Why is it so difficult to write about this stuff?

For start no-one wants to hear the term ‘tax credit’, so the government can fudge without fear of criticism. If you have read this far, congratulations, you may be alone.

It is hard not to be angry. No needy child gets any benefit out of National’s grand plan until April next year. Always jam tomorrow never jam today. Budgets should be about changes for the current year-not the year after. Shame on them.

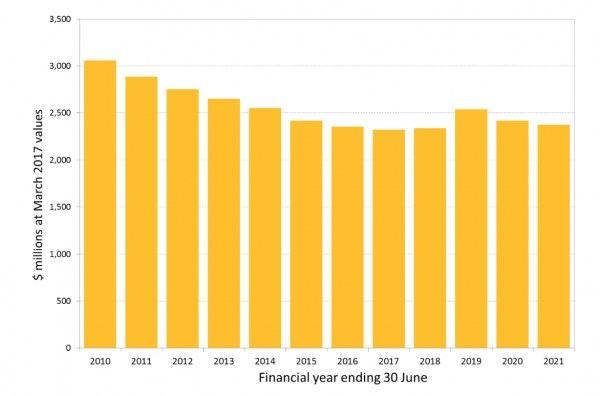

The rundown in Working for Families (WFF) since 2010 has seen $2 billion sucked out of families’ budgets- and the 2017 budget increases to the Family Tax Credit (FTC) did little to reverse this as the graph of real spending on WFF shows.

On the positive side, instead of a confusing proliferation of rates of family tax credits based on age, there will be two rates: $102 for the first child and $91.25 for subsequent children. For some low income young families there will be a significant increase in weekly assistance and it is pleasing that the increase is not conditional on paid work by parents.

But these rates would have been automatically increased by about 7% in April 2018 anyway. The rule is that the rates are adjusted when cumulative inflation is at least 5%. There has been no adjustment for 6 years. It is wrong for government to take the credit for a large part of this spending.

Sadly the anomalous In Work Tax Credit has been left out of the package. Addressing child poverty in a meaningful way requires that all low income children get the full package. This would cost another $500m on top of the $700m per annum needed to address the run down shown in the graph since 2010.

While the new rates of FTC are a welcome simplification and a real increase for some families, there is a heavy price to pay. The predictable outcome of raising the rates for second and subsequent children is the intensification of the clawback for working families to limit the benefits going too far up the income scale.

Now the very low income ‘ hardworking’ working families government professes to care about, face vicious poverty traps over very long income ranges when they try to earn more money.

‘Welfare only for the poor’ and thus ever tighter targeting is the mantra of this government, but what a price is paid for this.

Let’s take a family with 1 child on Labour’s new minimum of $16.50 an hour for 40 hours in 2018 – their gross is just over the new threshold for WFF of $35,000—a very modest income. They qualify for $100 a week ($5,400 pa) accommodation supplement, and $9,000 pa Working for Families. There is a student loan to repay. Lets say the working parent does overtime and earns an extra $10,000 gross. On this gross income tax and ACC is 18.9%, loss WFF and AS is 50%, Student loan 12%, KiwiSaver 3%, a total of 83.9%. So for the huge effort to earn $10,000 only $1600 is left in the hand and with the extra costs of working like child care and transport it is just not worthwhile.

The family package reduces the WFF threshold to $35,000 when it needed to be inflation adjusted to $45,000 and raises the rate of abatement to 25% when it should be 20%. Much of the apparent generosity of WFF for 2018 is clawed back by these features and the graph of real spending on WFF shows how quickly the real value of WFF falls away in the next few years.

What I don’t like is Joyce selling tax-cuts with Working for Families and accommodation supplement changes as a package. The family above on an income in the $40,000s would actually be worse off if they didn’t also get the tax cuts (because their higher WFF has been clawed back so sharply). So he can disguise the meanness of the claw back.

The tax cuts are well over 70% of the package especially once offsets in reduced supplementary assistance are factored in. Putting up the bottom two tax thresholds compensates for inflation and the tough total tax on low incomes and allows the silly independent earner tax credit to be absorbed. Fair enough. Any change in these thresholds is expensive and will also help those on higher incomes more. It is a change that reverses the tendency to an ever less progressive tax scale but it should be accompanied by other measures to reduce inequality of net incomes- like a risk free rate method of taxing housing for example.

There is plenty of scope for Labour/Greens to explain how and why they would do better than this.

One slight quible. The saying is “money for jam” I.e money for traffic jams. So the entire value chain recieves money for jam, from the police motorists and highways, construction, design, right back to the miner = money for jam.

How can this morally bankrupt government actually sleep at night knowing they have injured so many family souls living outside at this awful time in winter!!!!!!!

We need to get shod of this evil administration.

If children are suffering and the government says it will do something- it is criminal to say but only in a year’s time. Other policy can come in straightaway- like getting rid of the kickstart for KiwiSaver

With mild to server forms of intellectual, emotional and physical handicaps. Self induced of course.

Ps. Like most here are found of saying. “It is a mental health issue” through and through.

Because psychopaths don’t have a conscience so nothing to feel guilty about in their minds.

Money for jam is a different metaphor- it refers to getting money for doing just about nothing

My metaphor comes from Alice through the looking glass

…the Queen said. ‘The rule is, jam to-morrow and jam yesterday – but never jam to-day.’

‘It MUST come sometimes to “jam to-day,”‘ Alice objected.

‘No, it can’t,’ said the Queen. ‘It’s jam every OTHER day: to-day isn’t any OTHER day, you know.’

Touchè

National operates on plenty of pre-election bribes, and that’s it.

It is worth remembering that the WFF package was instituted by Labour, not National, and that National opposed it in parliament.

For me the WFF enabled our family to make the lending criteria to own our home, a modest but comfortable warm home not an old cold leaking rented dump.

Whatever worries I might have about Helen Clark’s Labour, I always will be grateful to them for this and mindful that it would almost certainly have never happened under a National government.

I wonder how many others benefitted like me.

absolutely– and National have grossly undermined it over the last 9 years. WFF deserves as much support as NZ Super. Currently it is a real mess trapping low income working families on their low incomes because of the lower threshold and higher abatement on top of other things that bleed out at he same time

Comments are closed.