There is a standard view of how capitalism is supposed to work given by the media. It goes something like this; capitalism is a system where people come together to freely exchange goods and services, including labour. Businesses compete competitively to give the most efficient outcome, and the profit motive gives incentive for innovation. People who become rich do so because they work hard to offer the market what it wants while the poor do not, so this wealth inequality is to a large extent the natural workings of the market. This is an imperfect but the best possible system.

That is I think the standard view given in the media, and I think most of it can be debunked while the rest can be turned on its head. I’ll be critiquing this view, but also give my own view of how I think Global Capitalism works. I’ll give what I think are realistic and viable solutions to the faults of Global capitalism at the end.

Probably the best way to start off with an analysis of capitalism in the 21st century is to give a bit of background information on how the system transformed from a production based system to a finance based system. Capitalism is always seeking to make profit, and it was able to make profits in the period from 1945-1971 in the productive sector of the economy, and under this system there was high economic growth which was relatively egalitarian. However, when the productive sector reached a certain capacity in the 1970’s, increasing productivity became less profitable, and rather than investing in more production, profits went into the FIRE economy.[i] That is, finance, insurance, real estate. This set off a chain of events, which caused the FIRE sector to lobby to get rid of the regulations that stopped them from merging, making risky transactions and gambling. And with the rise of banks that never got regulated, (called shadow banking), the banking sector became wealthier and got turned into an institution that gambles rather than investing in productive things, and in turn was able to lobby for even more deregulation. The economy is now a system that is normally stagnant, and only grows when it is driven by speculative bubbles which eventually crash. Then the process is repeated. It is now the core of the economic system in much of the west, including New Zealand. Under this new system, real wages stagnate, as they have in New Zealand since 1984, while corporate profits go way up. And we can check who’s profited from looking at the increasingly dazzling wealth of the national business review rich list every year.

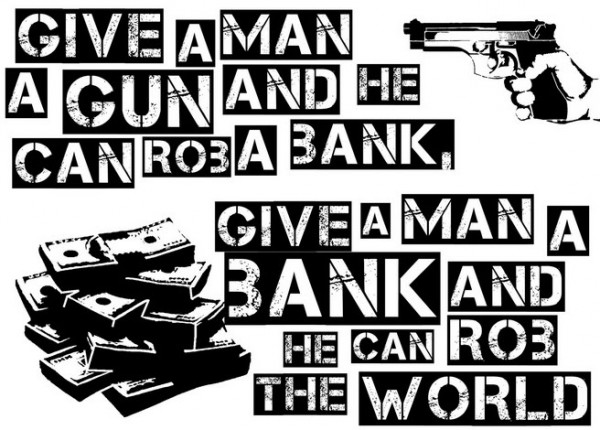

The banks now have a pretty good business model, at least for themselves. It is to make very profitable but risky transactions. When these risky transactions create speculative bubbles, as they did in the 2008 crisis, the cost is imposed on the population; and the taxpayer picks up the bill. [ii] These banks may know they are creating a speculative bubble that may destroy the global economy with hundreds of millions of people losing their jobs, but that’s the best way for them to make profits. The economics profession have called this ‘systemic risk’, which is the risk that the whole system comes crashing down, which imposes costs on all of us, which are called ‘externalities’ by the economics profession, and are one of the many inefficiencies in market systems.

In New Zealand the details of the FIRE economy are given in Jane Kelsey’s latest book, simply called the Fire economy, which draws much of its research from economists in the IMF, who have become marginally critical of their own policies since the global financial crisis. One research paper done by the IMF is a study into what the causes of the increasing number of financial crises since the 1970’s were. It gives a checklist of 8 different properties that an economy has which leads to a financial crises. New Zealand’s economy ticks most of the boxes on that checklist.[iii]

Studying economic history shows that the nations that are rich today became rich by pursuing the precise opposite of what the rich nations tell the poor countries to do today. The rich nations developed by protecting their industries with tariffs, while imposing free trade everywhere else, and when they become powerful empires, it was only then that the rich nations adopted free trade-because by that time the poor nations could no longer compete with their masters. In the 18th century Britain protected its textile industry from superior Indian production, and only dropped its protectionist barriers once it had become a dominant superpower and no one could compete with it. Once America became independent it pursued highly protectionist policy in the 19th century. Japan escaped the imperial reach of Britain, and was able to develop itself after World War 2 by kicking out foreign Ford and GM, then by developing their own car manufacturing industry through massive help from the state.

In the 1960’s and 1970’s, the poor nations were able to develop through protectionist policies with state intervention and had a substantial average growth rate of 3%.[iv] This all came to an end in the 1980’s when institutions like the international Monetary Fund, World Bank and GATT (now the World Trade Organization) started playing a bigger role in the governance of the poor nations. These institutions, are sometimes called ‘The unholy trinity’, were set up in 1944 as World War 2 was ending. John Maynard Keynes, one of the leading architects of these institutions expressed his contempt at the idea that those from the colonies and semi-colonies would have a role in these institutions, saying “they clearly have nothing to contribute and will merely encumber the ground.”[v] Thus, the World Bank and IMF were set up with a ‘one dollar-one vote’ governance structure, and since the rich nations had most of the capital, they got to decide which policies should be pursued in the poor nations. The Unholy Trinity pushed for austerity policies particularly hard in Africa, Latin America and parts of Asia. As well as advocating this theory taught to economics students called comparative advantage which tells countries to do export they are best at doing. Well it just so happens that the poor nations have a colonial history and have not yet developed, so pursuing what they are best at is exporting their raw materials to the rich nations. Maybe there is an exception, but every single country I’ve seen that adopted these policies ended with large masses of poor people and a small concentration of wealth in the hands of a minority, much like what’s happened in New Zealand except on a larger scale. There were some countries that escaped the austerity policies, namely the East Asian tiger economies; South Korea, Taiwan, Singapore, and Hong Kong. While Singapore and Hong Kong did do well under free trade, Singapore used large state subsidies to attract foreign investment and direct state owned enterprises, and Hong Kong developed under the protection of the British until the 1990’s.[vi] So that’s the real history of free trade capitalism up to the present and it’s been largely ignored from most of the top economists, the ones that win Nobel prizes and write the textbooks for example.[vii]

Another idea put forth in the media is that you need a capitalist profit motive for there to be any incentive to innovate. The argument seems to ignore the obviousness that much of the innovation in the 20th century has been done under highly socialist institutions, namely universities. But there are good reasons why these arguments are put forth, the Silicon Valley companies, Hollywood, pharmaceuticals, and agribusiness have a lot to gain from it. The way it works is that most of the research and development is done in the state sector, then once something becomes profitable it gets turned over to private power, which then modifies the technology and claim it’s their property through protective government enforced monopolies called patent laws. This is then followed up by the private media shamelessly claiming that state-interference is ruining the innovative and productive private sector. Since 1945 one third of US research professors have been supported by national security agencies. The US air force developed the basis for a personal computer and mouse for example, with the whole history of Silicon Valley being tied up closely to the US military.[viii] Actually the idea of a decentralized internet was laughed at by the US telephone monopoly AT&T in the 1960’s, and dismissed. It was only until 1995 that the private sector realized its commercial potential and had it given to them. [ix] But the state sector doesn’t do all of the research. Seeds that farmers use in the poor nations were developed over thousands of years, and then multinational agribusiness came in and genetically modified these seeds slightly so they could patent and claim royalties on them. It is also easy to see that in Hollywood’s entertainment industry do not innovate new cultural tastes by their control over patents and profit motivated production. In reality the media businesses largely produce music and movies based on the market that already exists, which would be why there are so many sequels to movies and such. That’s the opposite of innovation. The people who created new breakthroughs in music were often marginalized communities.

The order of global capitalism relies on various social philosophies that make it seem fair and just, and prevent the masses from getting rid of it. One is the social philosophy of tough love, and this is a core component of the neoliberal policies of the unholy trinity. It was strongest among the old-classical economists in the early 19th century. Back then professors of moral philosophy like Jeremy Bentham somehow rationalized the dual philosophy of tough love and the utilitarian theory of maximizing happiness, when expressing his view on the four year olds that worked in coal mines he had the following to say:

“Infant man, a drug at present so much worse than worthless, may be endowed with an indubitable and universal value.”

Thomas Malthus, the political economist and theorist on overpopulation was much worse, and he thought human population would grow faster than the productivity of bread, and had a complex plot of how the world should be shaped for the poor expressed in this passage:

“Instead of recommending cleanliness to the poor, we should encourage contrary habits. In our towns we should make the streets narrower, crowd more people into the houses, and court the return of the plague. In the country, we should build our villages near stagnant pools, and particularly encourage settlements in all marshy and unwholesome situations. But above all, we should reprobate specific remedies for ravaging diseases … If by these and similar means the annual mortality were increased . . . we might probably every one of us marry at the age of puberty, and yet few be absolutely starved.”[x]

The social philosophy of tough love has become more dishonest with its re-emergence in the 1980’s. While the mass media and politicians don’t have the honesty that Thomas Malthus did, they express it in more euphemistic terms. However, the results of stagnant pools and reprobating specific remedies are all but accomplished in the third world by the pharmaceutical corporations and privatized water monopolies. So when 2 year olds in Latin America have to start drinking water out of diseased stagnant pools because the world bank recommended handing public water over to private monopolies, these children have to learn ‘tough love’, or market discipline, and make ‘rational wealth maximizing decisions’ over ‘scarce resources’.

In South Africa, in the 1990’s, instead of Indian manufacturers producing specific remedies for ravaging diseases like HIV/AIDS at $300 each, the Western pharmaceuticals use their highly protectionist policies enabled by the unholy trinity to charge medicine in the price range of tens of thousands of dollars.[xi] So that is what’s called ’tough love’, or ‘market discipline’ for the people that die of HIV/AIDS, but not market discipline for the pharmaceuticals. They need the government to do most of innovation for them, so they can take that innovation and claim it’s their property.

I would rather criticize the institutional stupidity of global capitalism than the individuals within it, as criticizing those individuals makes no sense, since a change in individuals hardly changes the institution. However, Bill Gates is more than just an individual, he’s part of the media mythology of creative capitalism and benevolent capitalists.

Bill Gates made his fortune as a government welfare parasite, but it’s ok because you can get a job at his philanthropic organization, so long as you never mention two words. One of them is ‘intellectual’, and the other one is ‘property’. The benevolence of Bill Gates can be seen in supporting projects in the developing world like ‘creative capitalism’, in which this hard working capitalist strives to pump money into Monsanto, which develops its own patented GM seeds that are more productive and weather resistant to the ones developed by the third world farmers. Unfortunately, supporting tyrannical corporations makes the third world farmer dependent on Monsanto, and the other TNC’s, where they are driven into poverty, and they commit suicide in the hundreds of thousands.[xii] One critic, Vandana Shiva, calls the Gates foundations organization (the alliance for a green revolution; or AGRA) ‘the greatest threat to farmers in the developing world’.[xiii] The Gates foundation itself has inquired into the reasons why people don’t believe charity is helpful for the developing world. According to their study, called the ‘Narrative Project’, “they are all a bit stupid.” And they’re “too calloused to care about social causes.”[xiv]

The texts on neoclassical economics say that markets are based on rational consumers making informed decisions, and the market is efficient when it’s perfectly competitive, that is when no firm has control over price, supply and there are many substitute products to choose from. In reality, there is massive intervention in the market by creating irrational and uninformed consumers, mainly through advertising. And advertising has increased in concentration through the neoliberal era. Furthermore, studies done by two political economists Robert McChesney and John Bellamy Foster give in my view a pretty argument that corporate power in the 21st century is more monopolistic than it ever has been in history. This is done through tacit collusion and price leadership in an oligarchical market structure. So by the definition of efficiency given by neoclassical economics, we currently live in a very inefficient system. And the reason that oligopolistic power is often ignored can be traced back to the Chicago school of economics. One economist from that school, the Nobel laureate George Stigler writes in his 1988 memoirs that

‘The central objective of the Chicago school of economics was destruction of monopoly power in all its aspects (including advertising).’[xv]

This was done through considerable rewriting of history, such as the denying of predatory prices that led to the rise and dominance of Rockefeller’s Standard Oil.[xvi]

The world is now largely governed by the mobility of investors and lenders, who can speculate against currencies and pull capital from countries whose populations try to resist public policy, as has happened in Greece recently. But their attack on democratic governance can be resisted. It has been successfully resisted in Bolivia for example, under the governance of Evo Morales, resources have been nationalized and since then there has been some reduction in inequality. The excess of the FIRE economy has also been resisted in richer nations like Iceland. [xvii]

What can be done?

In the poor nations neoliberalism has been imposed with fascism and violence. In the rich nations it has been imposed with propaganda in the media, doctrines from elite universities, and the atomization of social and political life. Therefore, it should follow that to get rid of neoliberalism in the richer nations we would require debunking of the propaganda and the organization of social and political life.

I do not agree with the assumptions made about human beings in economics that we are rational wealth maximizers. If that were true, our human nature would be in line with the behavior of the corporation. But the corporation’s behavior is pathological. It is a totalitarian institution, driven by short term profit above all things, even the survival of human civilization is worth less to corporate power than the mass enrichment of a few hundred people. It forces human beings to behave amorally, but also forces the wage slaves at the bottom of it’s hierarchy to be mere extensions of the machines they operate on in their sweatshops, with no creativity in their robotic work.

I do not believe human beings are amoral creatures, nor do I think they are robots. The hierarchy of the private power is thus both degrading and insane, according to my own value judgement. So in my opinion we should be aiming to get rid of this hierarchy, and replace it with one that is democratic, where workers have democratic governance over production, consumption, and distribution rather than being made to be tools for an executive’s salary. This idea came from the mass movements of workers in 19th century Europe, and then got turned into the political ideals of socialism, and eventually turned into syndicalism-that merged with the ideas of anarchism to make anarcho-syndicalism in the 20th century. It was put into practice in Spain in 1936 before being crushed by fascists, Stalinists, and capitalists. In my view anarcho-syndicalism is one of the best attempts at a humane political system in the 20th century. It’s been written about by prominent philosophers Bertrand Russell in his ‘Political Ideals ‘and’ Proposed Roads to Freedom’, and I think more eloquently in Noam Chomsky’s ‘The Future of Government’.

Some might say the above is too utopian, but I think that women’s rights and getting rid of slavery were once utopian ideas as well. The other criticism which I think is perfectly valid is that it’s out of reach. This is true; we should be focusing on urgent things first like building up a mass movement, but we should do it with an end goal in mind. Once we have enough people to put pressure on the government then we can start doing things like re-regulating banks and nationalizing the media so it’s no longer controlled by advertisers and financial institutions, and getting rid of student debt which I also think should be a pretty high priority, as students have become more obedient and passive to political activism from the burdens of debt and a high unemployment rate. Those are good mechanisms of controlling people, whether they were designed to or not.

But I would like to say that those who only want to a more humane version of capitalism miss the point entirely of how capitalism functions. It is in its very nature a system that forces widespread human suffering; we shouldn’t be aiming to make an oppressive political system more humane but to get rid of it. It’s kind of like saying we should be kinder to slaves. Sure, that makes sense to say that, but why stop there when you can just get rid of slavery?

So that’s how I think global capitalism works and now it’s your turn to criticize it, reflect on it, or try to do something about it if you think it’s correct.

‘Douglas Renwick is an undergraduate student at Victoria university studying philosophy and mathematics. Outside of studying he is interested in talking about politics, so if you are interested in discussion, contact me!’

[i] The Endless Crisis: How Monopoly-Finance Capital Produces Stagnation and Upheaval from The USA to China

[ii] P77 The FIRE Economy: Jane Kelsey

[iii] P34 The Fire Economy: Jane Kelsey

[iv] A more in-depth but very accessible study to a non-economist is given in Ha-Joon Chang’s Bad Samaritans.

[v] P24 The Poorer Nations: Vijay Prashad.

[vi] P29 Bad Samaritans :Ha-Joon Chang

[vii] If you want some evidence for this statement, see the history that was given by 300 economists in the New York Times in 1993 in argument for NAFTA, seen here http://www.nytimes.com/1993/09/17/us/a-primer-why-economists-favor-free-trade-agreement.html Furthermore check the standard textbook for first year economics called ‘principles of economics’, and read the chapter on development. Nowhere is this mentioned.

[viii] P100 Digital Disconnect: Robert McChesney

[ix]P99 Digital Disconnect Robert McChesney

[x] P43 Capitalism and its economics: Douglas Dowd

[xi] P123 Bad Samaritans: Ha-Joon Chang

[xii] At least 250,000 Indian Farmers have committed suicide for example since 1995 as is documented by Vandana Shiva http://www.aljazeera.com/indepth/opinion/2012/02/201224152439941847.html

[xiii] P74 Whose Crisis, Whose Future?: Susan George

[xiv] http://www.aljazeera.com/indepth/opinion/2014/11/death-international-developmen-2014111991426652285.html: Jason Hickel

[xv] P94 The Endless Crisis: How Monopoly-Finance Capital Produces Stagnation and Upheaval from The USA to China: John Bellamy Foster, Robert McChesney

[xvi] P95 ibid

[xvii] https://zcomm.org/znetarticle/how-rejecting-neoliberalism-rescued-bolivias-economy/ and P240 of the FIRE Economy: Jane Kelsey

I agree with almost everything. Just a couple of additins.

It`s the personal choices we exercise on a daily basis that make a difference. One can hardly profess Bitcoin over Westpac without actually trading in it, or knowing how it works. Nor, can one complain about global warming while driving to work everyday. Why not carpool, walk, or bike? Personal choice is the arbiter, and that means action over opinion. If we all sit on our fat arse, buy McDonalds, Dole, or Starbucks then we are culpable participants in corporatisation of New Zealand.

I`m surprised you didn`t mention participatory culture, the orange economy and the creative economy as solutions. I guess the media in NZ protects Kiwi`s from knowing anything about participatory culture and it`s growth in Brazil. Particpatory budgeting for example allows every resident to vote on council by laws and expenditure. In NZ we`ve changed the name to “inclusive urbanisation” as part of a global campaign to corporatise what began as a grass roots movement by the educator Paulo Freire.

It`s also interesting to see Ecuador moving into bitcoin, the first government to do so in the world, but, certainly not the last. http://is.gd/iYrKG8

Happy Sundays to all.

Yes MuseNZ good point that,

“If we all sit on our fat arse, buy McDonalds, Dole, or Starbucks then we are culpable participants in corporatisation of New Zealand.”

Perhaps we need a Government again to grow balls as I saw in US living there when one or two Corporations got to big for the US consumer and economy to cope with.

AT+T the large Telecom overtook the “Baby Bell’s” networks and Nixon stepped in and broke AT+T up under federal law then, as “Anti-competitive”. Same with Bush and Clinton over Microsoft becoming anti-competitive.

Perhaps we need to see a return to a “Muldoon” like approach here also?

The banks are to big and Muldoon warned them in 1982 when the credit card interest was spiralling out of control at 24% Muldoon ordered them to drop them or be forced legislative change.

Keyster could but wont request less franchising and aggressive advertising, and restrict locations.

Hey i don’t know much about bitcoin but to me it seems like a volatile currency used for buying stuff on the black market. I

I also do not think personal choices over consumption have much of an effect on capitalism, and it does not address the rot of the system. These personal choices are not ones that the vast majority of the worlds population can engage in either.

i dont spend any time thinking about my choices of personal consumption because it would take too much time for me to think about all these sorts of things in everyday life. It takes time to research what behaviour a corporation has for every single commodity you buy and it would have a terrible drain on my time and energy. And if we convinced the 10% or so of the worlds population that can afford the time and energy to make these choices all the time, would it change the system very much? Maybe it would, but it’s hard to tell and it seems far too difficult.

I think the easiest solutions would be for the population to exert some sort of pressure on corporate and state power. That’s how labour parties have been elected for example, in the 1930’s.

I have read some Freire but am not very familiar with the orange economy, creative economy. Although i am familiar with participatory economics if that is related. I will add these things to the list of stuff i mean to look into. 🙂

This is clear, concise, joins the dots and explains the world as we know it. You’re totally ruining any chance you might have had of getting a job in the mainstream media Douglas.

That sounds about right, i would be quite ashamed of myself if the mass media ever offered me a job.

Many dots to connect there Douglas and well done for alluding to the NZ context.

Interestingly I have heard more than a few people comment on what Muldoon’s view might be viz the situation in NZ right now.

Sorta get the feeling that he knew what would happen if the banks were let off the leash but had no way of stopping a wave that swept the anglo world. For all his faults he had a much better idea of how economics and society meshed. He saw hard times in NZ in his younger days and never forgot it.

The majority of politically powerful people these days have never done a hard days work and wouldn’t know one if it jumped up-sides their head… just witness the almost comically lame excuse for Health & Safety law.

Would love to see a debate between Muldoon and B’linglish about economics. Mediated by Mike Hosking of course……

LOL

Excellent article but missing a few fundamental changes necessary to birth an enlightened society. Firstly the country must take control of the issuing of new currency no more borrowing, run an honest money system with personal accounts being a right not a privilege.

Secondly no more land lords, property speculators or land bankers(life style blocks) these are what drives this economy and our slavery to foreign banks robbing us of our most productive and creative years. Also end all property tax ie Rates. Hand it down or hand it back.

Re-nationalize all essential services and industries, eg power, water, transport, communications etc. we built it with our own hands and materials, it is our birthright and a moral imperative.

In my opinion the result would end poverty, crime (bar crimes of passion). We would have a healthier safer and greater caring society.

Great thinkers and innovators of this world were not so motivated by greed but by passion and compassion, usually only to be exploited by the greed of capitalists, bankers and politicians

Anarcho-syndicalism is the only way to end slavery and have real inclusive governmental structure where we vote on policy not on parties or personalities.

[…] – See more at: https://thedailyblog.co.nz/2015/08/30/sunday-long-read-douglas-renwick-how-global-capitalism-actually… […]

Comments are closed.