The New Zealand and Australian banking system is owned and controlled by a criminal conspiracy whose sole purpose is to gouge the community for the enrichment of a small class of ultra-wealthy individuals.

New Zealand’s “Big Four” main banks – the BNZ, ANZ, Westpac and ASB – are in turn owned by the Big Four Australian banks – NAB, CBA, ANZ and Westpac. They have between them 90% all mortgages and gross loans and advances in New Zealand and 80% in Australia.

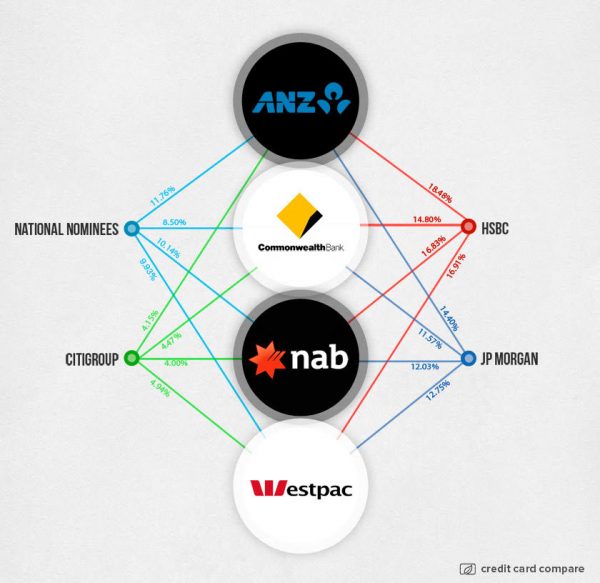

The main shareholders of all four Australian banks are the same top four financial investment groups – HSBC Custody Nominees; JP Morgan Nominees; National Nominees; and Citicorp nominees. Each nominee group represents big money investors who we are not permitted to know anything about.

But we do know that three of the four are from banking groups that have repeatedly been charged with illegal and corrupt practices including money laundering for drug cartels and terrorists, price fixing in relation to interest rates, being the banks of dictators, arms traders dealers of blood diamonds, environmental vandals and tax evasion on an industrial scale.

HSBC, the biggest shareholder in each of the Big Four, is the bank with the most public criminal record. See:

Banking Giant HSBC Sheltered Murky Cash Linked to Dictators and Arms Dealers

In return for admitting the charges and paying a $US1.92 billion fine no one from HSBC was actually prosecuted for the criminal activity. That may sound like a lot of money but the US Comptroller of the currency estimated that HSBC had potentially $60 trillion in illegal transactions in 2010 alone! The fine equalled about three weeks of annual profit.

HSBC Custody Nominees holds investments across the Australian economy. “As a wholly owned subsidiary of HSBC Bank Australia Limited, the custody nominees business held more than $700 billion in assets. It is not only in the big four. The sheer size of its investment capital means that it frequently shows up among the top 5 shareholders for a large number of Australian companies. In fact, HSBC, JP Morgan, National Nominees and Citicorp all frequently show up together among the top 5 or top 10 shareholders. They simply represent a very large pile of money, all of which has to be parked somewhere.” (Who Really Owns the Big Four)

The other two main owners of the Big Four – J P Morgan and Citicorp – have also been fined again recently for being part of a conspiracy of major banks that rigged the benchmark interest rate that sets rates across the global financial system. They actually called their online chat room where they did the fixing “The Cartel”. See:

Barclays, UBS among six top banks fined nearly $US6bn for rigging foreign exchange, Libor rates

Goldman Sachs, Morgan Stanley, Bank of America, JP Morgan Chase, Citigroup and more have been charged on numerous occasions with fraud. But invariably the charges are civil, not criminal. The banks pay a fine and promise to “never do it again.” A 2011 analysis of such cases showed just what those promises were worth. Over 15 years, there were at least 51 cases in which 19 Wall Street firms had broken the same antifraud laws they had agreed never again to violate. A New York Times Interactive has a catalogue of cases dating back to 1985.

The Big Four banks in Australia and New Zealand have a massive weight in the economy. They have turned the population into their debt slaves. Personal debt in Australia and New Zealand is amongst the highest in the world as a percentage of personal income – 180% and 160% respectively. As Who Owns the Big Four explains:

Australia’s big four are not merely big, they’re massive. Humongous. Their combined assets in 2013 stood at $2.86 trillion—or roughly twice the size of Australia’s national income.

They are four of the five largest Australian companies by market capitalisation, together representing more than a quarter of the market. According to a 2012 report by the International

Monetary Fund [PDF], the big four controlled 88% of residential mortgages and 80% of deposits. By contrast, the biggest six American banks held 30% of total deposits in 2013.

It’s not just banking: the big four own 53% of life insurance premiums, and account for 57.3% of retail investment funds through bank-owned platforms.

The Australian Institute makes the following observation about the pattern of bank ownership in Australia.

“An inspection of the top 20 shareholders in the big four banks reveals a very interesting pattern. On average, over 53 per cent of each big bank is owned by shareholders that are among the top 20 shareholders in all the big banks. Most of the owners, and certainly the top four shareholders, are nominee companies. Nominee companies hold shares on behalf of other entities that for some reason want to hide their identity. They tend to be both foreign investors and fund managers; increasingly they are investors acting on behalf of superannuation funds.

“The common ownership of the big four banks seriously challenges the idea that there are four separate big banks in Australia. Given the common ownership of the big banks, it is to be expected that the owners will put pressure on the banks to act as one and reap the monopoly profits. That seems to have been the motive of the investors who encouraged the NAB to move back in line with its competitors. Moreover, ownership figures for the second tier banks, the big three regionals, show they are also owned by the same organisations that own the big four.”

They are also hugely profitable. Banking profits in Australia at 2.9% of gross domestic product makes them the most profitable banks in the world in relation to the economy.

Profits in New Zealand for the four in 2015 totalled $4.6 billion – $1000 for every man, woman and child in the country. The profit rate is even higher than in Australia.

In 1937 Australia had a Royal Commission into the banks following deep public antagonism to their perceived role in helping deepen the 1930s Great Depression. The report’s recommendations tried to increase public influence over monetary policy and the scale and character of credit. This was all abandoned in the 1980s all over the world during the deregulatory fervour. Reckless bank behaviour was again a factor in unleashing the financial crises of 2008 and the long depression that has followed.

One of the members of the royal commission, a certain ex-engine driver called Ben Chifley, had stronger views on what needed to be done that remains valid for today when banking and criminal behaviour seem to go hand in hand. He wrote:

Banking differs from any other form of business because any action — good or bad — by a banking system affects almost every phase of national life. A banking policy should have one aim – service for the general good of the community. The making of profit is not necessary to such a policy. In my opinion, the best service to the community can be given only by a banking system from which the profit motive is absent and, thus, in practice only by a system entirely under national control.

No one being convicted is technically correct but the head of HSBC forex desk was arrested the other month for front running or lying to there clients http://www.bloomberg.com/news/articles/2016-07-20/hsbc-official-said-to-be-charged-by-u-s-in-fx-rigging-probe

Whilst all of the above may be true, it is all peripheral to the main issue.

The heart of the criminality is the creation of money out of thin air and the charging of interest on that money created out of thin air. The heart of the criminality is official endorsement of creation of money out of thin air and official endorsement of the charging of interest on money created out of thin air.

https://www.youtube.com/watch?v=UrJGlXEs8nI&nohtml5=False

For some reason contributors to TDB avoid the fundamental issues like the plague and continue to focus on the symptoms of dysfunctional systems.

“The heart of the criminality is official endorsement of creation of money out of thin air and official endorsement of the charging of interest on money created out of thin air.”

That is so true.

Why do governments, who are suppose to govern for the good of the people, allow private corporations to create the credit the country needs to function? Rhetorical question of course. Governments govern for the good of corporations of course. And we, the hoi poloi, are just their fodder.

People keep saying this but fail to explain how it happens. Put the numbers to paper with the reserve ratio & the number of banks & anyone with half a brain should see what is happening. While doing that try seeing what happens by charging interest & how that creates the need for an increasing money supply. Its fair to say the system is a con which is why it needs regulations. Bring back the pre 1980 rules & things will work better.

The Reserve Bank of NZ has openly stated that 97+% of new money in NZ is created by private banks. The Govt and people only print “replacement tender”. NZ could fund widespread social programmes and infrastructure, and , fund resilience in our industries; if it issued all the new money, and that would not be reflationary.

Money is bled out of NZ on a massive scale through banks and transnational corporations who are taking over rapidly and expatriating our wealth.

The RBNZ has board members and advisers from private business including the parasitic finance and insurance sector.

Money for jam and controlled by private bankers through many and various connections not made public.

Govts pass legislation to assist private banks but the legislation is always disguised as having another function.

Land price bubbles are a bonanza for banks hence Nact will do nothing to curb the bubble. When it bursts, in is the land holder who will loose not the banks as they will walk away with assets to realise against the falling prices, but not to worry because the banks just created the money and now the cash they get will be theirs – out of thin air.

A denial and cries of losses by banks are fictitious as they move cash gained into assets no longer then available for realisation by the banking body.

Anyway if they overplay their hand in hollowing out available equity deliberately as they do, then John Key has allowed the banks to use your deposits to bail out their “depleted books” which are not open for public scrutiny. A black hole.

And the equity they hold in the best sureties is already ring fenced to overseas banks so is not available to bail out local gambling bankers who have overplayed their asset divestment. We loose to banks all ways with the authorisation of this Govt.

Nationalising banks as non profit institutions owned by the people of NZ would see US frigates at out door. Libya had a state bank that defied the IMF and World bank so Killary Clinton and Co sacked the country and looted heavily.

We are already occupied.

Absolutely correct, but for some reason this conversation isn’t allowed to see the light of day in any mainstream media. In fact, it barely sees the light of day in the blogosphere? Why is this? Why are people afraid to state the obvious? The present system is a con job and a means of enslavement, and most politicians are well paid enablers.

Try and raise this point in conversation and you will be barred from their site. It is such an obvious issue but try getting a reply from any of the economists in this country. I’ve tried with every one of them. Not a single acknowledgement of receipt of my questions let alone any attempt at answering or addressing them.

This is the central issue behind every single other that anyone cares to raise. It is the root of all problems yet we aren’t allowed to even discuss it! The system is totally rotten, look at the candidates for Auckland Mayoralty interviewed on The Nation. Four right wing stooges, and I include the TPPA enabling career politician Phil Goff in that.

It’s a joke. Until this issue is sorted there is no point in talking about housing, health, education or any of that. If it was sorted none of these would be a problem.

‘This is the central issue behind every single other that anyone cares to raise.’

Correct.

This conversation cannot be permitted in the mainstream media because this conversation would destroy confidence in the system within days of it occurring in the mainstream media.

The mainstream media, government agencies etc. are therefore fully committed to ensuring the is NO discussion of fundamental issues.

The ironic effect of preventing this conversation is to cause everything that matters to be made worse……pushing the system towards its own collapse and pushing the Earth towards becoming largely uninhabitable.

Thus, we see that politicians and heads of corporations would rather destroy their own children’s/grandchildren’s futures than allow discussion of, or reform of, the corrupt and unsustainable systems.

It’s a bizarre world we live in.

AFKTT

It is a sickness we have. Tolerating parasites and allowing them to control what we believe.

Our tolerance is deliberately stretched through trying to cope with the suffering bestowed on us as we struggle to get to grips with the very idea of ridding ourselves of the vermin that have entwined into nearly every corner of our economic, cultural, family and academic life.

The inertia of the parasitic mechanism can be counted by understanding of how a systematic restructure of our health can be achieved.

But there are many gate keepers who depend on the present parasitic malaise as a base source of their wealth. We tolerate them and they in turn continue to exploit and damage our future.

This process goes much wider than money. It involves the broader responsibility for the planet and our children’s future.

We need an injection of activism to draw clear lines of what should not be tolerated and the direction for change in the public’s perception of a health societal structure.

The powerful glue of cooperation and responsibility for the group, is at present largely dysfunctional and this affects every facet of our societies value system negatively.

The slave master mindset is not only manifestly inadequate for our health but is fundamental to our malady.

Great work Mike, agree completely. You have hit the nail on the head with this one.

We also need to draw the connection with those above these banks, the wealthy elite with their agendas and plans to control the world economy.

http://www.zerohedge.com/news/2015-09-29/un-just-unleashed-global-goals-elites-blueprint-united-world

Check out what – MAX KEISER confirms about the NWO and its connections with the banking domination and corruption.

Traditionally banking used to be an essential institution and legitimate business, but what we have had evolve over recent decades has turned much of it into a huge game of monopoly or even a casino enterprise. Hence the GFC we still have not quite overcome.

Strict legal rules, frameworks and community oversight are needed, so that such excesses are stopped and disallowed for the future. The international finance sector has its fingers in too many pies, where will it all end?

But people fall for so much, now I hear the new insurance entrant to the market “youi”, has been exposed, as rorting the system and ripping endless numbers of people off.

And some in the MSM, now strongly critical of that company, they were running endless ads for them for over a year, earning themselves from it.

http://www.stuff.co.nz/business/industries/78294590/Youis-heavy-handed-sales-practices-condemned-by-customers-and-insider

Banking has not been a ‘legitimate business’ in the English=speaking world since before 1694, when the Bank of England was established on the basis a fraud: fractional reserve banking.

Once banks began issuing more notes for redemption as gold than the actual gold they held in reserve the entire system became fraudulent. As time went on they became more fraudulent. Now most have no actual reserves. And now that sovereign debts are so huge, central banks have adopted ZIRP or NIPR to prevent an immediate implosion of the system.

Since the system is dependent on perpetual growth on a finite planet it naturally follows that the whole fraudulent scam must collapse fairly soon, what with global extraction of oil having peaked and other resources close to peaking.

I suggest you become informed about how the banking sector REALLY functions (e.g. The Money Masters, Money as Debt, Zeitgeist etc.) rather than hanging on to the myths promoted by bankers.

At this point of time is suspect les than 0.5% of the populace understands how the money system works, which is one reason why corrupt politicians can get away with telling such huge pork pies.

100%

Keep the public busy struggling, and ignorant.

video of Mike’s speech on this topic at the rally for Housing Action outside the Block last week.

http://socialistaotearoa.blogspot.co.nz/2016/08/dont-block-our-dreams-homes-for-people.html

An update on the protest after all, thanks.

@ Mike Treen. Fabulous! A brilliant piece. I feel vindicated completely.

All Banks out of NZ / Aotearoa. Now.

All mortgage debt written off.

Credit cards? Burn them then ignore the threats and demands.

God, what a great read. Today is a good day. Thanks @ Mike Treen.

I hear banksters have reinforced collars under their white collar shirts, for a purpose, meant to resist the pressure from the noose of a rope.

I remember when I was a little ‘un with a school banking account, you remember the one that said on the cover “be squirrel wise, save a little each day..? We were told that when we made a deposit the bank “looked after it” for us. We were never told that the bank actually lent it out for about three times the interest that we received. We received interest once a year, 3% (that would be considered a good rate right now!) but at least we didn’t have Roger Douglas and his successors helping themselves to about a fifth of it.

One way we can show our disapproval of Australian banks gouging the NZ economy is to switch to NZ owned banks – Kiwibank, TSB and there are also several NZ operated credit unions.

Myself I operate accounts at Kiwibank and TSB. The latter is particularly good and the staff at my local branch are a pleasure to deal with.

Nice one to both Mikes, Treen and the Lefty.

Support New Zealand owned and vote with your hard earned dollar towards a sustainable local banking system, one that invests wisely with the citizens of its country at heart and in mind, not its bulging to obscenity back pocket.

Every dollar you allocate is a vote. We must all look deep inside and ask ourselves; who and what are we currently voting for?

https://www.facebook.com/photo.php?fbid=1256611021035939&set=a.208224255874626.58018.100000611592661&type=3&theater

You’re right you’re bright you’re bloody well right Mike,

You’re bloody well right to say.

Banks are leeches and when they need more profit they just squeal that government policy is bankrupting them and the Government comes to the rescue right away.

Banksters are probably the craftiest of all middlemen – those parasites who pretend to offer a necessary service, but contrive to rob and exploit both the producers and the consumers. Christ threw them out of the temple, but they seem to have got back in, sold off the altar, and privatised the pews.

John A Lee pressed for nationalisation of banking in the 1930 and achieved steps along the way. State housing was a back door mechanism for the state to create its own new money and it worked extremely well. We still enjoy that legacy except mow the bankers want to destroy it via Key / English sell off / privatisation.

The City of London leant hard on Nash as Minister of Finance with threats blackmailing NZ to put the brakes on a program of nationalisation. Nash folded in the face of undisclosed personal stand over after all he had a family so was vulnerable.

Savage was gutless and then blocked John A Lee’s progressive vision at the very time when we were on a roll and most likely to have achieved real progress in setting a better foundation for NZ society.

These tribal money controlling parasites operate in packs well out of public sight. They have a lot to hide and so has Key. His relationship with them at one level is well documented, comprehensive, with roots to the core and selected by Allan Greenspan to further their conquest. Key is here to do a job for them – not us. What he gets from Bilderberg meetings and behind the scenes direction is well protected and probably beyond hacking.

Although we are occupied by both City of London and Wall street divisions, resistance is not only legitimate but essential as these bastard vermin will not go away voluntarily.

They must be forced out and in this occupied country, it is the duty of every citizen to get educated and mobilise. It is our country not theirs. Ignoring the situation is not an option as the inequity grows and their power entrenches. Privatisation of everything ensures deeper echelons of slavery with ranks of slave keepers.

Don’t be afraid of speaking out as their hostility is veiled and as yet somewhat covet in rhetoric.

An effective leader in NZ will not emerge and survive without a groundswell.

Well put.

Comments are closed.