the day now is the rich make the poor feel guilty in every way possible. A perfect example is Bill English years ago saying NZers are living beyond their means and MUST experience financial cutbacks. The thing is whatever BIll English expected of NZers did not apply to himself whilst this one particular multi-millionaire had no hesitation or remorse in Double Dipping on the NZ taxpayers purse at the first opportunity.

Let us then remember Bill English’s actions when it came to Double Dipping at the voting boothes on 23.9.2017.

Its not just central government taxes that bleed the poor. Recent changes to resource management legislation mean that local government will have to raise further rates to pay for new infrastructure to service new housing, because the ability to levy financial contributions on new development (i.e. the ‘exacerbator pays’ principle that has traditionally been available to ensure developers contribute to the cost of new development) is being phased out over a 5-year period. But its not just any ratepayers that will pay – its ratepayers who are 1st home buyers (a shrinking pool of people) upon whom the cost of rates is a higher proportionate burden, and renters whose landlords who will pass the cost of rate rises onto their tenants. So housing will in fact become even less affordable. Meanwhile developers will absorb the savings – from not having to pay development contributions – in to their profits. Neoliberalism is getting more and more entrenched.

Comments are closed.