THE MAINSTREAM MEDIA is itching to call it a Capital Gains Tax. Indeed, that’s what they did call it in the hours immediately following the Prime Minister’s speech to the Lower North Island Regional Conference of the National Party. The Government’s spin doctors were beside themselves, frantically working the phones to persuade journalists that the suite of measures announced by the Prime Minister were targeted at property speculation – not capital gain. That they succeeded in winding back the hacks’ desire to brand the Government’s new policy an embarrassing U-turn, was in no small measure due to the fact that the Labour leader, Andrew Little, had himself been quick to tweet: “This is NOT a Capital gains Tax.”

He was right, but Andrew Little, born in 1965, would have been too young to remember the legislation from which the Prime Minister and his Finance Minister, Bill English, were so freely borrowing. As a little boy of eight, growing up in New Plymouth with his National Party-voting parents, Andrew was unlikely to have marked the introduction and passage of the Property Speculation Tax Act 1973.

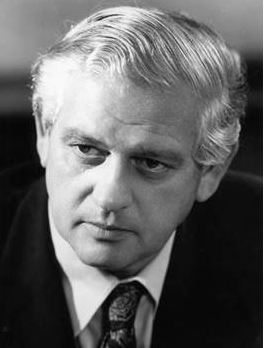

Introduced by Bill Rowling, Finance Minister in the Labour Government led by Norman Kirk, the Property Speculation Tax Act was intended to impose, assess and collect tax on “profits or gains derived from property speculation”.

Then, as now, the Auckland property market was dangerously overheated. The Flower-Power Generation were turning their backs on Keith Hay’s and Barry Beazley’s standardised suburban bungalows, in favour of the Victorian and Edwardian villas they had flatted in as students. Sharp-eyed speculators had been quick to seize the opportunity. In the formerly working-class suburb of Ponsonby, for example, Polynesian tenants were having to make way for young, professional Pakeha couples. Old rental properties, purchased for a song and swiftly renovated, were being flicked on to these middle-class interlopers, at a whopping profit.

“Big Norm’s” working-class government was having none of it. Following the Act’s coming into force in June 1973, speculators opting to sell their properties within a two-year time frame faced a punitive tax-rate of between 60 and 90 percent on any IRD-assessed profits realised! Not surprisingly, the Rob Muldoon-led National Party which, with much help from aggrieved property speculators, would defeat Labour in 1975, was pledged to repeal the Property Speculation Tax. By 1979 it was gone.

But, somehow, its provisions (if not its tax-rates) endured. Even after Labour’s legislation was repealed, proven property speculators continued to have their profits taxed by the IRD. One way or another, the two-year rule continued to have its effect. Rob Muldoon, or no Rob Muldoon, Norman Kirk’s legislativejihad against the Auckland property speculators of the 1970s continued to enjoy a ghostly afterlife.

And now, thanks to John Key and Bill English, Big Norm’s spirit is set to revivify the fiscal assault upon property speculation. The income tax legislation relating to property speculation is to be equipped with a new set of “bright line” definitions of speculative purpose intended to render the recovery of revenue much less vulnerable to legal objection.

What’s more, the latest incarnation of the speculative bogeyman – the much-maligned “Foreign Investor” – will be required to acquire his or her own IRD number, and a New Zealand bank account, before being allowed to purchase New Zealand real estate. The precise dimensions of the “problem” of foreign investment in the Auckland property market will soon be measured with considerable precision.

So, no, Andrew, you’re quite right. This is NOT a Capital Gains Tax. But it IS a property speculation tax, which no self-respecting Labour Party member or supporter should oppose. As someone who can remember the property speculators of those far-off days (in 1974 I even crashed in one of their renovated villas in Ponsonby’s Vermont Street) I am only too happy to congratulate John Key on his spectacular gift for irony. What was good enough for Big Norm is certainly good enough for me!

The National government using socialist policies to fix a free market problem! The Lord sure works in mysterious ways!

Seems the trolls have got here already

Wrong Wrong Wrong – you need to study Cloward and Piven.

Deliberately overload a public service so as to create the desired CRISIS and force change on everyone – left or right……we will ALL be affected by another TAX…….especially on property…..

1. Ak Council – Force COA and or CCC compliance on the public for historical permitted work.

2. Applications – time and cost – sent to Lodgement as requested for a COA – and it sits there unprocessed for five weeks…….

3. After multiple complaints demanding to know whats happening – they move the file to Processing – and finally deposit your cheque for fees so the 21 day reply clock starts ticking…

4. After almost two months – the file is still not processed and we are told the COA is NOT required – we must now apply for a CCC.

5. When I question this – I then find out that there is NO LEGAL requirement at all to get a CCC for work performed 20 years ago by registered builders to permit which was given FINAL CONSENT.

6. Council admits this in writing and state that there was NO legal requirement at all to get a COA or a CCC……..for such work….

7. So our home was deliberately kept from market for over two months – and so have thousands of others as they undergo a draconian compliance regime- and as for speculators – I know a few who have NOT been able to buy a home to speculate on……because many have been kept from market by this scam…….

8. Deliberately CONTROL SUPPLY and you limit the number of houses on the market…. deliberately forcing up the value on a few houses – so as to provide the excuse for a new tax on EVERYONE…….blaming speculators….yeh right…..and we all brought it hook line and sinker……this is NOT a left or right issue……..

It is the “elephant in the room”, the economics of trading with China.

Chinese buyers at 0% colonisation rates from Chinese banks.

But the new rules will limit buyers to those showing and IRD number from a bank in NZ.

href="http://www.landlords.co.nz/article/5369/chinese-banks-in-nz-likely-to-mean-more-choice-more-competition"

…and which ex-National Party leaders are linked to Chinese banks?

National Party’s links with Chinese banks

One million dollar average price for Auckland houses by 2016, one year out from the election year, 500,000 Aucklanders and 500,000 guaranteed National voters.

Makes one wonder what the draconian council really do in their air conditioned offices while ones application just sits waiting. I guess one could say both the application and the council are simply a waste of time?

@ Hornet. I would agree with you . I don’t believe it’s a Left / Right issue either. I think it’s a pack of crooks lining their pockets while masquerading as politicians who’re pretending they’re trying their best to take care of business for us . It’s a large pile of shit that they’ve shat. They’re bent and they’re lying and they need to be dragged into court .

You have some facts and figures wrong mate. Go have another look at what a COA and a CCC. And 20 yrs? No sorry.. Pre 1993 maybe.

Yeah BUT the building Acts are all available online. It is also Real Estate Agents and Conveyancing lawyers who are in on this. It pays to do your homework.I copied the 2005 compliance sections of the building code into various emails to lawyers over the years dealing with family estate property and my own property. These so called professionals are ignorant and uninformed. You don’t rely on ANYTHING they say,you find out for yourself. Also we now have many Asian lawyers in Auckland holding up deposits and using your money to gain a few nights interest on the currency markets. The whole thing sucks and is a scam.That’s how NZ is these days. That’s what we voted for. I am glad I have always been a cynical lefty I trust no one question everything and believe little of what I am told. Survivor’s policy.

You do not need Codes of Compliance for work done before 2005.

That includes gas and electricity.

That is what the Building Regs 2005 say. Your local council can have different specifications for permits. but Codes of Compliance did not come into force until 2005. As I stated above this is a stick uninformed professionals use to beat buyers and sellers with so their mates in the trade can do unnecessary inspections and work etc. I have experienced this and corrected more than one legal professional who didn’t know the Act.

RIP Big Norm.

@ Trevor Mills –

NZ was indeed blessed to have had such a PM of Norm Kirk’s standing. Not since his day has any successive PM had Big Norm’s enormous mana, or genuine respect and love for his country and citizenry.

Yes. May the big man rest in peace.

I think it’s quite simple. Those few who brokered deals to help rich foreigners into our real estate have had their palms greased . The money and perks are in the bank . So let them have their silly little property taxes etc . I have my millions so I’m all right jack .

199,000 New Zealand taxpayers are currently being subsidized by the ‘tax base’,(you and me that cannot escape paying either GST or income tax), to own ‘investment property’ in this country,

Anecdotal evidence from bodies such as the Property Institute says that among these 199,000 it is more likely they have 2 ‘investment properties’,

One of my Rellies is currently playing with 3, they have been the subject of successive ‘Interest Only Loans’ from different Banks,(you really need to have (a) a really good relationship with your Bank(s), and/or (b) a good mortgage broker to get the Bank’s to cough for these ‘Interest Free Loans),

None of these properties will be subject to the Prime Ministers ”yellow line”,(yellow in more ways than the Prime Minister intended i would suggest),they have and will continue to be milked by this particular Relly up to the point where the various Bank’s no longer offer ‘Interest Only Loans’,

Proof of the intention to have these properties as rental investments is supplied via having engaged the services of a Property Management Company,

The cost of the Property Management Company is written off against the due income tax from this particular Relly and His wife while they pay nothing on the Mortgage,

The rates due on the properties is also written off against the due taxes, as is any other cost such as insurance and repairs that exceed the annual income from Rent on the properties,

So, anyone who cannot escape paying any of their due GST or tax on income is directly subsidizing this particular Rellies wee property empire,

In the 8 or 9 years He has so far held these ‘investment properties’ He has simply rolled over the ‘Interest Only Loans’ with various Banks and will keep doing so while counting the Capital Gains,

The 199,000 of my fellow citizens playing this little ‘Game’ are long term speculators gaining spectacular long term capital gains while other taxpayers subsidize all of their costs,

The situation is so bizarre that this particular Relly and His wife rent the cheapest flat they could find because the direct tax subsidies they are accruing are far more beneficial to them than living in one of the 3 properties they have mortgaged…

It hasn’t escaped most New Zealanders that we are, in effect, subsidizing property investors/speculators by not having a CGT.

The Tories might be right that this isn’t a full-blown CGT. National is renowned for tinkering and not doing what is necessary.

That is why they are such hopeless economic managers,

I think National has now acted for one basic reason: The foreign speculators were muscling out the local speculators and National’s buddies were losing out. Something had to be done about that.

National did not act to halt the bubble or give first home buyers a chance one iota, they acted to try and give their speculator mates in Auckland an advantage.

Less than a couple of hundred years ago the Europeans arrived with ideas of property acquisition and of ‘buy and sell’.

Norm Kirk, RIP, my first opportunity to vote, i remember it well, Invercargill Borstal, all of us unlocked on a Saturday morning, me off to the hall to cast my ballot wondering where all my fellow inmates were as normally Saturday morning was a time where we had time to interact, swap books and other things better not mentioned,

Years later as my interest in politics developed i read of John.A.Lee, doing time in the same institution,(later to release Himself, doing a runner dead North straight up the railway tracks), i wondered as i read, the cell allocation at the time was done on an alphabetical basis, i could have been doing my time in a cell once inhabited by Lee Himself, and, laughingly considering whether it was the ghost of John.A. that had driven me down that strangely deserted wing of invecargill Borstal that Saturday morning so long ago to cast a vote for Norm Kirk’s Labour Government when all my fellow’s had become so strangely shy,

Excuse my reversion into reverie, Norm Kirk’s use of what would best be described as a very large engineers hammer to the 1970’s version of property speculation was where i was headed at the start of this comment,

While i well understand Big Norm’s revulsion of the practice of property speculation, He knew full well the excesses of the Landlord class,(imagine what Norman Kirk would have to say today about what’s left of the Labour Party riddled from top to bottom with nouveau riche Landords),

”Riddled” i could well imagine His soft deep growl, ”Not riddled, Rotten with them” is the way i would imagine His description of the Baby Boomer children, inheritors of the Party, of the parents His Labour Party had housed all those years ago,

House them they did, with a population of 2 million at the time Kirks Labour Government was overseeing the building of 24,000 of them a year, creating pathways for the parents of today’s Baby boomer crop of Landlords parent’s to cash up their family benefits and own their first Homes while ensuring the building of what then was a massive State House estate of 75,000 Homes for those of the 2 million who could never get from the Banks a mortgage,

Kirk, to have dealt to the speculators as He did must have despised them, the whole Landlord Class must have been anathema to every belief Norm Kirk held in His heart and Soul,

To Kirk houses were not mere chips to be aquired for use in some game of crazy capitalism, like me, Kirk would have seen them as HOMES,

Would i given the chance take to these despised perverter’s of the family HOME into a speculative token of greed with the same large hammer that Norm Kirk used all those years ago,

Well no, my thinking is it is better to find and use one of those fine small hammers that Doctors used to use to tap your knee testing for nerves,

”It’s been Government policy to levy tax on anyone buying an investment property with the INTENTION of selling it at a profit within 10 years of purchase for as long as i can remember”,

So said Property Institute Chief Executive Ashley Church, and, that is correct the TAX RULES are quite specific,

So the TAX RULES need clarification, simply remove the onus of proving ‘intention of selling at a profit’ from the IRD by deleting those 6 words and instead add the word AND,

Next, Interest Only Loans, there is legitimate reason for them, tho i dare say there is no legitimate reason for these loan structures to have a term of 5 years,

Apply a ‘sinking lid’ to the time allowed for an interest only loan from 5 years down to 3 months over a 5 year time frame, once the 3 month term is all that is allowed change the bankers rules to only allow such loans for family homes,

Next, apply that same ‘sinking lid’ to the game of tax write offs where anything, rates, insurance, interest payments,property management fees etc etc can be claimed against the personal income tax due by those who ‘own’ these properties,

it’s pretty simple, every year going forward X claim against losses would be assessed first with 3% less of the loss claim allowed to be clawed back from personal income tax due, should that claim come back a year later the 3% less would become 6% less and so on,

Next simply BAN outright the ability for those who are not citizens or do not have long term residency in New Zealand from purchasing any House or property intended for housing,(if non-residents and non citizens want to invest in property in this country tell them to shove their money in a bank that trades in New Zealand),

Pretty simple really, most of it is minor changes to tax rules, which would in 10 years send all those playing the Game, turning HOMES into mere chips in a game of crazy capitalism someplace else like the sharemarket to play,

Lastly, the Kirk Government, the last true Labour Government of the working class had the number of State Houses at 75,000 for a population of 2 million,

There are now only 69,000, soon to be far less, for a population of 4+ million, it is obvious that that number should be doubled and most of that doubling should occur in the city of Auckland first….

Comments are closed.