.

(Or, “Under-funded health, education, and other social services? Let them eat tax-cut cake!”)

.

.

2017 Election – Opening Gambits and Giveaways

You can tell it’s election year; the lolly-scramble (aka, hint of tax cuts) has begun;

.

.

Historical Context

Cutting taxes (and social services on-the-sly) is one of National’s mainstays when it comes to election promises. Bribes work best when a government has nothing left to offer.

Who can forget the infamous 2008 election campaign, where – despite the Global Financial Crisis firmly taking hold of the New Zealand economy – then-National Party leader, John Key promised tax cuts.

In January 2008;

“We will cut taxes, not just in election year, but in a regular programme of ongoing tax cuts.

[…]

And we will do all of this while improving the public services that Kiwis have a right to expect. ”

In March 2008, then Finance Minister, Michael Cullen warned against borrowing for tax cuts;

“ Those who would actively choose to drive New Zealand into further debt to pay for tax cuts lack real ambition for our economy…

[…]

Even before these challenges hit home John Key wants to increase our debt to at least 25 per cent of GDP. But he does not pretend he wants to borrow more to pay for more services and he does not really believe he needs to borrow more to pay for roads. He only wants to outspend Labour on tax cuts.

His plan would cost an extra $700 million a year in financing costs alone, around what the government has invested in new health services for each of the last two years.

But the real worry is that Mr Key’s pro-debt policy shows he does not take long-term challenges seriously. His risky deal for tax cuts today would leave the bill to our children and grandchildren tomorrow.”

Undeterred, Key pursued his irresponsible promises and in August 2008 announced to a gullible public;

National will fast track a second round of tax cuts and is likely to increase borrowing to pay for some of its spending promises.

Key made the incredible assertion that tax-cuts would not impact on government debt;

“So that will be extremely clear cut and rather hermetically sealed.”

Key’s claim of “hermetically sealing” tax cuts from the rest of government fiscal activity was never fully explained, and nor did the MSM ever challenge that unbelievable promise.

In October 2008, Key repeated his fantasy of affordable tax cuts;

“Our tax policy is therefore one of responsible reform… We have ensured that our package is appropriate for the current economic and fiscal conditions… This makes it absolutely clear that to fund National’s tax package there is no requirement for additional borrowing and there is no requirement to cut public services… National’s rebalancing of the tax system is self-funding and requires no cuts to public services or additional borrowing’ .”

The rest is history. National was elected to power on 8 November and tax cuts implemented in 2009 and 2010. Government borrowing and debt rocketed;

.

.

A third round scheduled for 2011 was cancelled as the budget blow-out caused – in-part – by unaffordable tax-cuts began to hit home even on a profligate National-led administration.

By May 2011, National was borrowing $380 million per week to fund it’s debt. Bill English and John Key seemed startled by the government’s deteriorating financial position;

Finance Minister Bill English said the Government’s financial position had deteriorated “significantly” since late 2008.

“The pre-election update in 2008 forecast that the deficit for this year would be $2.4 billion,” he said.

“It’s much more likely to be around $15b or $16b.”

That level of deficit, as NZPA has previously reported, will be the highest in New Zealand’s history and Mr English confirmed that today.

Prime Minister John Key confirmed the average weekly borrowing figure, which he said was unaffordable.

Michael Cullen’s warnings over unaffordable tax cuts seem to have been long-forgotten as collective amnesia over-took the National Party leadership.

Worse still, it was the rising army of unemployed who were to pay the fiscal bill for National’s profligacy;

More than three quarters of all beneficiaries will be forced to seek work or face cuts to their payments under sweeping recommendations from the Government’s Welfare Working Group… Working group chairwoman, economist Paula Rebstock, said the present high levels of welfare dependency meant major changes were needed. “ There are currently few incentives and little active support for many people reliant on welfare to move into paid work. Long term benefit dependency can be avoided if investments are well targeted and timely…” Social Development Minister Paula Bennett said the report was an opportunity to change the welfare system and would feed into Government work in the area.

Key indulged in National’s favourite activity when things went horribly wrong after his administration’s apalling policty-decisions. He blamed those at the bottom of the economic heap;

Prime Minister John Key says beneficiaries who resort to food banks do so out of their own “poor choices” rather than because they cannot afford food. “But it is also true that anyone on a benefit actually has a lifestyle choice. If one budgets properly, one can pay one’s bills. “And that is true because the bulk of New Zealanders on a benefit do actually pay for food, their rent and other things. Now some make poor choices and they don’t have money left.”

By 2016/17, National’s net debt had reached $66.3 billion. (Damn those beneficiaries’ “poor choices”.)

The Joy of Joyce’s Tax Bribe

On 8 February this year, Joyce announced aspects of this year’s coming Budget. Joyce dangled the tax-cut carrot in front of voters;

“It is also very important to remain mindful that the money the Government spends comes from hard working Kiwi families. We remain committed to reducing the tax burden on lower and middle income earners when we have the room to do so.”

On the same day, Joyce voiced concerns about New Zealand’s massive mountain of private debt;

“I have discussed DTIs with the Reserve Bank Governor, who remains concerned about the levels of debt in some households in the context of recent increases in house prices.”

Joyce has good reason to be nervous. As of this year, New Zealand’s household debt has reached stellar proportions;

.

.

Any further tax-cuts will not only be based on cuts to social services (health, education, housing, NGOs, etc), but may further fuel the housing bubble. This would raise the prospect of a monstrous three-headed creature of National’s making where;

- it would likely have to have to borrow to fund the tax-cuts,

- fuel an increase in private debt as tax-cuts are spent on a property-buying binge,

- as well as driving first-home buyers out of the market as housing-prices take off again.

Joyce voiced this concern on 8 February;

“The use of macro-prudential tools can be complex and affect different borrowers in different ways. I am particularly interested in what the impacts could be on first home buyers.”

So further tax cuts may have negative impacts that a fourth National administration would have to deal with if it wins the 23 Sept election.

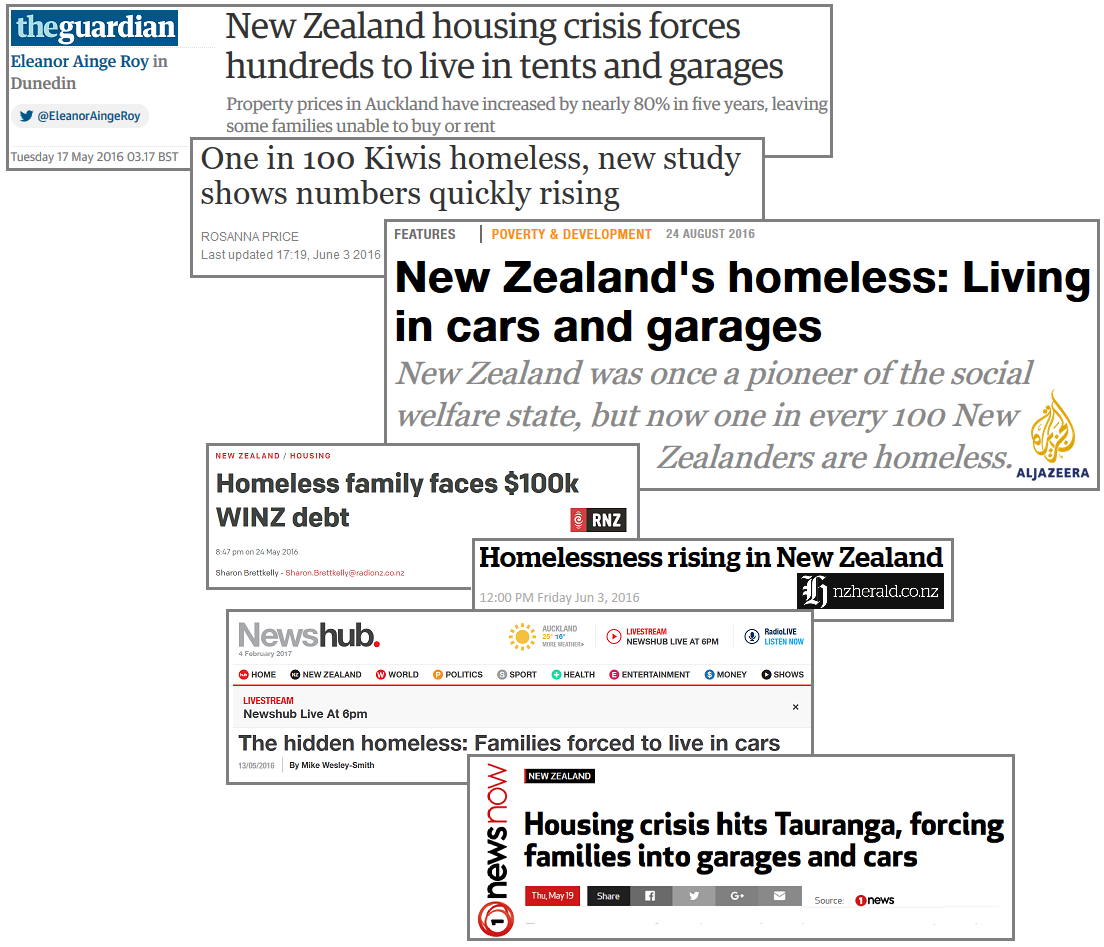

On top of which, New Zealanders would be faced with further cuts to social services and increasing user-pays in health and education. From our on-going housing crisis;

.

.

… to more user-pays in education;

.

.

…in healthcare;

.

.

… and the gutting of NGO services through budget-cuts;

.

.

When Kiwis take up National’s tax-cut bribes, they end up paying more, elsewhere.

But even slashing the budgets for the state sector and NGOs is insufficient to meet the multi-billion dollar price-tag for tax-cuts. National is desperately having to scramble to find money where-ever it can. So-called student loan “defaulters” are firmly in National’s eyesights;

Almost 57,000 student loan borrowers found in Australia

The agreement came into force in October and the details of around 10,000 New Zealanders were found in the first data match. The process has since been refined and a total of 56,897 people have now been located.

“These borrowers have a combined loan balance of $1.2 billion and $430 million of that is in default. Inland Revenue will now start chasing up these borrowers and taking action to get their student loan repayments back on track,” says Mr Joyce says.

Mr Woodhouse says “The data shows that more than half of these borrowers left New Zealand over five years ago, with nearly a quarter having been away for more than 10 years. A third of them have not returned to New Zealand in the past four years. One third of the group has had no contact with Inland Revenue, and 43% have not made a payment since they left New Zealand.

“It’s time these people did the right thing and met the obligations they signed up to when they took out their student loan,” Mr Woodhouse says.

Who else will National target to squeeze money out of?

What social services will National slash to fund tax-cuts?

What further user-pays will be implemented?

One further question; if National does not pay down our sovereign debt – how will the country cope with another global financial crisis and shock to our economy? As Joyce himself pointed out;

“ We need to keep paying down debt as a percentage of GDP. We’ve set a target of reducing net debt to around 20 per cent of GDP by 2020. That’s to make sure that we can manage any shocks that may come along in the future.”

When National took office from Labour, the previous Clark-Cullen government has prudently resisted National’s tantrum-like demands for tax cuts and instead paid down our sovereign debt. As former Dear Leader Key himself was forced to admit;

In 2005, as Leader of the Opposition;

“ Firstly let me start by saying that New Zealand does not face the balance sheet crisis of 1984, or even of the early 1990s. Far from having dangerously high debt levels, gross debt to GDP is around a modest 25 percent and net debt may well be zero by 2008. In other words, there is no longer any balance sheet reason to justify an aggressive privatisation programme of the kind associated with the 1980s Labour Government.”

In 2012*, as Prime Minister Key justified the partial sale of state-owned assets;

“ The level of public debt in New Zealand was $8 billion when National came into office in 2008. It’s now $53 billion, and it’s forecast to rise to $72 billion in 2016. Without selling minority shares in five companies, it would rise to $78 billion. Our total investment liabilities, which cover both public and private liabilities, are $150 billion – one of the worst in the world because of the high levels of private debt in New Zealand.”

(* No link available. Page removed from National Party website)

With our current debt of $66.3 billion, we no longer have a safety-buffer. That is the current dire state of our government books.

It is astonishing that Joyce has the nick-name of “Mr Fixit”, as he makes irresponsible hints of tax cuts to come.

Little wonder that Joyce’s unearned reputation as “Mr Fix It” was deconstructed by journalist and political analyst, Gordon Campbell;

The myth of competence that’s been woven around Steven Joyce – the Key government’s “Minister of Everything” and “Mr Fixit” – has been disseminated from high-rises to hamlets, across the country. For five years or more, news outlets have willingly (and non-ironically) promoted the legend of Mr Fixit…

[…]

Of late however, the legend has lost some of its lustre. More than anything, it has been his handling of the SkyCity convention deal that has confirmed a lingering Beltway suspicion that Joyce’s reputation for business nous has been something of a selfie, with his competence appearing to be inversely proportional to his sense of self-esteem. Matthew Hooton’s recent critique of Joyce in NBR – which was inspired by how the SkyCity convention deal had cruelly exposed Joyce’s lack of business acumen – got a good deal of traction for that reason. On similar grounds, Joyce’s penchant for (a) micro-managing and (b) the prioritising of issues in terms of their headline potential has resulted in his ministerial office becoming somewhat notorious around Parliament for (c) its congested inefficiency and for (d) a not-unrelated extent of staff burnout.

[…]

Not only is Joyce’s ministerial office renowned as an administrative bottleneck – where issues tend to be ranked in terms of their p.r. potential for the Minister – none of this seems to be in service of any wider goal or vision. As Mr Fixit, Joyce tends to be engaged in the equivalents of blown fuses and leaking taps – rather in the re-design of the political architecture. Joyce has simply never been – and has never pretended to be – a big picture kind of politician. He has been never someone with an abiding interest in – or the intellectual stamina for – systemic change.

The re-election of National this year – by any means necessary, whether beneficial to New Zealand or not, no matter what the social or financial costs – appears to be ‘Mr Fixit’s’ latest ‘DIY’ project.

And like most DIY budgets, wait for the blow out.

Just like 2009.

.

.

References

Interest.co.nz: Finance Minister says Government remains ‘committed to reducing the tax burden

Scoop media: Tax cuts still in the mix for Joyce’s first budget

Sharechat: Tax cuts still in the mix for Finance Minister Steven Joyce’s first budget

Radio NZ: Budget date set, tax cuts likely

NBR: Government hints at tax cuts in Budget 2017

Fairfax media: Joyce signals low and middle earners’ top rates target for tax cuts

NZ Herald: The Economy Hub – About those tax cuts… Steven Joyce, the big interview

NZ Herald: John Key – State of the Nation speech

Scoop media: Government will not borrow for tax cuts

NZ Herald: Nats to borrow for other spending – but not tax cuts

Guide2: National Party – Tax Policy

NZ Treasury: Financial Statements of the Government of New Zealand for the Year Ended 30 June 2010 – Debt

NBR: Tax cuts scrapped in budget

Interest.co.nz: Budget deficit worse than forecast; debt blows out by NZ$15.4 bln

NZ Herald: Govt borrowing $380m a week

Fairfax media: Extensive welfare shake-up needed – report

NZ Herald: Food parcel families made poor choices, says Key

NZ Treasury: Budget Economic and Fiscal Update 2016

Beehive: 2017 Budget to be presented on 25 May

Beehive: Finance Minister requests cost-benefit analysis on DTIs

NZ Herald: New Zealand residential property hits $1 trillion mark

Beehive: Almost 57,000 student loan borrowers found in Australia

Scoop media: John Key Speech – State Sector Under National

Werewolf: The Myth of Steven Joyce

Other Blogs

The Hand Mirror: A crack in the wall

Previous related blogposts

Letter to the editor: Setting it straight on user-pays in tertiary education

Letter to the Editor: tax cuts bribes? Are we smarter than that?

The Mendacities of Mr Key #3: tax cuts

The Mendacities of Mr Key # 19: Tax Cuts Galore! Money Scramble!

The Mendacities of Mr English – Social Services under National’s tender mercies

.

.

.

.

.

= fs =

WARNING TO STEVEN JOYCE – fix our Gisborne rail line you broke five years ago, when you as Transport Minister stole the rail maintenance fundIng from our track staff account, and reduced the staff from 16 to 4 so when the storm came in 2012 the staff were unable to cope to keep the drains from flooding.

http://www.scoop.co.nz/stories/PA1302/S00183/kiwirail-admits-lack-of-maintenance-led-to-wash-out.htm

So our Gisborne Mayor Meng Foon yet again in Saturdays Gisborne Herald 18/2/17 calls on you to “Fix our rail” as Government is responsible here as “Government owns the track” – unquote.

If you don’t, you can kiss Gisborne goodbye to National.

gisborneherald.co.nz

Qualified support for rail

by Andrew Ashton Published: February 18, 2017 9:58AM

Regional council says GDC needs to invest

A Gisborne consortium working to reopen the mothballed Gisborne to Wairoa railway line would be likely to receive backing from the Hawke’s Bay Regional Council — but HBRC says Gisborne District Council also needs to stump up with investment first. That is something Mayor Meng Foon says he does not favour.

In December, KiwiRail accepted three expressions of interest to operate the line, including one from the Gisborne Rail Co-operative (GRC) that would combine short-haul freight and tourism uses.

Following a presentation from the group this week, Hawke’s Bay Regional Council’s Corporate and Strategic Committee recommended that the regional council should send a clear message that it continues to support efforts to get the Wairoa to Gisborne section of the Napier-Gisborne line reopened.

GRC interim chairwoman Nikki Searancke said a joint approach between the regional council and Gisborne District Council was vital.

“That’s really what we went down to Hawke’s Bay for. We went to seek their co-operation to do this next stage. We recognise that HBRC have been very successful in working with KiwiRail, so we’re keen to work with Hawke’s Bay.”

Gisborne Rail Co-operative (GRC) made a presentation to the Corporate and Strategic Committee meeting asking the council to make a joint approach to KiwiRail for consideration of GRC’s proposal to reopen the Gisborne end of the Napier-Gisborne line for freight, as well as for tourism services.

HBRC contribution contingent on GDC money

The committee recommended that HBRC continue to offer its support for the preservation and preferably the restoration of rail freight options for the Wairoa to Gisborne section of the Napier-Gisborne rail line. Committee chairman Neil Kirton told GRC members that a business case was urgently needed for reopening the Wairoa to Gisborne rail line and it was essential that Gisborne District Council show its support for the proposal.

If GRC could get a commitment from the District Council to put some money towards developing a business case, then HBRC would also consider contributing some money.

Councillor Alan Dick told the meeting that HBRC’s Regional Transport Committee would hold its regular meeting in Wairoa on March 10. The visit was part of a commitment through ‘Matariki – the Hawke’s Bay Regional Economic Development Strategy’ to improve road transport options north, and rail would certainly be on the agenda.

The Napier to Gisborne line has not been used since it was damaged in 2012. Last year KiwiRail reached a commercial agreement with Napier Port to repair the Napier to Wairoa section to run a dedicated log service. It had earlier agreed to a deal with Gisborne City Vintage Railway to operate a steam engine on the Gisborne-Muriwai section, ending at Beach Loop.

Ms Searancke said she was encouraged that GDC councillors had attended a rail forum last year.

“So I’m extremely pleased that they did go to the forum and I think they will support us when we go to GDC and put our presentation to them.”

A decision on the future of the line is expected by the end of March.

Government should pay: Foon

However, Gisborne Mayor Meng Foon said while the topic could be discussed again at council meetings, it had been the council’s view that the Government should be the one to pay to fix the line, since the Government owned the line.

“We have enough projects to pay for in our own district, such as roads, stormwater, Waipaoa flood control and much more. I won’t support ratepayer money for the railway line. My personal view and my lobby to the Government and KiwiRail is to fix the line — if not, then make a rail trail.”

Mr Foon said it was “frustrating” that the region had lost out on “four years of employment and investment” due to the delay in restoring the line.

Using the rail corridor to establish a rail trail between Gisborne and Napier airports could provide a project that could transform the region, he said.

Excellent point, Cleangreen.

There is much more that could be achieved using rail instead of spending billions on more and more and more roading. Which then gets more and more and more clogged.

It simply takes imagination – something not in great abundance within the National caucus.

Give the rail portfolio to the Green Party (with a decent budget). Then we’ll see stuff happen.

Give the job to Nick Smith. Bill English thinks Smith is doing a great job on housing.

The only issue I have is that everyone else in N.Z.n thinks Smith’s F..^#@! it up big time!

Road systems provide more profit for global corporations than rail systems do.

There have to be peculiar circumstances for a government to support a rail system against the wishes of global corporations, and those circumstances are rare, e.g. the requirement to move billion of tonnes of coal or iron ore etc.

Find a large deposit of coal that can be mined via opencast methods (or mountain-top removal, or find a large deposit of a valuable mineral that can be exported to China. Then you will get a rail system super-fast (but not one for passengers, of course).

Otherwise forget it. Not only are you fighting corrupt politicians who are more than happy to sabotage their own progeny’s futures, you are fighting international banks and corporations whose business models demand that the future be sacrificed to maintain present arrangements just a little longer.

Very good article Frank .

It is a shame this sort of data is not more widely available to the general populace,…the deceit of core members of this govt is astounding… and while the second hand car dealer has slunk off,… we are still left with some of the original deceivers and manipulators such as Joyce.

Joyce.

Dildo Joyce.

Mr ‘ Fixit’.

The only thing this man has ever ‘ fixed’ has been to ensure working people are perpetually ripped off via working conditions and wages and that those who lobby and back him are paid handsomely in profits and returns.

That , and of course, … that large numbers of our community that are becoming more and more indebted with his colleagues private institutions and their exorbitant rackets by ensuring public health , social services and education etc are underfunded deliberately …

The carrot being ‘ tax cuts’ … and yet the denial of those same services needed to run an efficient and modern society via taxation… with the unstated motive to run them down to pave the way for private concerns to be able to price gouge…

Perhaps we could instead RAISE taxes, and RAISE wages…

Instead of LOWERING taxes for the upper income earners and LOWERING wages for the lower income earners…

And if THAT cant be done ,… perhaps it is time to start asking the question weve all been wanting to ask …

” WHY , – in a modern western and so called prosperous nation ,… do we have such high levels of poverty , joblessness , homelessness and shockingly low wages for so many people ? ”

And is it because …certain people and groups have certain agendas who want to keep things the way they are because it enriches them,… and that like a chameleon , when queried,… they talk of ‘change’ or if criticized they talk of all their ‘achievement’s’ … when anecdotal and empirical evidence presented by our social services tells us otherwise?

It is time to cast the liars out from our midst. We can no longer afford to give tacit approval to these parasites by not calling them to account for their behavior – they and their political ancestors the Rogernomes…

It is time these neo liberal thugs and liars are ejected from New Zealand politics. It is time that they must go.

Problem is, Katipo, that even when the info is widely available – it’s all separated out in disonnected stories. There is no linkage in the msm about tax-cuts and cuts to state/social services. And even when there is, it’s not spelled out.

Which, of course, suits the agenda of National and ACT to further the slow creep of the Cult of Individualism and winding back any notion of community cohesion/responsibility.

It’s quite different to the late ’90s when the msm presented a connected narrative to the public. That resulted in the election of a Labour/ Alliance government – on a platform of raising taxes, no less!

At the time, sufficient numbers of voters understood that tax cuts = slashed services. “Ain’t no such thing as a free lunch” , to quote our American cuzzies.

With the siloisation of media stories there is a disconnect between National’s tax-cuts and reduced social services. It’s just not presented in a way that people can put 2 and 2 together…

Indeed. You are so incredibly right.

And it has in fact been a very deliberate ploy to ‘ disconnect ‘ the dots. One only has to look at the ‘whys ‘… ie:… lack of funding for any state broadcasting with emphasis on a privately owned newsmedia…

A perfect set up for the neo liberal.

A media that has the same sort of self interest as the govt and its members…

Profit margins.

That is so…but the question is why? I know the media are facing financial pressures they weren’t back then but it appears an intentional act to not examine the effect of policy…is it an editorial edict? a lack of journalist understanding? pressure from income sources? …or perhaps a combination of all three?…or something else entirely?….whatever the cause, journalism as its practiced of late must be a most unfulfilling occupation.

it is difficult to understand how such a state of affairs could continue essentially unchallenged for approaching 9 years (I don’t recall such media reluctance during the Clark years)

You mean this media?:

http://www.chinesenzherald.co.nz/

yes Frank the tories talk social cohesion but their polices or lack of policies are actually detrimental to achieving social cohesion more likely to create divisiveness and an every man for himself attitude (individualism) which we have been seeing more and more over the last 8-9 years under the tories poor leadership

https://producaoindustrialblog.wordpress.com/

Not just tax cuts, It seems like the Natz strategy to try to compete against Winston Peters in particular and Labour is to suddenly start funding all sorts of projects in the ‘regions’…

Could this be a pre election strategy so they can rattle off a list of stats in election debates of what they have been funding… (the trick is to look at the dates, is investment in the regions just before the election?) and try to buy votes and look like they care?

That’s why it is hard to defeat the Natz, as well as importing in voters they have government money to dish out right before election time and buy voters ….

Check the dates is all I say!

When will students start burning effigies in Queen Street again? It is time to burn a Joyce puppet, I feel.

A woman threw a Joyce puppet at Joyce already. Trouble is, rubber doesn’t burn very well.

Excellent analysis Frank. It’s a shame that the brain-addled middle classes may once again fall for National’s tax-cut bribes. And then listen to them bleat about slashed healthcare and increasing education fees like school “DONATIONS”!!

This country is the author of it’s own misfortunes and nowhere in the Scandinavian nations would citizens continually vote in such a stupid fashion.

Money is created out of thin air via the issuing of a government bond, which is sold on the international bond market, frequently to the central bank of another country.

The interest paid on the original bond is created out of thin air via the issuing of another government bond.

It things start to get really bad, the central bank of the same country buys the government bond. Thus, the bank of Japan buys the bonds issues by the government of Japan, and everyone declare the bond auction a success. By the same token, if the share index starts to fall, the central bank injects fake money into the market to prop up the index.

The shift to purely abstract money held as digits in computer systems eliminates to cost of printing bits of ‘paper’ with squiggly lines and calling them valuable, and eliminates the cost of melting cheap alloys and stamping ‘magic’ symbols on them as replacement for metals with real value, like silver and gold.

It’s ALL a game of smoke and mirrors.

And the game of smoke and mirrors can be kept going as long as there are primary resources available that can be turned into waste and as long as there is an energy supply (especially liquid fuel) to keep doing so. That is why collapse is inevitable, and why collapse is extremely likely to occur over the next few years, and is CERTAIN to occur in the period 2020 to 2030.

Since the politicians have ZERO interest in telling the truth about anything (their job is to operate NZ Inc. as a short-term business for the overseas owners), they will continue to drive the country towards the point of complete environmental and energetic collapse. And enrich themselves and their mates in the short term whilst doing so, of course.

On the matter of controlling what people think, in America an admission that the media’s job is to control what people think:

http://www.zerohedge.com/news/2017-02-22/msnbc-anchor-admits-our-job-control-exactly-what-people-think

Here is a good example of how National pull this bullshit off so come on Her Majesties Opposition, you need to explain in real simple terms to the public what a National Party tax cut bribe really means.

Word is traffic policing in NZ is about to be neutered and in some parts virtually cease to exist apart from token gestures largely leaving road users to their own devices all because a huge amount of funding has been taken from the police budget, in what amounts to a budgetary shell game. It seems unbelievable but its happening.

The cut in the budget is substantial, much more than previously suggested and National is sitting very, very quietly on this.

So Bill English says he will raise the amount of police officers by nearly a thousand but at the same time oversee a huge but clandestine budget cut via funding arrangements between different government departments. Is this to direct the blame away from the government? Because we all know the Nat’s secrecy and paranoia means they micro manage everything so they must know what is going on!

Confusing, ironic, you bet! But this is EXACTLY how National work. It’s all a mirage, as will be these so called tax cuts.

They can’t afford them and they know it, so they lie.

See below for supportive conservative reports;

http://www.stuff.co.nz/national/politics/80801226/Government-denies-police-underfunding-to-blame-for-spike-in-road-toll

or (and there is plenty of others)

https://www.tvnz.co.nz/one-news/new-zealand/traffic-incidents-rise-but-number-road-police-drops.

http://www.newshub.co.nz/home/new-zealand/2016/04/govt-argues-with-police-over-26m.html

[…] blogpost was first published on The Daily Blog on 20 February […]

Comments are closed.