It’s too easy to respond to a story about debt in a ‘woe is us’ kind of way. Debt is neither good nor bad. It simply is. It’s one half of a relationship; a relationship between debtors and creditors commonly mediated through a chaperone, such as a bank. Strictly, in modern financial times, it’s a relationship between a group of debtors (a debtor class) and a group of creditors (a saver class), usually intermediated by a profit-seeking business such as a bank.

One person, in response to my last week’s blog Young Debt, said what many presume: “The problem with debt is that, eventually, it has to be paid back”. This is not strictly true.

Conventionally debt has to be ‘serviced’, and that may involve it being paid back by individual debtors. But most creditors are not at all interested in being paid back. Certainly the saver class, as a class, has no interest in being paid back. Its raison d’être is to accumulate entitlements, to ‘make money’ instead of being paid back in stuff. When this happens – as it usually does – the goods and services foregone as debt service must be consumed by the very debtor class that forewent those goods and services. What is paid back by one debtor typically is consumed, not by the creditor, but by another debtor

(A debt contract is a contract in which a creditor cedes an amount of stuff – goods and services – to a debtor in return for that debtor foregoing, as a lump sum or in instalments, a contracted amount of stuff in the future. If the future amount of stuff is greater than the present amount of stuff, then we can say that the rate of interest on this contract is positive. The debt is settled – repaid – only when the creditor completes delivery of the foregone stuff. Otherwise the liability is simply reshuffled within the debtor class; and that liability increases if the interest rate was positive.)

The more general meaning of debt service is to pay interest. But the debtor class doesn’t actually do that either, because the saver class exists to accumulate compound interest. Compound interest is what happens when creditors refuse to consume the goods and services that interest represents. Instead they cede it back to the debtor class.

Collectively the saver class believes it is entitled to receive, from the debtor class, goods and services valued at many times the world’s GDP. It’s a fiction that will practically never be a problem however, because by their very nature the saver class does not actually want ‘the bag’ (of stuff). No, it wants the money, unspent – the entitlement, unrealised – content for the debtor class to keep enjoying the bag and all its consumerist goodies. (Many of us will remember Selwyn Toogood and more recently John Hawkesby; host of the game show ‘The Money or the Bag?’)

The saver class relies totally on the debtor class having the stuff while it has the money for itself. The saver class makes its money through a combination of selling stuff to the debtor class and compounding interest against the debtor class. The debt of the debtor class is the wealth of the saver class. Liquidation of that debt represents a loss of saver ‘wealth’.

Interest is the price that debtors pay to savers when savers are scarce and wannabe borrowers are abundant. Economists have traditionally assumed the world has always been like that and always will be like that; scarce savers and abundant borrowers. Well, the relative scarcities have reversed; the world has become debt resistant. Many economists, shocked by the new reality that has dawned in 2015, have become transfixed. Few in this part of the world have noticed this herd of elephants stampeding towards our living rooms.

Interest is also the price that savers pay to debtors when wannabe borrowers are scarce and savers are abundant. That’s the underlying financial reality of the 2010s and possibly will be for the remainder of this century. Welcome to the world of negative interest rates. It’s explicit in Switzerland, Denmark and Sweden. In many other countries – the Eurozone and Japan – it’s explicitly zero but implicitly negative. Already, in 2015. In the OECD it’s mainly Australasia that’s still playing Canute.

Debt is not a sin. Debt is simply the complement of credit. In today’s brave new world, debt is an accommodation of saving that must be induced by an interest rate that clears the market. Under contemporary conditions, savers are having to pay debtors to spend on their behalf. Compound interest reverses; it unwinds. Absolutely a good thing. The conventional story of interest as a reward for thrift is in fact only half the story. Interest may also be a penalty for thrift. Interest is a payment that can go in either direction, depending on prevailing circumstances.

Negative interest rates are not quite as novel as many of us think. In the late 1970s and early 1980s we had interest rates well below inflation rates. That was the main reason for the neoliberal revolution of the 1980s. The saver class has a very strong sense of entitlement; an entitlement to receive a bounty from the debtor class. In the late 1970s and early 1980s, compound interest was unwinding; savers were effectively giving stuff to the debtor class.

The response of the saver class was threefold. First they joined the debtor class, borrowing to buy assets which they hoped would appreciate in value. It was a bit of a punt at the time. House prices and share prices were stagnating in the inflationary late-1970s. Second many savers took to more risky ‘investments’ in order to receive above zero ‘real’ returns on their savings. Thirdly they favoured monetary policies that obliged central banks to set interest rates above the rate of inflation. They introduced a specious argument for such policies; a claim that low interest rates were somehow inflationary. The gullible left even bought that argument. Look at Europe and the rest of the OECD now to see if low interest rates are inflationary. We now have deflation in the OECD such as few alive have ever witnessed.

Now that we have a substantially electronic monetary system, we can (indeed we must) manage our lives in a market economy with interest rates that properly reflect the abundance of saving and the resistance to debt. Scarce spenders need to be compensated by abundant savers.

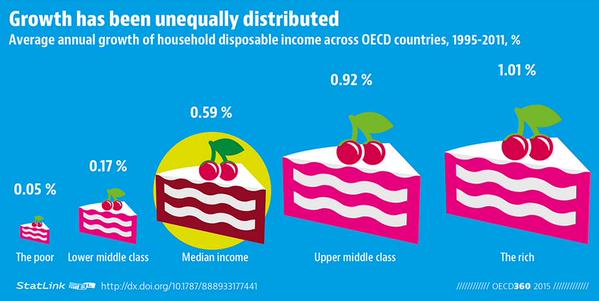

There are other things that we can do to arrest the current pattern of most of the world’s income going to those who least want to spend it. (Indeed many such people have so much income that much of the spending that they do is obscene in the context of the needs of so many others.) We can use democratic processes to change income distribution rules that presently favour individually-held property over collectively stewarded property. However, unwinding the savings glut through negatively compounding interest rates needs be part of the mix.

Capitalism depends on the spending of the poor, the indebted, and the poor indebted. Yes, maybe there is another -ism out there to replace capitalism. Myself, I prefer an internal revolution within capitalism to the replacement of capitalism with some -ism that supplants the price mechanism as our principal means of allocating resources.

Negative ‘nominal’ interest rates – the emerging reality of our financial marketplace – represent the price mechanism at its heroic best. In the 1930s’ Great Depression the possibility of negative rates was thwarted by people hoarding cash in the bottom drawer rather than paying the banks to recycle their unspent money. Today there are ways to discount hoarded cash.

It is the saver class, not the working class, who will rebel against capitalism this century. In the 1980s the saver class revolted successfully, paying themselves interest at distorted prices which they themselves controlled. It is now up to the debtor classes to save capitalism for the downtrodden; to spend money they haven’t received. In capitalism, someone must have the bag.

Shorter: To become bludgers.

I find it truly amazing that you can write that and still not realise just how fucked our financial system is.

The poor pay for everything including for the rich to be rich. Such a system is totally immoral.

You may not have noticed yet but prices aren’t actually allowed to allocate resources. If they were we wouldn’t have private motor vehicles as they use up more resources than public transport.

Then there’s the problem of maldistribution brought about by the market system. A good example is the fact that NZ can, and does, produce enough food to ensure that everyone is well fed and yet we have people going hungry.

Capitalism isn’t an economic system but a social system designed to have it so that a few people live in vast wealth on the back of the many who live in poverty. Its results are massively uneconomic as it squanders the scarce resources we have available for the enrichment of the few.

Capitalism is rent-seeking behaviour. The rich are seeking a consistent return on what money they already have – they let (lend) it out in exchange for rent (interest). Rent-seeking is bad economic practice and should be discouraged.

I support the free-market (with some regulation of course) in the “free-market capitalism” system we have at the moment, it’s the capitalism part that I’m opposed to. The price mechanism for allocating resources seems fine to me.

Is there an -ism (or other sort of name) for ‘free-market non-capitalism’?

By the way, I think that what you are saying is that capitalists’ purpose in life is to make ‘money’. Indeed that’s what most people think ‘the economy’ is about; ‘making (and accumulating) money’. The economy is about no such thing. But that’s what so many people think.

It’s the ‘saver class’ (or what you might call the capitalist class) that like to make and accumulate money. Making and accumulating money can only be done by running repeated financial surpluses (essentially parties persistently selling more than they buy). The problem is that all financial surpluses must be matched elsewhere by financial deficits (parties buying more than they sell). It’s zero-sum arithmetic, and is not understood by most policymakers and journalists.

Negative interest rates are a feature of the free-market price-mechanism that the saver class does not like. Negative interest rates thwart the pursuit of compound interest by the saver class.

Yeah I would like a word for that too, market socialism seems to be the closest available term at the moment.

Capitalists want to make money from money itself. Speculators want to make money at the expense of others misery. Businessmen want to make money from performing a useful task. Only the last should be encouraged.

Businesses require capital (and, rarely, individuals do too, eg to buy a house), but that does not mean it needs to be sought from rich privateers who seek only profits at the expense of all else. Community banks and local or national government could fill that role.

————

Inflation and debt defaults would be analogous to negative interest rates I suppose.

The price mechanism could possibly work if all costs were properly allocated. Instead most of them get dumped on society as externalities. An example of this is Anthropogenic Climate Change. Essentially, if fossil fuels had been properly priced for the last 150 years it wouldn’t be a problem but private motor vehicles would exist and the amount of long distance travel would be closer to what it was in the 19th century.

To get those costs properly allocated requires massive amounts of regulation. The exact opposite of what we’ve been getting for the last three decades.

Is taxing hydrocarbons like we tax alcohol really so difficult?

As a base to work from I can think of no better solution than to let a free-ish price system allocate resources. The only other system that comes to mind to me is a command economy.

As problems are identified taxes and subsidies are applied as required. The major problem today is parties with vested interests – that can be overcome (and has been in the past).

Apparently it is.

I can. Regulated costs. Why costs? Because it is the costs that are being skimped on. Wages have been screwed down to the point that they’re no longer livable. A lot of costs aren’t included at all in the production of some products and services.

That would be nice but it’s not happening as the lack of carbon taxes and, in fact, massive subsidies to increase GHGs in NZ shows.

True but when one government puts in place reasonable and needed legislation the next government can take it away as this government is presently trying to do with the RMA.

Can you expand a bit on what you mean by regulated costs? I’m genuinely interested.

The problem of low wages is easily solved by forcing people to work less, the same as when the 40-hour week was introduced.

All of these suggestions assume control of the government in which case a carbon tax would be trivial (I don’t actually support a tax on agricultural methane though).

Basically, regulations to ensure that the full costs of something fall in the right place so that products and services are properly priced. An example:

Trucking: Damage to the road goes up exponentially by weight. A two tonne vehicle will do more than twice as much damage than a one tonne vehicle. A 35 tonne truck will do something like 10, 000 times as much damage as a car. Proper regulation would have the truck paying 10,000 times as much to use the roads. ATM, cars massively subsidise trucks.

Yep, we need to bring back penalty rates.

No it won’t as both National and Act argue against a carbon tax/ETS on the basis that it will cost people more and people already in poverty (as the majority of people in NZ are) won’t support it on that basis. Of course, the whole point of pricing is to regulate use of something and National and Act are actually arguing against that regulation.

I do because we have too many fucken cows in NZ. That said, there are other regulations that also need to be brought in that will also decrease the number of cows in the country. Regulations on water use, land suitability use, protecting the environment etc etc.

Perhaps I didn’t put the sentences in the best order, but I think we basically want the same thing, a free-market with regulations.

Yes, trucking should be discouraged in place of rail and coastal shipping. I think farm’s nitrogen and phosphorous levels are more better targets for taxation and are of more concern than methane.

If you controlled government why would you listen to what National has to say? Also, please don’t talk about ACT as if they are relevant any more.

I want to get rid of the market and money altogether and make the economy democratic.

Because we’re not a dictatorship no matter that National seem to think that we are and so we do need to listen to everyone.

My brother has a very similar argument to yours. We have argued it out many times and it always come down me saying his replacement “system”, just a few nice sounding sentences really, is way too vague to take seriously, while he says that my detailed alternative is bad because it hasn’t been agreed to by a majority yet (or something like that).

If a boy repeatedly and falsely cries wolf I stop listening.

Has Mr Rankin ever lived for any length of time on nothing but his savings – with a miserable amount of interest – taxed, of course?

Has Mr Rankin ever saved up for an expensive item – fridge, or car, or house deposit?

Many ‘working class people’ have. Savers. Going without in order to remain debt-free. Budgetting to remain free of the interfering talons of WINZ and the great payday loan sharks.

Where does this minuscule group fit in the lather ATL?

Debt is neither bad nor sinful. That’s true. But the consequences of debt can be hideous indeed. And, if you’ve been there, then prudence definitely outweighs that urge to splurge. Save. Wait. Refuse to play on the money-go-round

And – no mention of the electronic tsunami of Quantitative Easing. No mention at all. All those surges of dosh captured by banks that continue to play their ‘scarcity’ games for lending at a profit.

Usury – plain and simple. Islamic lending rules seem quite attractive, sometimes.

By the way – isn’t it amazing that for all the spare money sloshing about so little has gone into building businesses and infrastructure? The engines of change are being starved of fuel – and we’ll pay dearly for that.

Islamic lending rules are there so that people can say that they aren’t charging interest while charging interest.

According to the TVNZ polls out tonight, 49 percent of polled persons with a party preference still seem to be infatuated with Kim John Key and his gang, and with modern day “class war” that enables many in the property owning middle and upper class “earn” heaps more week by week here in Auckland, by simply sitting on their properties.

Leave the hard work for the slaving class, increasingly disowned, and busy fighting amongst each other for the remaining morsels.

It seems the dictatorship is working, now that the MSM has completely given up on investigative journalism. No matter what Nicky Hager, Wikileaks and Snowden reveal now, it is not even mentioned on the news, apart that is, on the last humble “bastion” of public broadcasting, Radio NZ National.

The time to organise the “silent majority” increasingly falling behind, will soon come, and then it may get real ugly.

Whenever I read Keith Rankin’s articles, I wonder what he is doing in a Left Wing blog. He insists that negative interest rates are an absolute good, and that these fluctuations are the outcome of a ‘natural’ economic cycle (stated in a previous article). Yet these ‘negative’ interest rates only show up following a burst financial bubble. Japan’s ‘negative’ interest rates are the result of it’s real estate and stock market crash in 1991. The USA’s zero rates, and the quantitative easing that accompanied it, were the outcome of the sub-prime mortgage crash. Europe’s similar position occurred because it was caught up in the aftermath of that same crash. How can negative interest rates be “good” when they are the ‘natural’ outcomes of crashes, that cause such devastation to, often quite innocent, citizens.

I also query a reply of Keith’ s concerning a remark of a contributor who said “The problem with debt is that, eventually, it has to be paid back”. Keith replies “This is not strictly true.” In fact it is not true at all. The individual can and does repay his debt but that debt simply gets picked up by another debtor plus compound interest. In this way the debt grows exponentially and is unrepayable. In the UK the national debt, when the Bank of England started in 1694, was £10 million. It is now £1.5 trillion and has grown exponentially from the beginning. This would be true for any nation that uses the B of E monetary model. The present system must be wrong.

On debt .

Land of the free , home of the brave ; America ,now owes in private , business , and govt debt of over $ 61,000,000,000,000.(See US debt clock.org)That’s Trillion ….

Is any one free when having to service so much debt ? Hardly !

Banks and advertisers encourage all of us to buy more and more material possessions before we can afford them .Its a bank trap .

Kieth is quite right when he says creditors don’t want the loan repaid because when we do they stop making money .

Unlike America I have paid off my house , my car ,and my possessions, and I do actually feel free.

Not having to give banksters $ 600 a week in interest for doing nothing, feels really good.I can now spend this money on stimulating the economy in a real , positive way.

Debt is not neutral ,its a tool for long term enslavement.

Whats the alternative ?

.Save up . Buy it . Own it and then weep for the bank .

Saving up and defering your gratification means you will value it more.

In a global culture of self indulgent narcissistic consumerism and instant gratification ,the drug of credit leads to some destructive long term addictions.

Don’t be a lemming .Screw the bankers , be a black lemming and redefine what freedom actually means.

Comments are closed.