New benefit rates for 2016 announced by the Government reflect that measured inflation is practically zero over the last year.

This means that core benefits will not increase.

As a short-term one off policy, as promised a year ago, beneficiaries with children will have an extra $25 in their net benefit rate from April 1. After offsets to other assistance, sole parents are expected to be about $17.50 per week better off. For a couple, each will see an increase of $8.75. These increases represent about an 8% increase in the adult benefit, but are given selectively to only those with children. As the OECD recommended in 2015, all benefits needed a boost as they had fallen so far behind growth in wages.

“Children’s hardship in low-income families still needs to be addressed. The best way this can be done is by lifting Working for Families Tax Credits,” says CPAG Economics Spokesperson Susan St John.

Because of a change in policy in 2011, Working for Families (WfF) tax credits are not adjusted annually for changes in the Consumer Price Index (CPI). Adjustments only occur when cumulative inflation reaches 5%. This is particularly invidious in times of very low inflation, and means that since 2012 there has been no CPI increase. Now, none is likely until 2017 or 2018. The Government has saved costs at the expense of the worst-off families.

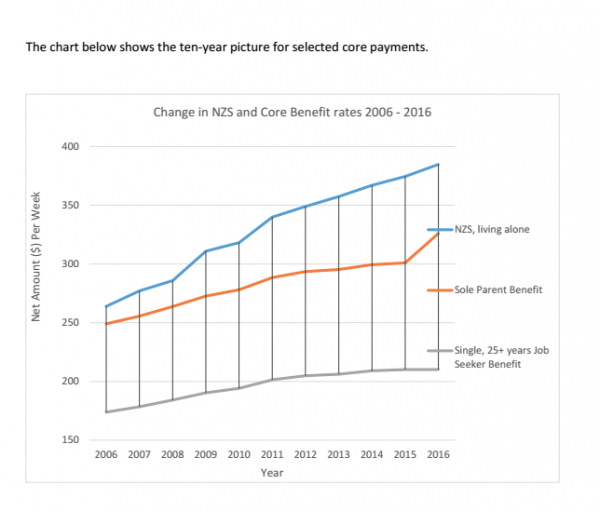

In contrast, the latest announcement sees NZ Super (NZS) increasing by 2.73% in spite of zero inflation because NZS is linked to average wages. Using the example of a single person living alone, NZS rises to $384.76, a gain of $10.23 per week. Over the years, such a link has seen older people well-supported in times of low general inflation and helps older people remain able to participate and belong to the communities they find themselves in when wages for others are rising.

Families on low wages, or on benefits because they are sick or can’t find employment or because they are caring for others, know that their money is not going as far as it did last year. Many can’t afford nutritious food, or power to heat their homes in winter. Many children in these families have to choose their subjects at school based on cost, and can’t even think about going on school trips. Rent increases matter more than many of the items included in the basket of goods that are used to calculate CPI inflation. While the official rate of inflation is -0.25%, rents increased in Auckland in 2015 alone by 10%.

These families are unlikely to get the In-work tax credit (IWTC) of $72.50 per week and so do not benefit from the Government belatedly increasing this fixed, unindexed amount by $12.50 per week. All this increase does is to recognise the lack of indexation since 2006 when the IWTC was introduced. In turn, for middle-income families the $12.50 will be clawed back by policy changes to the rate of abatement and a lower threshold for WfF over time.

Under current policy settings, despite the one-off increase to benefits, low income families have been left to lag further behind. Some very low income families get nothing from either the $25 or the $12.50 increase.

Child Poverty Action Group (CPAG) believes that the fragmentary exclusionary and confusing policies on the financial support for children need simplification and improvement if the most serious child poverty is to be reduced.